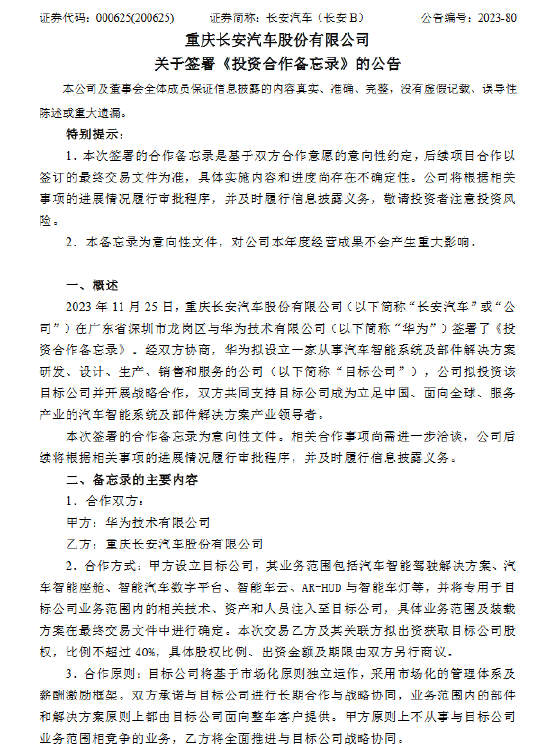

A major cooperation agreement is often signed at a location with the participation of many people, which can reveal a lot of information. On the evening of November 25th, Huawei and Changan Automobile signed a “Memorandum of Investment Cooperation”. Although it is an intention agreement, important executives from both sides, including top leaders, attended the signing, which took place in Shenzhen. This reveals that Huawei is not only the landlord but also an important leading party. The contents of the agreement had been reported in the media a day or two before it was officially announced. In short – Huawei is establishing a new company, with Changan holding no more than 40% of the shares. While the previously rumored “Huawei Car BU business divestiture” has not been announced, it is evident from the announcement that Huawei has committed not to “start a new fire”, and will no longer engage in business that competes with the “target company”. It is expected that the Huawei Car BU will be divested and injected into the new company.

It sounds like there’s not much difference from the agreements signed by both parties in the past five years. However, considering that when Avita was established, Huawei insisted on not investing or taking shares, following a typical HI model, this is not difficult to understand. As for the separation of the car BU from the Huawei system, it is a larger inference, which is based on the business architecture design trusted by the host factory. After all, in the past HI models, because Huawei only serves as a core supplier, market feedback comes more from its cooperative brands, such as the previous Saic Motor and BAIC, which have too many variables and uncertainties.

The establishment of Huawei’s car business unit, like a nimble cheetah, swiftly tore open the established boundaries of the automotive field. But within Huawei, this is the only business line in the business group that is losing money. Long-termism must be adhered to, but no one wants to be a conspicuous loss-making package, so, how to make a profit? It is nothing more than expanding the cooperation base and increasing the shipment volume. There are dual goals in this, the scale effect goes without saying, and more importantly, the products carrying the full range of Huawei’s offerings on the road will greatly increase the mileage that Huawei’s ADS cloud computing power learns every day, which will accelerate the speed of model training and transfer. Huawei Cloud’s hardware is not a problem, and its monthly increase in computing power is almost equivalent to the level of computing power maintained by competitors. The new company is like a “super platform” with three goals: joint procurement, joint product architecture design, and serving as a computing power base for partners. Huawei is already an important manufacturer of lidar, millimeter-wave radar, computing chips, and front-end chips. On the software side, it covers everything from the OS to dual-intelligent application software, as well as various basic libraries and tool chains. Simply put, with Hongmeng car machines and ADS intelligent driving, it has become the largest supplier of dual intelligence.

The entire vehicle E-E architecture, local computing power, and sensor hardware are now closely integrated with software. The traditional Tier1 survival solution has been greatly threatened. More and more OEMs are taking on the role of Tier1, responsible for integrating the entire vehicle into several domain solutions, with components directly purchased from Tier2, bypassing Tier1 in some scenarios. Huawei’s breakthrough not only provides complete vehicle domain solutions, computing power, and software solutions, but also puts its own intelligent hardware production capacity on the line. Shareholders can prioritize delivery to ensure supply, and even if prices rise, they can hedge with equity. Huawei is also aggressively attracting customers in the computing power base. Internal executives have said that Huawei aims to be the “second choice” for global computing power, serving as the base for Chinese computing power. This is equivalent to taking on the activities of Qualcomm, Nvidia, Google, and ChatGPT. Leveraging Huawei’s cloud computing power, model training and transfer can be easily conducted. Without the need to duplicate the construction of computing power, training data can also be shared with partners. The ability of the “super platform” translates into rapid iteration of autonomous driving capabilities, possibly faster than current smartphone updates. Furthermore, based on the complexity of hardware and tasks, OTA updates bring new experiences that surpass smartphones in every aspect. In fact, Huawei already holds the roles of Tier1 and Tier2 in the automotive industry, and its intelligent vehicle business can be considered Tier0.5. In a sense, calling Huawei an “automotive super supplier” is not an exaggeration. There have been views that Huawei intends to become “another Bosch,” but upon careful comparison, Bosch’s reach extends at most to Tier2, never intervening in entire vehicle design or customer marketing. In the era of new energy, Bosch has yet to introduce advanced assisted driving solutions, and there is no high-speed NOA.

Undoubtedly, the partnership between Huawei and Chang’an represents a new model. Just as in the era of gasoline cars, Tier1 suppliers such as Bosch established stable partnerships with mainstream car manufacturers globally. Even cross-border car companies would hold stakes in important first and second-tier suppliers. Under these stable partnerships, everyone shares the principle of benefit distribution. The upcoming joint venture not only integrates all of Huawei’s automotive business models, blurring the boundaries between HI and Smart Selection car models, but also, to some extent, makes Huawei’s “no car manufacturing” pledge more credible. More importantly, this platform is likely to spawn a joint procurement model for hardware related to intelligence, placing several major shareholders’ assets on the platform to achieve cost-effective effects. Previously, there has never been a similar intelligent hardware joint procurement platform, and new rules for the era of new energy are likely to emerge. The only variable is the number of main engine manufacturers on board. Currently, in addition to the exposed Sylphy and Chery, Smart Selection cars may also include BAIC and JAC. As for the HI business, there is currently only Avita, which used to need to put in more effort. Now, as long as it joins the super platform and enjoys the benefits of the big alliance, there is no need to worry about the number of partners. For those who are not at the table, the speed of distancing is likely to be measured in days… Description: Discover the details of the significant partnership between Huawei and Changan Automobile, revealing insights into their joint venture and the impact on the automotive industry.