The competition of new energy vehicles in 2023 has escalated from early-year pricing, mid-year marketing, to end-of-year intelligent driving. A sudden cold wave has brought electric vehicles back to the starting point as range anxiety once again dominates public opinion. A technical competition on energy replenishment has quietly begun. Starting from mid-December, within just two weeks, three new forces in the automotive industry, Aiways, Xpeng, and NIO, successively released their self-developed batteries. Among them, the most eye-catching is NIO’s 46105 large cylindrical battery, with the industry’s lowest single-cell internal resistance, capable of replenishing 255 kilometers in 5 minutes. More importantly, unlike previous pure technical releases, the self-developed batteries of the above-mentioned car companies have all entered the mass production stage.

For example, Guangzhou Aiways, while releasing the P58 microcrystalline super-energy battery, also officially completed the construction and production of its Yinfeng battery factory. Xpeng’s golden brick battery is also first installed in the new Xpeng 007, and delivery will start on January 1, 2024. NIO’s 150-degree solid-state battery has been directly tested on the road, with a range of over 1000 kilometers in low-temperature conditions in winter, and will be flexibly upgraded to serve all NIO models currently on sale. In addition, as leading car companies have successfully developed their own batteries, more companies are preparing to enter the market. Previously, Changan Automobile launched its self-developed battery brand “Golden Bell” at the Guangzhou Auto Show, and plans to release 8 self-developed battery cells over the next 7 years.

Recently, Gao Xinhua, Executive Vice President and Director of the Research and Development Institute of Chery Automobile, also revealed that Chery Automobile will officially launch its self-developed battery products next year.Including these two companies, as of now, more than 10 domestic car companies have developed their own batteries. In addition to a few companies such as Leapmotor and Lantu that choose to use externally sourced battery cells, including BYD, Guangzhou Automobile Group, SAIC, Geely, Great Wall, and NIO, most players have chosen to layout the entire industry chain from 0 to 1. Giants such as BYD and Guangzhou Automobile Group have also extended their reach to the upstream raw materials field.

To some extent, the pursuit of battery freedom by car companies seems endless, and this vigorous self-research wave has just begun. Beyond the existence of the engine, how important are batteries? The starting points for self-researching batteries by different car companies are not completely the same, but ultimately, they all share the same logic: batteries are too important. “Regardless of batteries, motors, or electronic control, they are the foundation of electric vehicles. This is our understanding and definition of the importance of batteries,” said Geely Holding Group President and CEO of Jikexin Intelligent Technology, An Conghui, at a media briefing after the release of the Golden Brick Battery on December 15th. In order to form competitiveness in the future, electric vehicle companies must master the core technology in various key areas, and batteries are the most basic element.

First, in terms of product definition, from endurance, space, performance, safety to experience, batteries affect every aspect of electric vehicles. For example, in the most obvious aspect of user perception, the endurance, a 100-degree battery pack with NEDC ternary lithium battery cells, and a dual-motor electric coupe, the 2.185-ton NIO ET5 can run about 700 kilometers, while the 2.655-ton Xiaomi car can run 800 kilometers. This is due to a 3-year technological difference in car batteries. Xiaomi’s car uses the latest Kirin battery from NEDC, which, under the same chemical system and the same battery pack size, increases energy by 13% compared to 4680, with a maximum energy density of 255Wh/kg. However, NIO’s 120-degree large cylindrical battery, released on NIO Day in 2023, already has an energy density of 260Wh/kg. “We have always felt that there is a lot of room for breakthroughs in batteries,” said Zeng Shizhe, vice president of NIO’s battery system.

