Just a few days ago, the annual Guangzhou Auto Show came to a close, marking the end of this year’s domestic car exhibition and officially sounding the “pre-war horn” for the 2024 auto market. According to incomplete statistics from Gaishi Auto, a total of 109 new cars were exhibited and released during the Guangzhou Auto Show, including pickups, modified cars, RVs, and concept cars. Among them, 57 new models were first released, made their domestic debut, or started pre-sales and price announcements, all of which are the main models for companies to compete in the future car market. It is worth noting that more than half of the new cars are pure electric, and the trend of larger car models with prices reaching hundreds of thousands is becoming more common. This seems to be contrary to the background of “turbulent international situation and global economic slowdown”. It is confusing whether car consumption is upgrading or downgrading. There is no doubt that electrification and intelligence have long been seen as the mainstream trends of the new round of automotive revolution, but the changes in the cars themselves are not just about the configurations. Looking back over the past few decades, as the variety of cars has increased, people have classified them into sedans, SUVs, MPVs, and sports cars based on body structure, length, and performance, further divided into compact cars, mid-size cars, and large cars. According to data from the Gaishi Auto Research Institute, as of October 31 this year, the terminal sales of cars in China over the past two years have been dominated by compact cars, with a majority falling in the 100,000-200,000 yuan (28230$) range, accounting for nearly half of the market.

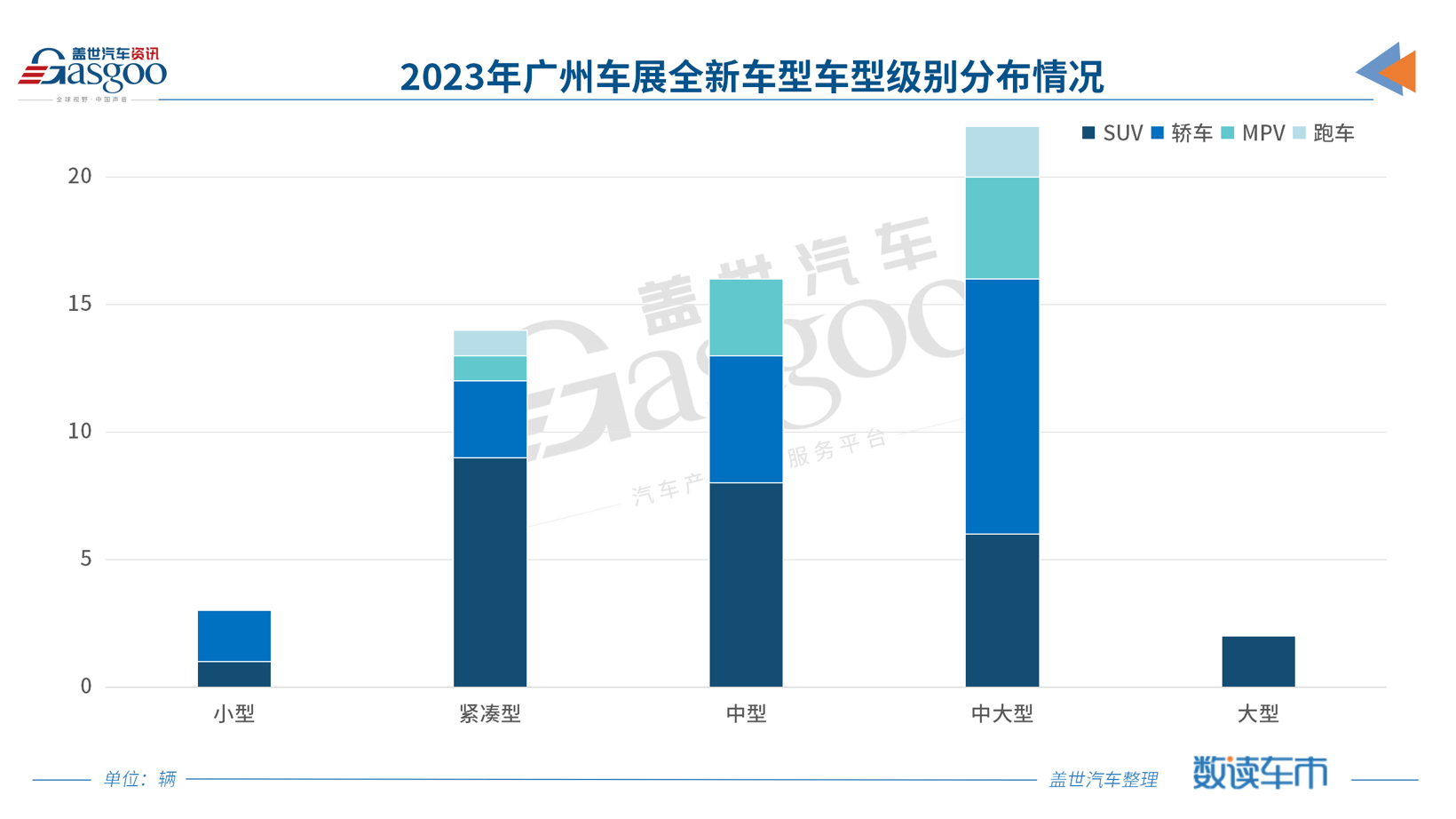

But at this auto show, among the 57 heavyweight new cars mentioned above, people seem to no longer be satisfied with compact cars. Not to mention the 16 mid-size new cars, the mid-to-large new cars alone account for as many as 22, including the BMW new 5 Series/i5, the Mercedes-Benz new E-Class/CLE, the Audi Q6 e-tron and other luxury brand flagship models, as well as the Toyota Crown, Prado two heavyweight nostalgic models, and the Zhiji S7, Xingtu Xingjieyuan ES, Geely Galaxy E8, Ideal MEGA, Xiaopeng X9 and other representatives of a number of domestic intelligent electric new cars. Not to mention the Wanjie M9 and Toyota World Extreme two large SUVs.

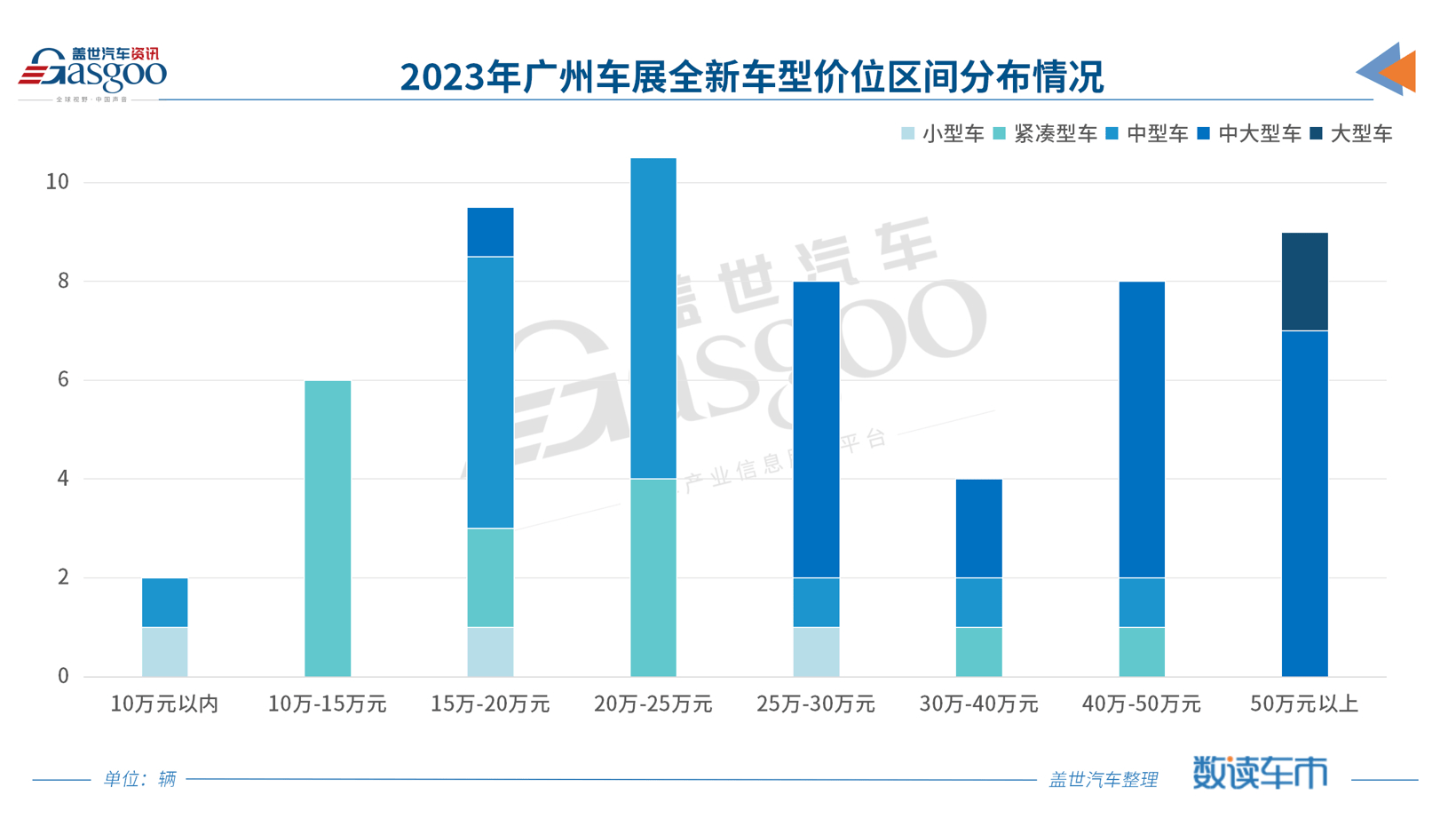

