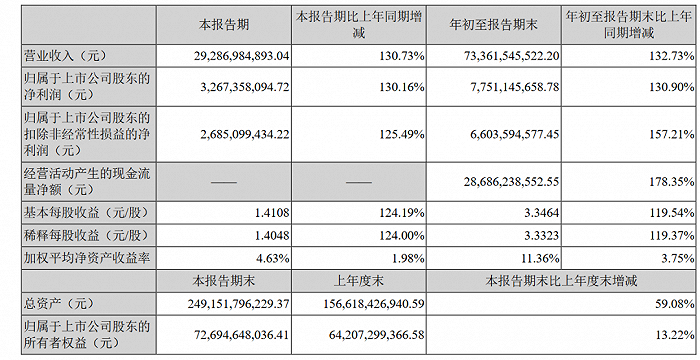

Recently, the A-share market has gone from “defending 3000 points” to “defending 2900 points”. Many former “kings” have fallen from grace as the index has experienced a comprehensive pullback. For example, the former champion of the new energy track, Ningde Times, has seen its stock price drop by more than 40% from its year-to-date high, with a cumulative decline of 27% since the beginning of the year. As of December 25th, it is the second most evaporated company in market value this year. Looking at a longer time frame, Ningde Times’ current market value has dropped by nearly 1 trillion yuan from its highest point in 2021. In the past four months alone, it has evaporated about 400 billion yuan. What’s worse is that Ningde Times’ net profit in the third quarter has experienced its first sequential decline since its listing. With its performance growth slowing down, can the “Ning King” who once made numerous car companies work for it regain its former glory? From Ningde Times’ third quarter report, its ability to make money is actually not bad. In the first three quarters of this year, it made almost the same profit as the entire previous year. The company’s revenue and net profit in the first three quarters of this year increased by 40.10% and 77.05% respectively compared to the same period last year.

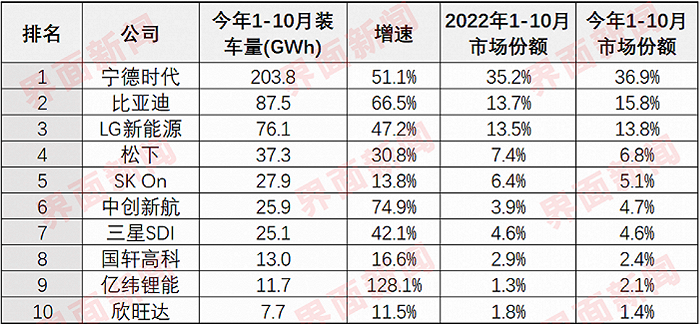

However, the capital market does not buy it. The stock price of CATL has been falling since before the release of the third quarter report, and the decline continues to this day. Behind the “double kill” of stock price and performance, perhaps because the “imagination space” of CATL is shrinking. In February of this year, Ford announced that it would cooperate with CATL to build an electric vehicle battery factory in Michigan, USA. This news is also seen as a major benefit for CATL to expand its second growth curve overseas. However, affected by the US battery act, CATL’s factory construction plan was once suspended. Although it has now been announced to restart, the factory’s production capacity has been reduced by nearly 40%, and it is still unknown whether it will be put into production as scheduled in 2026. For CATL, the blocked factory construction plan is just one of the barriers to its entry into the overseas market. As a leading company in the global power battery market, CATL has long been targeted by all sectors. In early December, Duke Energy, a US utility company, announced that it would cut off its connection with CATL and claimed that Chinese batteries posed a security threat. In August of this year, although CATL’s first overseas factory in Germany has already begun construction, it has been opposed and complained by local people in Hungary, claiming that the factory did not meet the EU groundwater conditions in terms of water use, but still obtained a construction permit. Insiders say that as a global lithium battery giant, CATL is inevitably targeted by different political forces. After all, in the game of the new energy vehicle industry in China, the United States, and Europe, different countries and companies will inevitably prioritize their own interests, and leading companies such as CATL will also be the first to stand on the cutting edge. But even with so much uncertainty in the overseas market, for CATL, a comprehensive entry into the overseas market is an imperative. According to data from the South Korean research institution SNE Research, CATL’s installed capacity from January to October this year reached 203.8 GWh, ranking first with a market share of 36.9%. However, compared with last year, this year CATL’s installed capacity growth has started to slow down. The growth rate in the first ten months of last year was 92.5%, but this year it was only 51.1%. In terms of the domestic market, CATL’s market share in the first ten months of this year was 42.76%, a decrease of nearly 10% from the peak in 2021.

