As 2023 comes to a close, the automotive market has experienced ups and downs, but also welcomed new opportunities. At the beginning of the year, the automotive industry kicked off an unprecedented price war. Faced with a increasingly competitive market, car companies have been showcasing their technology, products, and services. This “competition” within the automotive industry has also signaled the start of an industry elimination match.

However, the Chinese car market has lived up to expectations, continuing to move steadily forward under heavy pressure, especially with the continuous increase in production and sales of new energy vehicles, the continuous increase in market share of independent brands, and the achievement of multiple breakthroughs in overseas exports, playing a leading role globally. In the crazy and opportunistic 2023, the picture of the Chinese car market comes to a close. However, many highlights in the automotive industry throughout the year are still impressive, worth reviewing one by one. Next, we will take stock of the major events in the automotive industry this year from the theme of “crazy internal competition”. 1. The car market has ignited a crazy price war. In January 2023, the 13-year national subsidy policy for new energy officially ended, causing a surge in prices in the domestic new energy car market due to the increase in costs for car companies. However, just 5 days later, Tesla defied the trend and launched the “strongest in history” promotion, with the Chinese-made Model Y long-range version dropping by 48,000 yuan (6720$). Following Tesla’s announcement of a major price cut, AITO, Xpeng Motors and other new energy car companies followed suit. And so, at the beginning of 2023, the new energy car market kicked off a round of price wars. Tesla’s price cut was just the appetizer. In early March, several car companies in Hubei Province, in collaboration with Dongfeng, launched a subsidy promotion for car purchases, igniting a price reduction frenzy in the car market.

After this wave of price reductions swept across the region and then the whole country, more than 49 car companies, including FAW, SAIC, Chery, Chang’an, Beijing Hyundai, and SAIC Volkswagen, joined the massive price war, attracting widespread attention from all sectors of society. In order to control the spread of the price war, 16 car companies signed a “Commitment to Maintaining Fair Competition in the Automotive Industry” at the 13th China Auto Forum hosted by the China Association of Automobile Manufacturers in July, promising not to disrupt market order with abnormal prices. However, the clause was quickly deleted. Just when everyone thought the first round of price wars was coming to an end, well-known car manufacturers such as Volkswagen, Tesla, and Cadillac announced price reductions for their electric vehicle models, sparking a new round of price wars in the new energy vehicle market. In August, car companies geared up for the traditional peak sales season in September and October, starting a new round of price wars. More than 10 car companies, including SAIC Volkswagen, Leapmotor, Tesla, and NIO, joined the price reduction trend by offering cash discounts and increasing purchase benefits. Subsequently, many car companies launched promotional measures for the “golden September and silver October” sales season. By the end of the year, in order to boost sales, numerous car companies, including BYD, Dongfeng Citroen, Leapmotor, and FAW Toyota, announced purchase promotion policies on the first day of December. Thus, price reductions became the norm in the car market throughout the year, from the beginning to the end of the year, with price wars spanning the entire year of 2023. However, while the strategy of trading prices for sales volume may achieve short-term sales targets, it has been eroding the profit margins of car companies and dealers. Many dealers have expressed that what was initially a small profit reduction due to price reductions has turned into significant losses as the price war intensified. Using Tesla as an example, the price reduction has brought the company’s third-quarter gross margin down to 17.9%, a 7.2 percentage point decrease from the 25.1% in the same period last year. Tesla’s Q1 gross margin was 19.3%, which further dropped to 18.2% in Q2. This means that Tesla’s gross margin has continued to decline over the three quarters this year, reaching the lowest level in nearly four years. Looking at car market sales, the fierce price war has not led to a significant increase in sales, but has instead triggered consumer wait-and-see sentiment. At the current trend, the “price war” may continue to be a key word in 2024, and next year will be a crucial stage for the elimination of new energy vehicles. Second, car companies are crazy about the technology of internal competition. For the 2023 Chinese car market, price war is just one of many common business tactics, but the real internal competition is the technology, which is the core competitiveness of car companies. At the beginning of the year, while everyone was still discussing which new car was equipped with the “Qualcomm Snapdragon 8155 chip,” by the end of the year, car companies had unanimously embraced the Qualcomm Snapdragon 8295, and this trend will continue until 2024. For example, the intelligent cabins of models such as the Ideal MEGA, Xiaopeng X9, Lixiang C10, new Mercedes-Benz E-Class, Jinko 001FR, Jiyue 01, Geely Galaxy E8, and ZEEKR 007 all have the 8295 chip. It is worth noting that among these new cars, there are both the 600,000 yuan (83990$) Ideal MEGA and the rumored 150,000 yuan (21000$) Lixiang C10, covering a very wide price range. Therefore, in order to provide users with a smoother interactive experience, car companies will probably use the 8295 chip in new cars in the future. From this perspective, the degree to which the automotive industry is embracing chips in intelligent cabins is more intense than that of the mobile phone industry. In 2019, Porsche introduced the first mass-produced car Taycan with an 800V high-voltage platform. At that time, 800V high-voltage fast charging was still a standard feature for million-level electric vehicles, even more impressive than the cockpit chip.