M9 debuts at the Guangzhou Auto Show It is believed that everyone has already noticed that in recent years, the MPV trend has made a comeback. From the pre-show launch of the Buick Century, Tengshi D9, Lantu Dreamer Wei, Gaoshan MPV, Volvo EM90, to the new debut at this year’s auto show of the Ideal MEGA, Xiaopeng X9, GAC E8, JAC Ruifeng RF8, and the new four-seat/six-seat versions of the Lexus LM. And just recently, NIO also revealed that it will join the MPV battle. Cars are getting more expensive With the leap in car level, prices naturally rise. I still remember that at the Shanghai Auto Show, the U8 attracted countless spectators to take a look, just to see the “true face” of this million-dollar new car from a domestic brand. After that, the “Pandora’s box” of the ceiling price for domestic brands was overturned, and everything just couldn’t stop. First, the Haobo SSR and the Jike 001 FR were launched one after another, with the former even raising the ceiling price to 1.686 million yuan. And at this year’s Guangzhou Auto Show, this trend seems to be even more fierce, with the Qichen DaV hydrogen market price at 998,800 yuan (141000$); Tank 700 Hi4-T pre-sale price at 700,000 yuan (98820$); In addition, according to the pre-sale prices released by M9 and Ideal MEGA, they will all exceed 500,000 yuan (70580$).

