In the last week of 2023, several car companies released new models, including NIO ET9, WENJIE M9, JIKE 007, and Xiaomi SU7, enriching the end-of-year market supply and signaling the Chinese car market for 2024. There is no end, only more to come.

This is an unprecedented “crazy week” in the car market, and a microcosm of the 2023 new energy vehicle market. It is not difficult to foresee that the new energy vehicle market in 2024 will see even fiercer competition. Car companies showcase new cars to demonstrate their strength As 2023 comes to a close, NIO, WENJIE, Jike, Xiaomi, and Xiaopeng have chosen this moment to launch highly anticipated new car models, injecting a strong sense of innovation and vitality into the entire car market, while also showcasing their respective strengths. At NIO Day 2023, NIO’s intelligent electric executive flagship model ET9 made its official debut.

Despite being positioned as a million-dollar luxury car, the new car has a pre-sale price of 800,000 yuan (112450$), and has made new breakthroughs in design, space, driving experience, performance, recharging, and intelligence. On the technology front, the NIO ET9 is equipped with the all-domain 900V platform, SkyRide chassis system, and the self-developed Shenji NX9031, showcasing technological peaks beyond the current level. In other words, the NIO ET9 will reach the industry’s top level in vehicle recharging and energy consumption performance, chassis comfort and driving performance, as well as the functions and intelligent driving experience of the vehicle.

In addition, the ET9 features advanced battery technology and an intelligent driving assistance system, significantly improving range and safety while also providing rich comfort and entertainment functions, aiming to bring users a more luxurious driving experience. At the M9 launch event, Huawei’s Executive Director, Terminal BG CEO, and Intelligent Car Solutions BU CEO, Yu Chengdong, stated: “The M9 will redefine the best intelligent flagship SUV under 10 million yuan, bringing users a leading-edge new experience that goes beyond just one generation.” As another heavyweight product of the collaboration between Huawei and Cyrus, the M9 has luxurious interior design, spacious space, and a powerful intelligent driving assistance system and power system, providing users with a more convenient and comfortable travel experience.

Of note, Yu Chengdong emphasized the safety of the M9, which uses Xuanwu body design and 2000MPa nuclear submarine icon-level hot-formed steel in 12 locations to ensure absolute safety. Additionally, 80% of the M9 is made of aluminum alloy, and other components undergo integrated die-casting treatment with a 9000T press, ensuring the vehicle has top-level safety. In terms of active safety, the M9 is equipped with 9 airbags and 16 safety points, providing passengers with all-around protection. The battery pack features a five-layer thermal safety protection, including high-temperature resistant mica board, insulating mica paper, aerospace-grade insulating aerogel, nano-ceramic insulating layer, and ultra-thin liquid cooling system, to prevent thermal runaway and diffusion. On the safety of the Wanjie M9, Yu Chengdong also played a video, showing that the car sustained minimal damage when squeezed between two large trucks. Netizens expressed their trust in the safety of the M9, and its leading position is not without reason.

At the launch event of the Wanjie 007, Wanjie Intelligent Technology CEO An Conghui set the tone for this brand’s first all-electric luxury sedan. From a product perspective, the Wanjie 007 is built on an 800V high-voltage platform, equipped with an 800V power battery and a 475kW high-performance silicon carbide electric drive system, with a range of over 800km, leading in its class in terms of architecture and powertrain. At the same time, the new car is equipped with industry-leading “black technology” configurations such as the 8295 smart cockpit chip, the NVIDIA OrinX smart driving chip, and Geely’s self-developed Kr AI large model, showing the potential to redefine the new standard for intelligent electric travel.

Of course, the highlight of the Wanjie 007 is its competitive pricing, with the entry-level rear-wheel drive version priced at only 209,900 yuan (29500$), and the top-of-the-line four-wheel drive performance version at just 299,900 yuan (42160$), coupled with various limited-time reservation benefits, giving it a strong advantage in the same class of all-electric sedan market, truly “rolling to the end.” As many car companies are launching flagship models, Xiaomi finally couldn’t sit still and held a “Xiaomi Car Technology Conference” on February 28, 2023. The conference mentioned almost all the features and configurations of the Xiaomi SU7, except for its price.

