With the release of NIO’s last performance report, NIO, XPeng, and Li Auto, the three new forces in the car-making industry, have all released their third-quarter financial reports.

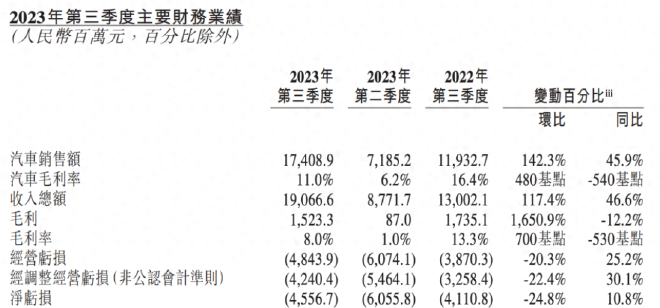

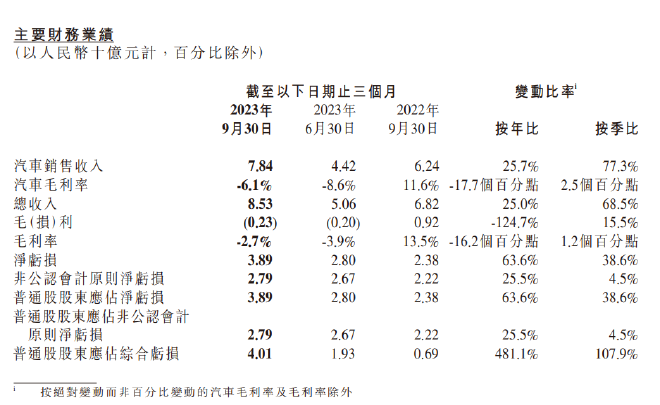

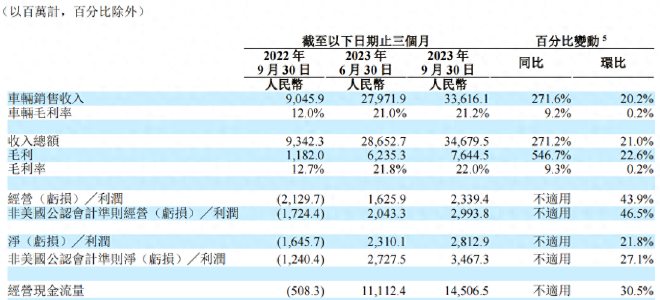

Financial report data shows that NIO’s third-quarter revenue was 19.067 billion yuan, a year-on-year increase of 46.65% and a quarter-on-quarter increase of 117.4%; XPeng’s revenue was 8.53 billion yuan, a year-on-year increase of 25.0% and a quarter-on-quarter increase of 68.5%; and Li Auto’s revenue was 34.68 billion yuan, a year-on-year increase of 271.2% and a quarter-on-quarter increase of 21.0%. In terms of profit, NIO’s net loss in the third quarter was 4.557 billion yuan, a year-on-year increase of 10.8% and a quarter-on-quarter decrease of 24.8%; XPeng’s net loss was 3.89 billion yuan, a year-on-year increase of 63.6% and a quarter-on-quarter increase of 38.6%; and Li Auto achieved a net profit of 2.81 billion yuan, an increase of 21.8% from the previous quarter, and has been profitable for four consecutive quarters. As for gross profit margin, NIO’s gross profit margin in the third quarter was 11.0%, an increase of 4.8% from the previous quarter and a decrease of 5.4% year-on-year; XPeng’s gross profit margin fell to -6.1%, a decrease of 17.7 percentage points year-on-year; and Li Auto’s gross profit margin was 21.1%, an increase of over 9 percentage points from the same period last year, surpassing Tesla’s 17.9% and approaching BYD’s 22.1%. Compared to the past, the situation of Weilai, Xiaopeng, and Ideal has changed significantly.

