Our country’s new energy vehicle industry began with the “Ten Cities, Thousand Vehicles” project from 2009 to 2012. In 2013, financial subsidies were rolled out nationwide without discrimination, marking the beginning of a tumultuous and fluctuating development journey for the new energy vehicle industry. Over the past decade, the new energy vehicle industry has gone through chaos, confusion, and fervor, gradually entering a passionate and rational period. The country has invested heavily, and the market has not been lenient on speculators. The past ten years have been a test, and the road ahead still requires perseverance. The flourishing decade of new energy vehicles has painted a grand picture covering products, technology, supply chain, infrastructure construction, and intelligence. As we commemorate the 45th anniversary of the reform and opening up, and look back and forward, Autohome presents the “China’s Flourishing Decade of New Energy” series. This article, the fourth in the series, focuses on the exploration and progress of a group of new forces in car manufacturing with an internet background in the wave of intelligent electrification. On New Year’s Day 2024, several new car manufacturers successively announced their performance for the full year of 2023. NIO delivered a total of 160,038 new cars throughout the year, a 30.7% increase compared to the previous year, ranking second in the new car delivery rankings among new car manufacturers. XPeng delivered a total of 141,601 new cars in 2023, a 17% increase compared to the previous year, with steady growth in the past few months and a positive trend, even though the annual delivery volume was slightly lower than that of Leapmotor.

For a long time, the discourse power of the Chinese automobile market has been held by some hundred-year-old multinational car companies. However, in less than ten years, China’s new car-making forces have been actively exploring the road of intelligent electrification, continuously innovating products and technologies to gain consumer recognition, and Wei Xiali, who was once laughed at as the “three idiots of electric cars,” has become an emerging force in the global automobile industry that cannot be ignored. However, the market is unpredictable, and now only six companies on the list have large-scale production. As the new energy vehicle market becomes increasingly crowded, who will get the “final tickets” in the future? 01. The first batch of new car-making forces rise Starting in 2009, four departments jointly launched the “Ten Cities and Thousand Vehicles” technology demonstration project for electric vehicles, officially kicking off the development of the new energy vehicle industry. However, at that time, most new energy vehicles were converted from oil to electricity, lacking in safety, power, and space advantages, and with a lack of charging facilities, coupled with weak batteries, directly causing range anxiety. It wasn’t until April 22, 2014, that a milestone event occurred – Elon Musk officially handed over the Model S car keys to the first batch of Chinese users. This was not just a car delivery ceremony, but also a technology carnival. Tesla’s arrival brought a new idea to Chinese consumers and the market, a new experience, a technology sense from the outside to the inside, and a pure electric car experience. At that time, Musk also met with then Minister of Industry and Information Technology Miao Wei, who highly praised Tesla’s achievements and stated, “The Chinese government is now formulating policies to help companies like Tesla enter China and promote the development of the electric vehicle industry in China.” It can be said that Tesla ignited a fire for the rise of China’s new forces, and a mysterious car-making journey began in China. In early 2015, then CEO of Yiche, Li Bin, opened up to Tencent CEO Ma Huateng, sharing his determination to resign and start a car-making business. Ma Huateng expressed his support for Li Bin’s decision at the moment he heard about this ambitious plan. A normal dinner party became the beginning of NIO’s takeoff. Before meeting with Ma Huateng, Li Bin had tried to establish NIO with Li Xiang, the founder of Autohome, but the two veterans of nearly 20 years of entrepreneurship had never worked for anyone else and had difficulty agreeing on who should report to whom. In the end, Li Xiang declined Li Bin’s offer, but was willing to become an investor and shareholder of NIO. Li Xiang’s idea of leaving Autohome began in early 2015. He sought advice from his longtime friend Huang Mingming, who was surprised by Li Xiang’s idea but also felt that Li Xiang was determined to start a car company. Huang Mingming immediately said, “As long as you dare to do it, I dare to invest.” He Xiaopeng initially participated in Xiaopeng Motors as an investor. After UC was merged into Alibaba, He Xiaopeng held various positions at Alibaba. He had tried multiple times to enter the new energy vehicle industry, but was rejected. One day in 2014, He Xiaopeng found Xia Heng, who had a background in Guangzhou Automobile Group. After hearing He Xiaopeng’s reasons, Xia Heng and his colleagues He Tao and Yang Chunlei resigned and joined He Xiaopeng’s car-making plan, forming the initial team of Xiaopeng Motors. In 2017, He Xiaopeng left Alibaba and officially returned to his car-making team. It was at this time that the team finally had a name for their car, “Xiaopeng Motors.” That day, He Xiaopeng posted on his social media: “Entrepreneurship is a cycle, bitter, sweet, sour, salty, and returning is still youthful.” In the order of the three brands launching mass-produced cars, Ideal, NIO, and Xiaopeng Motors are affectionately referred to by netizens as “Wei Xiao Li.” In the first wave of car-making, faced with the limitations of technology and resources, they could only adopt the “copycat” strategy. Whether it was software-defined cars, intelligent driving, or direct sales models, Wei Xiao Li found it difficult to escape the logic and framework defined by Elon Musk.