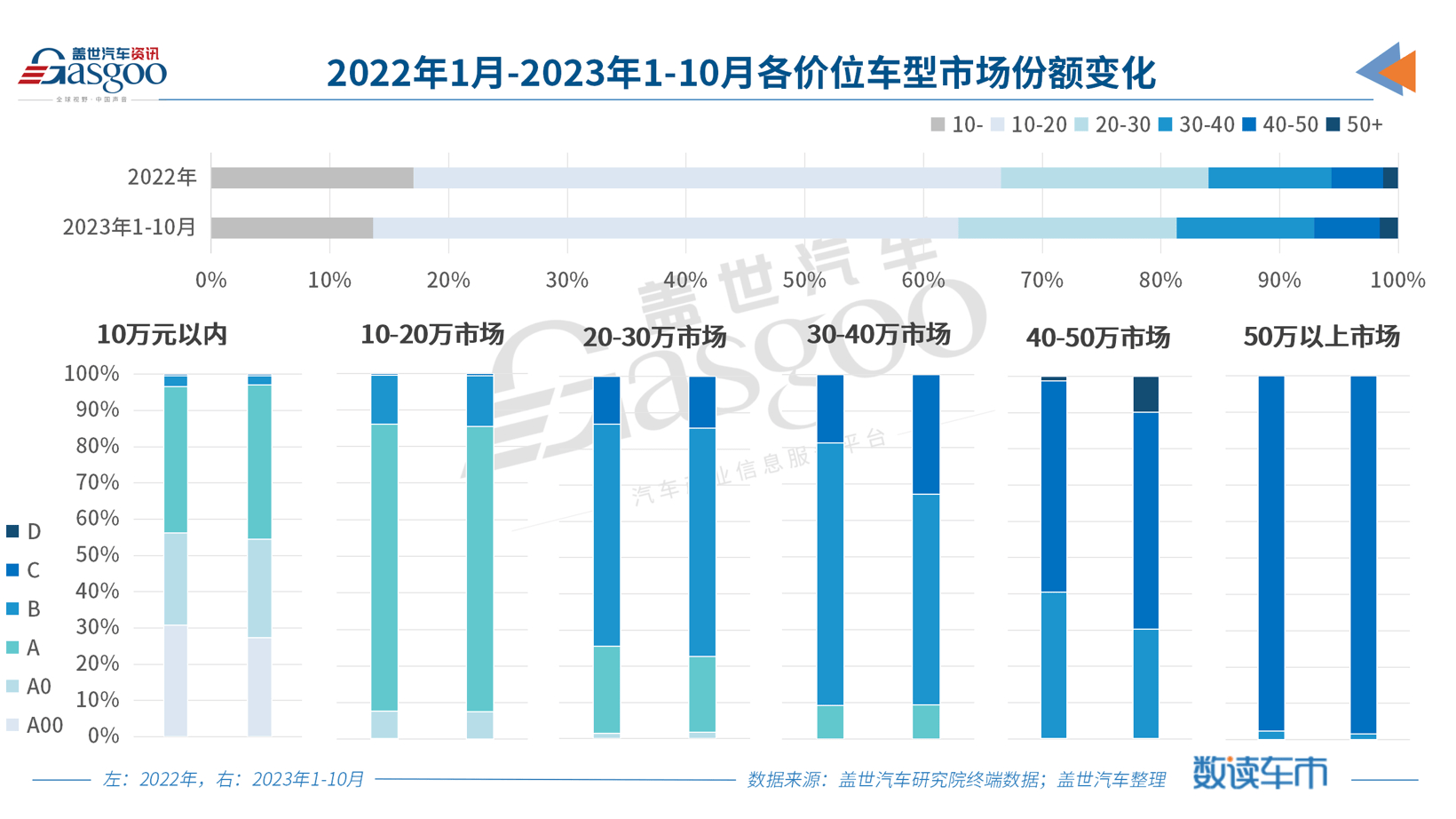

Among the 57 heavy-duty models mentioned above, the price range of 150,000 to 250,000 yuan (35290$) is still the main battleground of this auto show. It includes traditional fuel-powered star models such as the Toyota Camry, Hyundai Santa Fe/Sonata, as well as joint venture new energy vehicles such as the Volkswagen ID.7 VIZZION, Honda e:NS2/e:NP2, and local heavy-duty new energy vehicles such as the BYD Han 07 EV, Geely 007, Leapmotor C10, and Startos Yao Guang C-DM, GAC E8, etc. As mentioned earlier, the number of high-priced models is rapidly expanding. There are 17 new cars priced at over 400,000 yuan (56470$) in this auto show. If we further expand the price range, over half of the new cars are priced at over 250,000 yuan (35290$). From 100,000 to 150,000 fuel cars to 200,000+ electric cars. In fact, the trend of cars selling at higher prices has already emerged. In recent years, with the Chinese auto market entering the stock market, the main scenario for car consumption has gradually shifted from first-time purchases to replacement purchases. It is expected that by 2025, the proportion of replacement purchases for passenger cars will increase to 65%, and the market share of mid-to-high-priced vehicles will increase year by year, mainly reflected in the replacement of fuel cars with new energy vehicles in first-tier cities. According to the data from the GAC Automotive Research Institute, from January to October 2023, the sales of cars priced at less than 100,000 yuan (14120$) have gradually narrowed, while the market size of cars priced at over 200,000 yuan (28230$) has rapidly expanded. Correspondingly, with the entry of the domestic Tesla Model 3, coupled with the Model Y opening up the 200,000-300,000 yuan (42350$) new energy vehicle market in China, a wave of models such as Xiaopeng P7/P5/G6, NIO ET5, BYD Han, Geely 001/X, Haobo GT, Volkswagen ID.4 X/CROZZ have followed. Against this backdrop, as of October, the market share of terminal passenger cars priced at 200,000-300,000 yuan (42350$) in China this year has reached 18.38%, with new energy passenger cars in the 200,000-300,000 yuan (42350$) price range accounting for over 22% of new car sales, an increase of 6.35 percentage points from 16.03% in 2022. This year’s auto show is in focus, with models like the Jike 007 starting at a pre-sale price of 229,900 yuan (32450$) and the Zhijie S7 at 258,000 yuan (36420$). Even the Geely Star 4 and the new Cadillac Rui Ge will be priced at less than 300,000 yuan (42350$), intensifying the competition in the 200,000-300,000 yuan (42350$) market, especially in the new energy vehicle market. According to the China Association of Automobile Manufacturers, the high-end market above 300,000 yuan (42350$) will maintain a high growth rate in the future due to the trend of trade-ins and consumer upgrades. Cost-effectiveness is still king. After the conclusion of the Guangzhou Auto Show, Tesla and BYD announced price adjustments for some of their models. Tesla raised prices for the fourth time in nearly