This phenomenon has been evident since the second quarter. Ideal’s revenue, net profit, and gross profit margin have reached new highs, while Weilai has the greatest performance pressure, followed by Xiaopeng. Of course, the financial data performance is also closely related to sales volume. Weilai delivered 55,432 new cars in the third quarter, an increase of 135.7% month-on-month and 75.4% year-on-year. Xiaopeng delivered a total of 40,008 vehicles in the third quarter, an increase of 72.4% month-on-month. Ideal delivered 105,108 vehicles in the third quarter, an increase of 296.3% year-on-year. Although Ideal’s performance is good, it is not without worries. With the increase in sales volume, Ideal’s production capacity has become the biggest challenge, and whether the pure electric track has further growth advantages is also unknown.

Recently, Weilai and Xiaopeng have both launched a number of cost reduction and efficiency improvement measures to quickly emerge from the downturn. Next, Weilai’s challenges will be presented in different forms. Weilai: Adhere to stable prices and continuously expand the circle of friends. From the third quarter financial report of Weilai, although its losses have narrowed month-on-month, it is still in a period of poor performance. However, compared to the current losses, what is more concerning about NIO is the recent internal restructuring and constant external collaboration news.

During the third quarter earnings conference call, Li Bin, chairman of NIO, responded to topics such as battery swapping cooperation, contract manufacturing, and layoffs. He stated, “We have recently reviewed and adjusted the company’s key goals, priorities, and action plans, focusing on efficient execution and system improvement, and will continue to focus on advancing core technology, developing key products, and enhancing sales and service capabilities in the future.” From a financial perspective, NIO’s performance in the third quarter seems not as bad as speculated by the outside world. The gross profit margin and cash flow situation have improved, allowing NIO to pass through the third quarter without much difficulty.

Unlike Xiaopeng and Li Auto’s product strategy and business philosophy, NIO has always believed that the high-end market needs appropriate diversity. Therefore, among the three companies, NIO has the most models, including three SUVs, three sedans, and two coupe SUVs. Xiaopeng has six models, while Li Auto currently only has three models – L7, L8, and L9. The multi-product strategy has brought significant challenges to NIO’s cost control and profitability. During the product upgrade period from April to May this year, NIO’s sales volume almost halved month-on-month, with only the ET5 and ES7 as the main selling models, leading to a significant decline in revenue in the second quarter.

However, since all of NIO’s products switched to the NT2.0 platform, covering 80% of the main sales models in the BBA segment market, and presenting overwhelming advantages in terms of product strength, it has entered a period with a stronger product line overall, while avoiding the problem of selling two generations of models simultaneously. Looking at the sales volume in the third quarter, NIO has also achieved preliminary success. In July, NIO delivered over 20,000 vehicles for the first time, a year-on-year increase of 104% and a month-on-month increase of 91%. In August, NIO delivered 19,300 vehicles, an 81% increase year-on-year.

In September, NIO delivered 15,600 new vehicles, a 43.8% increase year-on-year. In the third quarter earnings call, Li Bin stated that NIO currently has over 5700 sales advisors, with over 3000 recent hires who will undergo one month of training before starting, taking some time to become combat-ready. This once again signals NIO’s focus on boosting sales momentum, seen as a key driver of NIO’s performance breakthrough by the industry. Looking ahead to the fourth quarter, NIO’s new car delivery guidance is 47,000 to 49,000 units, considering the 32,000 units delivered in October and November, December sales are expected to be between 15,000 and 17,000 units, with overall manageable pressure. Regarding the ongoing price war, Li Bin stated that NIO will not sacrifice sales volume by lowering gross margins or prices.

The NIO brand will continue to maintain price stability, steadily increase gross margins, and increase sales through improved sales capabilities and efficiency. He also predicted that NIO’s gross margin for the fourth quarter of this year will reach 15%. In terms of products, NIO has already completed the transition of all models to the second-generation platform, and will not release any completely new models next year, only annual product updates. This means NIO will compete with other car brands using existing products.