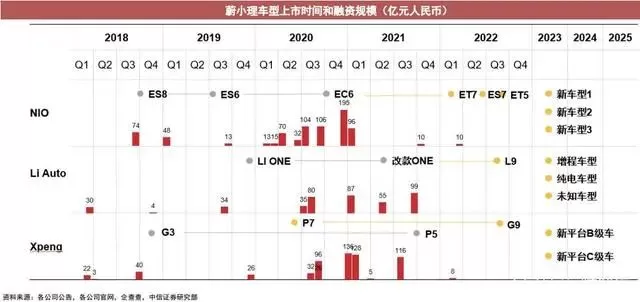

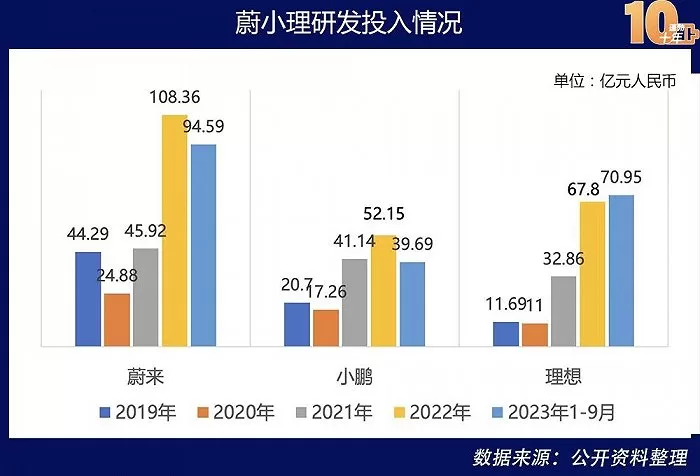

Even if you catch the market wave, successfully copy the homework, and truly achieve mass production and stand out in the competition, car manufacturing is still very difficult. How much money the founder can raise indirectly determines how long this car-making new force can survive. 20 billion yuan is the threshold for car-making that Li Bin gave in 2016, and in 2022 he said, “Now, it may not be possible to do it without 40 billion.” In addition to fighting for financing, car manufacturing also requires strategic vision. Even though Tesla has brought many non-car things and inspired the innovation of Chinese companies, the apprentices of Tesla still have to cross the river by feeling the stones to see how to land. At that time, each car company chose a different differentiated path and looked for the longest board in their own barrel. Li Bin defined the focus of NIO as “service + high-end brand”. The first product ES8 is priced at 500,000 to 600,000 yuan (84380$), targeting the luxury car market space. Later, ES6 was launched, accumulating users and word of mouth in the SUV market. Ideal shifted from small cars to family cars, chose the extended-range electric car that was not favored at the time, but the success of Ideal ONE made it stand out. Xiaopeng chose intelligence and has been committed to being “China’s number one in automatic driving” since its inception, and its products are also considered the most similar to Model 3. With differentiated product competition and Internet tactics, these three car-making new forces have outperformed the cycle and the market and climbed to the top of the mountain. In addition to NIO, there are many new brands that have entered the first wave of car manufacturing. A more iconic event is in 2015 when a person opened his arms at a press conference and shouted “Let’s suffocate together for the dream” like a towering god in the wind. This person is Jia Yueting, who caused a stir in the market that year. The capital master created LeTV’s brilliant record of tripling its stock price in two months in 2015 and announced at the end of the year that it would produce LeTV supercars. However, this “car-building dream” took nine years and did not start mass production until 2023. Despite this, the vision proposed by FF at the beginning of its establishment still ignited the dreams of many people. Xiaopeng He once said at the 2018 China Electric Vehicle Forum, “China has more than 300 new car companies.” New brands such as Weimar, Xiaopai, Qidian, Sailin, Zhidou, Yundu, Borui, and Lvchi have appeared on the market. In that year, the penetration rate of new energy passenger vehicles began to exceed 2.5%, and the new forces of car manufacturing began to increase successively. Some tasted the sweetness and even achieved their own moments of glory. For example, Byton, founded in 2017, assembled technical personnel from car companies such as BMW, Mercedes-Benz, and Infiniti at the beginning of its establishment. The team configuration was very luxurious and was once considered the most likely car company to challenge Tesla. In September 2018, Weimar’s first mass-produced model, the EX5, was launched and ranked as the single model sales champion for several months among the new car manufacturing forces. In July 2019, Mr. Wang Xiaolin, the chairman of Jiangsu Sailin Automobile, stood in the center of the Bird’s Nest with a very bright smile. At that time, he was full of spirit and vowed to make domestic consumers “affordable to drive a supercar.” However, after a few more years, some stories can’t go on… 02, Surviving life and death If 2014 was the year when China’s Internet car-making movement began, then 2019 was the year that determined the survival of the new car manufacturing forces and whether they could continue to move on to the next stage. In June 2019, the central government’s subsidies were greatly reduced, and local subsidies were simultaneously canceled. According to the China Association of Automobile Manufacturers, car companies’ actual subsidies were reduced by 80%. Car companies need to absorb changes in single vehicle costs of about 40,000 to 50,000 yuan (7030$). At that time, most start-up car companies mostly relied on equity financing to obtain development funds. A large number of car companies’ products had not yet been launched. According to statistics, among the more than 300 new car manufacturing forces that year, only 12 companies