Starting this year, domestic traditional car companies have also begun to disclose the sales of their new energy products, competing with the emerging forces in the car manufacturing industry. Among them, top traditional car companies such as Geely, Changan, Great Wall, and FAW are racing ahead with their “new energy brand” in the new energy field, with BYD leading the pack.

Not long ago, Roewe also announced that it is ALL in new energy, preparing to return to the mainstream track. A series of changes have also shown us that traditional car companies, after experiencing a brief “slump,” are beginning to dominate the new energy market and are preparing to regain their voice while accelerating the marketization of new energy vehicles. Top traditional car companies are accelerating Facing the wave of the new energy era, although new car forces are taking the lead in the new energy market and have a certain advantage, traditional car companies, with their stable production capacity and mature supply chain, are also showing undeniable competitiveness. According to the China Passenger Car Association’s sales ranking of new energy vehicles from January to October 2023, traditional car companies such as BYD, Geely, Changan, GAC Aion, and Great Wall have all performed well in the sales of new energy vehicles, and are returning to the main track, reclaiming their voice in the new energy era. Among the top traditional car companies, BYD is far ahead, with sales reaching 2.371 million units from January to October, and sales in October surpassing 300,000 units. If this pace continues, it is very likely that sales will exceed 3 million units by the end of the year. Currently, BYD’s existing models still maintain strong competitiveness, and more new models are being launched. With the release of the BYD Song L, Tang Leopard 5, and E-SEED U9, it is expected to bring new growth to BYD, and sales in the fourth quarter will also perform better.

Some organizations have given higher forecasts, believing that BYD’s new car deliveries in the fourth quarter will exceed 960,000 units, with a total annual delivery of over 3.04 million units, and they are optimistic about the performance of new models to be launched at the end of the year. Unlike BYD’s comprehensive electrification, Geely Auto also has good performance in the fuel vehicle segment, while focusing on the layout of the new energy vehicle field, showing good performance since the second half of this year. Currently, Geely Auto has four major new energy brands: Geely, Lynk & Co, Geometry, and Zeekr. Among them, the Geely Geometry series, targeting the mass market, has been well received by consumers due to its high cost performance and affordable price, showing a comprehensive development trend. The newly established high-end Geely Galaxy series also has strong momentum, with steady sales growth. The first model, Galaxy L7, has accumulated sales of over 50,000 units in five months since its launch. The Galaxy series achieved a monthly sales volume of over 13,000 units in October, accounting for more than 22% of Geely’s total new energy vehicle sales. In addition, Geely’s first pure electric sedan, Galaxy E8, equipped with an 800-volt ultra-fast charging system and silicon carbide electric drive, made its debut at the Guangzhou Auto Show. The new car, together with Galaxy L6 and Galaxy L7, enriches the Galaxy series product lineup and helps achieve new sales growth. It is worth mentioning that Zeekr, as Geely’s high-end intelligent new energy brand, has also made rapid progress in sales. In October 2023, its new energy sales exceeded 13,000 units, a year-on-year increase of 29%, and a staggering 86% increase compared to the same period last year. As of the end of October 2023, Zeekr’s total sales have exceeded 90,000 units, making a final sprint towards the annual target. Geely Auto has adopted a multi-brand strategy in the new energy race track in order to reduce development costs, generate synergies, and achieve a “1+1>2” effect, which is already showing initial results. Turning to Changan Auto, the cumulative sales of new energy vehicles from January to October this year reached 36,400 units, an 88.76% increase year-on-year. This result may not be the best, but it is already impressive for Changan Auto, which is undergoing a rapid transformation. Changan Auto’s outbreak in the new energy field is mainly due to the contribution of Deep Blue Auto, with a monthly delivery of 15,500 new cars in October and sales exceeding 10,000 units for four consecutive months, which is a success for a brand with only two products.

