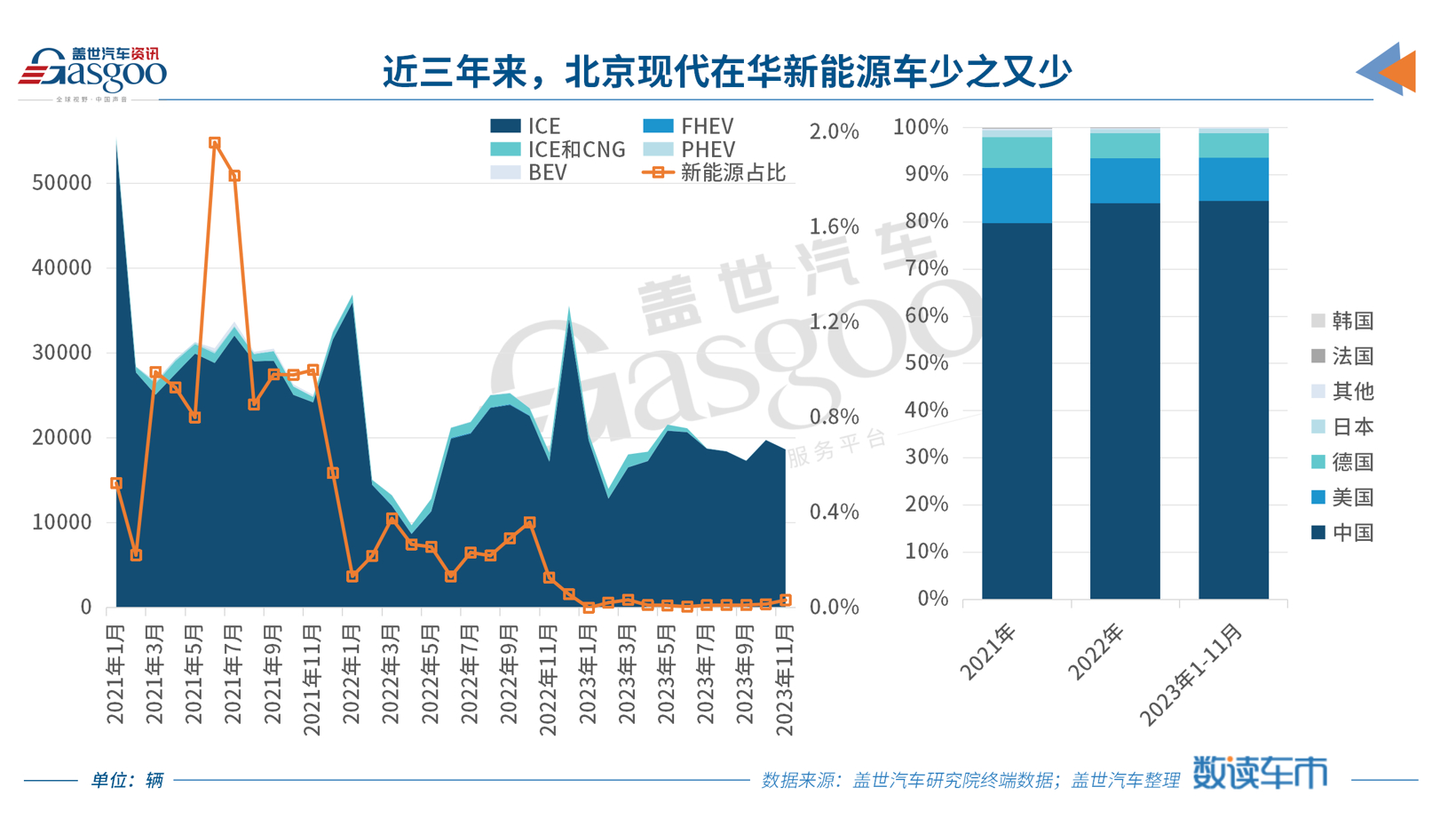

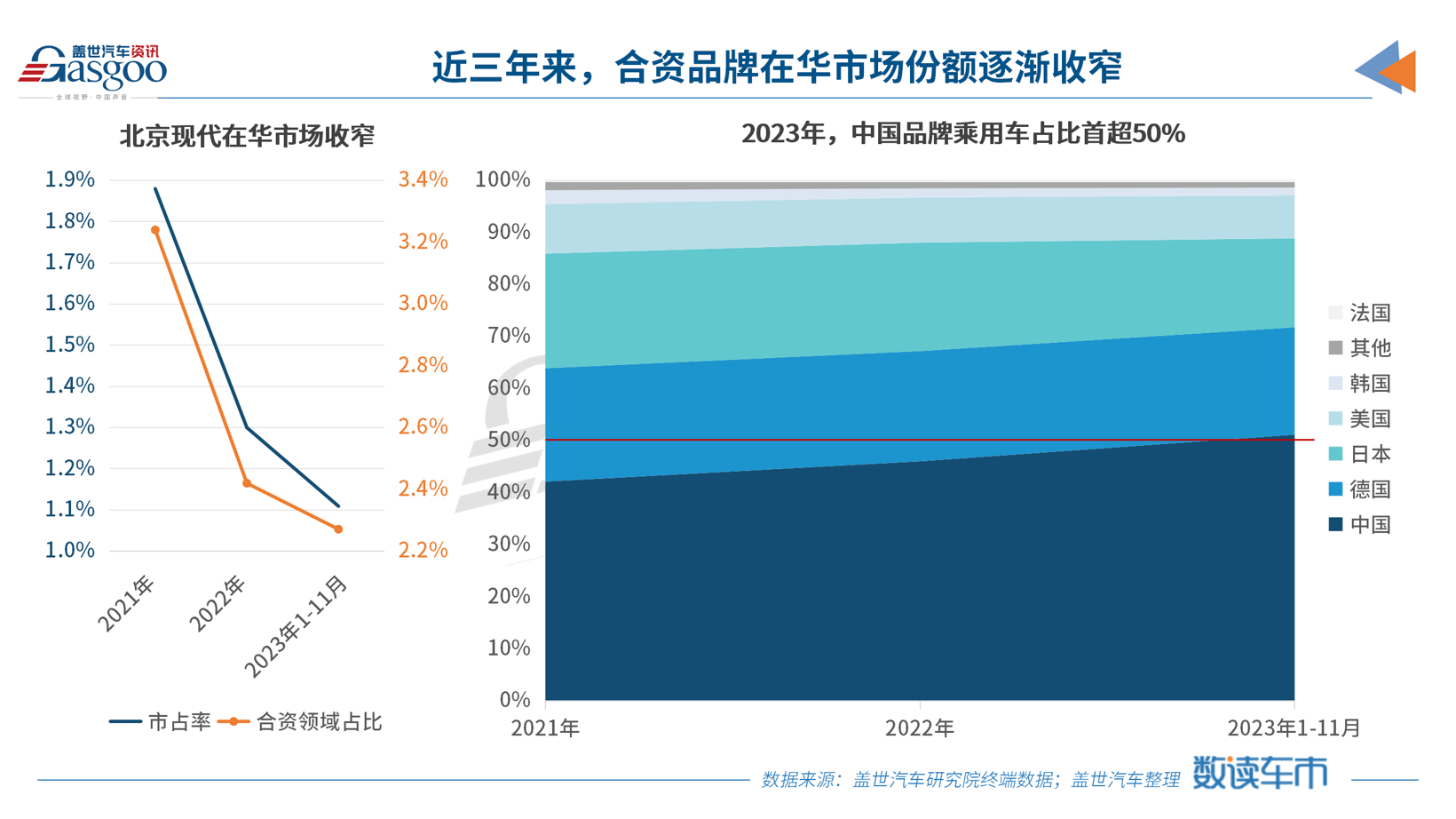

As 2024 begins, numerous car companies have released their 2023 performance reports to summarize the past year. Compared to domestic brands that have risen with the development of new energy vehicles, the data from joint venture brands seems more intriguing. On January 4th, Beijing Hyundai announced its latest sales figures, mentioning that its exports exceeded 10,000 units in the past year and aiming to reach a scale of 100,000 units within three years. Similarly, Tesla, BMW, Ford, and other car companies are expanding their car manufacturing exports in China, with Nissan also including this in their upcoming plans. Switching from domestic sales to exports seems to be becoming a “life-saving” measure for joint venture car companies in China. A stagnant Chinese market We will continue to focus on Beijing Hyundai, which did not have a good year in 2023. Looking back at the past year, the biggest exposure for Beijing Hyundai may have been in August when it was reported that they were selling their Chongqing factory, and then in October when it was reported that they would be