However, Li Bin also revealed two major product developments at this earnings call. One is the launch of a new flagship car at NIO Day on December 23rd, and the other is the development progress of the first car from the sub-brand Alpine. He disclosed that the first car from the Alpine brand has recently completed the VP trial production, the best state of any car in VP stage in history, which means the entire vehicle system functions have been tested. Additionally, Li Bin mentioned that the Alpine brand and NIO brand will share some services, such as service centers and battery swap networks, but sales will be separate, with the Alpine brand establishing independent stores.

In addition, NIO has expanded its battery swapping “circle of friends”, announcing cooperation with Changan and Geely Holding Group on November 21 and November 29, respectively, to jointly promote the operation of battery swapping business and vehicle development. This is an important attempt by NIO to improve the performance of its battery swapping business, according to industry insiders. During the evening conference call on November 5, NIO announced that it will open up its battery packs and swapping stations to partners in the mass market brand. “The charging pile business has basically reached break-even, and there are also investors interested in independent financing for NIO Power,” said NIO. In addition to expanding battery swapping business cooperation, NIO has also begun to try to reduce operating costs.

Li Bin stated that NIO will adjust projects that have not been profitable for three years or have not contributed to gross margin improvement, such as in-house battery production. Research and development of battery cells and packs will continue, but production will be outsourced to reduce costs. It is worth noting that NIO has confirmed the acquisition of relevant JAC Motors factories in its financial report. “If vehicles are completely manufactured by NIO itself, costs will decrease by 10%. If this reflects in profits, it will be good news for NIO,” Li Bin explained during the financial report conference call. For NIO at present, how to increase sales is crucial.

Currently, companies like Xpeng and Li Auto have already surpassed NIO in deliveries, and Li Auto’s monthly deliveries have exceeded 40,000 vehicles, putting significant pressure on NIO’s sales. Xpeng: Adjusting product structure and reducing costs is key Compared to NIO and Li Auto, Xpeng is facing even greater pressure. The financial report shows that Xpeng had a net loss of 3.89 billion yuan in the third quarter, an increase of 1.51 billion yuan from the same period last year. The bad news is that it is still incurring losses, but the good news is that the loss has narrowed.

Xiaopeng explained that, according to the third-quarter financial report, due to the fair value change, an “non-cash loss” of 970 million yuan was recorded. This was due to the rise in the stock price of Xiaopeng, which increased the value of the equity investment by the public. According to generally accepted accounting principles, the fair value change must be included in Xiaopeng’s financial report. This “non-cash loss” is unrelated to the actual operation of the company. In addition, compared to Ideal and NIO, Xiaopeng’s gross margin performance was below expectations.

The continuous decline in gross margin also worried the market. Xiaopeng must continue to work hard to improve the gross margin. The financial report data shows that Xiaopeng’s gross margin in the third quarter was -2.7%, a decrease of 16.2 percentage points from the same period last year. The automobile gross margin was -6.1%, which is much worse than the 11.6% in the same period last year. Due to the intense price war in the market for new energy vehicles in the 200,000 yuan (28030$) level, it is even more difficult for Xiaopeng to achieve a positive gross margin. In fact, the higher the sales volume of Xiaopeng, the more losses it incurs due to the negative gross margin.

Therefore, the loss of Xiaopeng in the third quarter further expanded, with a net loss of 3.89 billion yuan. Excluding the fair value change brought about by the rise in the stock price of Xiaopeng after excluding the public equity investment, the loss at the business level was 2.79 billion yuan, which was basically flat with the previous quarter. At present, Xiaopeng is in a period of adjustment, and since the beginning of this year, Xiaopeng has made many changes in both its organizational structure and product research and development. “Thanks to the upgrading of this year’s strategy, organizational structure, management team, and product technology planning, Xiaopeng’s performance in the third quarter exceeded expectations and entered a preliminary positive cycle. It is expected to enter a high-speed development positive cycle in the fourth quarter of next year.”

