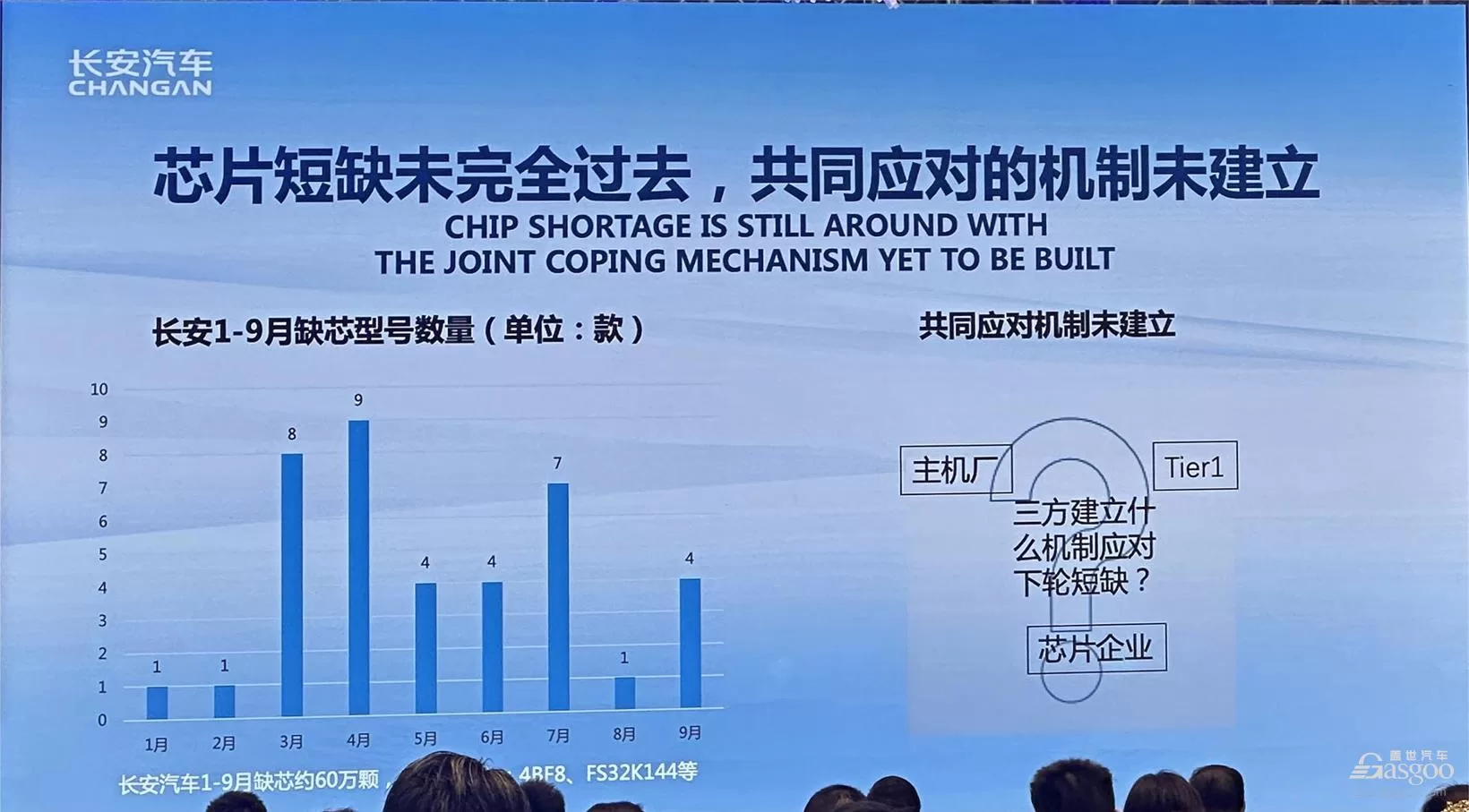

Car chip shortage is not over yet “Changan Automobile had a shortage of 600,000 chips from January to September 2023, and the chip shortage has not completely passed.” Recently, at the 2023 Global Automotive Chip Innovation Conference and the Second China Automotive Chip Summit Forum, Li Wei, Chief Expert of Changan Automobile Co., Ltd., revealed this in his speech.

Not just Changan Automobile, according to the latest data released by AutoForecast Solutions, a company that predicts automotive industry data, as of November 26, this year, the global automotive market has reduced production by about 2.44 million vehicles due to chip shortages. Among them, the reduction in the Chinese automotive market is 467,000 vehicles, accounting for about 19.1% of the total global reduction.

