As 2023 draws to a close, the automotive market has seen ups and downs. Despite industry turmoil, the Chinese automotive market has continued to move forward steadily, especially in the new energy vehicle sector. Domestic brands have also seen an increase in market share and overseas exports have flourished, leading the way globally.

In the crazy competition and opportunity-rich 2023, the curtain fell on the Chinese car market. However, in this year, the automotive industry still had many impressive moments, worth reviewing one by one, and next, we will review the major events that happened in the automotive industry this year from the theme of “new opportunities”. First, Chinese brands rose and hit the “fast forward button” With the first-mover advantage in technological innovation, business models, and industrial chain ecology established in the field of new energy, Chinese brands achieved overtaking on the bend, and under the impetus of the national policy encouraging car consumption, both production and sales of cars in China achieved positive growth. At the recent 2024 China Automotive Market Development Forecast Summit, relevant personnel from the China Association of Automobile Manufacturers stated that the total sales of cars in 2023 are expected to be around 30 million, an increase of 11.7% compared to the previous year. Among them, passenger cars are expected to be around 26 million; commercial vehicles are expected to be around 4 million; and new energy vehicles are expected to be around 9.4 million.

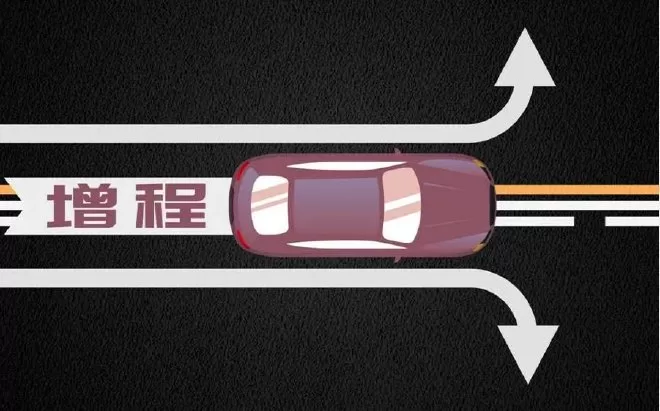

It is worth mentioning that the market share of independent brands has already occupied half of the Chinese auto market. Data shows that from January to November this year, independent brand passenger cars have accumulated sales of 12.98 million units, a year-on-year increase of 23.8%. The market share has reached a historical high of 55.8%, a year-on-year increase of 6.6%. Independent brands have performed well in sales, mainly due to the rapid growth of new energy vehicle sales. Looking at the retail market share of new energy vehicles, in November, the mainstream independent brand’s new energy vehicle retail market share was 70%; joint venture brand’s new energy vehicle market share was 5.1%; new forces’ market share was 15.1%; and Tesla’s market share was 7.8%. In terms of penetration rate, in November, the penetration rate of new energy vehicles in independent brands was 62.1%; in luxury cars, the penetration rate was 30.9%; while in mainstream joint venture brands, the penetration rate of new energy vehicles was only 6.6%. As the penetration rate of new energy vehicles continues to increase, the market share of fuel vehicles is gradually shrinking. The Chinese auto market, which used to be dominated by joint venture vehicles, is undergoing a reversal, and Chinese brand auto companies are showing a strong rise. In addition, independent brands have obtained significant increases in the new energy and export markets. Leading traditional car companies have shown excellent performance in transformation and upgrading, with significant increases in market share for brands such as Chery, BYD, Changan, and Geely. According to the sales data released by independent brand auto companies, BYD Auto has already achieved 89.45% of its annual target of 3 million units. In the last month, BYD’s sales should reach a new high, completely achieving the sales target without any suspense. 1. Geely has completed 93.09% of its annual target of 1.65 million vehicles, and industry insiders expect its overall sales to exceed 1.7 million vehicles this year, surpassing the target. Changan Automobile has completed 83.5% of its annual target of 2.8 million vehicles. Guangzhou Automobile Group has completed 85.06% of its annual target. Chery Group has achieved 83.3% of its annual sales target. SAIC Group has completed 73.06% of its annual target. Great Wall Motor has achieved 69.89% of its annual target. It can be seen that in the era of electric vehicles, more and more consumers are choosing Chinese automotive brands, and the market share of independent brands has exceeded that of joint venture brands, which is of great significance to independent brands. 2. New energy vehicles have continued to gain popularity, especially plug-in hybrid and extended-range models. According to the statistics from the China Association of Automobile Manufacturers, from January to November this year, the sales of pure electric vehicles in China reached 8.304 million units, a year-on-year increase of 36.7%. The sales of plug-in hybrid electric vehicles reached 2.439 million units, a year-on-year increase of 83.5%. The rapid growth in the sales of plug-in hybrid and extended-range models has stirred up the new energy vehicle market, and more and more car companies have entered this sub-segment market, including Changan Qiyuan, Geely Galaxy, and Chery Fengyun, as well as Great Wall Motor with a comprehensive hybrid. So, why have plug-in hybrids and extended-range models become so popular? The main reason behind this is market demand. In the past, plug-in hybrid vehicles had to integrate two complete power systems, pure electric and fuel, but due to high cost, complex structure, frequent charging, and other shortcomings, plug-in hybrid models have not been very popular.