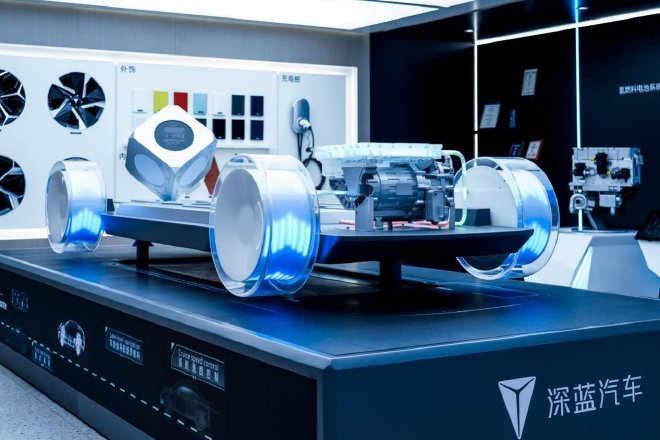

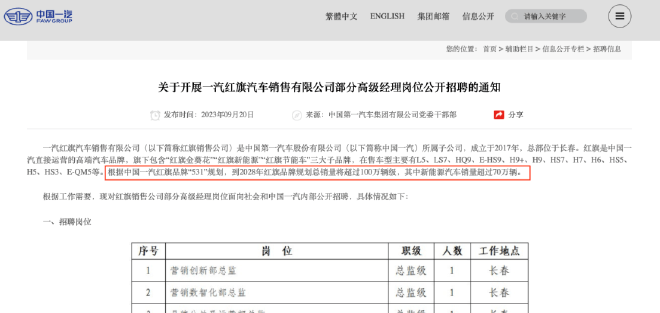

At the 2023 Guangzhou Auto Show, Deep Blue Motors unveiled its super-range extension technology. Unlike traditional range extension technologies, this innovation is based on a fully forward-designed pure electric platform, offering innovative energy supplementation speed on pure electric vehicles, effectively addressing the two major pain points of energy saving and energy supplementation, and featuring super energy efficiency, super excitement, and super safety. This will also help increase the sales of new energy vehicles for Changan Automobile. In addition, Changan Qiyuan released the Qiyuan A07 and A05 models in the second half of this year. These two models have accumulated over 20,000 orders, becoming a new growth point for Changan’s independent new energy vehicle sales. With the support of the Qiyuan, Deep Blue, and Avita three major new energy brands, Changan Automobile’s new energy system is being perfected, and future sales growth is imminent. Unlike other independent car companies that are simultaneously launching multiple new energy brands, Great Wall Motors is currently choosing to develop and strengthen its technological capabilities. Now, Great Wall Motors’ new energy products are also gaining market share. Data shows that from January to October this year, Great Wall Motors sold 205,600 new energy vehicles, an increase of 85.93% year-on-year. In October, the sales of new energy models exceeded 30,000, an increase of 178% year-on-year. It is reported that since proposing the new energy transformation strategy, Great Wall Motors has successively released more than 10 new energy models such as the Haval M6 and second-generation DaGou PHEV, the Weipai Gaoshan and Lanshan, and the Tank 400 Hi4-T and 500 Hi4-T, in addition to the Ora brand, continuously expanding the new energy market product lineup. Of note is that, with the launch of the Hi4-T model and the Haval MING, Tank has not only solidified its leading position in the hardcore off-road segment market, but also provided strong support for the growth of Great Wall’s new energy sales. Looking at the performance of traditional top car companies in the field of new energy, including BYD, Geely, Changan, Great Wall and other car companies have performed extremely well, even surpassing some new car makers, attracting attention in the new energy vehicle market. Old car companies are looking for new breakthroughs. At the current critical period of transformation in the automotive market, competition in the domestic new energy vehicle market has become more intense, and even some lagging car companies face the danger of being eliminated, so everyone is working hard to find new breakthroughs. Compared to the rapid transformation and success of top car companies, the voices of traditional old car companies such as BAIC, Dongfeng, and FAW will appear to be very low. Although they have experienced glorious moments, they are still slightly inferior in the face of strong competitors in the new energy era. However, it is worth noting that, although the results are not yet outstanding, their resilience in the new energy race is strong. Taking the Hongqi brand as an example, earlier this year, it held a global strategic conference on new energy vehicles and officially released the Hongqi brand’s new energy brand architecture, brand logo, design language, technology platform, product planning, etc., officially launching the counterattack in the new energy race. In September, Qiu Xiandong, who took over as the head of FAW Group, carried out a deep reform of the Hongqi brand. According to the “531” plan of China FAW Hongqi brand, by 2028, the total sales of Hongqi brand will exceed 1 million units, with the sales of new energy vehicles exceeding 700,000 units.