Looking back on the past nearly four years, we can see that since the outbreak of the epidemic, the counter-trend surge of new energy vehicles has made the mismatch between supply and demand increasingly prominent, and the global automotive industry has thus fallen into a chip shortage crisis, with the norm for many car companies being to grab chips to ensure supply and reduce allocation to stabilize production. After a long period of industrial adjustment, people’s attention has gradually shifted from chip shortages to concerns about “soulless” cars.

Many people believe that chip shortages are no longer the main factor of the crisis, but reality has once again sounded the alarm. Capacity runs with demand Expanding production can be said to be the most important keyword in the entire semiconductor industry in recent years. According to the “World Fab Forecast Report” released by SEMI in December 2022, the global semiconductor industry will invest more than $500 billion in new construction of 84 fabs from 2021 to 2023. Among them, 33 new factories are expected to start construction in 2022, and 28 are expected to be added in 2023.

Image source: Infineon Earlier this month, Texas Instruments broke ground on a new 12-inch wafer factory in Utah, USA, to meet the needs of customers for the next few decades. Not only that, IDM companies such as Infineon and Renesas, which have the ability to design and produce chips, have announced new chip factory construction plans this year. However, supply and demand imbalances have never been far away. As mentioned earlier, the chip shortage crisis stems from the mismatch between supply and demand brought about by the surge in the new energy vehicle market.

At that time, it was Tesla’s production in China, Li Bin’s turnaround from being the “most miserable person,” BYD’s doubling growth, and the gradual formation of various new energy vehicle brands such as Aiways and Xpeng. Quoting Jiang Jian, Vice President of Bosch China, from his 2021 speech, “Currently, traditional internal combustion engine vehicles use about 100 to 200 semiconductor chips, while the number of chips used in new energy vehicles will increase fivefold. If we calculate based on the sales volume of new energy vehicles exceeding 5 million vehicles in 2022, the chip shortage will only become more severe.”

Unbelievably, in 2022, China’s production and sales of new energy vehicles reached 7.058 million and 6.887 million vehicles, respectively, an increase of 96.9% and 93.4% year-on-year, with a market share of 25.6%, 12.1 percentage points higher than in 2021. At the same time, the intelligentization of automobiles is also accelerating. The latest report on the advanced driver assistance systems industry released by the GSA Research Institute shows that the penetration rate of L2-level autonomous driving functions in China has exceeded 30% in 2022, further approaching 40% from January to October this year, corresponding to an increase in hardware such as millimeter-wave radar and lidar.

