After losing 17 million vehicles, car companies have realized. In 2021, a sudden crisis quickly swept through the global automotive industry. This crisis made Musk lament “a nightmare of the supply chain”, made Ford CEO Jim Farley complain “money can’t even buy it”, made the CEO of Volkswagen’s brand Thomas Schaefer criticize the supplier for raising prices by 800% overnight, and even made Zhu Huarong, chairman of Changan Automobile, call for “anti-profiteering action to crack down on hoarding and speculation”. The excruciating crisis for car companies is the shortage of chips.

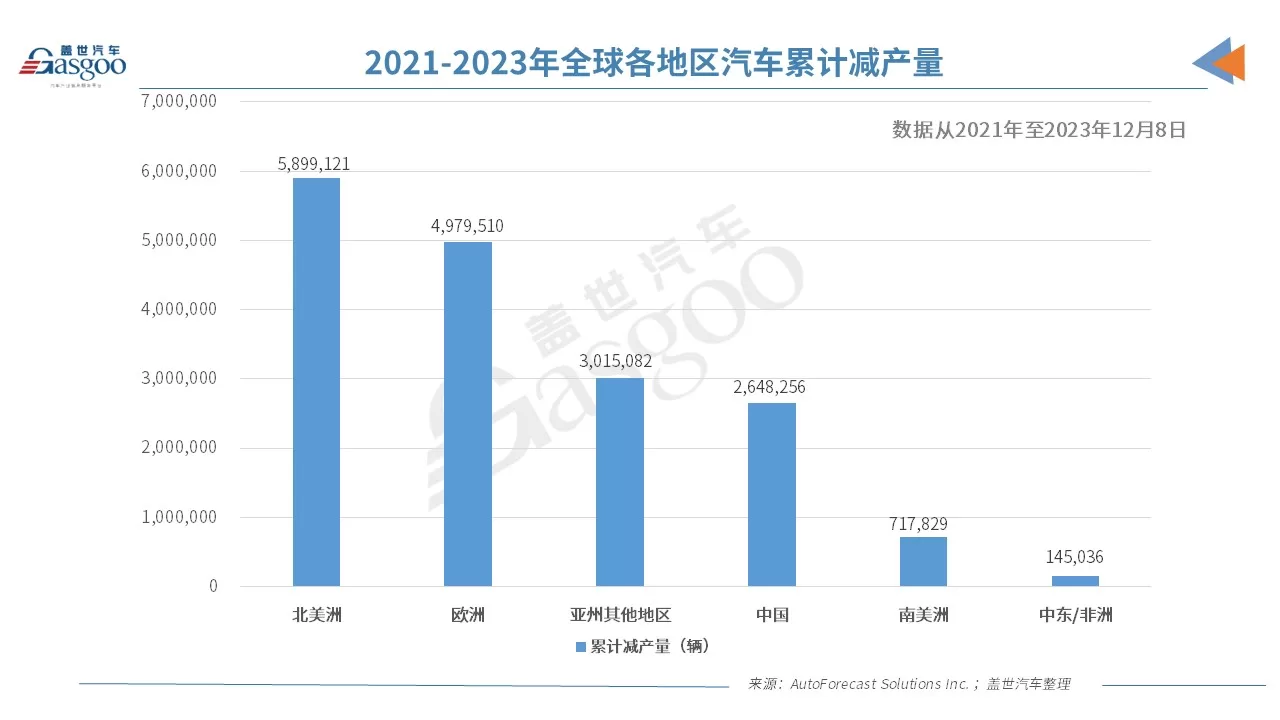

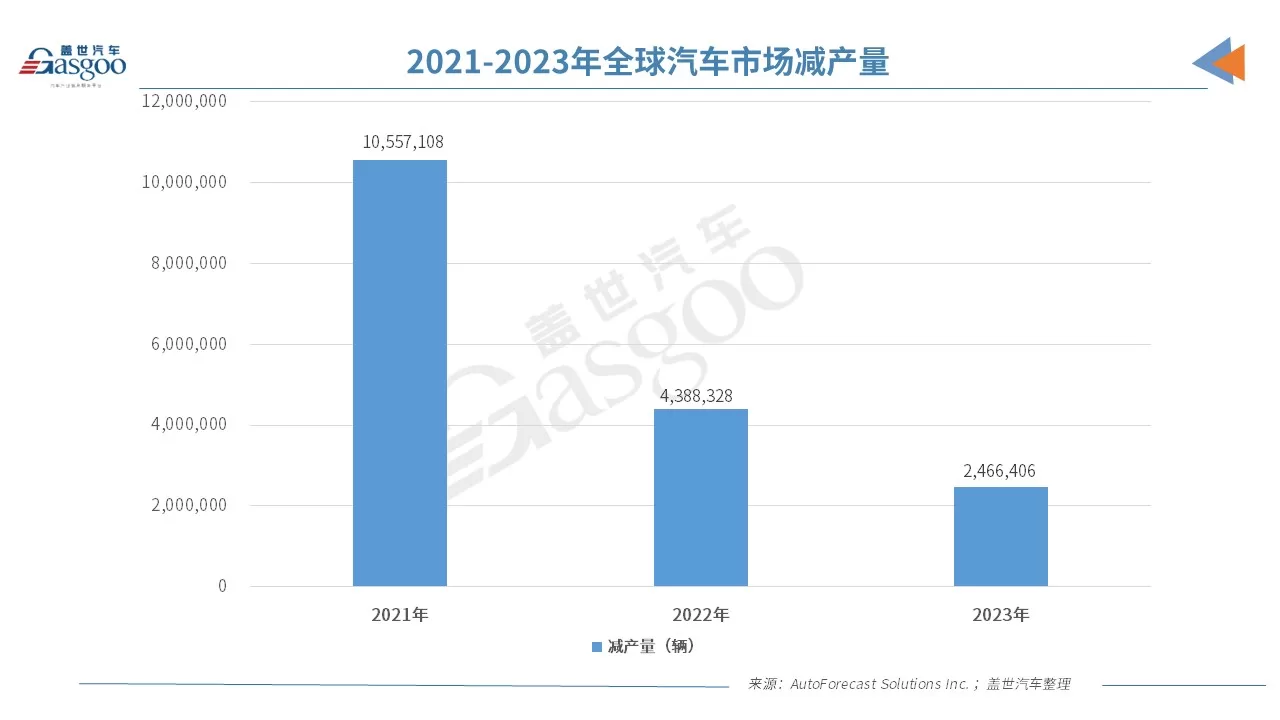

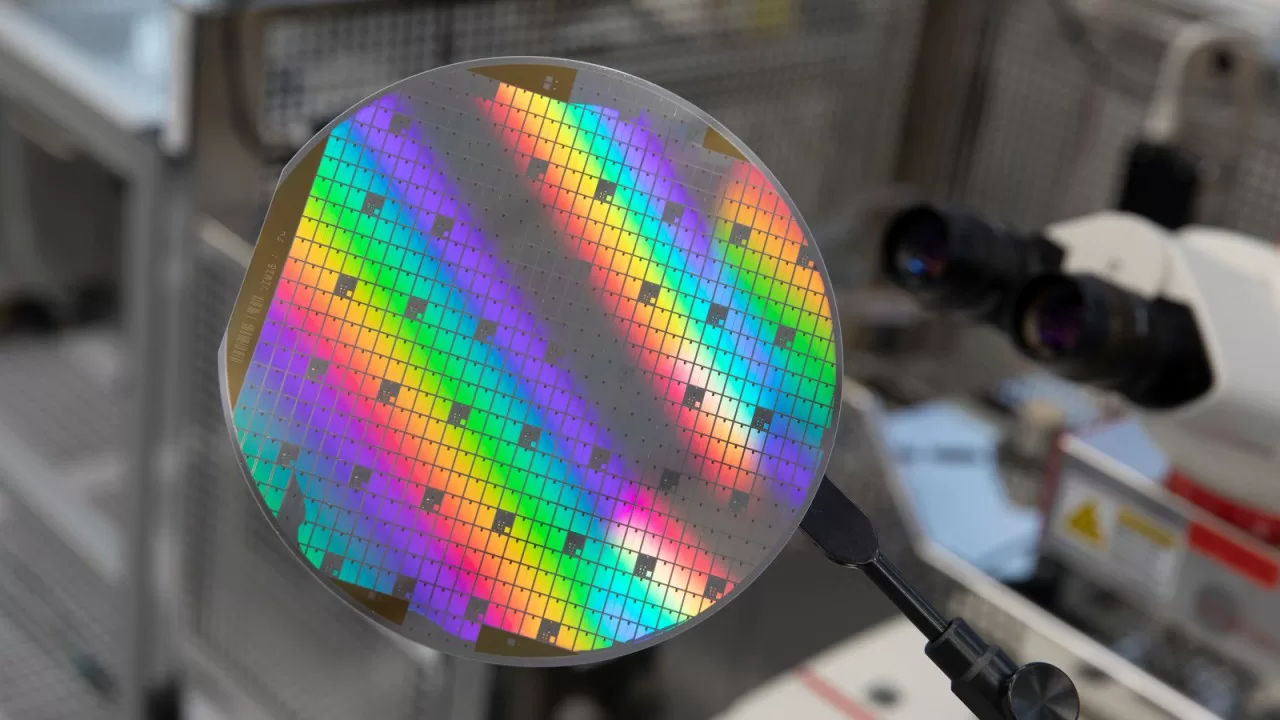

In the past three years, a global chip shortage has severely disrupted the automotive supply chain, forcing car manufacturers to cut production by millions of vehicles and causing a significant decline in new car inventory and parts supplier profit margins. Chip “bottleneck” leads to reduced production and lower inventory At the end of 2020 and the beginning of 2021, the semiconductor shortage caught the automotive industry off guard. Due to the impact of the COVID-19 pandemic, many chip suppliers suspended production in the spring of 2020 and struggled to keep up with rapidly growing demand, forcing them to consider how to allocate limited production. To the disappointment of the automotive industry, consumer electronics and other industries were prioritized ahead of them when it came to allocating limited chip production. Tech giants that manufacture smartphones, computers, TVs, and gaming consoles were more willing and able to spend big money to maintain their chip supply, as the semiconductors they needed typically featured the latest designs and were more profitable. In contrast, the chips needed by automotive companies rely on more mature semiconductor technology, resulting in thinner profit margins. In this “chip allocation grab” battle, automotive companies suddenly realized they were at a disadvantage. In this situation, a “chip shortage wave” swept through the global automotive industry. According to data from automotive data forecasting company AutoForecast Solutions, in 2021, due to the chip shortage, the global automotive market reduced production by 10.56 million vehicles, and in 2022, by 4.39 million vehicles. AFS predicts that in 2023, the global automotive market will reduce production by approximately 2.47 million vehicles, with most of the reduction occurring in the first half of the year.