such as NIO, Weimar, Xiaopeng, and Zero Run achieved deliveries, and only four companies delivered more than 10,000 vehicles. Even with the start of deliveries, there was no positive cash flow, and the subsidy policy changed suddenly, affecting market confidence. New car makers generally had difficulty financing, and many start-up car companies did not survive the year. I remember at a forum event in June, Li Bin finished his speech, walked off the stage with a smile, then took out his phone and looked at it, his face changed dramatically – NIO ES8 self-ignited three times in two months, the biggest crisis since the company was founded. The framework agreement for a 10 billion yuan investment from Beijing E-Town was no longer mentioned. Li Bin recalled that the company was on the brink of collapse, “in the ICU.” In 2019, NIO’s stock price plummeted, hitting a low of just $1.19 per ADS, on the verge of delisting. Li Bin was named the most tragic entrepreneur of 2019. Investors were unwilling to fill the gap, and everyone thought NIO couldn’t go on. Also in July 2019, in Guangzhou, Beijing, and other places, there were collective user rights protection incidents for XPeng Motors, with slogans like “fraudulent sales,” “thin paint,” “demanding refunds,” and “regret buying.” This made He Xiaopeng unable to sleep at night and had to apologize in person: “Sorry for making everyone sad.” That year, XPeng Motors, which was in the process of Series C financing, had no lead investor due to its high valuation. He Xiaopeng had to invest his own money and even consulted Li Bin about a possible merger to help each other through the difficult times. In the first half of 2019, NIO, which was also in the process of Series C financing, could not raise funds due to various negative news about new car makers. It was said that during that time, Li Xiang’s body had an allergic reaction, his immunity weakened, and he needed medication to recover. Despite his illness, Li Xiang, along with Ideal Motors CFO Li Tie, visited more than 100 institutions to find survival funds, but the company still did not secure financing. This year was the darkest year for the “Wei Xiaoli” three Chinese new car forces since their founding, and they were once ridiculed as the “three fools of electric cars.” At the time, He Xiaopeng said in an internal chat, “I hope NIO can survive, which is good for the entire new car industry. If NIO can persist, it will win more respect from people.” In 2019, during NIO’s low point, a ES8 car owner advertised for NIO by taking out 12,000 taxis in Shanghai, and dozens of car owners paid for advertisements for NIO. More car owners mainly advertised for NIO through WeChat Moments. In the first quarter of 2020, NIO delivered 3,838 new cars, and 69% of the orders were recommended by old users, which has become a classic story. NIO’s CEO Li Bin said, “I must have saved the galaxy in my previous life to have the best users in this life.” NIO’s turning point came in January 2020, when Li Bin was told by Chen Xiang, the chairman of Anhui Provincial Investment Group, to discuss government investment in Hefei. This opened up the story of Hefei’s investment in NIO and NIO’s “turning the tide.” At the end of 2019, a significant event occurred – “new car force mentor” Tesla came to China. On December 6, 2019, the domestic version of the Model 3 officially entered the Ministry of Industry and Information Technology’s promotion directory. This moment was interpreted as “the wolf is coming” by the industry, and domestic new forces will face tremendous pressure. However, Tesla has also successfully stirred up the Chinese new energy vehicle industry, more like a “catfish.” Faced with the delivery of Tesla’s domestic cars, companies in the industry chain welcomed it. They regard Musk as the “big brother” and hope to follow Tesla to replicate the miracle of Apple’s industry chain. On January 3, Tesla released information about price cuts for domestic models; on January 6, the stock prices of new energy vehicle industry chain companies rose, forming a “Tesla concept stock” sector. Most of these companies are already in Tesla’s supply chain system, including Xusheng shares, Sanhua Zhikong, Top Group, Hongfa shares, CATL, and Putailai. In 2020, Tesla became the world’s most valuable car manufacturer, with a market value of over $600 billion, equivalent to three Toyotas. A securities analyst believes that the incremental effect brought by the introduction of Tesla domestically to the new energy