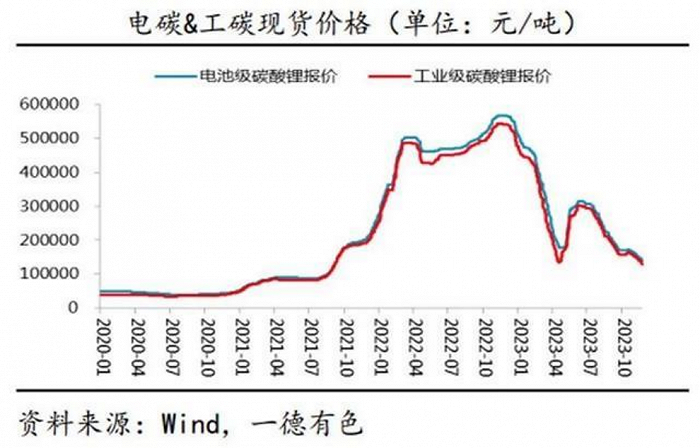

Behind the slowdown in revenue and installed capacity is the fact that new energy vehicle companies no longer want to work for CATL. Last year’s most popular saying in the new energy vehicle circle was the statement made by Zeng Qinghong, chairman of GAC Group, that “all vehicle companies are working for CATL.” Public data shows that the proportion of power batteries in the overall cost of new energy vehicles is as high as 40%-50%. Since 2021, due to the full outbreak of the new energy vehicle market, the price of lithium carbonate, a raw material for the core battery, has continued to rise, and CATL’s batteries have also increased in price several times. Although the price of batteries is determined by the “supply and demand relationship”, CATL is just following the market trend. However, for vehicle companies, the “high price” of batteries has seriously squeezed the company’s profit space. More importantly, this part of the cost is completely beyond the control of vehicle companies. Placing autonomy in the hands of others is not a long-term plan. Therefore, many vehicle companies have already begun to develop, produce, and sell power batteries on their own, including Great Wall, NIO, Geely, BAIC, SAIC, and Changan. Among them, Great Wall Motor has incubated Honeycomb Energy and this year “intercepted” CATL, winning hundreds of billions of yuan in large orders from BMW. Recently, Jiakr announced that its 800V lithium iron phosphate ultra-fast charging “gold brick battery” is officially in production. Before this, Jiakr and CATL have maintained a friendly cooperative relationship, and even the first launch of CATL’s Kirin battery was also by Jiakr. It is not difficult to see that, whether in a competitive or alliance relationship, domestic and foreign vehicle companies are inevitably embarking on the road of self-developed batteries. However, if all vehicle companies choose to develop their own batteries, then who will CATL sell its batteries to? In addition to the continuous reduction in market demand, CATL also faces the pressure of overcapacity. In February of this year, CATL threw out a “lithium mine rebate” plan to a group of car companies, which means that CATL promised to settle with car companies at the end of this year at a price of 200,000 yuan (28300$)/ton of lithium carbonate, but the premise is that car companies promise to lock in about 80% of their battery purchases with CATL. When CATL threw out this agreement, the average price of battery-grade lithium carbonate was about 400,000 yuan (56600$)/ton, which means that CATL would suffer a big loss if it settled with car companies at a price of 200,000 yuan (28300$)/ton. However, CATL dared to make this promise, which also represents CATL’s concern about industry overcapacity, according to industry insiders. Essentially, the “lithium mine rebate” is a betting agreement. If the future price of lithium carbonate rises to above 200,000 yuan (28300$)/ton, CATL will have control over the majority of car companies’ 80% of purchases for the next three years, and will be able to reduce the manufacturing cost of batteries through economies of scale. If the price of lithium carbonate falls to below 200,000 yuan (28300$)/ton, then CATL will make a steady profit. But businesses will inevitably carefully calculate the odds. Judging from the timing of the beginning of the year, considering the formal withdrawal of subsidies for new energy vehicles, the demand for new energy vehicles will likely decline for a period of time, and the continuous increase in production capacity of other battery factories, the mismatch between supply and demand for power batteries will probably come to an end. In fact, the price of battery-grade lithium carbonate has plummeted by 80% since the beginning of this year, from a high of about 500,000 yuan (70750$)/ton at the beginning of the year to around 100,000 yuan (14150$)/ton at the end of the year. Insiders in the mining industry say that the current price of lithium carbonate does not reflect the true market supply and demand relationship, but is more due to the collapse of market demand expectations for the new energy vehicle industry, which has led to companies selling off inventory at low prices.