Chip shortages and other supply chain challenges, in addition to production cuts, have led to a significant decrease in new car inventories. In the United States, for example, new car inventories fell to less than 1 million vehicles in the spring of 2021. According to Cox Automotive’s estimate, as supply chain issues are resolved, new car inventories will begin to recover from the summer of 2022, reaching approximately 2.5 million vehicles by November 2023. Despite high consumer demand, low inventory levels have constrained new car sales. The decrease in new car sales, coupled with unstable production schedules, has led to a substantial decline in profits for suppliers, putting the financial condition of many parts manufacturers in jeopardy. However, for car manufacturers and dealers, reduced inventory may not be a bad thing. Car manufacturers prioritize the production of high-profit models such as pickup trucks and SUVs. Dealers are faced with a market where demand exceeds supply, allowing them to reduce incentives for vehicle purchases and increase profits. Despite the headache of chip shortages, the past few years have been the most profitable for car manufacturers and dealers. Fiorani stated that, in order to maintain high profits, car manufacturers continue to prioritize the production of high-end models rather than entry-level models. “Car manufacturers realize that producing high-profit models will result in stronger profits, and the assembly lines seem to be running smoothly. The only problem is that consumers in need of entry-level models are being pushed into the used car market.” Fiorani also stated that this may provide an opportunity for new entrants to the American market. In the 1960s and 70s, the designs and quality of cars produced by American car manufacturers were not up to par, opening the door for Japanese car manufacturers to increase their sales in the United States; in the 80s and 90s, soaring import car prices in the United States led to Hyundai and Kia successfully seizing market share. This seems to be somewhat similar to the current situation.

