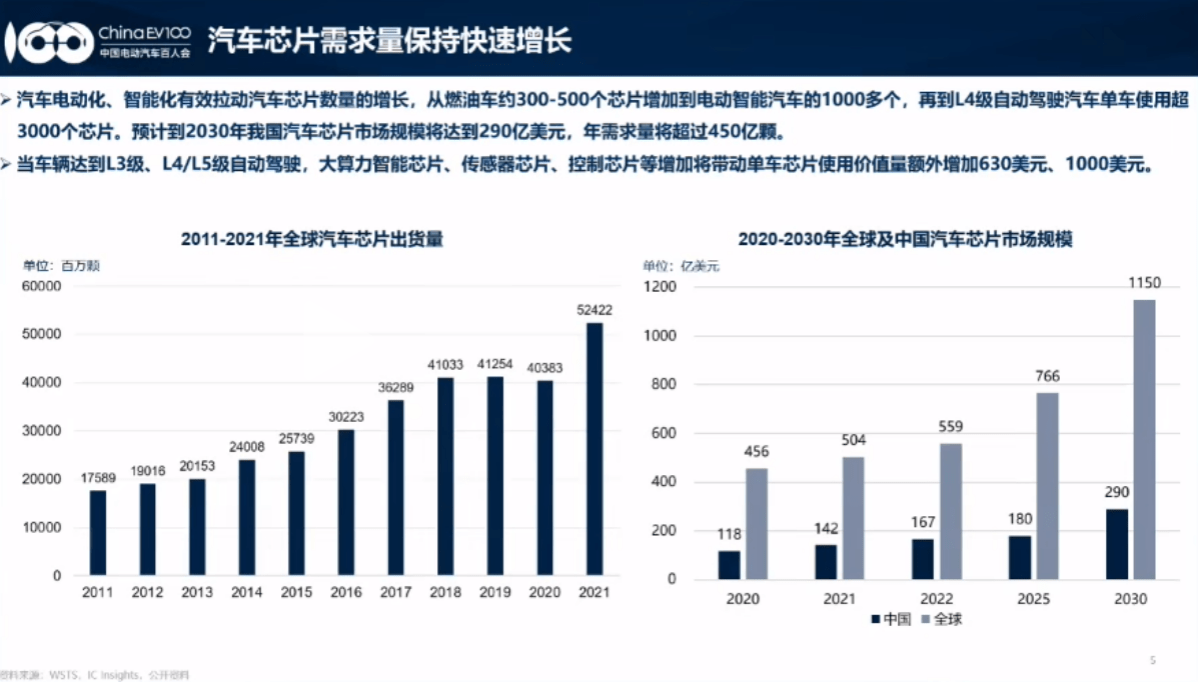

The significant increase in the electrification and intelligence penetration of automobiles undoubtedly has paved a “golden track of simultaneous increase in quantity and price” for the chip industry, and domestic automotive chips have also ushered in a window of development. However, behind the huge growth potential of automotive chips, there is still a severe situation of low domestication rate, with the self-sufficiency rate of some high-end chips even less than 1%, and the obvious shortcoming in the industrial chain. So, after so many years of the road to domestication of the chip industry, what is the biggest pain point? While the industry has given a relatively clear answer, how can it be solved? Automotive chip quantity and price rise, and regional industrial clusters become a trend Ten years ago, there were few domestic enterprises focusing on automotive chips; today, there are hundreds of related companies emerging. From “sitting on the cold bench” to becoming popular, why have automotive chips suddenly become popular in recent years? The answer behind it is undeniable: thanks to the “explosive” development of the intelligent electric vehicle industry. In 2011, the annual sales of domestic new energy vehicles were only in the thousands, while the sales from January to October this year alone have reached 7.28 million vehicles. It is said that electrification is the first half of the revolution in the automotive industry, and intelligence is the second half of the final game that determines the future of the automotive enterprise. One of the key factors in determining intelligence is the underlying chip. The higher the degree of intelligence in automobiles, the higher the requirements for chip performance, process, and power consumption. According to industry statistics, the number of chips per electric intelligent vehicle has increased from 300-500 in fuel vehicles to over 1000, and it is estimated that the usage of chips for L4 level autonomous vehicles will exceed 3000. In terms of value, according to the latest “Automotive Chip Industry Development Report,” when vehicles reach L3, L4/L5 level autonomous driving, the addition of high computational intelligent chips, sensor chips, control chips, etc., will drive the additional value of single vehicle chip usage to increase by $630, $1000 respectively. The report further shows that the market size of China’s automotive chip market in 2022 is $16.7 billion, and is expected to reach $29 billion by 2030, with an annual demand of over 45 billion chips, and the global market increment will be even larger.