a month, while BYD reportedly offered discounts of 5,000-7,000 yuan (990$) on its Dynasty series models after releasing a favorable policy in early November, with the Tang DM-i model receiving the largest discount of 7,000 yuan (990$), which combined with previous discounts amounts to around 10,000 yuan (1410$). In fact, price fluctuations in the auto market have become commonplace since 2023. From Tesla’s price reduction announcement to AITO, Xpeng, NIO, Volvo, and Aiways all joining the unprecedented price war in the new energy vehicle market, the entire auto market has been swept up, reaching its peak in March. More than 50 auto brands and over 100 models joined the fray, with some even attempting to stand out by offering their models at half price. Since then, the price war has never truly subsided, with each brand trying to outdo the other by stacking up on range, features, and fast charging capabilities in order to maintain their market share in this chaotic market. For example, the price reduction of the Landtour FREE led to a doubling of sales for the entire Landtour brand, while the Zhijie M7’s price reduction helped the Zhijie brand rebound from the bottom. Additionally, the Zhiji LS6 quickly gained attention with its low price and high configuration. As a result, the Feifan R7 was launched at this year’s auto show with a starting price of 202,400 yuan (28570$), a decrease of 90,000 yuan (12710$) compared to the 2023 model priced at 279,900 yuan (39510$). According to the latest data from the Global Automotive Research Institute, the market share of compact cars in the 200,000 to 300,000 yuan (42350$) segment of China’s passenger car market has narrowed in the first 10 months of 2023 compared to 2022. Meanwhile, the market share of mid-sized and large-sized cars has increased by 1.79 percentage points and 1.07 percentage points, respectively.

In the above time period, the market share of mid-sized cars in the 300,000-400,000 yuan (56470$) terminal passenger car market in China has narrowed from 71.99% in 2022 to 57.83%, while the market share of mid-to-large-sized cars has increased by 13.95% to reach 32.72% compared to 2022. The 400,000-500,000 yuan (70580$) terminal passenger car market is no longer exclusive to mid-sized and mid-to-large-sized cars, as the rise of NIO has led to a rapid increase in the market share of large SUVs. As a result, we have to admit that despite our years of advocating for consumer upgrades, in the face of wave after wave of price wars this year, the market still focuses on value for money. So, is the car consumption upgrading or downgrading after all? This may be a new concept – upgrading and downgrading at the same frequency. Upgrading refers to the value and experience of the car, such as larger space, richer configurations, and cleaner energy sources, while downgrading refers to the purchase price of the new car. Buying a larger and more feature-rich model for a similar price has become the mainstream consumer trend, perhaps reflecting the trend of equal access to technology in the new era.