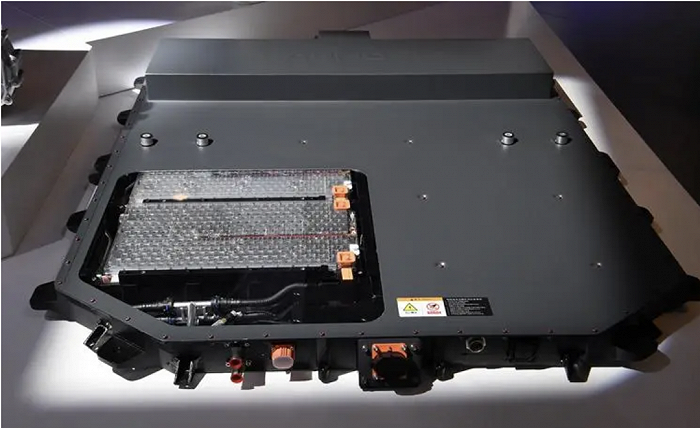

Many car companies simply piece together things from suppliers, but battery innovation is now reflected in details such as material selection and welding methods for components. For example, through special designs for partial glue bonding and collision prevention in the upper cover, NIO’s large cylindrical battery space utilization has increased by 24%. It is worth noting that much of the innovation is not only based on battery density. According to Bi Lu, head of NIO’s electric drive and high-voltage architecture, in the competition among car companies for high-voltage fast charging technology, it is a big closed loop from external supercharging piles, battery swapping stations, to internal electronic control and batteries. Batteries not only need to meet the storage density of high-voltage fast charging, but also the energy efficiency of high-voltage transmission. This means that without high-rate batteries, high-voltage fast charging is difficult to truly be effective.

For example, as the first domestically produced mass-produced car based on an 800V high-voltage platform, the XPeng G9 series comes standard with a 3C fast-charging battery pack, which can replenish 400 kilometers in about 15 minutes, but the latest model on the market, the Jinko007, equipped with a 4.5C gold brick battery on the same 800V platform, can replenish 500 kilometers in 15 minutes. For car companies, batteries have become a key part of the entire recharging system. Currently, in order to complement the launch of the first all-electric vehicle, Li Auto has not only vigorously deployed supercharging stations, but also jointly developed a 5C fast-charging battery with CATL. This battery can replenish 500 kilometers in 12 minutes, but may still be slightly inferior to NIO’s 5C battery under the 900V platform, which can replenish 255 kilometers in 5 minutes. “The key point of 5C charging lies in the impedance of the battery,” Zeng Shizhe explained. Currently, the resistance of the large cylindrical battery on the market is generally around 3 milliohms, which makes it difficult to support 5C fast charging technology.

NIO’s 46105 large cylindrical battery can achieve a resistance of 1.6 milliohms, which is equivalent to a 50% reduction. However, he also emphasized that the ultra-fast charging technology of large cylindrical batteries is still in a very early stage, and there is still a lot of room for improvement in the future. From the perspective of product strength, the upgrade of batteries is far from over. In the current escalating competition in the automotive industry, in addition to endurance and energy replenishment, car companies can find solutions from batteries in terms of space, performance, safety, and even brand competition. For example, in terms of performance, the gold brick battery of Jiuke can reach a maximum pulse discharge rate of 16C in 3 seconds, and the huge instantaneous energy can easily accelerate to 100 kilometers in 3 seconds.

With the advancement of integrated battery body technologies such as CTP, CTB, and CTC, batteries are gradually changing from energy components to structural components, and the interior space of the car is also continuously expanding. According to a set of statistics provided by Jiuke, the “room rate” of traditional luxury brands such as Audi A6L, Mercedes-Benz E-Class, and BMW 5 Series is generally between 73% and 76%, while the “room rate” of Jiuke 007 equipped with the gold brick battery reaches 81.8%. Previously, Li Xiang, the head of Ideal Car Battery, revealed that as early as the second half of 2019, the Ideal product team received a request from founder Li Xiang to develop a family MPV. However, based on their own extended-range technology, the “occupancy rate” of Ideal’s MPV at that time could only reach 67%, which was equivalent to the large SUV model L9. Later, it was discovered that achieving an “occupancy rate” of over 70% could only be done with a pure electric vehicle.

“This is the natural advantage of electric vehicle software and hardware,” NIO CEO Li Bin said in an interview at the 2023 NIO DAY. “Due to the inherent technical characteristics of batteries and electric drive, electric vehicles can now do many things that fuel vehicles cannot.” He cited safety as an example, saying, “In the past, it made no sense to talk about safety redundancy in cars because it was impossible in the era of internal combustion engines, at most there was a spare tire in the back.” Now, electric vehicles can leverage their own technical features to further enhance the safety limits of the entire vehicle. According to Li Bin, NIO’s new flagship model ET9 has 7-fold safety redundancy in braking, steering, and other aspects.