However, with the innovation in technology by major car companies, the manufacturing cost of plug-in hybrid models has decreased significantly. Many car companies have launched “oil-electric same price” products, thereby increasing the market competitiveness of plug-in hybrid models. Looking at the market demand, plug-in and extended-range models better fit the current usage scenarios of consumers. Users can enjoy the experience of pure electric driving without the range anxiety, and these types of vehicles can also be exempt from restrictions in some areas, as well as having the advantage of “oil-electric same price,” meeting the diverse needs of consumers. Additionally, this year, there has been a price war for fuel cars nationwide, with the overall price system of fuel cars decreasing, and the myth of retaining value being shattered. More and more consumers are considering switching to plug-in hybrids. Therefore, until the shortcomings of pure electric vehicles are resolved, plug-in hybrid models can serve as transitional products. Perhaps not the main direction of future development, but they can indeed solve the problems of some consumers at present, while also achieving a good balance in terms of economy and convenience. As for how long plug-in hybrid models will remain popular in the future, industry experts believe that within the next 5-10 years, the proportion of plug-in hybrids in the entire new energy vehicle market will increase, with market share potentially rising from last year’s 22% to 30%-40%. “Plug-in hybrids are just transitional technology, pure electric is the future” was once the judgment of many industry leaders on plug-in hybrid technology. However, in the current domestic new energy vehicle market, this judgment needs to be re-evaluated. Currently, plug-in hybrid vehicles, previously considered “transitional products,” are increasingly competitive in the market. They not only change the traditional market pattern of fuel cars but also directly challenge joint venture fuel cars. At the same time, they play an important role in promoting the popularization of new energy vehicles in China and promoting the transformation and development of car companies. Three, personalized segmented markets are popular With the rapid development of the new energy market, car companies have to explore new segmented markets to find new growth points. Recently, new energy MPVs, pure electric sports cars, mid-to-high-end pure electric sedans, and new energy off-road vehicles have become the new battlefields that car companies are enthusiastic about. At the earliest in the Guangzhou Auto Show, Ideal Auto brought the pure electric MPV Ideal MEGA, which adopts a design style similar to a bullet head, which is very similar to the front of a high-speed train, achieving a wind resistance coefficient of 0.215Cd for the entire vehicle, and will be officially delivered in 2024. In addition to the Ideal MEGA, the Xiaopeng X9 also has very high popularity. Like the Ideal MEGA, the Xiaopeng X9 is also positioned as a mid-to-large-sized pure electric MPV, equipped with the fifth-generation intelligent cockpit system XOS Tianji, with a pre-sale price set at 388,000 yuan (54810$), and will be officially launched on January 1, 2024, targeting Ideal MEGA as a competitor. In addition to the new forces in car manufacturing, traditional car companies are also striving to catch up. Great Wall Motors, which has always focused on pickup trucks, off-road vehicles, and SUV models, has also released its first high-end new energy MPV – the Weipai Gaoshan. There is also Volvo’s pure electric luxury MPV EM90, with a new car price of 818,000 yuan (115560$), which also has strong advantages in safety. In addition, there are many MPVs such as GAC Trumpchi E8, Haval V09, Jianghuai Ruifeng RF8, Buick Century Yunshuiyin, Roewe Marvel X, and SAIC Maxus G70, which have regained attention for these once niche car models.