At the 2023 China Chongqing Automobile Forum, Chairman Zhu Huarong of Changan Automobile stated that the demand for domestic power batteries in 2025 is expected to be 1000-1200GWh, but the industry’s production capacity has already reached 4800GWh, resulting in a serious imbalance between supply and demand. In fact, when car companies complained about working for CATL, CATL also responded that it was struggling on the edge of profitability. It is not difficult to see that CATL also knows that it is actually “working for lithium mine resources,” so it also wants to take control of the upstream lithium mine resources by forming a group with car companies. However, car companies are unwilling to “make wedding clothes for CATL.” In the domestic market, CATL’s market share is continuously declining, and it is being replaced by power battery manufacturers supported or incubated by other car companies, including BYD, SVOLT, Guoxuan High-Tech, LG Energy, and Farasis Energy. Among them, the gap between BYD and CATL is narrowing. In the first ten months of this year, CATL’s market share has decreased by nearly 10%, while BYD has increased by nearly 12%, which also means that the “de-CATLization” of car companies has produced significant effects. But more importantly, the penetration rate of domestic new energy vehicles has reached nearly 40%. Once the penetration rate of an industry exceeds 30%, it means that it has moved from the outbreak stage to the stable development stage. Domestic power battery companies are also turning their attention to overseas markets. Therefore, in addition to facing uncertainties such as trade wars and policy factors in overseas markets, CATL also needs to face the walls built by European and American countries for Chinese power battery manufacturers. Yang Bin, an analyst at Haitong International, pointed out that between 2027 and 2030, Europe and the United States will achieve comprehensive localization of power battery manufacturing. Whether Chinese power battery manufacturers, including CATL, can take the lead in laying out overseas remains to be seen. Therefore, both car companies and power battery manufacturers have accelerated the pace of technological innovation. CATL has released the ultra-fast charging “Brick Battery”, NIO has brought the 150-degree ultra-long-range battery pack, and Li Bin has even launched a 14-hour ultra-long live broadcast for this. GAC Aian’s P58 microcrystalline super energy cell has the ability to charge for 10 minutes and achieve a range of 250 kilometers. Domestic automakers are developing batteries to not only control costs, but also to improve battery life, charging speed, and safety. Ningde Times is feeling the pressure of competition and is accelerating its pace of technological innovation. They are developing a battery-centric skateboard chassis design and plan to begin mass production in the third quarter of next year. This move is seen as a signal that Ningde Times is moving towards car manufacturing. In this context, the company’s future core competitiveness will undoubtedly be its constantly innovating technological strength.