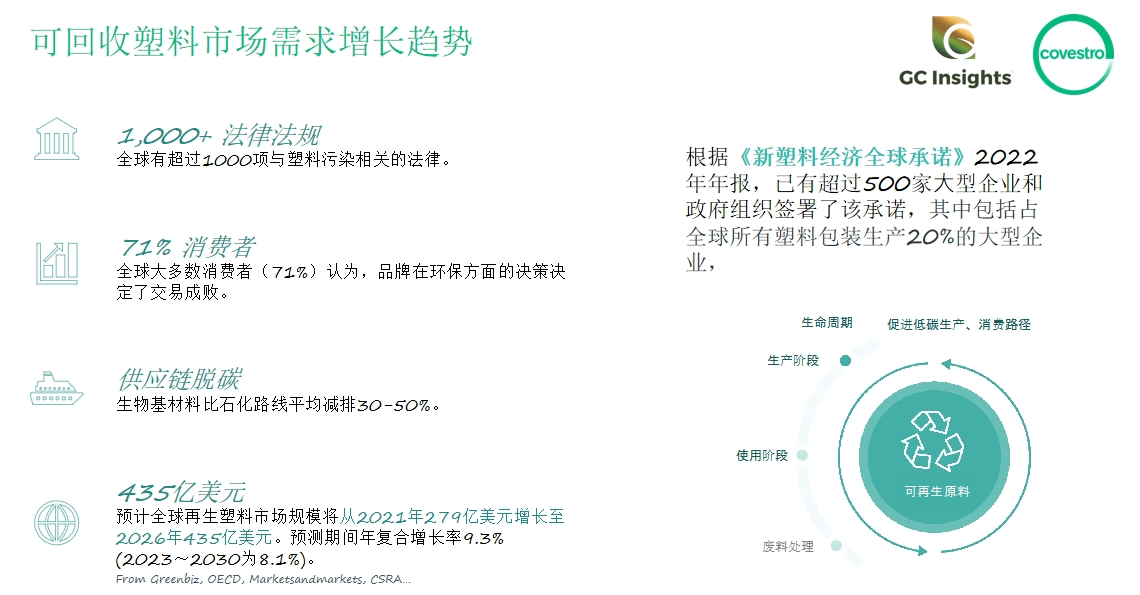

The following is a rewritten version of the text in TSN style: As the storm approaches, the automotive industry may undergo significant changes. Last week, officials from around the world gathered in Nairobi, Kenya to begin a new round of negotiations to develop the first-ever global treaty to curb plastic pollution. It is expected that the final version of this treaty will come into effect by the end of 2024, making it the second largest environmental treaty after the climate change convention. This is expected to have a huge impact on the global automotive industry. The gears of fate are quietly turning. In March of last year, the fifth session of the United Nations Environment Assembly adopted a historic resolution titled “Ending Plastic Pollution: Developing a Legally Binding International Instrument.” And just last week, the “Third Meeting of the Intergovernmental Negotiating Committee on a Treaty on Plastic Pollution, including Marine Plastic Litter” was held, aiming to reach a consensus by the end of 2024 and conclude an internationally legally binding agreement. Also in the past week, the United States and China issued a Sunshine Statement on Strengthening Cooperation to Address the Climate Crisis, which includes their determination to end plastic pollution and work with others to develop a legally binding international instrument on plastic pollution. Most people may be confused about the connection between plastic pollution and automobiles. However, as the country that has been the world’s largest producer and seller of automobiles for more than a decade, with a total of 330 million vehicles, where do the millions of scrapped vehicles go each year? According to data, China’s scrapped vehicles produce millions of tons of plastic, nearly tens of millions of tons of scrap steel, as well as a large amount of waste rubber, glass, and other materials each year. However, in reality, only a very small amount of plastic can be recycled. At the same time, with the “3060” dual-carbon goal, more and more car manufacturers and component companies view plastic as one of the most ideal alternative materials for lightweight and environmentally friendly cars. In their view, a plasticized automotive era is on the horizon. On one hand, there is a significant increase in the use of plastic, and on the other hand, there is the inevitable pollution from plastic waste that is difficult to recycle.