Not only the new energy MPV is on fire, but this year many Chinese brand car companies have launched pure electric sports cars, such as the affordable NIO GT, MG Cyberster electric sports car, as well as the Haobo SSR, Jike 001 FR, and Yangwang U9, these million-level electric sports cars have suddenly set the market on fire. The era of new energy vehicles is providing new opportunities for Chinese brand sports cars. The new energy wave is gradually breaking through the entrenched brand barriers of the past. The Chinese sports car market may truly usher in a new era and reshape the market pattern of electric sports cars. However, the Chinese sports car market is still in its infancy and climbing stage. The unique sports car culture of China is also emerging. In the era of new energy vehicles, Chinese car companies have opportunities everywhere. Starting from the fourth quarter of this year, the medium and large-sized sedan products labeled with “intelligent electrification” have become the new battlefield for Chinese new energy vehicle manufacturers. With the launch of the Huawei Smart Selection Car Smart World S7, as well as the recent landing of the first model SU7 of Xiaomi’s car, and the arrival of many new products such as the Geely Galaxy E8, Jike 007, and the new Feifan R7 that appeared at the Guangzhou Auto Show, the competition in the high-end pure electric sedan market has also begun to heat up. Although the above products have not yet been fully delivered, and some models have not even started pre-sale, the market’s expectations for China’s high-end new energy vehicles are getting higher and higher. In the past, “new energy” and “hardcore off-road,” two seemingly distant sub-sectors, did not seem to match, but in 2023, more and more “sparks” were ignited. From Great Wall Haval, Tank, to BYD Eyewear, Formula Leopard, and Dongfeng Warrior, more and more domestic car companies are laying out the new energy off-road vehicle sub-market, and hardcore off-road + new energy is becoming a new competitive sub-sector for car companies. It can be seen that in the face of the gradually saturated C-end market, and the situation where the new energy vehicle industry is rising, car companies must explore more differentiated sub-markets and choose relatively focused product layouts in order to seize more market share. Fourth, huddling together becomes a unique landscape. After experiencing the withdrawal of national subsidies, continuous price wars, and the internal competition of car companies, the Chinese automobile market in 2023 can be said to be colorful. Perhaps the fierce competition has brought about excessive consumption, and in the second half of the year, car companies are more inclined to huddle together to resist the cold winter of the auto market. Recently, one car company after another has landed cooperation projects. Volkswagen has acquired a board seat by investing in Xiaopeng, while Stellantis has secured a 20% stake in Zero Electric Vehicles with a 15 billion euro investment.