It is also equipped with large cylindrical batteries that incorporate a new thermal-electric separation design and has developed an intelligent high-precision thermal runaway algorithm, which can significantly improve the safety of individual battery cells and prevent overheating and even spontaneous combustion. Overall, the battery is like the heart of an electric vehicle, and its condition determines the final product boundaries. Its importance far exceeds that of the internal combustion engine in the era of fuel vehicles. Looking solely at the cost ratio of 30%-40% of the entire vehicle, the importance of the battery in the supply chain is self-evident. For companies like NIO that adopt a battery swapping model, the battery is not just a component, but rather an independent major product.

“There are also some differences in mindset,” Li Bin said. Therefore, NIO considers not only the 8-year warranty period, but also includes the battery material, recycling process, recycling technology, and cascaded utilization in the battery’s full lifecycle. “If we look at it this way, the perspective is different, and we need to define it ourselves.” Tesla leads the way in the battle for battery dominance among car companies. For a long time, the supply chain for batteries has been dominated by a few giants such as CATL. This supply chain is closely related to the industry threshold of power batteries. Batteries are resource-intensive, requiring large investments and having a long recovery cycle. CATL, due to its early start, has a large scale advantage and has taken down the supporting technical standards through early cooperation with international first-class car companies such as BMW.

In terms of market share, from 2016 to 2022, CATL has won the global power battery installation volume for six consecutive years. In 2022, CATL’s installed capacity reached 191.6GWh, accounting for 37% of the market share. This market dominance has laid the groundwork for the supply and demand conflict of batteries. In 2015, Tesla, dissatisfied with the limitations on Panasonic’s production capacity, started the trend of car companies developing their own batteries by investing in Jeff Dahn’s research group, the father of the ternary lithium battery. Subsequently, Tesla acquired the battery technology company Maxwell and the battery equipment company Hibar, and launched its own 4680 battery in 2020. Tesla’s moves have prompted some car companies to follow suit.

Great Wall Motor separated its battery department in 2018 and renamed it Honeycomb Energy, focusing on the research, production, and sales of power batteries and energy storage battery systems. Nio, after releasing a 100-degree battery pack at the end of 2020, also began to invest in the research and development of 150-degree semi-solid-state batteries. At the time, these actions seemed only tentative to the outside world. However, the battery shortage that broke out in 2021 further catalyzed the supply and demand contradictions of batteries. Many car companies’ leaders need to personally “grab batteries,” and even He Xiaopeng was once reported to have been waiting at CATL for a week. At the same time, the continuously rising battery prices also made it difficult for all car companies to speak.

Zeng Qinghong, chairman of GAC Group, even complained in public, “We are working for CATL.” In contrast, BYD, which started with batteries, gradually ushered in a business outbreak due to its own battery supply capacity. Especially in 2022, when car companies were generally affected by the epidemic, BYD also enjoyed the vertical integration of the supply chain. The company’s annual car sales reached 1.8685 million, a year-on-year increase of 212.82%, and even surpassed Tesla in one fell swoop to become the global new energy vehicle sales champion. More importantly, in the case of car companies generally facing cost pressures, BYD’s profitability is also outstanding. According to financial reports, from Q1 to Q4 of 2022, BYD’s net profit increased from 808 million yuan to 7.311 billion yuan, and its annual net profit reached 16.622 billion yuan, equivalent to the total profit of the past five years.

The profit growth rate was also as high as 446%, leading the industry by far. In addition, Lixiang Automotive, which has been imitating BYD’s vertical integration route, has also begun to show its strengths. In 2022, Lixiang Automotive sold 111,200 vehicles, a 154% year-on-year increase, with total revenue of 12.385 billion yuan, a 295% year-on-year increase. In early 2023, in order to further seize market share, Lixiang Automotive lowered the price of its mid-size SUV C11 to 149,800 yuan (21050$) under the slogan of luxury and equality.

