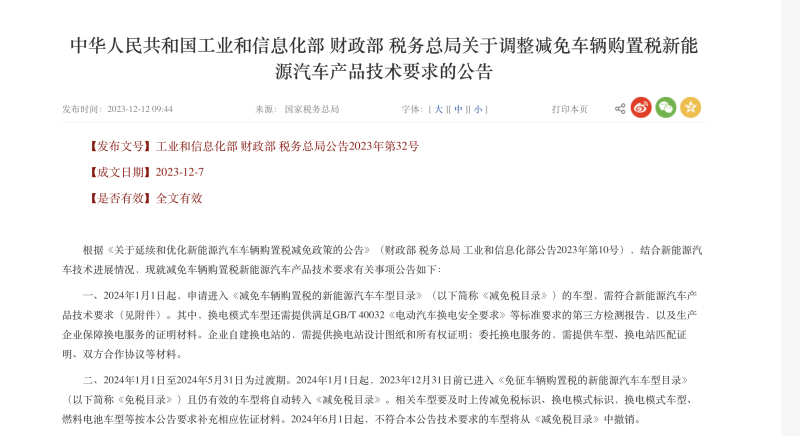

Translated_text: On December 11th, the Ministry of Industry and Information Technology, the Ministry of Finance, and the State Administration of Taxation jointly released the “Announcement on Adjusting the Technical Requirements for Vehicle Purchase Tax Exemption for New Energy Vehicles,” which proposed new technical requirements for new energy vehicles enjoying the purchase tax exemption policy. From January 1, 2024, vehicle models applying to enter the “Catalog of New Energy Vehicle Models Exempt from Vehicle Purchase Tax” must meet the corresponding technical requirements.

The best-selling mini cars have the biggest impact, and the adjustment of the cruising range has a considerable impact on the price of the car. In terms of cruising range, the pure electric passenger car’s range has been increased from the original 100 kilometers to 200 kilometers. The energy density of the power battery system has been adjusted from no less than 95Wh/kg to no less than 125Wh/kg. The requirement that “the pure electric cruising range of the plug-in hybrid passenger car should meet the conditional equivalent full electric range of not less than 43 kilometers” remains unchanged.

Currently, the main models of A00-level vehicles with a cruising range of less than 200km are the Wuling Hongguang MINI EV, Chery QQ Ice Cream, Changan Lumin, and other models with a price of 50,000 yuan (7030$). According to the data from the China Passenger Car Association, the sales of such models account for 39% of the sales of A00-level electric vehicles within the year, which is relatively high. Cui Dongshu, the secretary-general of the China Passenger Car Association, analyzed that due to changes in policy thresholds, most micro electric vehicles need to readjust their cruising range layout, especially to increase the cruising threshold for entry-level models.

When the cost of manufacturing cars increases, the advantages of low-cost low-speed electric vehicles become more prominent. “Increasing the cruising range means adding more batteries. To increase the cruising range by 50 kilometers, at least 5 degrees of batteries are needed, which is equivalent to a price difference of about 4000 yuan (560$). Consumers in counties and townships are very concerned about low prices.” The attention to low-temperature mileage decay has increased, and “winter testing” has become a hot topic. At the same time, the “Announcement” gives policy preferences to new technologies and new models such as low-temperature resistance and battery swapping mode.

The “Announcement” proposes that for pure electric passenger car models tested in accordance with Appendix A of GB/T 18386.1-2021 “Electric vehicle energy consumption and cruising range test methods Part 1: Light vehicle”, the battery system energy density should not be less than 95Wh/kg, and the cruising range should not be less than 120km if the low-temperature mileage decay rate does not exceed 35%. Recently, the debate over the results of “Dongchedi’s 2023 Winter Test” between AITO and Dongchedi, jointly created by Huawei and Sailesi, has attracted attention from inside and outside the industry.