vehicle market is far greater than the crowding-out effect. The industry is in deep thought, “Does Tesla need China, or does China need Tesla?” Tesla’s introduction still has a profound impact on the Chinese electric vehicle market. In the spring of 2020, NIO’s stock price began to rise immediately after completing its second round of financing, and car sales continued to reach new highs. The stock price rose 11 times within a year, and it increased 35 times from the lowest point at the end of 2019. After a long period of gloom, Li Bin finally went from being the “most miserable person of 2019” to “one of the happiest people of 2020.” The timing of the Ideal Car’s IPO application was just right. Due to the soaring stock prices of Tesla and NIO, Ideal Car was also sought after in the capital market, with its stock price rising by more than 50% on the first day of trading. The same situation also occurred with He Xiaopeng. In the days before the listing of Xiaopeng Motors, He Xiaopeng’s WeChat and phone were almost bombarded, and the whole world was asking for investment shares. The second half of 2020 and 2021 are the “NIO, Xiaopeng, and Ideal” moments, as they are recognized as industry leaders, representing the direction of the transformation of the automotive industry. Chinese car brands have broken through the “ceiling” of 300,000 yuan (42190$), with an average delivery of nearly 100,000 vehicles in 2021. This is the first time that people have seen high-end car brands created by Chinese new forces surpassing traditional luxury brands such as Mercedes, BMW, and Audi, and the first time that Chinese brands have the opportunity to engage in direct competition with industry giants such as Volkswagen and Toyota in the global car market, which is the ultimate dream in the hearts of generations of Chinese car entrepreneurs. 03 The trouble of growth Li Xiang once wrote a long article in January 2022 to share his entrepreneurial experience. He judged that “Weixiaoli” had passed the “from 0 to 1” verification period in 2021, each holding a 3% share of the sub-market. The next stage is the “from 1 to 10” growth period. Li Xiang believes that this stage is a comprehensive competition to maintain unique advantages, and achieving an annual income of over one trillion yuan is considered “handing in the homework,” which is equivalent to obtaining a “ticket to the finals.” During this period, Weixiaoli collectively encountered “growing pains,” combined with the accelerated reshuffling of the new energy vehicle market. These three companies still have a lot of work to do to get a “ticket to the finals.” Nio: Unlike other car companies, Nio has been firmly committed to the battery swapping technology route since its inception. When the battery of the vehicle is about to run out, it can be directly replaced with a fully charged battery at the swapping station, similar to refueling, and the time required is also considerable. This model is a major competitive moat for Nio. Many car owners purchase Nio vehicles for this reason. However, this requires the standardization of the battery pack, and the size of the battery pack is closely related to the overall vehicle model, which means that Nio may not be able to design a mid-size car based on the existing battery pack size. In order to enter the mainstream market, Li Bin revealed in June 2022 that they plan to launch a new brand targeting the mass market in the price range of 200,000 yuan (28130$). The planned production capacity is 500,000 vehicles, and delivery is expected in the second half of 2024. The new car will use a different battery pack, and a new brand operating system will be established. In the early days, Nio relied on a money-smashing “fan service” to shape its brand image and provide various benefits to car owners. However, when it comes to the mass market, Nio can only adopt a multi-brand strategy. The sustainability of the “fan service” model remains a question mark. On the other hand, Li Bin believes that in order to form a barrier, it is necessary to expand and strengthen the business. In addition to the high investment in the battery swapping system, a year after founding Nio in 2015, Li Bin had already assembled a self-driving team, which is two years earlier than Xiaopeng, which regards intelligent driving as its core competitiveness. In today’s new competition for technology and research and development, NIO’s territory has expanded to include self-developed chips, mobile phones, and self-produced batteries.