“Our mid-size SUV can sell for 149,800 yuan (21050$). In short, it relies on our self-developed capabilities, including batteries,” said Song Yining, vice president of the Zero Run Car Battery Product Line. Zero Run has a self-developed rate of up to 70%, and the self-created C2C battery integration can significantly reduce costs. The C11 price release means that others will need at least one or two years to learn from us.” Tesla once provided a more intuitive comparison of the cost reduction space brought by batteries: due to the 5-fold increase in the single-cell capacity of the 4680 battery compared to the 2170 battery, the investment cost per degree of electricity is reduced by 7%, and the total cost is reduced by 14%.

Through the 4680 CTC integration technology and the vehicle’s integrated die-casting process, 370 parts can be reduced, and the weight of the entire vehicle can be reduced by 10%. Under strong comparison, more car companies are accelerating their independent research and development efforts. In May 2022, NIO announced an investment of 2.18 billion yuan to establish a battery core research laboratory and a pilot line in Shanghai. In October of the same year, NIO once again established NIO Battery Technology Co., Ltd. in Anhui with a registered capital of 2 billion yuan, mainly engaged in battery manufacturing and sales. In response, Li Bin also did the math: batteries account for nearly 40% of the total vehicle cost.

If calculated at a 20% gross margin, NIO could increase the overall gross margin by about 8 percentage points if it manufactures its own batteries. For car companies that purchase batteries externally, the general gross margin for the entire vehicle is around 10 percentage points. If NIO self-develops batteries and chips, the overall gross margin can increase by about 10 percentage points, equivalent to an overall gross margin of about 20%. According to incomplete statistics from power plants, in 2022, in addition to NIO, many car companies such as SAIC, GAC, Geely, Volkswagen, BMW, etc. are also starting construction of their battery projects.

Geely has invested more than 130 billion yuan in 12 battery projects in China since March 2019, and the 4 projects that will be launched in Yingtan, Tonglu, Yancheng, and Quzhou in 2022 account for about 31% of the total investment. During this period, the self-developed wave spread, and battery giants also attempted to repair and consolidate their cooperation with car companies. In early 2023, CATL launched a “lithium mine rebate” plan. That is, in the next 3 years, if 80% of the orders are given to CATL by the car companies, CATL will settle 50% of the lithium carbonate raw materials at a price of 200,000 yuan (28100$) per ton, and the remaining amount will be calculated according to the market price. In response, car companies are not interested. Song Yining told the power plant that this clause is of little practical significance.

On the one hand, car companies are more optimistic about the expected price reduction of batteries than the price of 200,000 yuan (28100$) set by the above clause. On the other hand, CATL has some hidden clauses beyond the above conditions, such as, in the 3-year cooperation process, car companies still need to pay the market price first, and the difference will be refunded after settlement later. This is unable to relieve the cash flow pressure for many car companies. He emphasized that Zero Run still hopes to dominate the battery, “In addition to the battery core, all of our batteries are made by ourselves, so we have standardized the battery core, equivalent to the size, model, and capacity, and can choose from 4 or 5 suppliers at any time. We are taking the lead, so we are using fewer and fewer batteries from CATL in the past two years.”

From self-development to self-supply, how far are car companies from battery freedom? The problem is that self-developed batteries by car companies are not a smooth path, and the most typical representative may be Tesla. Since the launch of the self-developed 4680 battery in 2020, Tesla has encountered various problems in the mass production stage. The biggest feature of this battery is the use of pole-less ear technology, which can shorten the electronic circulation path, reduce the internal resistance and heat generation of the battery, and bring higher output power and better fast charging performance. However, this also brings challenges in production processes, such as difficult control of the laser welding process, and the yield rate has been low. In early 2022, after a year and a half of exploration, Tesla’s 4680 cell production exceeded 1 million for the first time. Subsequently, Tesla announced the opening of 4680 battery production lines in its new factories in Texas and Berlin, with planned capacities of 100GWh and 50GWh, respectively.