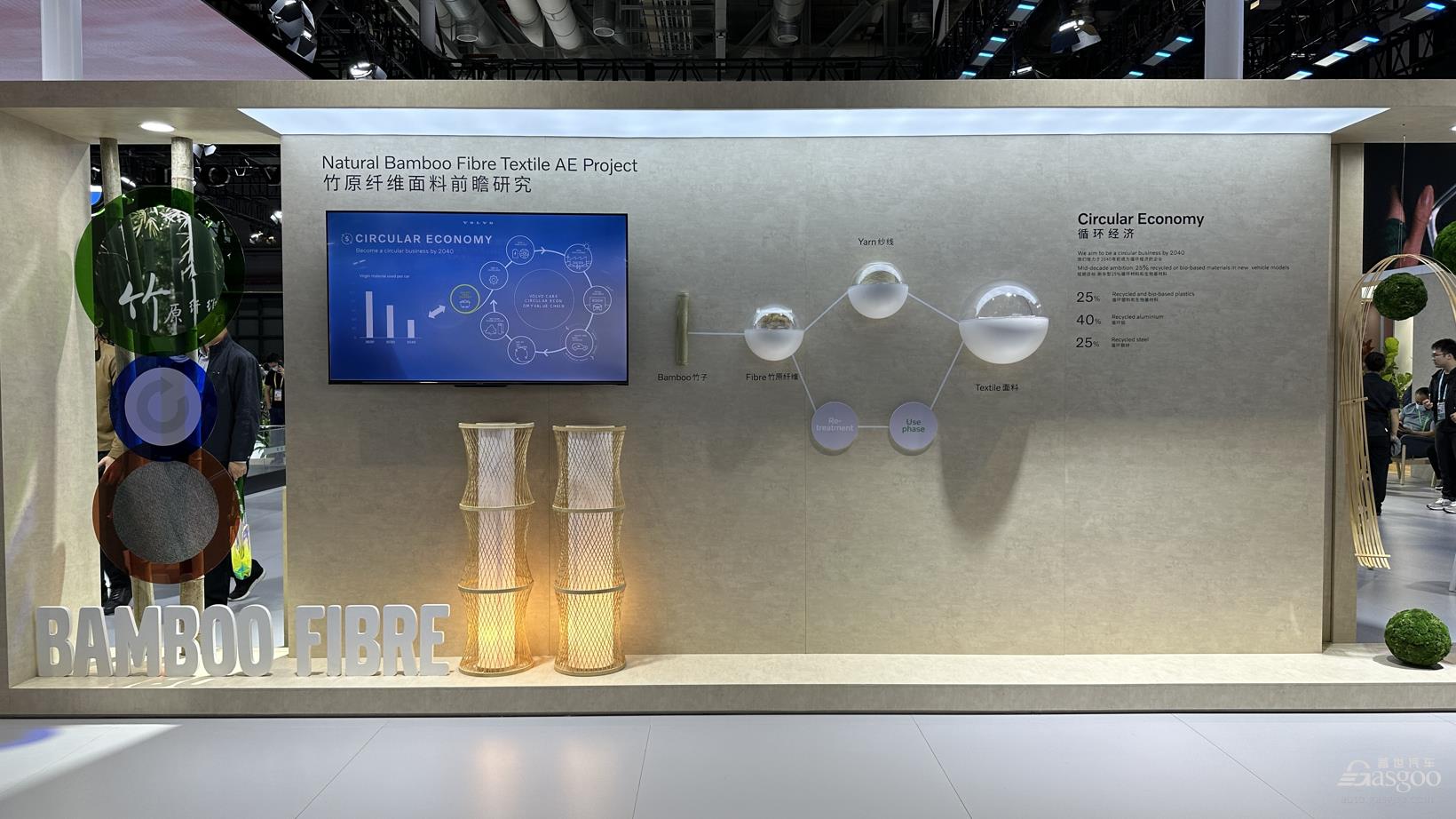

Image source: EU It is for this reason that in July of this year, the EU took the lead in issuing a relevant proposal, specifically pointing out that 25% of the plastic used in the production of new vehicles must come from recycled plastic, of which 25% must be recycled from scrapped vehicles. In other words, 6.25% of the plastic used in the production of each new vehicle must come from recycled materials from scrapped vehicles. At the same time, it encourages the recycling of more and higher quality raw materials, including key raw materials, plastics, steel, and aluminum; and 30% of the plastic in each scrapped vehicle should be recycled. This has sparked widespread attention and discussion in the global automotive industry. In fact, as early as 2019, Volvo announced that by 2025, at least 25% of the plastic used in all new vehicles will come from renewable and bio-based materials. Subsequently, Mercedes-Benz, BMW, Audi, Volkswagen, Honda, Hyundai, and Kia have all successively launched research and development applications for recycled plastics.