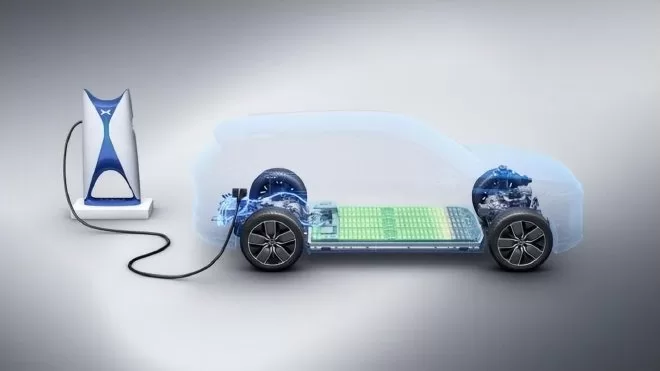

By 2023, China’s auto market has achieved technological equality with 800V. The prices of the Xiaopeng G6, Haobo GT, and Zhiji LS6 have been brought down to around 200,000 yuan (28000$). The Geely Galaxy E8 and Jihou Alpha T5 have further reduced the price to less than 200,000 yuan (28000$) for 800V cars. Industry leaders are pushing the industry forward, and other manufacturers are also beginning to accelerate their 800V layout. Both domestic and foreign manufacturers such as Jike, Jihou, Kia, Avita, Xingtu, Li Xiang, Xiaomi, and Lotus all have 800V technology. In addition to competing in charging speed, NIO has chosen to build a battery swapping network. In November, NIO signed agreements with Changan and Geely to jointly build battery swapping stations. Currently, NIO has built over 2,300 battery swapping stations and will continue to advance in this field. Furthermore, the charging speed of the Ideal MEGA 5C Kirin battery is claimed to be able to reach a 12-minute recharge for a 500 km range. NIO’s 150kWh battery pack also has a range of over 1,000 km. Other car companies will continue to compete in charging speed and range. In 2023, the car market’s technological competition also includes smart driving. As the year-end approaches, the domestic city NOA battle is intensifying. L3 testing policies have officially landed, and Xiaopeng, Ideal, NIO, Jihou, Avita, and Wanjie are all competing in the speed of opening cities, with some even redefining the concept of a city. On December 22, Changan announced that it had successfully obtained 17 L3 level automatic driving road test licenses for high-speed roads, becoming the earliest and single largest enterprise to obtain such licenses in one batch. In addition, BMW, Mercedes-Benz, and Zhiji have already obtained conditional L3 level automatic driving road test licenses in Beijing and Shanghai. The smart driving market in 2024 will be even more competitive. It can be foreseen that in 2024, the city NOA will definitely become more competitive. As players start to make their moves, not keeping up will make you fall behind the times. Therefore, traditional car companies and new carmakers are also accelerating their layout. Companies such as Zhiji, BYD, Weimar, Leapmotor, Xpeng, Wuling, and others have already planned to land in the city NOA in 2024. Third, the industry reshuffle continues to accelerate. In recent years, the rapid development of China’s automotive industry has made the market even more “internal”, and the competition between car companies has become even more fierce. This has also led to many once popular and beloved car brands being in the phase of being eliminated. In 2023, the speed of industry reshuffle continues to increase, and the differentiation of new car manufacturing intensifies. Joint venture brands that cannot sustain themselves are withdrawing from the Chinese market. Today, the era of “lying and winning” for joint venture brands has come to an end. Some joint venture car companies have had to bid farewell. Following the regrettable exits of Suzuki, Renault, Fiat, Acura, and JEEP from the Chinese market, GAC Mitsubishi also announced its exit from the Chinese market in 2023. According to data from the China Passenger Car Association, in the past three years, the market share of almost all overseas brand car companies in China has declined. Among them, the market share of Japanese brands has dropped from 24.1% in 2020 to 17.6% in the first half of 2023, a significant decrease of 6.5%, the most obvious decline among all car series. The market share of German car models has also declined significantly, from 25.5% in 2020 to 21.4% in the first half of 2023; American car models have dropped from 9.4% to 8.5%; and Korean car models have dropped from 3.8% to 1.7%, already halved. From the current perspective, the sales of new energy vehicles are growing rapidly, while traditional fuel vehicles have generally experienced a decline in sales, posing a survival challenge for car companies that are slow to transition in the field of new energy.