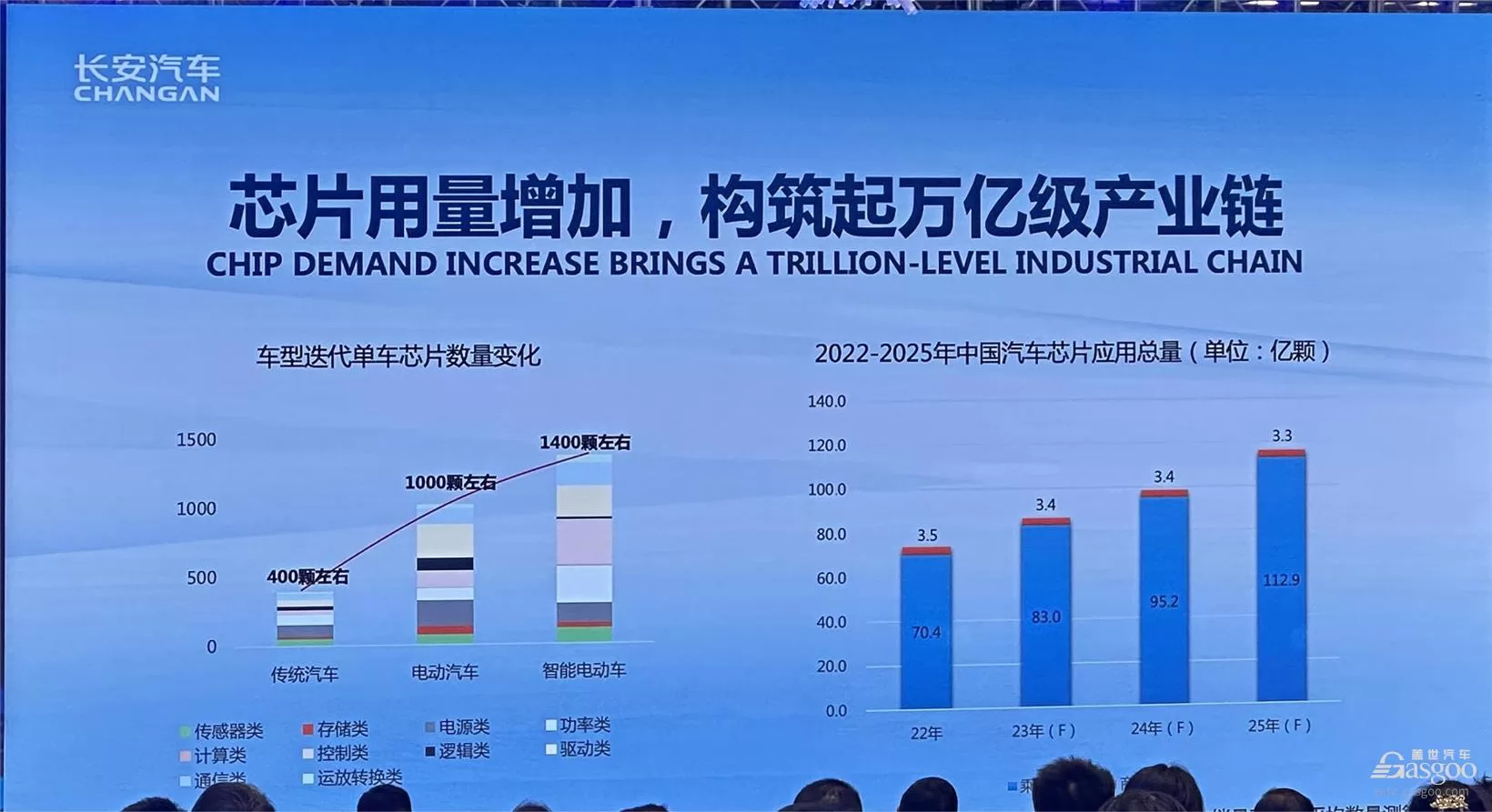

Based on this, Li Wei further predicts, “In terms of chip usage per vehicle, traditional cars use about 400 chips, electric cars use about 1,000 chips, and smart electric cars will reach 1,400 to 1,500 chips.” “The application volume of automotive chips in China reached 7.39 billion chips last year, and it is expected to reach 11.62 billion chips by 2025.”

He concluded that automotive-grade chips have become one of the three major application industries in the global semiconductor market, and demand will exceed the industry growth rate by more than 2 times. It is worth noting that at present, the number of automotive-grade chips carried on top smart electric vehicles such as Xpeng Motors and NIO has exceeded 10,000, and with the rapid development of intelligentization of vehicles, the application of automotive chips in China is more than expected.

The shortage of chips is not only in terms of absolute quantity, but also in terms of categories. Excess capacity and shortage of production lines Focusing on the chips themselves, they can be divided into nine categories according to their functions, namely control, computing, power, sensors, storage, power management, communication, information security, and driver.

In recent years, the shortage of chips has been a major issue for the automotive industry. The lack of supply has mainly affected core components such as engine ECUs and ESPs, followed by a widespread shortage of MCU chips. The situation worsened due to the Southeast Asian pandemic, leading to the shutdown of a chip supplier’s factory in Malaysia, causing difficulties in the supply of products such as ESP/IPB, VCU, and TCU.

This has put significant pressure on companies like Bosch. While the chip shortage has been somewhat alleviated after three years of increased production and stockpiling by downstream manufacturers, the demand for chips in new energy intelligent connected vehicles has significantly increased, leading to a rapid upgrade in technology requirements and computing capabilities. The wave of digital cars is driving the automotive industry towards a new era, with digital cars becoming large intelligent computing terminals, energy storage units, data collection carriers, and mobile multifunctional spaces.

This has led to a push for standardized architecture, high system voltage, service-oriented functionality, and the evolution of intellectual and emotional intelligence in cars, driving a transformation in the chip industry, particularly in the production of automotive-grade chips, characterized by high application volume, high integration, high computing power, low power consumption, and high security.

Specifically, the chip is evolving towards multi-functional integration, such as the general MCU, which is evolving towards multi-core high computing power, and on the other hand, towards high integration, high performance, and high reliability, providing new opportunities and possibilities for automotive use scenarios; at the same time, power chips are evolving towards high voltage and low loss development. In addition, high-computing chips are the inevitable demand for the evolution of smart cars and central integration architecture. The entire vehicle electronic and electrical architecture has been upgraded from a decentralized multi-controller, tree-like structure to a centralized central architecture with software and hardware, standardization, and gradually evolved into a high-computing super central processor mode.

Corresponding chips have also evolved from the physical fusion of multiple chips to the final development of a single-chip fusion SOC. In this context, Li Wei proposed further suggestions, hoping that chip companies can deepen cooperation with OEMs to develop products that can adapt to future whole-vehicle system architectures, and secondly, to increase research and development in the 48V chip field, and to jointly develop main control SOC chips. The automotive chip industry needs to adhere to globalization development.