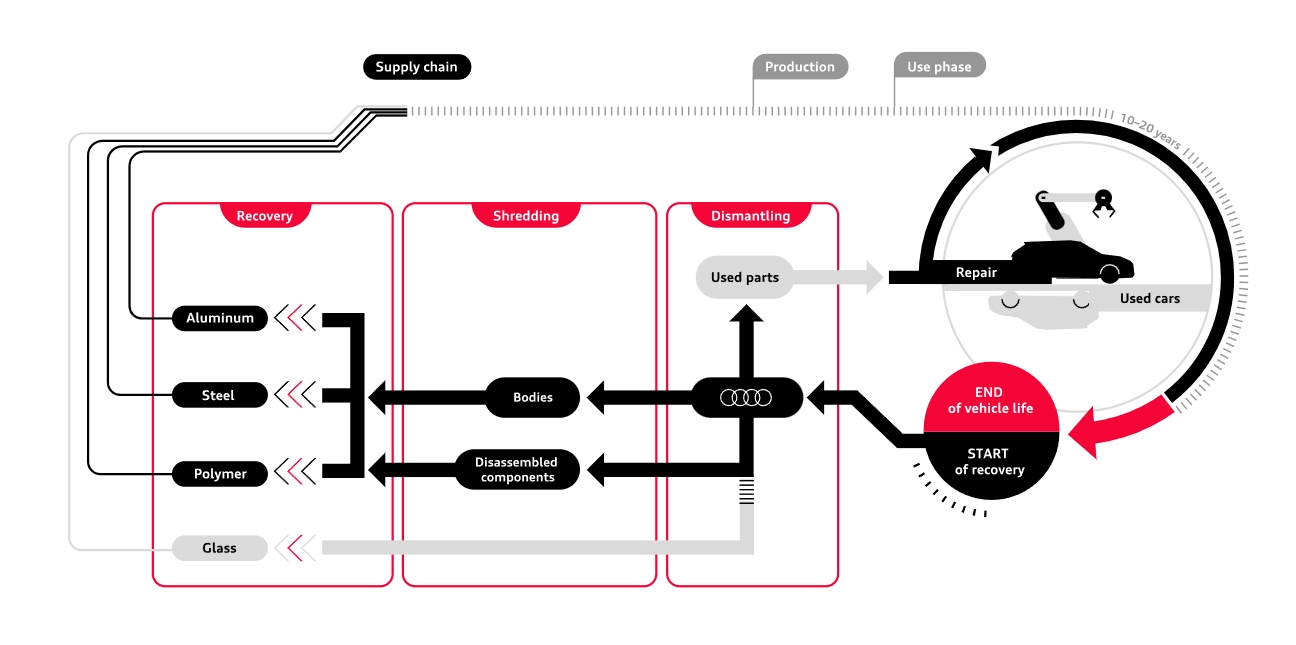

Audi announced in March this year a collaboration with 15 institutions from the supply, recycling, and research sectors to establish the “Materials Loop” project, which aims to extract steel, aluminum, glass materials, and plastics from 100 used cars as much as possible for recycling and reuse, in order to manufacture new flagship models. This includes support from experts in material procurement and plastic recycling, the Dutch digital product passport provider Circularise, and one of the world’s largest polymer, petrochemical, and fuel companies, LyondellBasell, to produce quality balanced raw materials for the safety belt buckles of the Audi Q8 e-tron series.

Image source: Audi In this context, as the world’s largest automobile production and export country, China, if it wants to further expand into the EU market, it will inevitably need to increase its investment in the automotive recycled plastics industry from top to bottom. Recycling of automobile plastics poses many challenges Regarding the recycling of scrapped cars, our country does have corresponding development plans. As early as 2001, the State Council issued the “Regulations on the Management of Scrapped Vehicles,” and the management of the recycling of used cars in China has been steadily progressing. In June 2021, a pilot implementation plan for the extension of the producer responsibility for automobile products was jointly issued by four ministries, including the Ministry of Industry and Information Technology, which proposed that the recycling rate of automobiles must reach 95%, and the proportion of recycled materials used in key components must not be less than 5%. “At present, the first batch of EPR pilot projects has 11 vehicle manufacturers and 62 upstream and downstream enterprises in the industrial chain participating. It is expected that an evaluation meeting will be held at the end of this year, and the pilot acceptance will be conducted next year.” Recently, at the “Forum on Sustainable Development of Automobile Plastic Parts” jointly organized by the Ningbo Automobile Parts Industry Association, the Ningbo Plastic Industry Association, and the Plastic Recycling Branch of the China Synthetic Resin Association, Fan Lihua, from China Automotive Data Co., Ltd., revealed. Although the calculation method of this plan is different from the new EU proposal and the target audience is different, the gap between them is still clearly visible. Based on this, Fan Lihua stated that our country’s policy will have a higher set of quantitative targets, and it is not yet certain whether it will align with the EU in the future. What is certain is that the development trend of the policy is very clear.

