Wuling’s new round of transformation begins with a sedan product. On December 6th, Wuling’s first super A-class new energy sedan product – Wuling Xingguang was officially launched. The initial two models on the market are plug-in hybrid versions, with a pure electric range of 70km and 150km under CLTC conditions, and a price range of 88,000-105,800 yuan (14820$).

Starlight, photo source: Wuling Motors The new car is based on Wuling’s original new energy architecture, equipped with the “Wuling Lingxi hybrid system” and “Shenlian battery” two self-developed core technologies. It was officially launched in the last month of 2023, and it is defined by the official as the blockbuster of the year. Obviously, Wuling has big plans for this car. It is not only a trial in the mainstream family sedan market, but also bears the heavy responsibility of Wuling’s brand electrification transformation and challenging the higher-end market. In the past, Wuling was the “King of the Mountain” and the “National Divine Car”, but neither the Hongguang nor the Hongguang MINIEV has brought much profit.

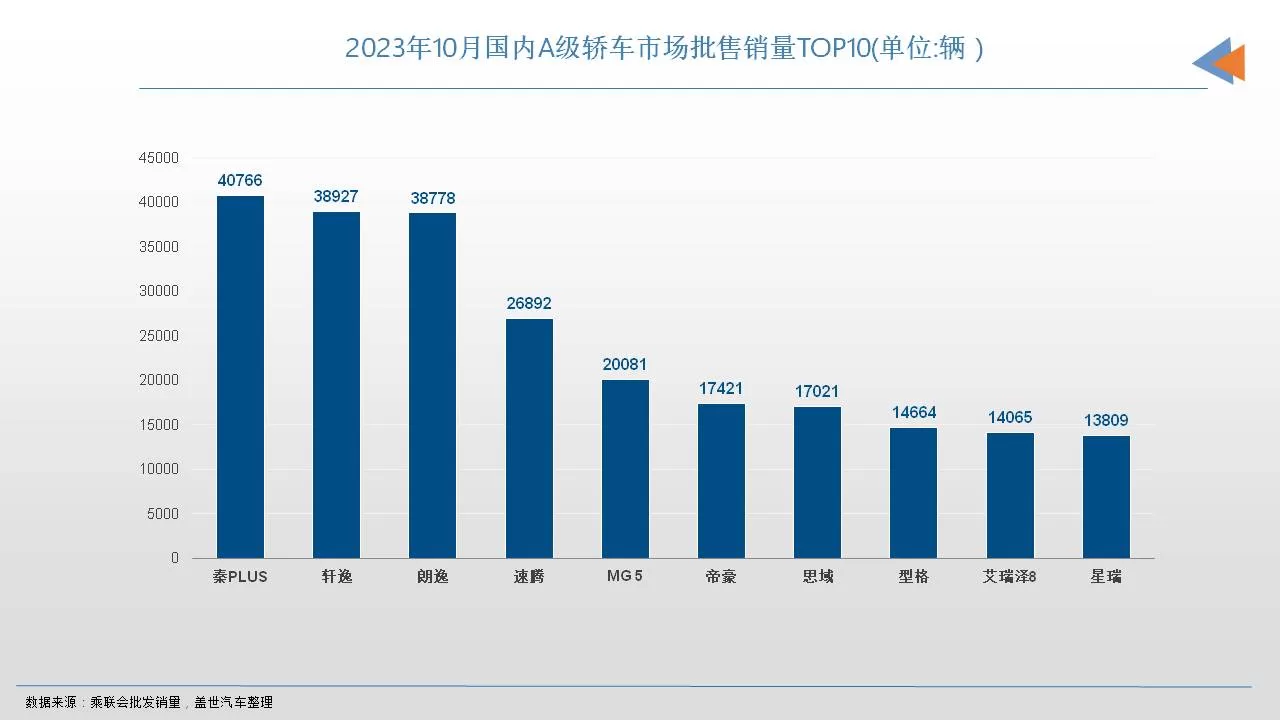

In fact, in the first half of this year, SAIC-GM-Wuling’s net profit dropped by nearly 90%. At this stage, Wuling urgently needs a hot-selling product that can improve profitability, and the new car Starlight undoubtedly has to take on this responsibility. But the problem is, the family sedan market in China is one of the most fiercely competitive segments. Can Starlight really achieve the expected results? The current domestic family sedan market is very competitive. The family sedan market is currently the most competitive track in the domestic automotive market. The spirit of “whoever gets the A-class car gets the world” is thoroughly implemented by both domestic and foreign car companies. In the top 20 list of sedan sales in October compiled by Gaisi Auto, 8 of them are A-class family sedans, and 5 of them have monthly sales of over 20,000 units.

BYD’s Qin PLUS aims to “unify the world and overthrow fuel”; The Xuan Yi is the last market pillar of Dongfeng Nissan, “holding the position” is the most basic requirement; The Lavida and Sagitar are the “trump cards” of the north and south of Volkswagen in the sedan market, and they cannot afford to make mistakes. In addition, the Civic, Stylish, and independent camp products such as the Emgrand, Aries 8, and the Xingrui, the domestic sedan market has long been “congested” exceptionally. As a latecomer, if you want to achieve results, you can only become more and more “rolled up”, and even everyone has already started to define the “rolled up” model, which is a clear signal.