Xiaomi SU7 is hailed as a dark horse that rivals Porsche and is not inferior to Tesla. The car is highly competitive in design and intelligence. Lei Jun stated that he aims to become one of the top five global car manufacturers through 15-20 years of effort. Xiaomi’s official description of the SU7 emphasizes its ultimate industrial design, intelligent interior configuration, high-performance electric drive system, and excellent handling. It is a high-performance ecological technology sedan that integrates technology and driving pleasure. Xiaomi SU7 uses Pango OS to provide a smartphone and tablet-like user experience in the car. The entire vehicle is easy to use and also caters to the driving experience of iOS users. At the Xiaomi car technology conference, Lei Jun officially responded to the Xiaomi car prices, stating that 99,000 yuan (13920$) is out of the question, 149,000 yuan (20940$) may not even cover the cost, and it’s hard to say if 200,000 yuan (28110$) can secure the standard configuration.

At least 250,000-300,000 yuan (42170$) is a more reasonable range. Like other emerging carmakers, Xiaopeng Motors is also making waves. On the first day of 2024, Xiaopeng Motors brought a New Year’s gift to family users – the Xiaopeng X9. This car has undergone significant upgrades in design and technology, especially in its autonomous driving technology, reaching an industry-leading level. It is worth mentioning that the X9 not only has a long range and excellent performance, but also provides users with an unprecedented intelligent driving experience. The launch of the new car will undoubtedly further consolidate Xiaopeng Motors’ position in the electric car market. It is evident that the new forces in car manufacturing have released a new wave of cars, showcasing their strength and bringing the market competition to its peak. The “price war” will continue in 2024. In early 2023, the highest price reduction for domestically produced Tesla models was 48,000 yuan (6750$), sounding the horn for a “price war.”

From then on, an unprecedented price war swept through the automotive industry, overturning the stable industry rules that had been in place for many years. “Price reduction” and “internal competition” became the main theme running through the car market. Entering 2024, new energy vehicle companies such as BYD, GAC Aion, Ideal, NIO, Xiaopeng, and Leap Motor successively announced their 2023 sales results. With the combined support of consumption promotion policies in many parts of the country and the preferential activities of car companies, major car companies have achieved good results, playing a role in promoting the development of the entire new energy vehicle market. Ideal car achieved the title of top sales in 2023 among new car manufacturers, with a total annual sales of 376,000 units. It is the only new car manufacturer to reach its annual sales target in 2023, with monthly sales surpassing 50,000 units for the first time. The next goal is to challenge the target of 800,000 units in annual sales and 100,000 units in monthly sales.

Xiaopeng Motors saw a rebound in sales in the second half of 2023, with deliveries increasing for three consecutive months. The total annual sales reached 141,600 units, a 17% year-on-year increase. The highly anticipated X9 model has been officially launched and delivered, while the XNGP intelligent assisted driving system now covers a total of 243 cities. Nio delivered a total of 160,000 new cars in 2023, a 30.7% year-on-year increase, ranking second among new energy vehicle manufacturers. The entire Nio product line completed generational transitions, and at the recent 2023 Nio Day, the Nio electric flagship ET9 made its official debut, attracting significant attention. In response, Nio CEO Li Bin stated, “There is no doubt that the external environment and the company’s own factors have contributed to our failure to achieve our established goals this year.

We have many shortcomings in terms of environmental uncertainty, risk awareness, and organizational readiness.” Most new energy vehicle brands incubated by traditional car manufacturers experienced growth, with the popular AITO Wanjie achieving monthly sales exceeding 20,000 units for the first time. Lantu Automobile and Zhiji Automobile also achieved monthly sales exceeding 10,000 units for the first time. After experiencing a slowdown in sales growth in October and November, GAC Aion saw a rebound in sales in December. Overall, the industry generally believes that price wars and “internal competition” will continue into 2024, and the elimination round will persist. This can be seen from the rhythm of the intensive release of new cars by car manufacturers at the end of 2023. Industry forecasts, the new energy vehicle industry will become more competitive in 2024 as new products are rapidly iterated. The competition among car companies will intensify, not only in terms of the speed of launching new products, but also in the speed of product innovation. A senior executive of Geely Auto said, “In 2023, everyone was talking about competition, but this is no longer surprising.