Image source: GC insights The upper trend is clear, but there are many difficulties in implementation, and the first obstacle is “unavailable for purchase.” Taking Ningbo as an example, as one of the largest automobile parts production bases in the country, it is home to more than 5,100 enterprises directly involved in automobile and parts manufacturing, with over 2,000 related to automotive plastic parts. These companies are important suppliers for Tesla, BYD, Geely, and other emerging enterprises. “During our visits and investigations, we found that the demand for PCR is higher than we expected, but the problem is that it is not available for purchase,” said Wang Hong, Executive Vice Chairman and Secretary-General of the Ningbo Automobile Parts Industry Association. One reason for this is the difficulty in recycling. According to Liu Zhisheng, Chairman of Dongguan Wandefu Environmental Protection Technology Co., Ltd., plastic products for passenger cars currently account for about 6% of the total weight. For example, the weight of plastic in a Passat is around 97.9 kilograms out of a total weight of 1535 kilograms. If we break it down by individual products, for sedans, automobile plastic products are mainly concentrated in bumpers, fenders, dashboards, fuel systems, bodies, engine hoods, interiors, electrical components, exterior parts, lighting systems, seat covers, and storage tanks. However, different products require different materials, including polypropylene, ABS/styrene/butadiene, PVC, polyethylene, and nylon. Even the largest material, PP, accounting for over 60%, is difficult to recycle efficiently and at low cost, not to mention the challenges of promoting the recycling, dismantling, extraction, and regeneration of relatively small-volume materials in a limited area. As a result, recycling enterprises mostly exist in small, scattered “guerrilla” form, making it difficult to achieve scale, limited profitability, and unclear quality, not to mention the digital traceability of the materials themselves. Impossible to trace, difficult to verify, how can vehicle and parts companies ensure that the materials they purchase are from recycled materials from scrapped vehicles? To achieve recycling, it needs to start from the design. Recycling should not only be the work of downstream and after-sales, but should change the upstream design based on the difficulties encountered by the downstream recycling industry, or pre-set for better recycling. Wang Wang, executive vice president of the Plastic Recycling Branch of the China Synthetic Resin Association, pointed out that the current recyclability and reuse needs to include three elements: scale, economy, and market value of recycling applications. Therefore, the plastic products on the market are generally divided into three categories: recyclable, requiring testing, and non-recyclable. Among them, recyclable can be further divided into easily recyclable, in need of improvement, and low value with conditions. Obviously, easy recyclability is the highest level of recyclable design. Taking the most common Nongfu Spring mineral water bottle on the market as an example, its body is made of PVT material, the cap is made of HDP, and it is designed for labeling. During the crushing process, it can be easily and efficiently distinguished, thus entering the recycling process. Therefore, it is considered one of the best examples of recyclable design. On the other hand, taking the example of a car headlight cover, it is often a complete set of headlights that are recycled, with a vacuum design and multiple material combinations, adding many difficulties to the recycling process. At the same time, each company and each car model have different headlight designs and material usage, making it difficult to form a scale within the recycling region. Therefore, headlights are often seen as difficult to recycle. “Recycling companies prefer efficient and simple process flows to produce high-quality recycled products,” said Wang Wang. He further cited that the current production line for PP bottles in China is about 300 meters long, while Japan’s is only 60 meters. The reason is not the complexity of the process, but rather the unified standards for bottle color, labels/cap materials set by the Japan Beverage Association, which are efficient, simple, and maximally reduce production costs. As a result, Wang Wang summarized that the most easily recyclable and sustainable design is a result of a compromise between economic and technological factors in the upstream and downstream. “There are too many designs that are worse than it, but recycling and processing both good and bad designs can only be based on the worst process route.” Wang Hong, Executive Vice Chairman and Secretary General of the Ningbo Automobile Parts Industry Association, further suggested that in the process of manufacturing automobile plastics, materials with good recyclability, good compatibility, and environmental friendliness should be used, and the use of multiple plastic varieties within the same product, as well as surface coatings in the form of painting, electroplating, and capacitors, and toxic and harmful materials should be reduced or avoided. In this logical context, we may imagine whether the form and design standards of future automobiles will form a relatively unified material and design standard due to the emphasis on recycling and reuse rates. For example, whether the 200,000 yuan (28200$) market and the 300,000 yuan (42300$) market will form different design standards and material requirements. In this process, some larger car companies such as BYD and Geely may form their own design standards and material requirements due to their own scale and strength, further increasing the homogenization. The answers to these questions may require time and market validation, but the future of the automotive industry may undergo some changes due to these factors. At the same time, digitalization is also being laid out to connect upstream and downstream, making data visualization, traceability, and certification possible in order to achieve industry standardization. In the future, despite facing many challenges, I believe that China’s automotive recycled plastics will develop towards safety, durability, adaptation to new technologies, environmental friendliness, meeting new standards, and easy maintenance,” said Wang Hong, envisioning the future.