manufacturing Beiqi Jihu cars at their third factory in Beijing, in an effort to revitalize their struggling business in the Chinese market. In fact, Beijing Hyundai’s difficulties did not happen overnight. Since 2017, they have been struggling in the Chinese market. Terminal data from the Gaishi Automotive Research Institute shows that from January to November 2023, Beijing Hyundai’s sales in China were 206,692 units, a 7.52% decrease compared to the previous year. Before 2016, their annual sales exceeded 1.14 million units, with a market share of 4.67%, but now it has barely passed 1%. And if we look at the proportion of various fuel vehicle types, it seems that new energy vehicles, which are currently popular, are not the focus of Beijing Hyundai. Terminal data from the Gaishi Automotive Research Institute shows that in the first eleven months of this year, they only sold 29 pure electric vehicles, and not a single plug-in hybrid model.

In contrast, the market share of new energy vehicles in China climbed to 34.08% from January to November 2023, with the penetration rate approaching 40% in some months this year, compared to 26.32% in 2022, less than 15% in 2021, and only 5.4% in 2020. As mentioned earlier, it is with this momentum that the Geely Automotive Research Institute’s terminal data shows that a total of 9.5321 million new cars were sold by domestic independent brands in China in the first eleven months of this year, a year-on-year increase of 20.57%, accounting for 51.16% of the total sales of passenger cars, with a market share increase of 5.72 percentage points compared to the same period last year. In the new energy market, independent brands even occupy 80% of the market share.

Believe more people know that this achievement is not only due to the trend of new energy, but also a wave of price wars started by domestic brands in 2023. In order to compete for more market share, car companies are crazily increasing battery life, piling up configurations, and promoting fast charging, in order to maintain a certain market share in this chaotic market situation. Not only Beijing Hyundai, but also joint venture car companies have not been passive in the past year, but have always failed to enter the main battlefield, “unable to keep up” seems to be a phrase that more and more people often mention.