The comprehensive 4P marketing of cars has started to be competitive in terms of price, product, channels, and promotions. The market pressure in 2024 will definitely be great. We are also seeing the continuous release of new cars. There is no doubt that the pure electric market will experience consumer upgrades.” Zhang Yongwei, Vice Chairman and Secretary General of the China Electric Vehicle 100 People’s Association, believes that from 2024 to 2025, the automotive industry will enter a period of deep reshaping. For enterprise competition, this will be a critical period of survival of the fittest. Industry reshuffling is expected to accelerate, providing growth opportunities for many companies. He also emphasized that 2024 will be a critical period of survival of the fittest. There will be more new energy vehicle products launched in the market, with more than 1,100 new energy vehicle models introduced in the Chinese market in 2023 alone.

The automotive industry has entered the era of Moore. In Zhang Yongwei’s view, the lifecycle of new car models is accelerating and shortening. In the era of fuel vehicles, a new car was launched every 4 years, but now the new product launch cycle is 12-18 months. The “competition” in the automotive industry is not only limited to price competition at the commercial level, but is also reflected in high-frequency innovation. Nio founder William Li has already taken precautions. He says the competition in the car industry will intensify in the next two years. The priority is to reduce costs and increase efficiency. Don’t be surprised if you see a more intense “price war” after the Spring Festival holiday. This may be the new normal for the next few years.

In addition, industry insiders generally believe that by 2025, the pattern of the Chinese automobile market will become clearer, with some car companies being eliminated in fierce competition. Looking at the 2023 automobile industry pattern, data shows that the sales of Japanese cars have dropped by more than 14% compared to the previous year, while domestic brands have achieved a 22% increase. The rise of domestic brands is not only reflected in the surge in sales, but also has strong industry driving force in the development of new energy and intelligence. In the recent sales pattern, BYD and Tesla are leading in the new energy market, while NIO and XPeng are facing the impact of traditional car companies incubating new brands such as Jikua and Zhiji, as well as the challenge of Weimar’s M7 and M9 to the position of Ideal Cars. Moreover, NIO, Ideal, and Weimar are also joining forces to attack the market of new energy vehicles priced above 500,000 yuan (70280$), which was previously the territory of traditional luxury brands.

Faced with the internal competition of the Chinese automobile market, the President of Porsche China stated, “I have been working in the automobile industry for over 30 years, and a large part of the time has been in markets outside Germany, but I have never seen such a chaotic price war in the Chinese market.” In order to avoid getting deeply involved in a price war and to ensure the quality of terminal dealer operations, Porsche has begun to reduce its product supply in China and will supply capacity to the North American, European, and other larger regional markets. Like Porsche, luxury brands such as Mercedes-Benz, BMW, Audi, as well as joint venture car companies such as Volkswagen and Toyota, are also facing great pressure in China. In the future, launching low-priced products in China may become the new norm for these overseas giants. Reshaping the new pattern of the automobile industry Entering 2024, despite facing many challenges, the automobile market will also see new changes.

According to industry forecasts, the penetration rate of new energy vehicles in China may exceed 40% in 2024. Previously, Cui Dongshu, Secretary General of the Joint Conference on Passenger Vehicle Market Information, stated, “The growth of the new energy vehicle market in 2024 is expected to be relatively optimistic. The wholesale of new energy passenger cars is expected to reach 11 million, with a net increase of 2.3 million, an increase of 22% compared to the previous year. New energy passenger cars maintain strong growth momentum.” From this news, it can be seen that China’s strength in the field of new energy vehicles is not only reflected in the scale of sales, but also demonstrates strong capabilities in technology, innovation, and the industrial chain. Looking at the level of new energy vehicles, thanks to policy promotion and the reduction of actual vehicle operating costs, as well as the continued trend of electric conversion, the development of the new energy market will be even more rapid.

