Recently, the latest data was released by the national passenger car market information joint meeting. Despite the lack of endogenous vitality in the market due to the recent terminal heat not meeting expectations, and the various “encirclements” of limited-time discount plans and local subsidies introduced by many car companies at the end of the year, it is preliminarily estimated that the narrow passenger car retail market this month is about 2.27 million vehicles, an increase of 9.3% month-on-month and 4.8% year-on-year. Among them, the retail of new energy vehicles is about 940,000 vehicles, an increase of 11.8% month-on-month and 46.6% year-on-year, with a penetration rate of about 41.4%. A price war greater than “Double Eleven” is coming Looking back on the keywords of 2023 in late December, the price war is definitely one of them, and it has run through the entire year of 2023.

From the beginning of the year when Tesla announced price cuts, to AITO, Xiaopeng, NIO, Volvo, Ai’an, and other companies taking action, the new energy vehicle market has experienced an unprecedented price reduction trend, which quickly swept the entire automotive market. In March, the price war reached its peak, with more than 50 automotive brands and over 100 models joining the fray, with some even attempting to stand out in this melee by offering half-price deals. Since then, the price war has never truly faded, it has just been a back and forth battle to gain more market share. Models such as the Lantu FREE, AITO M7, Zhiji LS6, and Feifan R7 have benefited from lower prices due to new launches. As the year comes to an end, looking back over the past few years, most of the new energy vehicle subsidies have been reduced at the end of December.

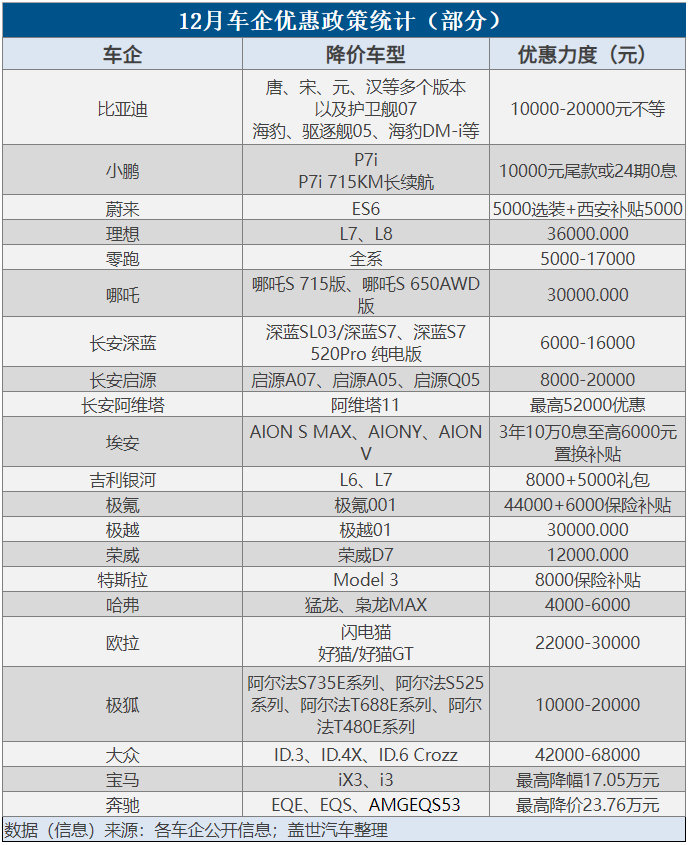

Therefore, December is a hot month for subsidy-driven consumption. Last year’s tax incentives for the purchase of fuel vehicles also expired in December, returning to normal this year, and consumer enthusiasm for purchases is far lower than the trend. However, it is clear that after a year of price wars, car companies will not tolerate this situation. Therefore, “limited-time discounts” and “year-end shopping spree” with price reduction labels have emerged one after another. According to incomplete statistics from Gaishi Auto, since December, nearly 20 car companies have successively launched price reduction promotions. This includes not only new forces, but also joint venture brands, and even state-owned car companies have joined the battle. Overall, the year-end sprint is as hot as the “Golden September and Silver October” peak consumption season, indirectly driving consumer demand.