“Xiaopeng Motors Chairman He Xiaopeng stated in the financial report conference call that the internal cost reduction action at Xiaopeng is quite effective. The first target of cost reduction is to make R&D more efficient, thanks to Xiaopeng’s cooperation with Volkswagen. Xiaopeng is also accelerating the “end-to-end cost reduction” of the supply chain, including design, R&D, manufacturing, and marketing. Currently, Xiaopeng’s cost reduction action is ongoing, and with further increase in delivery volume and deepening of channel reform, He Xiaopeng expects Xiaopeng Motors’ gross profit margin to turn positive in the fourth quarter of this year, stating, “This is also the starting point for our long-term scale profitability.” In addition, He Xiaopeng also stated, “Under the leadership of President Wang Fengying, the sales channel is undergoing a transformation, which I believe will make the entire system more efficient and flexible, with faster channel expansion and targeting more third- and fourth-tier cities.”

He Xiaopeng judged that the channel upgrade and expansion will become one of the important driving forces for Xiaopeng’s sales growth in 2024 and beyond. At the same time, cost reduction measures will significantly improve product competitiveness while significantly improving Xiaopeng Motors’ gross profit margin. Previously, Xiaopeng Motors was most aggressive in R&D, directly benchmarking Tesla and attempting to make intelligent driving its corporate label. However, this year, Xiaopeng’s R&D investment has slowed down, with Q3 R&D expenses reaching 13.1 billion yuan, maintaining a stable state. It is worth noting that Xiaopeng Motors’ revenue in the third quarter increased compared to the previous quarter, mainly due to the increase in delivery volume of the entire product lineup, with the G6 as the main model. Since its launch, the Xiaopeng G6 has continued to sell well, driving sales growth of the entire lineup.”

In addition, in terms of technology, Xiaopeng Motors continues to increase investment, and the trend of maturity and deep landing of technologies such as the Fuyao architecture, XNGP, and XOS. The Xiaopeng X9, as the first flagship model under the Fuyao architecture, has excellent intelligent performance. During the conference call, He Xiaopeng emphasized that the XNGP system of Xiaopeng has the technical capability to support urban intelligent driving nationwide, and will expand to 25 cities by the end of November and 50 cities by the end of December.

Furthermore, it is expected that by 2024, Xiaopeng will integrate the full-stack self-developed capabilities of multiple different systems, including the next-generation electronic and electrical architecture, unified intelligent driving domain, intelligent assistance system for human-machine co-driving, intelligent voice, intelligent cockpit capabilities, new large-scale language model capabilities, and next-generation intelligent chassis, to achieve rapid deployment of different vehicle capabilities. Moreover, Xiaopeng Motors stated that the X9 is currently the highest gross margin product in its product portfolio, and is expected to improve profitability.

Thanks to the company’s continued cost reduction and the arrival of the X9 and 2.0 platform, the gross margin in 2024 is expected to be significantly higher than in 2023. Based on positive sales expectations, Xiaopeng Motors has raised its Q4 performance guidance, expecting deliveries to reach 59,500-63,500 vehicles, a year-on-year increase of approximately 168.0% to 186.0%, and total revenue to reach 12.7-13.6 billion yuan, a year-on-year increase of approximately 147.1% to 164.6%. Entering the fourth quarter, Xiaopeng had a good start, with monthly sales exceeding 20,000 vehicles in October, reaching a new historical high. In November, new car deliveries reached 20,041 vehicles, breaking the 20,000 mark for the second consecutive month, with a year-on-year increase of 245%, setting a new record for monthly deliveries. For Xiaopeng Motors, the focus is still on “intelligence + cost-effectiveness.”