Image source: Screenshot of the China Electric Vehicle Hundred People Conference In the face of such incremental prospects, it is impossible to ignore the increasingly complex international environment and the frequent occurrence of black swan events. This has awakened the importance of various countries in building local secure and resilient supply chains, especially during the epidemic period, the crisis of car production caused by the “chip shortage” is still a lingering shadow in the industry. Xu Erman, Deputy Secretary-General of the China Electric Vehicle Hundred People Conference, stated that the chip shortage has led major countries and regions around the world to pay more attention to the construction of independent industrial chains. The global specialization of the semiconductor industry has been impacted, and regional industrial clusters have become a trend. In order to seize the market initiative, countries such as Europe, the United States, Japan, and South Korea, which already have an advantageous position in the semiconductor field, are promoting the localization of chip manufacturing capacity through large subsidies. At the same time, as the power struggle among major powers intensifies, the constraints on the development of China’s high-end chips are increasingly evident. “With the development of smart cars, the intelligent chips on which this high-end process relies will become a lever in future Sino-US trade. Currently, for China, automotive chips will become a potentially huge risk in the future supply chain development from the perspective of production capacity and future intelligent development,” said Li Zhaolin, a professor in the Department of Computer Science and Technology at Tsinghua University. Breaking through from the inside out is the inevitable path to the localization of chip production. In the process of upgrading the local industrial chain, automotive chips have always been a weak link in the industry, and the “bottleneck” of the lifeline is influenced by foreign giants. In order to truly break free from external dependence and strengthen autonomy, in addition to the above external factors, the industry has been constantly asking where the difficulties of internal breakthroughs lie. Chips have always been a highly specialized and concentrated industry. The global automotive chip market and industrial chain face the “three highs” challenges: high risk, high uncertainty, and high vulnerability. These three major challenges have become particularly prominent after the epidemic. In fact, it was after the chip shortage that the communication barrier between the host factory and the chip factory was clearly broken, and the traditional chain supply chain structure also shifted to a mesh structure. Gong Xi, general manager of Great Wall Capital Shanghai and director of the chip industry strategy department of Great Wall Motors, pointed out that before the chip shortage, there was almost no contact between the host factory and the chip factory. The chip shortage brought the communication between the two circles to a very close state, and the host factory’s chip production also became endless. However, “most of the chip companies incubated by the majority of host factories across the country are almost all Fabless companies, and do not involve chip manufacturing links. In essence, if it does not involve manufacturing, the fundamental cause of the chip shortage has not been resolved, and there will still be a shortage when needed,” he said. One of the reasons for the previous chip shortage was that “the wafer factory was unwilling to allocate capacity to the automotive industry, and even if it was allocated to the automotive industry, it was unwilling to allocate capacity to the ‘outdated’ process after 40nm.” The insufficient manufacturing capacity is actually a microcosm of the entire domestic automotive chip industry. Xu Erman also pointed out that the domestic automotive chip industry is not only insufficient in logic chip manufacturing technology and capabilities, but also has shortcomings in product coverage and manufacturing of analog chips, and there are many areas where there are bottlenecks. From the perspective of the entire chip industry chain, China is highly dependent on EDA tools, IP cores, and semiconductor equipment, especially the most core lithography machines, which have a considerable gap compared to international advanced levels. There are also significant shortcomings in the capacity of automotive-grade wafers. “What China really lacks is the 55nm to 14nm process for automotive chips, as well as the high-end process for future autonomous driving chips,” Li Zhaolin added. The industry generally believes that although the overall requirements for manufacturing level of automotive chips are lower than those for consumer electronics such as mobile phones and computers, automotive-grade chips have extremely high requirements for performance, reliability, and automotive-grade verification. The return on investment cycle is long, and it is difficult to significantly increase production capacity in the short term, which can easily lead to a mismatch between supply and demand. In other words, the entire automotive chip industry, from chip manufacturers to original equipment manufacturers, has not formed a complete closed-loop, and is currently facing major supply chain challenges. Focusing on the entire automotive industry chain, Zhao Bin, Vice President of Strategic Products and Market at GigaDevice Semiconductor, added, “The biggest pain point in the entire industry is that Tier 2 in automotive semiconductors is monopolized by foreign IDM companies. Foreign IDM companies are very strong, with the top five holding a market share of about 50%, and the top ten holding 70%.” He pointed out that even the best power semiconductor in domestic automotive semiconductors has a market share of less than 10%, making it very weak in the Tier 2 segment. Gong Xi also emphasized that a Tier 1 that can do Tier 2 is a good Tier 1. He pointed out, “The pure profit margin and net profit margin of the electronics sector are actually lower than those of the iron and steel industry. Moore’s Law cannot beat the iron and steel industry, which is a very abnormal logic. This just shows that most of China’s automotive electronics Tier 1 companies do not have the core Tier 2 capabilities.” Taking automotive electronics giant Bosch as an example, in the global automotive parts rankings from 2010 to 2020, the rankings of the top two to top nine Tier 1 companies have been constantly changing, but Bosch has always held the top position. Gong Xi believes that this is closely related to its ability to produce underlying chips. Bosch’s automotive electronics division is not only responsible for verifying the reliability of all components entering Bosch’s supply chain, but will also develop its own chips.