At a recent media briefing held by the China Electric Vehicle Hundred-Person Conference, relevant personnel stated that with the further expansion of production and sales scale, the cost of new energy vehicles will be further improved, new technologies will steadily land, and the consumer environment will continue to optimize. It is expected that by 2024, the “battle between oil and electricity” will intensify further, and new energy vehicles will further encroach on the mainstream market of fuel vehicles. A-level and B-level cars in the 10-15 thousand yuan price range will become the key incremental market, contributing to one-third of new energy vehicle sales. At the same time, plug-in hybrid PHEVs will become a new driving force for the growth of new energy vehicles. In terms of new energy exports, global sales of new energy vehicles are expected to exceed 20 million units by 2024, with China contributing to over 60% of global sales.

The position of China’s new energy vehicle industry in the global market will be further enhanced. It is worth noting that with the rapid development of the new energy vehicle industry, domestic brands have taken the lead and their product competitiveness has also become stronger. Industry experts predict that 2024 will be a very difficult year for joint venture brands, and their market share will continue to decline. However, many joint venture brands are now improving their layout and localization research and development in China, accelerating structural adjustments, and adapting to the trend of electrification and intelligence. At the same time, the cooperation model between Chinese and foreign car companies is also undergoing new changes.

Some Chinese and foreign companies are strengthening their cooperation in research and development, technology, brand, export, and supply chain, changing the one-way input mode of foreign investment since the establishment of joint ventures. From a technical perspective, the era of popularization of 800V high-voltage fast charging is now. By the end of 2023, Xiaopeng, Li Xiang, Zhijie, Chery, and Ji Ke have successively launched models equipped with the 800V high-voltage platform. 2024 will be a year of comprehensive popularization of the 800V voltage platform, and it is expected that this technology will also be extended to new cars at lower prices. Industry insiders predict that with the progress of China’s charging infrastructure, from 2024 onwards, electric vehicles will become a pleasant “charging journey.” It will take only 10 minutes to charge 400 kilometers, and the era of the “Flashman” is coming.

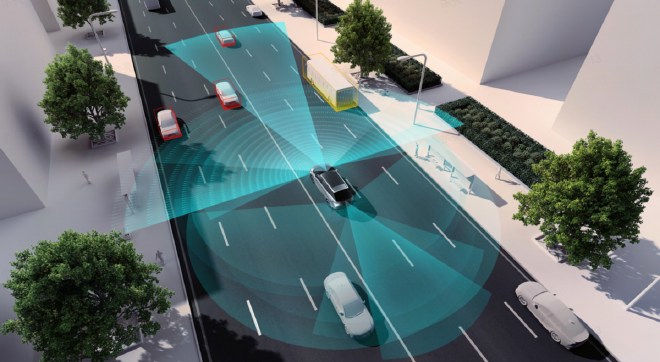

In addition, with the support of AI large models, as BEV+Transformers gradually become mainstream, domestic high-speed NOA is maturing. Both traditional car companies and new forces are actively deploying, and it is expected that urban NOA will be widely implemented in 2024. At the Xiaomi car technology conference, Xiaomi CEO Lei Jun stated that Xiaomi’s intelligent driving capability can handle complex road conditions, and the driver will not need to take over the entire journey. The goal is to open 100 cities’ urban leading NOA by the end of 2024. Currently, the first-tier members represented by Huawei and Weixiaoli are promoting the landing of urban NOA functions and “mapless solutions” with broader coverage. The second-tier independent brands and foreign brands will improve the high-speed NOA technology and explore the expansion of functions to more advanced urban NOA functions by 2024.

With the continuous advancement of technology, it is expected that urban NOA functions will become the main theme of the automatic driving industry in 2024. Car companies will continue to increase research and development investment in urban NOA functions, accelerate the competition for “intelligence” products, and help the automatic driving industry enter the fast lane of development. In summary, looking ahead to 2024, the competition in the automotive industry will undoubtedly become more intense, and brands will engage in more intense competition in technology, intelligence, and sustainability. Everyone is striving to be the player who stays at the table, making the Chinese car market “not the most rolled, but even more rolled.” It is worth noting that the 2024 car market competition will also focus more on technology, quality, and innovation. We look forward to this new wave continuing to drive the automotive industry towards a more brilliant future.