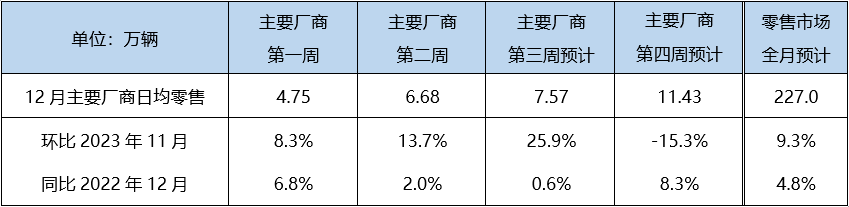

According to the survey conducted by the China Passenger Car Association, the overall market discount rate for passenger cars in mid-December was about 19.9%, with further declines in terminal discounts compared to the same period in November. Manufacturers have intensified their year-end discount policies, and the downward trend in prices is more pronounced. Looking at the situation by week, the market operated moderately in the first week of December, with major manufacturers selling an average of 47,500 units per day, an increase of 8.3% compared to the previous week and a 6.8% year-on-year growth. In the second week, manufacturers intensified their efforts to reach last year’s sales targets, selling an average of 66,800 units per day, a 2.0% increase compared to the previous week. However, extreme weather hindered the increase in store traffic, resulting in only a 2.0% year-on-year growth, which was lower than expected.

The market heat has recovered slightly under the influence of additional discounts at the end of the third week, with an average daily sales volume expected to be 75,700, up 25.9% from the previous month and 0.6% year-on-year. In the fourth week, the market still has some momentum, with an average daily retail forecast of 114,300, down 15.3% from the previous month and up 8.3% year-on-year, with an estimated total retail of 2.27 million in December. However, it is worth noting that the retail volume accounted for more than 80% of the top companies’ retail targets set this month, an increase of 9% from November. Under such pressure, the year-end sprint of manufacturers is relatively limited compared to the same period in previous years.

Even so, based on the 2.27 million retail sales in December, the narrow passenger car retail market is expected to reach around 21.62 million units for the whole year, up 5.2% year-on-year, with approximately 7.75 million new energy retail sales, an increase of 36.5% year-on-year, a penetration rate of 35.8%, an 8 percentage point increase from last year. Exports are steadily advancing, with a year-end sprint of 5 million units. As mentioned earlier, the price war is one of the key words throughout 2023, so another key word is undoubtedly exports. On December 13, at the 2023-2024 China Economic Annual Meeting, Han Wenxiu, Deputy Director of the Central Financial and Economic Affairs Commission and Director of the Central Agricultural Office, introduced that China’s automobile exports will exceed 5 million units in 2023, setting a historical record.

According to the latest data from the General Administration of Customs, China exported 524,000 cars in November, a year-on-year increase of 41.6%. From January to November, China exported 4.762 million cars, a year-on-year increase of 59.8%, with an export value of 92.7 billion US dollars. In November, the export of new energy passenger cars reached 89,000 units, an increase of 8% year-on-year and a decrease of 21% month-on-month, accounting for 23.5% of the total passenger car exports. Among them, pure electric cars accounted for 89% of the new energy exports, and A0+A00 level pure electric cars accounted for 53% of the new energy exports. The China Association of Automobile Manufacturers also pointed out that the surge in exports of new energy vehicles has driven the rapid growth of China’s automobile exports, with both export volume and average prices showing strong performance.

It is expected that the total export volume this year will reach 5 million units, surpassing Germany and Japan to become the champion. It is worth noting that the average unit price of car exports has increased by nearly 50% in the past four years, mainly due to the advantages of intelligent electric vehicles. It is undeniable that the recent tension in the Red Sea has become more intense, forcing the Asia-Europe route to choose a safer route around the Cape of Good Hope, resulting in an increase of 7-11 days in one-way voyage and high transportation costs. However, it is worth noting that the China-Europe express trains, which have been built and operated for several years, are gradually becoming a new choice due to the surge in exports.

On December 18, a special train for new energy vehicles departed from Heilongjiang, Tianjin, and other places, carrying new energy vehicles to various parts of the world including West Asia and Europe. Driven by the full efforts of domestic manufacturers and the steady progress of overseas markets, the narrow passenger car retail market is expected to reach around 21.62 million units for the whole year, a year-on-year increase of 5.2%. New energy retail is about 7.75 million, a year-on-year increase of 36.5%, with a penetration rate of 35.8%, an increase of 8 percentage points from last year.