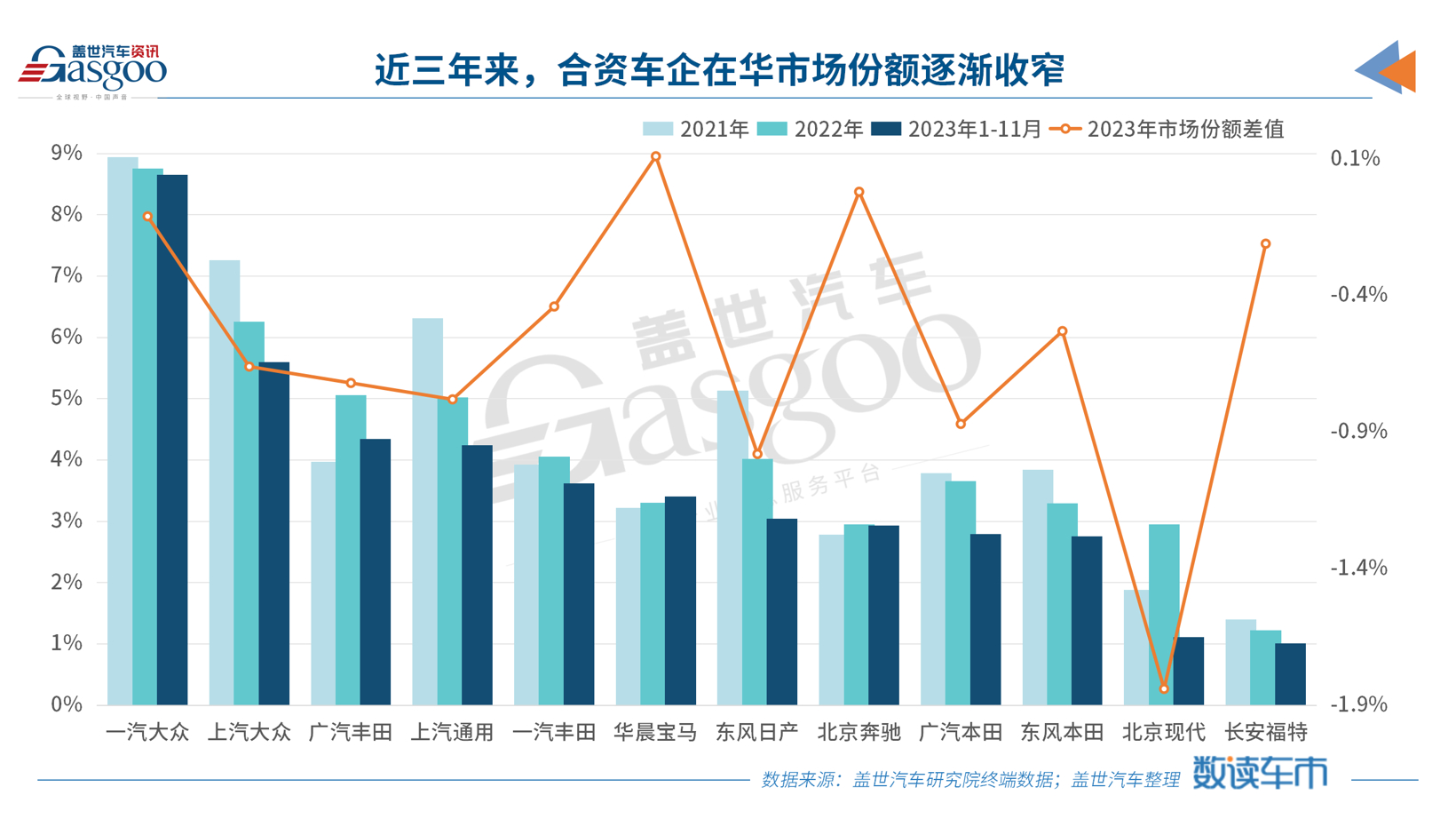

In March 2023, a number of joint venture car companies joined the price war; Source: various car companies According to the data from the Gaishi Automobile Research Institute, from January to October 2023, Dongfeng Nissan sold a total of 565,600 new cars, a sharp drop of 19.77% compared to the same period last year, reflecting a loss of 0.98 percentage points in market share compared to 2022. Toyota and Honda, once seen as the pillars of sales among joint venture brands, also experienced declines. Guangzhou Honda’s cumulative sales exceeded 520,000 vehicles, a decrease of 18.55% compared to the same period last year, and the market share narrowed by 0.87 percentage points compared to 2022.