Over the past 30 years, the continuous innovative development of the global semiconductor industry has been based on the global supply chain architecture of interests and professional division of labor. Under this architecture, Europe and the United States focus on IC design and sales, Japan and the Netherlands focus on IC materials and equipment, while South Korea, Malaysia, and China focus on production and manufacturing. Countries and related companies maintain close cooperation in the complex industrial supply chain, creating a prosperous scene for the global semiconductor industry.

However, in recent years, the global chip shortage crisis has forced countries to take measures to support the development of the local semiconductor industry in order to seize the high ground of future technological development. China, which excessively relies on imports and has a self-sufficiency rate of less than 5%, is particularly affected. From the official release of the “Automotive Semiconductor Supply and Demand Coordination Manual” guided by the Ministry of Industry and Information Technology in February 2021, to the accelerated layout of domestic chip companies represented by Horizon and Black Sesame Intelligence, to the entry of state-owned enterprises, the independent automotive chip industry chain is gradually forming a siege, and the breakout battle has begun in full swing, with some achievements already made.

Recent customs data reflects the improvement of China’s self-sufficiency rate for chips. The data shows that in the first three quarters of this year, China’s chip imports decreased by 14.6% year-on-year, with the import value decreasing by more than $60 billion, a 19.8% decrease. However, it is worth noting that, despite some progress in the automotive chip field, China still faces some challenges. For example, in the MCU sector, foreign leading companies such as NXP, Microchip, Renesas Electronics, STMicroelectronics, and Infineon Technologies occupy more than 80% of the market share. What’s even more regrettable is that the technology that meets functional safety level D is still largely monopolized by foreign countries. Hu Kairu, general manager of the MCU division of Zhongke Integrated Circuit Co., Ltd., reminded.

The CEO of Bosch China, Chen Yudong, who was once surrounded due to a chip shortage, posted a circle of friends on February 19th this year. Li Wei summed up the challenges faced by China’s automotive chip development as follows: first, the current international situation is not clear, and there are many uncertain factors in the global anti-globalization of chips; second, automotive grade chips have higher requirements in terms of safety and reliability compared to consumer electronics; third, the chip shortage problem has not completely passed, and the mechanism for joint response has not been established; finally, chip companies are over-competitive in some areas and lack competitiveness in some areas.

In this context, the Ministry of Industry and Information Technology is stepping up its efforts to continue to organize the automotive and integrated circuit industries to work together on the basis of previous work, adopt more policy measures, aim at continuous efforts in automotive chips, continuously improve the level of product technology and quality, ensure production and supply, and promote high-quality development. Guo Shougang, deputy director of the Equipment Industry Department of the Ministry of Industry and Information Technology, called on all parties to adhere to the direction of global development, strengthen the global coordination of automotive chips, promote convenient and efficient circulation of elements, effectively allocate resources, continuously enhance the risk resistance of the industrial chain and supply chain, and jointly ensure the safety and stability of the automotive chip industry chain.

In addition, in order to further promote the development of China’s automotive chip industry, it is necessary to give full play to the leading role of leading enterprises in application and traction, focus on future technological progress and industrial development needs, and deepen the coordinated development of the upstream and downstream industrial chains to develop the automotive chip industry ecosystem. At the same time, it is necessary to further optimize the market-oriented, rule of law, and international business environment, support domestic enterprises to deeply participate in the global automobile industry division of labor and cooperation, and provide more convenience and better guarantees for enterprises from various countries to invest and develop in China.

However, solving the chip crisis is not a temporary responsibility. It requires a focus on the future. Therefore, Wang Shijiang, deputy director of the China Academy of Information and Communications Technology, has three suggestions for the next step in the development direction of China’s automotive chip industry: First, improve the coordinated promotion of the industry chain to closely bind design, manufacturing, and testing companies, and refine and iterate products and processes. Second, continue to deepen technological innovation to create leading products, gradually enrich the product spectrum, and strengthen the ability of system solutions.

Third, continuously promote supply and demand docking in multiple dimensions, further enhance information exchange between the supply and demand sides, allow more chip companies’ good products to be seen by users, and enable user-side demand to be more accurately understood by chip companies. “The automotive chip industry is important and unique. The construction of a new ecosystem requires colleagues from multiple industries such as automotive and chip to jointly think, agree, act, build, share, and use China’s organized scientific research, organized common technology development, organized standards and testing certification to take the lead, and organized construction of a safe and controllable chip and software industry chain that is open and inclusive to the world.” Chinese Academy of Engineering academician and professor at Beijing Institute of Technology, Sun Fengchun, further emphasized, “China must have and use its own automotive chip software development testing tools and equipment, collaborate for innovation, continuously iterate, and build an independent ecosystem.”