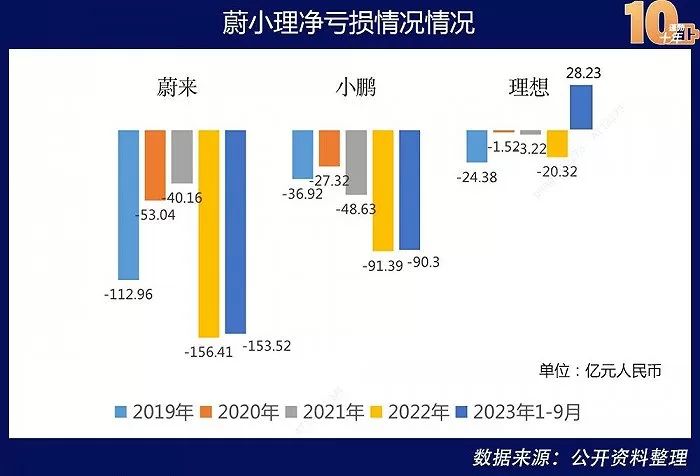

This is also why Nio is the car company with the highest losses among the three. Compared with previous years, the investment and financing channels are no longer as smooth, and the competition in the new energy vehicle market is more intense. Nio barely managed to make a decision to reduce the price of the swap rights and expand the sales team, but sales only exceeded 20,000 units for one month and then fell back. On November 3, Li Bin announced in an internal memo that Nio plans to reduce about 10% of its positions to optimize resources. Nio will merge duplicate departments and positions, reform inefficient internal workflows and divisions, cancel inefficient positions, and postpone or cut investments in projects that cannot improve the company’s financial performance within three years. This is one of the cost-reduction and efficiency-improvement measures implemented by Nio in response to its losses. Regarding the sluggish market, Li Bin also expressed helplessness, saying he did not anticipate the current situation. Looking back, many things can be seen more clearly today. For example, the US dollar market in 2021 had zero interest rates, but how could it have always been zero? Over the past few decades, there has been unilateral upward growth. We should feel very fortunate. Now we should have more risk awareness and cycle awareness. Many Chinese entrepreneurs may need to take this lesson. Xiaopeng Motors: Xiaopeng Motors started in the mainstream market. The first model launched in 2018 had a post-subsidy price of 135,800 to 165,800 yuan (23320$). Xiaopeng Motors opened up the market with mid-size cars. Until 2023, only three models, G3, P7, and P5, were available, corresponding to SUVs, coupes, and sedans. Only the price range of the P7 is between 240,000 and 350,000 yuan (49220$). Due to the low product price, Xiaopeng Motors’ profitability is poor. In the first half of 2022, Xiaopeng Motors became the best-selling new car maker. However, the 2022 financial report showed that Xiaopeng Motors’ gross profit margin was 11.5%, the lowest among the three companies. Xiaopeng hopes to find a flagship model like the P7 in the mid-to-high-end market. The flagship model G9 was highly anticipated, but the release of this car was the beginning of Xiaopeng’s nightmare. The chaotic SKU sparked collective complaints from users. Although Xiaopeng urgently modified the SKU two days later, it was still too late. In the past year, Xiaopeng Motors has seen a decline in performance, with sales difficult to boost and stock prices fluctuating between $7 and $14. In response, He Xiaopeng carried out a major organizational change to improve collaboration. In early 2023, automotive industry veteran Wang Fengying became the president of Xiaopeng Motors, a key figure in the company’s restructuring. After joining Xiaopeng, Wang Fengying adjusted the sales structure, merging two sales systems and changing the four major regions into 24 districts to achieve sales flattening and improve feedback speed. The G6, which launched in June 2023, was the result of several rounds of discussions and collisions led by Wang Fengying with the product planning and sales teams. After the G6 was launched, Xiaopeng Motors’ delivery volume in July returned to 11,008 units, reaching 11008 units. “Lifeline” is not an exaggeration to describe the Xiaopeng G6. He Xiaopeng said that together with Wang Fengying, he will make cost reduction one of the core goals of product, R&D, manufacturing, supply chain, and marketing teams. “I am confident that by the end of 2024, the overall cost will be reduced by 25%, and even exceed this target in many areas,” He Xiaopeng said. Achieving this goal is not easy. According to the latest financial report, Xiaopeng Motors’ revenue in Q3 2023 exceeded 8.5 billion yuan, an increase of 68.5% month-on-month, and the total product delivery volume exceeded 40,000 units, an increase of 72.4% month-on-month. Even with significant increases in revenue and product delivery volume, net losses increased by 38.6% month-on-month, and the sales gross margin was -2.7%, which was worse than expected and greater than the pressure from NIO. Therefore, in addition to promoting cost-effective models this year, Xiaopeng has also started to lay out the imageless urban intelligent driving and the MPV market that has never been involved before. Whether it will be favored by consumers remains