After 7 months, CATL’s lithium iron phosphate battery installation volume once again surpassed BYD’s. On December 11th, the China Automotive Power Battery Industry Innovation Alliance released the latest data, showing that in November, CATL’s domestic power battery installation volume was 19.7 GWh, with a market share of 43.91%, firmly holding the top spot. During the same month, BYD’s power battery installation volume was 10.2 GWh, with a market share of 22.73%, hitting a new low for the year. In terms of technical route, CATL’s installation volume for ternary batteries in November was 9.07 GWh, with a market share of nearly 60% in the domestic market, and the installation volume of lithium iron phosphate batteries was 10.63 GWh, with a market share of 36.52%. BYD’s November power battery installation volume still comes entirely from lithium iron phosphate batteries, with a market share of 34.99% in this area, being overtaken by CATL.

Before this, BYD had been ranked first in the field for seven consecutive months, so in the ranking of the cumulative market share of lithium iron phosphate batteries in the first 11 months, BYD still ranks first with an advantage of over 7 percentage points, with a market share of 41.11%. Lithium iron phosphate and ternary batteries are the two mainstream routes for domestic power batteries. From 2018 to 2020, the installed capacity of lithium iron phosphate batteries in China was lower than that of ternary batteries. With the help of innovative technology, the advantages of lithium iron phosphate in safety and cost have become more prominent. In July 2021, the market share of lithium iron phosphate batteries surpassed that of ternary batteries and has since maintained the lead. In November of this year, the domestic power battery installed capacity was 44.9 GWh. Among them, the installed capacity of lithium iron phosphate batteries was 29.1 GWh, accounting for 64.9% of the total installed capacity; the installed capacity of ternary batteries reached 15.7 GWh, accounting for 35% of the total installed capacity.

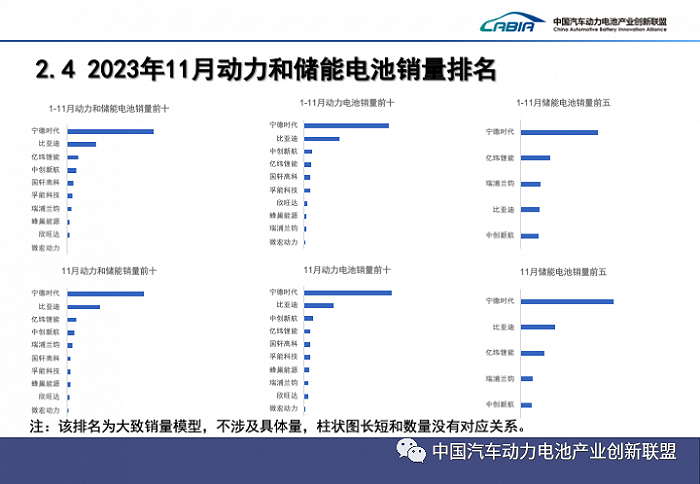

In November, CATL’s installed capacity of power batteries reached 3.24 GWh, ranking third with a market share of 7.21%, down 2.46% from the previous month, also hitting a new low for the year. Guoxuan High-Tech and EVE Energy ranked fourth and fifth with installed capacities of 2.11 GWh and 2.05 GWh, respectively. EVE Energy’s market share was 4.56%, while Guoxuan High-Tech’s market share reached 4.7%, a new high for the year. LG Energy, Hefei Guoxuan, Funeng Technology, Xingwanda, and Ripu Lanjun ranked sixth to tenth, with market shares of the top nine companies all exceeding 2%.

In November, domestic energy storage battery sales reached 16 GWh, a 15.1% increase month-on-month. The top three companies in terms of sales volume were CATL, BYD, and EVE Energy. In terms of exports, domestic power and energy storage batteries totaled 17.9 GWh last month, with power batteries accounting for 13 GWh, or 72.6%, and energy storage batteries accounting for 4.9 GWh, or 27.4%, a 6.3 percentage point increase from the previous month. In terms of exports of power and energy storage batteries in November, CATL led other companies by an absolute advantage, ranking first, with BYD and Funeng Technology ranking second and third, respectively.