In addition to some joint venture brands that may exit the Chinese market, the recent days of joint venture car companies have not been good. Data shows that in 2022, the market share of domestic independent brands reached 49.9%, and the market share of joint venture brands in China fell below the 50% red line. Under heavy pressure, some car companies also carried out large-scale layoffs in 2023, including several dozen companies such as GAC Honda, Volkswagen, GAC Group, Volvo, NIO, Tesla, Kia, and Landtour. Some of these companies have undergone more than one round of layoffs, with proportions ranging from 15% to 30%, reflecting the cruel competition in the market. It must be admitted that with the rapid rise of independent brands driven by electrification and intelligence, the Chinese car market has undergone earth-shaking changes. The previous “market for technology” drama is now reversing. The current joint venture car companies are generally facing the pain of transformation and reform, and the future will further intensify differentiation. The post-joint venture era of the automobile industry is coming. In addition to car companies, several dealer groups also declared bankruptcy this year. In early 2023, China’s Zhejiang Taizhou’s largest car dealer group Zhongtong Group closed all 19 of its 4S stores; the long-established 4S group Longhua in Chongqing, which has been in business for nearly 30 years, officially delisted, and many of its 4S stores either closed or transferred ownership. Industry professionals say that price wars and market competition will not only reduce carmaker profits but also test the ability of dealers to handle pressure. Closed dealers will significantly reduce inventory prices, leading to a vicious cycle. It is expected that more players will exit the market in 2024, and the result of the automotive market will be an accelerated elimination match, affecting not only carmakers but also industry professionals. The differentiation of new car-making forces is evident. 2023 may be a year of accelerated elimination in the new energy vehicle industry, but also a year in which major players further establish their market position. NIO, Xiaopeng, and Ideal, the top players in the new car-making forces, have shown clear differentiation since the second quarter of this year. Nezha and Leap Motor, although stable, face their own difficulties. Looking at NIO’s third-quarter financial report, despite a narrowing loss, it is still in a period of poor performance. Regarding the issue of profitability, Li Bin said that the breakeven point will be pushed back. In addition to the current losses, what is more concerning about NIO is the recent internal contraction and external cooperation. NIO announced cooperation with Changan and Geely Holding Group on November 21 and November 29, respectively, to jointly promote the operation of the battery swapping business and vehicle development. Industry insiders see this as a crucial attempt by NIO to improve its battery swapping service performance.