The current car classification standards are becoming increasingly inconsistent. In the past, when we talked about A-class cars, they were basically products with a length of no more than 4700mm and a wheelbase of around 2600mm. However, in the past two years, with the rise of the independent car market, the above body size and wheelbase can no longer contain the “expansion and strengthening” of independent A-class cars. Many independent cars with a length close to 4800mm and a wheelbase of 2800mm are still positioned as A-class cars, relying on differentiated positioning and more prominent cost-effectiveness to strive for a breakthrough. The Geely Xingrui is a very typical product with online interior and exterior design, and its configuration has also achieved the “top” in the segmented market. In addition, with its larger body size and competitive price compared to products of the same level, this car was extremely popular when it was launched, and was entrusted with the responsibility of overturning the monopoly position of joint venture sedans in the market.

Although the subsequent overall electrification of domestic car consumption has not truly met the market’s expectations, the overall performance of the oil-powered Star Ruixing has been commendable, with monthly sales stabilizing at over 10,000 units. Just a few days ago, the Star Ruixing series introduced a new oil-electric hybrid model, the Star Ruixing L, which may further enhance the market performance of the entire series. The market strategy of the Star Ruixing, which is similar to the Starlight, also plays on the positioning of the products. The official positioning of the Starlight is a super A-class family sedan. The new car has a wheelbase of 2800mm and a length of over 4800mm, but it does not directly define itself as a B-class car. Yet, the price range does set it apart from B-class cars.

The Starlight is also unwilling to be directly associated with A-class cars, so it has created the concept of a super A-class family sedan. The original intention of this approach, as explained by the Starlight at the launch event, is that, according to Wuling’s observation, there is a common pain point in the traditional family car market in China: “the larger the car, the more fuel it consumes, or the larger the car, the higher the price.” The main force of fuel-efficient family cars also has the problem of limited space. Wuling’s ultimate conclusion is that the terminal market needs a family car product that can meet the requirements of large space, without fuel consumption concerns, and at a reasonable price.

Therefore, the super A-class represents a potential market. Will the Starlight be Wuling’s new hope? Wuling previously released a set of data: one week after the start of pre-sales, orders for the Starlight exceeded 5,000 units. It can be tentatively determined that a family car bearing the Wuling brand can be popular. However, will this car be a big hit? Whether benefiting from forward-looking insight or pure “luck,” the experience of the past years is enough to prove that Wuling is a brand that is good at seizing new market opportunities. At the time of the surge in demand for commercial and home needs, Wuling successfully transformed with the reputation accumulated in the microvan market, and, with the Hongguang series of models, took the lead in opening up the domestic low-end MPV market.