Huawei has formed an alliance with many car companies to build the HarmonyOS ecological car alliance. NIO’s electric vehicle “Friends Circle” continues to expand. Recently, Mercedes-Benz and BMW have established a joint venture company in China to jointly operate a super charging network. Looking ahead, in July, Geely officially announced the establishment of a joint venture company with Renault. The new company is mainly responsible for the research and development, manufacturing, and supply of advanced hybrid powertrains and efficient fuel powertrains. There is also cooperation between Audi and SAIC Group’s Zhiji. For the automotive industry, cooperation between car companies is not new, but the phenomenon of such frequent and large-scale cooperation models that have never occurred before. At present, no matter how car companies cooperate, the core point is “win-win cooperation and mutual benefit.” Of course, cooperation also has many benefits, such as reducing costs and increasing efficiency. In the case of NIO’s cooperation with Changan for battery swapping, NIO’s approach will not only effectively reduce its own massive financial pressure, but will also help accelerate the expansion of the scale effect of battery swapping, accelerate the construction and development of battery swapping stations, and even accelerate the unification of domestic battery swapping standards. For Geely and Changan, they can avoid high costs of establishing battery swapping stations, saving money, time, and effort. Therefore, cooperation becomes a smart choice, and cooperation between the two parties can greatly reduce their expenses in the energy replenishment strategy. On the other hand, car companies cooperating in groups can complement each other. For example, Jianghuai, Changan, and BAIC are good at vehicle manufacturing, but have limited technology in smart terminals, so they need Huawei’s strong support. Huawei’s BU car business is currently in a loss-making state. After years of struggling alone, it has not made a profit. It is better to open up and let more car companies participate, so that costs can be better amortized after forming a scale and achieve profitability. Currently, Huawei also has rich experience and technological accumulation in the field of new energy vehicles, which can help automotive companies accelerate the development of new energy vehicles and adapt to changes in market demand. 1. The reason why the public chooses Xiaopeng Motors as an investment partner is due to its leading advantage in the field of autonomous driving. Stellantis Group’s partnership with Lingpao relies on Stellantis’ global manufacturing facilities to produce Lingpao brand products, which gives Lingpao an advantage over its competitors. 2. China’s car companies are making breakthroughs in going global. In recent years, as the automobile industry has undergone profound changes, the pace of Chinese car companies going global has accelerated, and they have achieved good results in overseas markets. Going global has become the “second growth curve” for many Chinese car companies. 3. According to the latest data released by the China Association of Automobile Manufacturers, China’s car exports in November 2023 reached 482,000 units, a year-on-year increase of 46.3%. From January to November, automobile exports reached 4.412 million units, a year-on-year increase of 58.4%. The industry predicts that the full-year exports will reach over 4.5 million units, and China’s automobile export sales in 2024 are expected to increase to 5.5 million units. 4. Based on this calculation, China will become the world’s largest automobile exporting country in 2023, with new energy vehicles being the main driver of growth. From January to November, cumulative exports reached 1.091 million units, a year-on-year increase of 83.5%. This indicates that China’s automobile industry has strong international competitiveness and is playing an increasingly important role in the global automobile market. 5. China’s main automobile export countries currently include Russia, ASEAN, Western Europe, and the Middle East. From the data on car exports, the main battleground for Chinese car exports has shifted from Europe to Southeast Asia. Most European countries have fallen out of the top ten in terms of export volume, with the Philippines and Thailand in Southeast Asia becoming the countries with the highest export volume.

The change is related to the European Union’s formal announcement that it has launched an anti-subsidy investigation into Chinese electric vehicles. In the first half of this year, China’s total automobile exports to Europe accounted for 39.1% of the total export volume, compared to only 5.7% in 2018. The demand for Chinese brand products in the European market is increasing. At the Munich Auto Show in September of this year, Chinese companies stood out, even stealing the spotlight from German car companies. According to statistics, nearly 50 Chinese companies participated in this year’s Munich Auto Show, accounting for about 7.4% of the total exhibitors. Chinese passenger car brands also accounted for one-third of this year’s Munich Auto Show passenger car brands. The increase in the number of Chinese brands at this year’s Munich Auto Show has led some foreign media to comment that “China is rapidly transforming into a superpower in electric vehicles, even posing a threat to established car manufacturers in Europe” and “Munich is brewing a perfect storm.” The outstanding performance of Chinese car companies in the European market has made European car companies feel the crisis. Some European car manufacturers’ executives have expressed that they must strive to produce lower-cost electric vehicles in the face of China’s leading position in developing cheaper and more consumer-friendly models. The powerful electric vehicles in China have attracted international attention and sparked an anti-subsidy investigation. The Secretary General of the China Association of Automobile Manufacturers, Cui Dongshu, stated that the direct reason for the EU’s investigation into Chinese electric vehicle subsidies is the sharp increase in the export of whole vehicles of new energy vehicles in China. Despite opposition, the European Commission has initiated an anti-subsidy investigation into three Chinese car companies, BYD, SAIC Motor, and Geely. However, Chinese cars are popular in Southeast Asia, where local tax subsidies for the purchase of new energy vehicles have been introduced. In addition, Southeast Asian countries have opened a “green channel” for local factory construction. Currently, BYD, Great Wall Motors, Changan Automobile, and other car companies have already established vehicle factories in the region. It can be seen that as China becomes the world’s largest car exporter, it faces both opportunities and challenges. In the current environment, Chinese brands should focus on improving product competitiveness, building brands overseas, and fully understanding the needs of local consumers. Therefore, Chinese car brands going global should not just go out, but also go up.