In August of the same year, the first model equipped with the 4680 battery, Model Y, was also relaunched on the official website in the United States, and everything seemed to be gradually on the right track. However, the good times did not last long. Since August 2022, the 4680 version of the Model Y has appeared twice and disappeared twice from the Tesla official website. There are two common speculations about this: one is that the actual road test results are not good, and Tesla is preparing to upgrade the existing 4680 battery; the other is that the production capacity of the 4680 battery is limited, and Tesla needs to prioritize the capacity supply to the Cybertruck, which has recently started delivery.

However, from the latest news, the biggest challenge is still the mass production of the 4680 battery. According to foreign media reports, the current production capacity of Tesla’s 4680 battery cells can only support the delivery of 24,000 Cybertrucks per year due to the inability to meet the requirements for large-scale production of the dry coating technology used in the production of the 4680 battery cathode materials. Elon Musk has also emphasized that the production capacity of this vehicle will not reach 250,000 units until 2025.

In fact, Tesla is not the only one facing mass production challenges recently. NIO’s 150 solid-state batteries, which have already been road-tested, are also under significant pressure. According to Li Bin, these batteries have been verified and tested, and the market has high expectations for them. However, each battery cell needs to undergo CT testing, making the overall cost high and production difficult. Currently, the output is not high, and large-scale deliveries will have to wait. “Batteries are a highly technical industry,” said Song Yining, noting that self-developed batteries can indeed bring significant cost reductions. However, car companies may not necessarily need to produce battery cells themselves. “I have always believed that there are two things in batteries that are particularly challenging: the battery cell and the chip.

These two things are strange in that they can only be in a usable or unusable state. Even if they are well-made, if they cannot be used, their value is zero.” The top 10 battery manufacturers on the market, especially Chinese manufacturers, have invested many years in developing mature lithium iron phosphate technology. In addition to CATL, companies such as Contemporary Amperex Technology Co. Limited are also doing well in the more challenging ternary lithium battery technology. Song Yining believes, “With so many manufacturers doing well, car companies do not need to go it alone. It would be good enough to integrate resources well.” Zhang Xiang shares the same attitude. He told the media that the manufacturing threshold for batteries is also very high.

If car companies produce their own batteries, they will occupy valuable development funds. Car companies should focus more on battery integration. According to a research report from China International Capital Corporation Limited, even without considering research and personnel investment, the cost of lithium battery equipment is around 200 million yuan/GWh, and the replacement cycle for this equipment is only 3-5 years. In addition, according to McKinsey’s estimate, only when the scale of automobile production reaches 500,000 vehicles or the scale of battery production reaches 15GWh, can car companies have a cost advantage in producing their own battery cells. This means that in such a high threshold, high investment, and long-term industry, competing with leading companies is very risky, especially considering the great uncertainty in battery technology evolution.

Facing significant financial pressure, NIO, which originally planned to produce its own battery cells, has been forced to abandon this path. Recently, Li Bin admitted in an interview that while developing batteries can improve the gross margin for car companies in the long term, it is indeed difficult in the short term. Car companies need to constantly balance input and output. “Batteries are a heavy asset. From materials to cells, whole packs, BMS, we will do our own research and development, but we will let others manufacture them.” Of course, many car companies are still persevering, such as GAC Aian and Krypton. According to An Conghui, the self-developed Golden Brick battery by Krypton can increase production efficiency by more than 40% and reduce the cost per kilowatt-hour by 14.8% compared to similar ternary lithium batteries.

However, he also admitted that if the battery and other energy storage networks are accounted for independently, this business is still in the red. Among them, the investment in the Quzhou Krypton factory exceeds 10 billion. In terms of investment capacity and sales volume, the only companies currently able to support their own battery factories are BYD, Tesla, and GAC Aian. By 2023, their annual sales distribution will be 3 million vehicles, 1.8 million vehicles, and 480,000 vehicles, respectively. GAC Aian’s Yinpai battery factory has recently been officially put into operation, with a maximum single-line capacity of 6GWh, but GAC Aian has remained tight-lipped about the overall scale and specific production time. Even giants like Tesla and BYD still have a long way to go before achieving true battery freedom in the automotive industry.