When the new energy tide surged, Wuling once again showed “magic” by avoiding the already somewhat crowded mid-to-high-end electric vehicle market and choosing to focus on the third and fourth-tier markets and rural markets to serve users of original electric two-wheeled vehicles, electric three-wheeled vehicles, and low-speed electric vehicles who are eager to upgrade their products, aiming at the low-end market and once again creating a phenomenal hit – the Hongguang MINIEV, leading the consumer frenzy for A00-level electric small cars in the country for the past two years. The Wuling brand, and even SAIC-GM Wuling, has always had the tradition of creating hit products in the low-end market, but breaking into the high-end market is extremely difficult.

Previously, New Baojun had an unsuccessful precedent. Will Wuling Starlight be any different? Indeed, this new car is not positioned as a true high-end model, but it has already touched the market red line of 100,000 yuan (14010$). Within Wuling, it is already considered a genuine push into the high-end. What is Wuling relying on? In fact, Wuling’s intentions are quite clear. If it can truly solve some of the pain points of sedan users, there is indeed a possibility of becoming a new hit. Wuling believes that traditional sedans are not atmospheric enough, with designs that are compact, narrow, and short, lacking in tension.

Therefore, when designing the Wuling Starlight, special attention was paid to creating a sense of atmosphere. The figure should be slender, the front and rear lights should be eye-catching, combined with the diving-style front and large sloping back overall shape, in terms of appearance, it is more in line with the realistic aesthetic of the public. In recent years, SAIC-GM Wuling has launched many new cars, and the design is mostly a bonus.

Wuling Motors With a length of 4835mm and a wheelbase of 2800mm, the Starlight ensures a decent interior space; the combination of MacPherson independent front suspension and E-type multi-link independent rear suspension is relatively high in terms of chassis specifications among similar products; In terms of human-computer interaction, the high-end version of the Starlight is equipped with LingOS system, currently the main system of SAIC-GM-Wuling, supporting continuous dialogue within 20 seconds, which is considered mainstream in the current domestic car market.

The power aspect is the highlight of the Wuling Starlight, and the Lingxi hybrid system presents many highlights in terms of paper data. Wuling has independently developed a new hybrid-specific engine platform, with the engine achieving a maximum thermal efficiency of 43.2%, and through optimization in combustion systems, low-friction systems, and thermal management systems, the fuel efficiency of the entire hybrid system is ensured. Under WLTC conditions, the Wuling Starlight can achieve a fuel consumption of 3.98L/100km. In terms of the battery, the Wuling Starlight is equipped with Shenlian batteries, which, in tests conducted by the China Automotive Technology and Research Center, showed normal charge and discharge after the battery core was deformed by 40% and punctured to one-third of its depth, and no fire or explosion occurred when the steel needle pierced the battery core vertically.

In addition, it is worth mentioning that the first owners of the Wuling Starlight can enjoy a lifetime warranty for the three-electric system. Overall, the Starlight holds the title of Wuling’s first home sedan, with a well-designed and well-equipped configuration compared to similar products, and more importantly, it has a significant pricing advantage. The starting price of the Qin PLUS Champion Edition plug-in hybrid sedan has been lowered to below 100,000 yuan (14010$), while the Wuling Starlight has gone even further, with a starting price of less than 90,000 yuan (12610$), further lowering the purchasing threshold for new energy sedans, and the new car has already gained a good market momentum. However, it should be noted that the arrival of the Starlight will not only increase the competitive pressure in the segmented market, but will also inevitably transmit this pressure within the Wuling brand. With the super A-class plug-in hybrid sedan Starlight priced at only 88,000 yuan (12330$), will potential consumers of the small electric car Binguo be swayed? Will the internal product diversion problem that SAIC-GM-Wuling has not solved well reappear? Let’s hope that this time, it will finally lead to a good result.