to be seen in the 2024 car market. Ideal car: For Li Xiang, 2023 can be said to be a time of success. The Ideal car, which he leads, has achieved its 300,000 unit sales target for 2023 ahead of schedule. NIO and Xiaopeng are both struggling to make a profit. However, Ideal was the first to achieve “turning losses into gains” in the fourth quarter of 2022, and has been profitable for four consecutive quarters until the third quarter of this year. In the first half of 2023, it achieved a net profit of 3.244 billion yuan. For new forces in car manufacturing, gross profit margin is the most important indicator. In the industry’s view, a gross profit margin of over 20% is needed to ensure the long-term healthy development of a car company. Otherwise, if the financing channels are blocked, it is difficult for the car company to continue long-term investments in research and development and delivery. In the eyes of investors, “Ideal is the company among all new car manufacturers that can do subtraction. Ideal rarely does strange things in marketing, product planning, and branding.” While NIO is making smartphones and entering the sinking brand market, and Xiaopeng is exploring flying cars, Li Xiang clearly stated, “Ideal only has one brand.” However, having a single technological route is also a potential risk for Ideal. Ideal entered the market with extended-range hybrid technology, which was initially not well-received by the industry. However, after the Ideal models sold well, a large number of competitors followed suit, and competition may become fierce. Because the L-series looks similar in appearance and interior, it has been criticized by the public. In the eight years since its establishment, Ideal has actually only produced one car – the L8 is an updated version of the Ideal ONE, the L9 is an evolved version of the Ideal ONE, and the L7 is a five-seater version. The mid-size five-seater L6, which is set to be launched in 2024. Looking to the future, Ideal faces many challenges in order to continue to sit securely as the leader among new forces. For example, pure electric and intelligent technology. Just as Li Xiang himself reflected at this year’s strategic meeting, “We have been fully engaged half a year late, and the lessons we have learned can only be resolved by increasing investment.” The “half-year delay” refers to Ideal’s self-developed urban NOA landing progress falling short of expectations. In the second half of 2023, Ideal explicitly made leading intelligent driving technology a core strategic goal and began to invest heavily. An industry insider said, “Ideal’s intelligent driving performance is still not comparable to Xiaopeng’s, and it will take time to catch up.” Whether the pure electric products can continue the success of the L series is another difficult challenge facing Ideal. At the end of this year, the Ideal launched its first MPV electric car model MEGA since its establishment 8 years ago. Compared with its competitors, Ideal’s pure electric car is 6 years later than NIO, 7 years later than Xiaopeng, and 15 years later than Tesla. More importantly, Ideal, which came from behind, needs to build its own charging system, which is a very difficult task. A research report by Ping An Securities believes that Ideal Motors has not yet proven itself in the field of pure electric vehicles. If the sales of pure electric car models are not good, it will affect its valuation level. In addition, after the launch of pure electric car models, Ideal Motors’ various investments may increase significantly, and indicators such as gross profit margin may also decline. In the past, the differentiated positioning of NIO, XPeng, and Ideal allowed the three companies to stay out of each other’s way. But now, no one will take the initiative to give up other sub-markets. All three companies will compete directly in the market for vehicles priced below 300,000 yuan (42190$). The three companies will compete in multiple price segments and categories. In the second tier, Lixiang Automobile’s sales volume has increased, achieving a positive gross profit margin for the first time in the third quarter, and its profitability has improved, but the company is still in a loss-making state. Nezha Automobile, once considered a “dark horse,” has poor sales and faces a tough market situation. At the same time, some of the new forces that once set out together have gone bankrupt, some have chosen to transform, some