Nio has begun to try to reduce operating costs. Li Bin said that Nio will adjust projects that have not been profitable for three years or have not contributed to gross profit improvement, such as battery production. Xpeng is facing greater pressure than Nio and Li Auto. Xpeng’s financial report shows a net loss of 3.89 billion yuan in the third quarter, an increase of 1.51 billion yuan from the same period last year. However, Xpeng is currently in a period of adjustment, and the reforms it has made in organizational structure and product development seem to be paying off. Li Auto has been profitable since the fourth quarter of 2022. However, with the rapid growth in product sales, Li Auto is gradually approaching its production capacity ceiling. In an open letter for the 8th anniversary of Lixiang, Zhu Jiangming stated that the company has achieved a delivery volume of 300,000 vehicles in 2023 and has achieved positive gross profit in the third quarter ahead of schedule. In addition, under the blessing of the price war in the car market, many companies have seen a decline in profits, with some even going bankrupt. For example, Weyin Automobile, which was once popular in the new energy market, ultimately couldn’t survive and announced bankruptcy reorganization in October 2023. Weyin Automobile is not an exception. Most enterprises such as Leiding Automobile, Ai Chi Automobile, Tianji Automobile, Hengchi Automobile, and Byton Automobile have applied for bankruptcy and have been forced to come to an end. Data shows that in 2018, there were about 480 new energy vehicle companies in China. By 2023, the number of new energy vehicle companies in China has dropped to just over 50, indicating that the market is accelerating the pace of elimination. Huawei, Xiaomi, and Meizu join the car-making circle. When companies like NIO and Geely extended their reach to the mobile phone industry, smartphone manufacturers such as Huawei, Xiaomi, and Meizu also actively entered the car industry. Previously, Shen Ziyu, Chairman and CEO of Starry Meizu Group, had stated, “Currently, the three OS systems created by Huawei, Starry Meizu, and Xiaomi represent the players of the car 3.0 era.” Although not directly involved in car manufacturing, Huawei, with its strong technological capabilities, has become an upstream supplier to the automotive industry through various models, such as component supply, providing full-stack intelligent solutions through the HI supply mode, smart car mode, and cooperation from shallow to deep. In the new energy vehicle race, Huawei’s empowering presence is everywhere, and the advantages of the cooperative models are beginning to be highlighted. According to the data released by Yu Chengdong at the press conference, the sales of Huawei’s new M7 have exceeded 100,000 units since its launch on September 12th; the smart car S7, developed in collaboration with Chery, has received orders for over 20,000 units by the end of November.

In addition, Huawei recently established an independent new company for its car BU. In the future, core technologies related to Huawei and automobiles, including intelligent driving and Hongmeng cockpit, will be independent in the new company, with Changan Automobile holding a 40% stake in this new company. Additionally, Huawei has also issued open invitations for equity to Saicest, Chery, JAC, and BAIC, and hopes that China FAW Group will join. The real player entering the car manufacturing game in “Huaxiaomei” is Xiaomi. After Xiaomi’s founder and CEO Lei Jun announced the car manufacturing plan two and a half years ago, Xiaomi’s car finally arrived late. Recently, Xiaomi officially announced that it will hold a Xiaomi car technology launch event on December 28th. The official released a poster for the car chassis, and Lei Jun posted on social media, “This time only technology, no products.” Recently, Xiaomi’s first new car, the SU7, appeared in the 377th batch of the “Announcement of Road Motor Vehicle Production Enterprises and Products” published by the Ministry of Industry and Information Technology. According to media reports, Xiaomi’s first car has entered the fifth stage of production line verification at the Yizhuang factory. According to current information, Xiaomi’s SU7 will be mass-produced in the first half of 2024, equipped with the Penglai OS system, forming an ecosystem with other smart products such as Xiaomi phones. Backed by Geely Automobile, Meizu integrates directly into the automotive system to empower the Geely system. At the 2023 Meizu Autumn Unbounded Ecosystem Conference held on November 30th, Shen Ziyu announced that Meizu will launch its first car, the MEIZU DreamCar MX, combining a series of manufacturing capabilities from the Geely Group. As a former mainstream player in the domestic mobile phone market, Meizu is now targeting the smart car market. Backed by the deep accumulation of Geely Group in the automotive industry, the high-profile return of Meizu is seen as a new player with both the genes of a mobile phone manufacturer and a car manufacturer. However, compared to Huawei, its say in the car manufacturing race is still somewhat weaker. Compared to “Weixiaoli”, “Huaxiaomei” is still in the early stage of new energy vehicles, but the ambitions of each company have already been revealed. It must be said that the car manufacturing race is not only attractive but also very competitive.