Image source: Bosch In addition, the lack of sound standard systems and testing platforms, insufficient technological research and development capabilities, lack of application for key products, lack of accumulation in car standardization process, and insufficient ecological development are all obstacles to the localization of automotive chips. Furthermore, these are also important factors that restrict the development of automotive chips or the internationalization of automotive products. The localization of chips is accelerating. It can be seen that China is currently in a leading position in the entire new energy vehicle market, but it also faces the problem of further iteration and upgrading of the domestic chip industry chain, which is difficult to solve in the short term. As Gong Xi said, “As long as automotive electronics involve semiconductors, the rate and time frame of their localization, as well as the political factors involved, will take longer, possibly 10 to 20 years in the future of the automotive industry.” However, it can also be seen that, although there is still a big gap between China and semiconductor powerhouses such as the United States, Japan, and Europe, with the rapid development of the domestic new energy vehicle industry, local chips are also accelerating. Xu Erman pointed out that currently, domestically produced automotive chips focusing on intelligent driving and intelligent cockpit computing chips, incremental sensor chips, power chips, etc., have achieved significant breakthroughs. The overall localization rate has increased from less than 5% in the past to around 10% now. Jiefa Technology’s Chief Technology Officer Li Wenxiong also stated that Chinese automotive chip companies are gradually narrowing the gap with traditional international giants. Earlier, Nvidia and Qualcomm’s chips basically monopolized more than 95% of the market. Currently, domestic chips from Huawei, Horizon J2, J3, and J5, as well as Black Sesame A1000, are entering the market and even penetrating the global OEM and Tier1 supplier system. This includes the power devices mentioned above, which is an area with a relatively fast localization process. According to the data provided by Gong Xi, the localization rate of silicon-based IGBT has reached around 30%. In the first half of 2023, BYD Semiconductor ranked first, with approximately 1 to 1.1 million of its 1.8 million vehicles using their own IGBT modules. Following them are Infineon, CRRC Times Electric, and others. More than half of the top ten are Chinese companies. Particularly, the third-generation semiconductor represented by silicon carbide, thanks to the explosive growth of new energy vehicles, more and more car companies are using silicon carbide devices. However, the global industrial chain has not matured yet. For China, under the drive of this rapidly growing market, there is hope for an opportunity to overtake in the field of silicon carbide. “As the battery voltage increases, what is the next generation of core technology? Silicon carbide + 800V voltage platform,” said Xiang Qi, Vice President of Guangdong Xin Yue Neng Semiconductor Co., Ltd. In addition, for example, analog chips are less affected by process iteration advances, and the iteration speed is not so fast. In this environment, it is also an opportunity for domestic chips.

Image source: Bosch Overall, chip empowerment of cars has become a key factor in determining car production. The development trends of electrification, intelligence, and networking in the automotive industry are very certain, and the trend of domestic substitution is also irreversible. The strength of chip suppliers and the performance of product quality to OEMs and Tier 1 have also passed the “watering the fish” stage, with increasingly high requirements. At the same time, supply guarantee, complete product coverage, flexibility in services, customized development, and system-level understanding are all key factors for chip suppliers to go further. In the face of huge industry development dividends, Li Zhaolin suggested that domestic automotive chips should strengthen basic capabilities, establish standards from the top-level design of the country and the industry, and solve application problems to build an open-source and open automotive application environment in China. Xiangqi also called for a very good opportunity for rapid domestic substitution at this stage. OEMs and industry chain suppliers should cooperate to build up the industry chain. Domestic chips can only have the opportunity to iterate and upgrade if they achieve scale. “The largest car market is in China, the fastest engine for technological innovation and change is in China, and the fastest-growing downstream customers are also in China. Chinese chip manufacturers, based in such an innovative soil, have the advantage of closely cooperating with downstream partners to jointly face the future and develop some independently defined and innovative products. This may be the ultimate solution to market competition.” Wang Shengyang, founder, chairman, and CEO of Nascent Microelectronics, said optimistically.