The topic of “low-temperature mileage decay” has once again made headlines. Dongchedi recently tested the pure electric endurance rate of 19 plug-in hybrid models in extremely cold conditions. Among them, the BYD Tang U8 ranked first with an endurance rate of 85.08%, while the AITO M7 extended-range version ranked last, with a pure electric endurance rate of only 31.6%. After the release of the winter test results, Yu Chengdong, Chairman of Huawei’s Intelligent Car Solutions BU, was the first to raise questions.

Later, Great Wall and Geely Auto successively joined the “battle,” questioning the test labels and evaluation process. Subsequently, Dongchedi’s official response stated that all winter test projects use uniform testing standards, which comply with user scenarios for winter extreme cold driving, and there is no differential treatment. Consumers are more concerned about the underlying issues behind the event. In cold environments, the internal chemical reactions of power batteries slow down, resulting in different degrees of shortened endurance mileage for new energy vehicle models. This is an unavoidable problem under current technological conditions and is also a pain point for consumers in the winter. However, low-temperature mileage decay is not irreversible.

Some car companies optimize charging efficiency and improve battery health by upgrading the temperature control system, battery heating, and accelerating the layout of energy replenishment networks. In the long run, the development and application of new materials are also crucial. Analyst Cui Dongshu stated that raising the technical standards of the vehicle purchase tax exemption policy will not only help improve the performance of pure electric vehicle models in winter low-temperature environments and enhance consumer experience but also take into account the technical characteristics of sodium-ion battery systems, which have low energy density and good low-temperature decay resistance, leaving room for the development of new power battery routes.

As an efficient form of energy replenishment, battery swapping has also encountered a new turning point after the release of this “announcement.” NIO may have the last laugh. In June this year, the Ministry of Finance, the State Administration of Taxation, and the Ministry of Industry and Information Technology jointly issued the “Announcement on the Continuation and Optimization of the Policy of Exempting New Energy Vehicle Purchase Tax,” which allows the separate accounting of sales for new energy vehicles with and without power batteries when selling “battery swapping mode” new energy vehicles, and the separate issuance of invoices.

The notional price of new energy vehicles without power batteries stated on the unified invoice for the sale of motor vehicles can be used as the taxable price for vehicle purchase tax. In short, for battery swapping mode vehicles, invoices will be issued separately for power batteries and vehicle bodies, and no purchase tax will be levied on the power battery part. This announcement supplements and refines the content of the June announcement, specifying the relevant requirements for battery swapping mode vehicles. These requirements include the provision of third-party inspection reports that meet the standards of GB/T 40032 “Safety Requirements for Electric Vehicle Battery Swapping,” as well as proof of the production enterprise’s guarantee of battery swapping services.

For enterprises that build their own battery swapping stations, they need to provide design drawings and ownership certificates for the swapping stations; for those that commission battery swapping services, they need to provide materials such as vehicle model and battery swapping station matching certificates, and cooperation agreements. Speaking of battery swapping, it is necessary to mention NIO as a pioneer in the construction of a replenishment system in China. After expanding losses, NIO chose to expand its replenishment “circle of friends.”

On November 21, NIO announced a battery swapping business cooperation agreement with Changan Automobile. Both parties will cooperate in establishing battery swapping standards, building and sharing battery swapping networks, developing battery swapping vehicle models, and establishing an efficient battery asset management mechanism. On the 29th of the same month, NIO signed a strategic cooperation agreement for battery swapping with Geely Holding in Hangzhou. The two parties will conduct comprehensive cooperation in multiple areas, including battery swapping standards, battery swapping technology, the construction and operation of battery swapping service networks, the development and customization of battery swapping vehicle models, and battery asset management and operation.

According to the data released by NIO on November 20, nearly 80% of the charging capacity of NIO’s replenishment network is provided to non-NIO users. Multi-party cooperation not only helps integrate resource advantages, but also facilitates the rapid formation of economies of scale to seize the industry’s first-mover advantage. As more participants join, the supplementary power track may be added to the current industry competition. Companies that plan early and become rule makers will have more initiative than latecomers.