According to the data, the determination of the Hongqi brand in the new energy track is very firm. If we follow the past speed of Hongqi, this goal can be easily achieved. Public data shows that from 2017 to 2021, the sales of the Hongqi brand increased rapidly from less than 5000 vehicles to over 300,000 vehicles, equivalent to a 63-fold increase. The sales volume broke through one barrier after another, like riding a jet rocket. In recent years, with the rise of new energy vehicles and intelligent connected vehicles, traditional car companies that had advantages in the era of fuel vehicles have also been impacted, and the same is true for the Hongqi brand. The growth rate of the Hongqi brand has slowed down since 2022, with a year-on-year growth falling from over 50% to 3%, and annual sales reaching 310,685 vehicles, only achieving 77% of the target sales. In addition, the Hongqi brand has not kept up with the pace of new energy development. In 2022, the annual sales of Hongqi new energy vehicles were only 36,213 vehicles, accounting for 11% of the brand’s sales. However, according to the recent new energy data released by the Hongqi brand, the October new energy retail sales volume exceeded 10,000 vehicles. In the first half of 2023, the sales volume of Hongqi’s new energy vehicles increased by 282% year-on-year to reach 33,091 vehicles. Although the sales volume did not skyrocket, it is still developing well. From the perspective of FAW Hongqi’s new energy layout, the Hongqi brand will launch two pure electric vehicle models, E001 and E202, within the year. By 2028, they will have launched a total of 11 pure electric vehicle models and 11 plug-in hybrid vehicle models, achieving full coverage of the A to D class car, SUV, MPV and other segmented markets. Currently, in the latest batch of Ministry of Industry and Information Technology’s declaration list, we also found that the Hongqi pure electric sedan with the code name E001 has completed the declaration with the official name “EH7,” and it is expected to be launched soon. Looking at the “national team” Dongfeng passenger car, on November 17th, Dongfeng Fengshen, eπ, and Dongfeng Nano all appeared at the 2023 Guangzhou Auto Show stage in a united manner. More importantly, these three major brands are all making a strong push into the new energy market, showcasing their strength in the new energy market. Among them, Dongfeng Nano is a national-level electric car brand newly created by Dongfeng passenger car to meet the daily car needs of the general public. The Nano 01 is the brand’s first model based on the all-new Dongfeng Quantum Architecture 3 platform, a 4-meter level pure electric compact car with advantages in space, appearance, intelligence, and energy saving. In addition, Dongfeng passenger car also brought the electric coupe Eπ007 and Dongfeng Fengshen Hao Han Space E-sports Edition. Currently, Dongfeng passenger vehicles have established a comprehensive lineup of hybrid electric vehicles (HEV), plug-in hybrid electric vehicles (PHEV), and electric vehicles (EV) in the electrification field, covering brands and products from national level to mainstream and advanced levels.