The first-tier FAW-Volkswagen and SAIC Volkswagen are also facing the fate of market share loss, not to mention the gradually marginal joint ventures such as Changan Ford, Changan Mazda, Dongfeng Citroen, and GAC Mitsubishi. Therefore, while the leading joint venture car companies are striving to keep up with the development of new energy vehicles in China, some marginal car companies have to seek new “life-saving” measures. Domestic sales turning to exports becomes a new way out. As mentioned earlier, the price war is one of the key words throughout 2023, and another key word is undoubtedly exports. On December 13, at the 2023-2024 China Economic Annual Conference, Han Wenxiu, Deputy Director of the Central Finance and Economic Affairs Office and Director of the Central Agricultural Office, introduced that in 2023, China’s automobile exports will exceed 5 million vehicles, setting a new historical record. According to the latest data from the General Administration of Customs, China exported 524,000 vehicles in November this year, a year-on-year increase of 41.6%; from January to November, customs vehicle exports reached 4.762 million vehicles, a year-on-year increase of 59.8%, with export revenue reaching 92.7 billion US dollars, exceeding Japan’s long-term position as the world’s largest exporter of automobiles. Barring accidents, the annual data will further consolidate China’s leading position in the global automobile market. At the same time, the regions where Chinese automobile brands are gathering for overseas expansion have gradually expanded from Southeast Asia, South America, Africa, or Russia, Mexico and other markets to the European market. However, if the composition is carefully analyzed, the proportion of foreign brands exporting Chinese-made cars is relatively large. Taking the data from the International Energy Agency as an example, 16% of electric cars sold in Europe in 2022 were imported from China, with domestic Chinese brands accounting for only 40%, while Tesla China exported more than 300,000 electric cars in that year, accounting for over 40% of its production, with the majority sold to the European market. As mentioned earlier, not only Tesla, but more and more foreign brands such as Volvo, BMW, and Ford are increasing their exports. In September 2023, another brand under the Hyundai Motor Group, also a member of the joint venture car companies, announced that the Yueda Kia factory in Yancheng will be developed into a global export base, currently working to expand the business of exporting complete vehicles and CKD. According to the latest data released by Yueda Group, Yueda Kia sold 166,000 vehicles in 2023, a year-on-year increase of 31%, with 86,000 complete vehicles exported, a year-on-year increase of 125%.

Image source: Jiangsu Yueda Group The export strategy covers more than 70 countries and regions in Central and South America, North America, the Middle East, and the Asia-Pacific, with three export vehicle models, the K5, EV5, and the export of complete sets of parts and engine assemblies to Vietnam, Slovakia, South Korea, and other places. In the future, Yueda Kia will launch a full-scale attack on the annual production and sales of 300,000 vehicles with the advantage of exports. In September 2023, a batch of Odysseys produced by the Guangqi Honda Zengcheng factory were shipped from the Dongguan Xinsha Port to Japan for reverse export sales.

Source of the picture: GAC Honda It cannot be denied that more and more Chinese domestic brands are ramping up their export business in 2023. However, compared to newly joined and less well-known Chinese car brands, foreign brands such as Tesla, Hyundai-Kia, Ford, and BMW have a more prominent “reverse export” advantage. Therefore, joint venture brands’ exports are still an important part of China’s current automobile export. “Chinese joint venture car companies have been deeply involved in the Chinese automobile industry for many years and have cultivated a strong system of related parts and components enterprises. The industry has a huge scale, which is a huge advantage. Unlike the manufacturing environment in Europe and the United States, China has a better systematic support for exports in terms of industrial environment and transportation conditions.” Cui Dongshu, Secretary-General of the China Passenger Car Association, further pointed out, “China’s world position is relatively special. Compared to European car companies, it is more convenient for exports to Asia and Oceania, especially suitable for achieving regional coverage.” However, he also suggested that simply exporting existing products is not a fundamental solution. International car companies should turn China into a new energy export base for the world, continuously improve their own new energy technology advantages, and gradually realize the construction of a new energy export system. Based on this understanding, in December 2023, Nissan reached an agreement with Tsinghua University to accelerate the research and development of electrification using local resources, and plans to export existing internal combustion engine models, upcoming pure electric, and plug-in hybrid vehicles manufactured and developed in China to overseas markets.

Image source: Dongfeng Motor Just seven months before this news was released, the CR-V and e:NS1 produced by Dongfeng Honda had already crossed the border and sold to more than twenty European countries including the UK, Ireland, Iceland, Greece, and Portugal. As mentioned earlier, in the past year, it has been repeatedly verified that joint ventures do not have enough ability to keep up with the fierce competition in the Chinese market. More car companies must change their mindset, adjust their tactics, and change their approach. Therefore, using the existing large industrial chain base, China’s leading intelligent electric technology advantages, and the natural advantages of foreign brands, it is an effective measure for joint ventures to switch from domestic sales to exports, which is a “life-saving” measure for joint ventures.