are still struggling, and some have been kicked out of the game. In 2016, Shen Haiyin, the founder of Qiantu Motors, once said on WeChat Moments, “Even if some of our new car companies today will become withered bones in the future, there will definitely be a company that succeeds.” Who would have thought that Qiantu Motors, which burned through 17 billion yuan in financing and failed to produce a single car in 9 years, became one of the “withered bones.” Weima, once known as a member of the “new car-making forces F4,” its founder Shen Hui once led Geely Automobile’s acquisition of Volvo, but even an experienced veteran in the automotive industry “ran away” to the United States, leaving behind 100,000 car owners and a mess. Jia Yueting, Bi Fukang, Liu Xinwen, Huang Xiuyuan and others, are all industry leaders, each with the dream of building cars. However, due to various issues such as car-making strategies and business operations, or the founders’ inability to endure the hardships and loneliness that ordinary people cannot bear, and their willingness to dig into their own pockets to keep the company afloat when it lacks money and is on the verge of collapse, these new forces are being washed away in the tide of car-making.

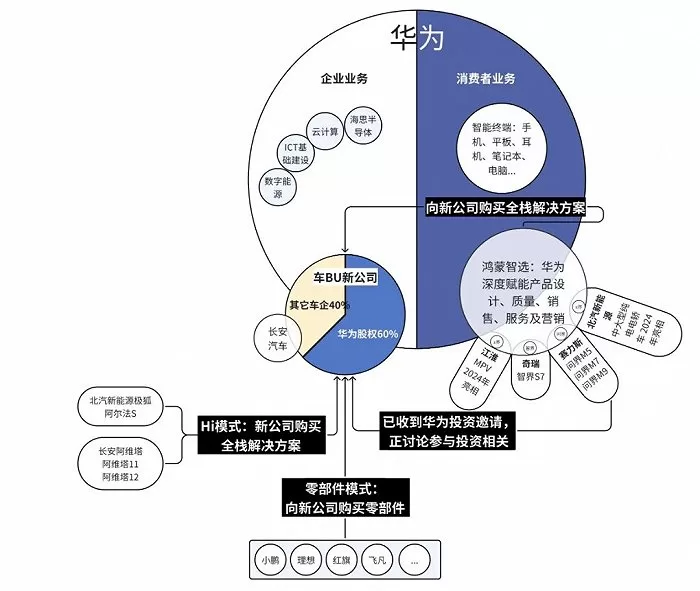

Even with the initial pattern already set, new players are joining, making the track more crowded, becoming a potential threat to existing brands. The second wave of new car-making forces has already emerged from all directions. “I am willing to bet all the achievements and reputation I have accumulated in my life for Xiaomi’s cars. This decision means that we need to be prepared for another full sprint of at least five to ten years.” In March 2021, Lei Jun, who has started multiple businesses, made the decision to embark on the journey of car-making after visiting over 200 people in the industry in 75 days and ultimately decided to start a new business. 1003 days after announcing the car-making, Lei Jun held a technology release conference for Xiaomi’s cars. In a speech that lasted three hours, Lei Jun demonstrated the progress of Xiaomi’s cars’ five core technologies. In key areas such as electric drive, batteries, die-casting, smart driving, and smart cabins, Xiaomi’s self-developed technology has achieved many global firsts and China’s firsts. He pointed out that since the new century, Tesla has led the way in smart electric vehicles, turning cars into “mobile computing terminals”. The new mission of the automotive industry is to create “mobile intelligent space”, which is the starting point for Xiaomi’s car-making. In addition to Xiaomi’s cars, another company that has entered the automotive track with a huge “halo” is Huawei. Although it has not directly made cars like the new forces, no new force will underestimate it. In the internal strategic meeting of 2023, the top level consensus was clear: “Huawei is too strong, we must avoid it.” Since then, at every car new product launch event of Huawei, there have been people shouting “far ahead.” After several years of exploration in the automotive industry, Huawei has brought two new cooperation methods. In November 2023, Huawei announced the establishment of the “Hongmeng Intelligent Travel” ecological technology alliance, with current members including Saicest, Chery Automobile, Jianghuai Automobile, and Beiqi Blue Valley. Huawei and them jointly created four new brands, with two already confirmed as “Wenjie” and “Zhijie.” Huawei takes the lead in product definition and design, and these cooperative models are equipped with Huawei’s full set of intelligent systems, especially intelligent driving and intelligent cockpit products. It is worth mentioning that the Wenjie series delivered a total of 94,380 vehicles in 2023, with 24,468 delivered in December, an increase of 29.96% compared to the previous month. It is reported that the Wenjie M9 has sold over 30,000 units in the first seven days of its launch, and its future performance is worth looking forward to. In order to prevent car companies from becoming “OEM factories,” Huawei’s intelligent car business has undergone a major adjustment. At the end of November 2023, Huawei announced plans to split the original intelligent car solution business unit and establish an independent intelligent component company, inviting many car companies to invest. Among them, Changan Automobile is the “angel round investor” of this new company.