In the high-end new energy brand, Dongfeng Motor has launched the Lantu car, Dongfeng Mengshi, and its new energy legion has taken shape. From January to October this year, Dongfeng Group’s new energy vehicle sales reached 24,000 units, a year-on-year increase of 52.81%. Among them, the monthly sales of Lantu cars exceeded 6,000+ for the first time. With the expansion of the market and the continuous increase in the penetration rate of new energy vehicles, the market performance of Dongfeng passenger cars will inevitably reach a new level. Looking at the old car company’s Beiqi New Energy, as one of the first companies to focus on new energy vehicles, Beiqi New Energy gained a first-mover advantage in the early days of electric vehicles and won the title of China’s pure electric vehicle sales champion for six consecutive years. However, starting in 2019, Beiqi New Energy began to fall behind. Nevertheless, as a car company with deep roots, Beiqi New Energy has revitalized its products, upgraded its technology, and engaged in cross-border cooperation. Its Jihu car signed a cooperation agreement with the BaoMir Group from the United Arab Emirates to jointly sell Jihu cars in the UAE and Saudi markets. Additionally, there have been reports that Beiqi New Energy has signed a cooperation agreement with a Japanese company, and there are rumors of negotiations with Xiaomi on production matters. The latest sales data shows that Beiqi New Energy’s cumulative sales in the first 10 months of this year reached 61,767 units, an 80.27% increase year-on-year. Among them, the high-end brand Jihu car under Beiqi New Energy sold 3,107 units, a 217% increase year-on-year, setting a new monthly sales record. The Jihu Alpha S sold 1,300 units, a 112% increase year-on-year, while the Jihu Koala also showed growth potential. Currently, Beiqi New Energy is increasing its efforts in “scenario-based car manufacturing,” accelerating the stimulation of market potential, and gradually building its own moat. In addition, Beiqi New Energy is also increasing its cooperation in domestic and international markets, which is also one of the strategies to break through sales volume. It is not difficult to see that traditional car companies are making every effort to advance in the new energy track, while also gathering momentum in adjustment. Fierce competition is accelerating marketization. Now, the Chinese new energy vehicle market has entered a stage of full competition. Traditional car companies and new forces are bringing more products to consumers, while market competition pressure is also intensifying. However, unlike the past 10 years, consumers now pay more attention to the vehicles themselves when purchasing new energy vehicles, rather than eye-catching marketing strategies, which gives traditional car companies more opportunities. In the rapid development of new energy vehicles, traditional car companies and new forces in car manufacturing are competing with each other while also promoting each other. The former has made new breakthroughs in marketing concepts and systems, learning marketing from the new forces, while the latter is rapidly making up for deficiencies in vehicle quality control, supply chain management, and car manufacturing systems during rapid development. Therefore, in the current process of fierce market competition, all parties need to learn from each other and make up for their shortcomings in order to quickly fill the gaps and jointly promote the rapid marketization of new energy vehicles. Previously, NIO co-founder and president Qin Lihong said, “The biggest problem in the high-end market is that the penetration trend of electric vehicles is not strong enough, so the competition is not high. But at the same time, NIO has enjoyed certain dividends, but the trend is not strong enough to hinder our development.”

In other words, in the market competition, both traditional car companies and new forces in car manufacturing need to make up for their shortcomings and launch products and services that meet consumers’ needs in order to promote a better and faster development of the new energy vehicle market. From the current development of the automotive market, although new car manufacturers have advantages in some aspects, traditional car companies, with their deep technical expertise and brand influence, also demonstrate remarkable competitiveness. In terms of technological research and development, traditional car companies are actively catching up and increasing investment in order to make breakthroughs in new energy technology. This sustained effort and investment provide a solid foundation for traditional car companies to maintain their competitiveness in the new energy vehicle market. In addition, traditional car companies, facing the rapidly developing new energy market, also need to adapt to the constantly changing market demands and innovate their products and services. This is not just a technological competition, but also a competition of market strategies and brand influence. Recently, the Vice Minister of the Ministry of Industry and Information Technology, Xin Guobin, stated at a meeting, “After many years of development, China’s new energy vehicles have entered a rapid development stage on a large scale, but there are still some shortcomings and problems in comprehensive market development.” He believes that the next step is to optimize production capacity layout, promote the withdrawal of backward whole vehicle enterprises and production capacity in a market-oriented and rule-of-law manner, promote group-scale development, and accelerate the cultivation of Chinese brands with international competitiveness. It can be said that the rapid development of the new energy vehicle market not only brings more choices for consumers, but also drives technological progress and market changes in the entire industry. In the future, the competition in the new energy vehicle market will be diverse and fast-paced. Product innovation, technological research and development, and market strategies of car companies will be the main driving force for the development of this market, and also the key to competition. Overall, the new energy vehicle industry is currently in a rapid development stage, and traditional car companies are enhancing their market competitiveness through reasonable layout, high-quality products, and advanced technology, while also accelerating the marketization of new energy vehicles. Of course, whether traditional car companies or new forces in car manufacturing, they both need to constantly innovate and adjust their strategies in order to quickly adapt to the constantly changing market, maintain their advantages in fierce competition, and bring new vitality to the development of the entire industry.