Over the past year, Xiaopeng Motors has undergone in-depth product technology architecture and organizational changes, putting Xiaopeng Motors on the path to a virtuous cycle. With the launch of the Xiaopeng X9 and the gradual implementation of intelligent driving technology, Xiaopeng Motors is accelerating towards new sales milestones. Goal: Challenge to sell 50,000 vehicles per month, and capacity must keep up Since achieving profitability for the first time in the fourth quarter of 2022, this is the fourth consecutive profitable quarter for Ideal Cars, and the first among all new carmakers to achieve profitability.

Based on the strong performance in the third quarter, Ideal Car expects a delivery volume of 125,000 to 128,000 vehicles in the fourth quarter, a year-on-year increase of 169.9% to 176.3%, with a total revenue of 38.46 billion to 39.38 billion yuan, a year-on-year increase of 117.9% to 123.1%. Now, Ideal Car has delivered over 40,000 new cars in October and 41,000 in November. As of November 30, 2023, Ideal Car has delivered a total of 325,700 vehicles for the year, surpassing the annual target of 300,000 vehicles for 2023. In December, the company aims to challenge the goal of delivering 50,000 vehicles in a month. In terms of research and development, Ideal is also willing to invest. Its R&D expenses in the third quarter were 2.82 billion yuan, a year-on-year increase of 56.1%.

Ideal Car stated that the increase in R&D expenses is mainly due to the increase in employee compensation caused by the increase in the number of employees, as well as the increase in expenses to support the continuous expansion of the company’s product portfolio and technology. In addition, Ideal Car’s urban NOA research and development is progressing smoothly. It is reported that by the end of this year, the official version of AD Max 3.0 will be pushed to all users, providing car owners with full-scene NOA capabilities. In the first half of next year, the official version of AD Pro 3.0 will also be pushed to users. At present, although Ideal Car has achieved leadership in revenue, delivery volume, and gross profit margin in many aspects in the third quarter of this year, with the rapid growth in product sales, Ideal has gradually approached its production capacity ceiling.

Its layout in the pure electric track is crucial for whether it can maintain further growth. Ideal Car CEO Li Xiang previously stated on social media, “Production capacity is the only bottleneck this quarter, and it is unsolvable this quarter.” Earlier, Li Xiang had already revealed this signal to the public: production and delivery, the bottleneck of 8,000 vehicles per week continues. Previously, Ideal Car President and Chief Engineer Ma Donghui also stated that the main bottleneck is in the supply of parts, mainly because the production demand has increased compared to the target set at the beginning of the year. Although strategies and plans to increase production capacity have been formulated, the parts production line is still in the process of debugging and verification, and it will take some time to release new production capacity.

During the third quarter performance conference call, Li Xiang stated that Ideal Auto’s Changzhou manufacturing base completed capacity upgrades in October, preparing for further production ramp-up in the fourth quarter. In addition, in terms of supply chain management, Ideal has continuously broken through the bottleneck of component supply by optimizing management strategies, upgrading management processes, and strengthening efficient collaboration with suppliers. Apart from capacity, Ideal also faces unknown challenges in the pure electric racing track. Ideal’s first pure electric model, MEGA, will begin delivery in February next year, and whether it can replicate success in the pure electric racing track is also crucial for Ideal’s continued expansion.

Furthermore, Ideal also stated that with the advancement of the dual-energy strategy of intelligence and electricity, in addition to the highly anticipated launch of the first pure electric model, MEGA, Ideal Auto is expected to release four new products in 2024, making it the most abundant year of products since its establishment. At the third quarter financial report meeting, Li Xiang also mentioned, “In the first half of 2024, Ideal will release the L6 targeted at younger families, and in the second half, three pure electric products will be delivered. The pace of product launches and deliveries will continue our excellent tradition.” It is noted that Ideal will release four models next year, three of which are pure electric models and one is an extended-range SUV, not including Ideal MEGA. The challenge that Ideal Auto is about to face is how to maintain high gross profit and low cost rate while expanding rapidly.