At present, Xiaomi, which is making a high-profile car, and Huawei, which insists on not making a car, are bound to have a battle in 2024. Before that, Huawei and Xiaomi will be surrounded, and then the traditional automakers will follow. In recent years, a series of new brands have emerged, such as GAC Aion, SAIC Zhiji, BYD E-SEED, and the Avita jointly created by “Changan, Huawei and CATL”. Industry insiders jokingly call it “all the immortals have come”. Based on the production progress of various companies, the second wave of new forces will begin in 2023, and it is expected to gradually climax in 2024 and 2025. “Rolling” will still be a trend in the Chinese automobile industry. During this period, the first-stage winners represented by Weimar will inevitably be challenged by the head enterprises of the second wave, and the difficulty of breaking through will increase. Before the 2023 Shanghai Auto Show, He Xiaopeng publicly stated that the elimination competition in the new energy vehicle market has begun and will last for 5-10 years. By the end of 2025, there will be an “Elite 32” in the industry, and a few years later, there will be an “Elite 8”. He believes that an annual sales volume of 3 million vehicles is only a “ticket” for car companies to participate in the elimination competition. Li Xiang even believes that the market does not need so many car companies, and the pattern of the intelligent electric vehicle market will be more like the top five of the intelligent mobile phone market in order to survive better. Li Xiang also said that Tesla, BYD, and Huawei have already locked in their qualifications. This means that other companies aspiring to occupy the mainstream will compete for the remaining two spots, with only a two-year window in 2024 and 2025. “Union” will be the theme of the next two years. In addition to Huawei inviting car companies to invest, each car company has also chosen its own way to “huddle for warmth.” For example, in the huge investment in infrastructure, no company can dominate alone, and there is no need to duplicate construction. Alliance between car companies is the norm. In North America, Tesla has attracted almost all car companies to cooperate. In China, NIO has also formed an electric vehicle “circle of friends” with Geely and Chang’an. Collaboration and alliances are happening globally, and a major new trend is Chinese car companies beginning to “reverse export” electrification and intelligent technology. For example, Volkswagen has invested in Xiaopeng Motors, and Stellantis has invested in Leap Motor. Everyone hopes to make it to the end in the brutal elimination match. In the second half of the competition, intelligent driving will be the highlight. In an internal letter in 2023, NIO’s founder, William Li, stated that the company will further strengthen the ability of intelligent assisted driving. XPeng has stated that it will completely eliminate the need for high-precision maps to achieve this function. Although NIO has not shouted a specific “slogan,” it has already demonstrated its ability through practical actions. Its full-area navigation assistance system NOP+ has already exceeded the set goal for cumulative mileage on urban routes. Undoubtedly, intelligence is the recognized direction of the industry transformation. Intelligent cabins and intelligent driving are the selling points of each company. Voice interaction, over-the-air upgrades, and assisted driving have become the daily routine of car owners. In the next article, we will present “China’s Prosperous Decade of New Energy” from the perspective of the development of intelligent network technology. We hope that the new forces of Chinese car manufacturing can live up to the mission of the new era and open the “golden decade” of rapid progress in the automotive industry.