Fiorani said, “The next new entrant is likely to be a Chinese company. Due to tariff restrictions, this Chinese company needs to produce cars for the US market outside of China, but this seems imminent. Chinese automakers are already planning to produce cars in Korea and other Southeast Asian countries, and more importantly, they are likely to be able to establish factories in Mexico.” Rethinking the relationship with the supply chain The chip shortage has brought a painful lesson to the entire automotive industry. Sam Fiorani, vice president of AutoForecast Solutions, responsible for global automotive forecasts, said, “Looking back at the semiconductor shortage, the first thing that stands out is the ‘arrogance’ of the automotive industry. For a century, the automotive industry has always recognized its importance and that of suppliers. Therefore, automakers are not used to being subordinate in obtaining parts supplies.” “Perhaps the automotive industry, like other industries, has a demand for semiconductors, but they have realized that they are not the most important customers when it comes to chips.” Currently, the chip shortage has entered its fourth year, but the shortage problem is gradually easing and disappearing. For many automakers, the chip shortage has not brought their supply chains to a standstill, and the worst case scenario has only resulted in reduced production, but new vehicle inventories have now returned to normal. However, the chip shortage has left the automotive industry with bad “memories,” forcing companies to rethink their production processes, and prompting some automakers to prioritize the production of higher-profit margin models. It has also prompted the US and European governments and many manufacturers to push for strengthened supply chains and chip production to reduce risks. Analyst Phil Amsrud said, “Companies have had to rethink their relationship with the supply chain.” Dan Hearsch, managing director of IHS Markit, pointed out, “The relationship between automakers and chip suppliers has become closer. In the past, procurement personnel did not pay much attention to chip suppliers, but now, chairmen are personally calling semiconductor companies just to build better relationships and understand the situation.”

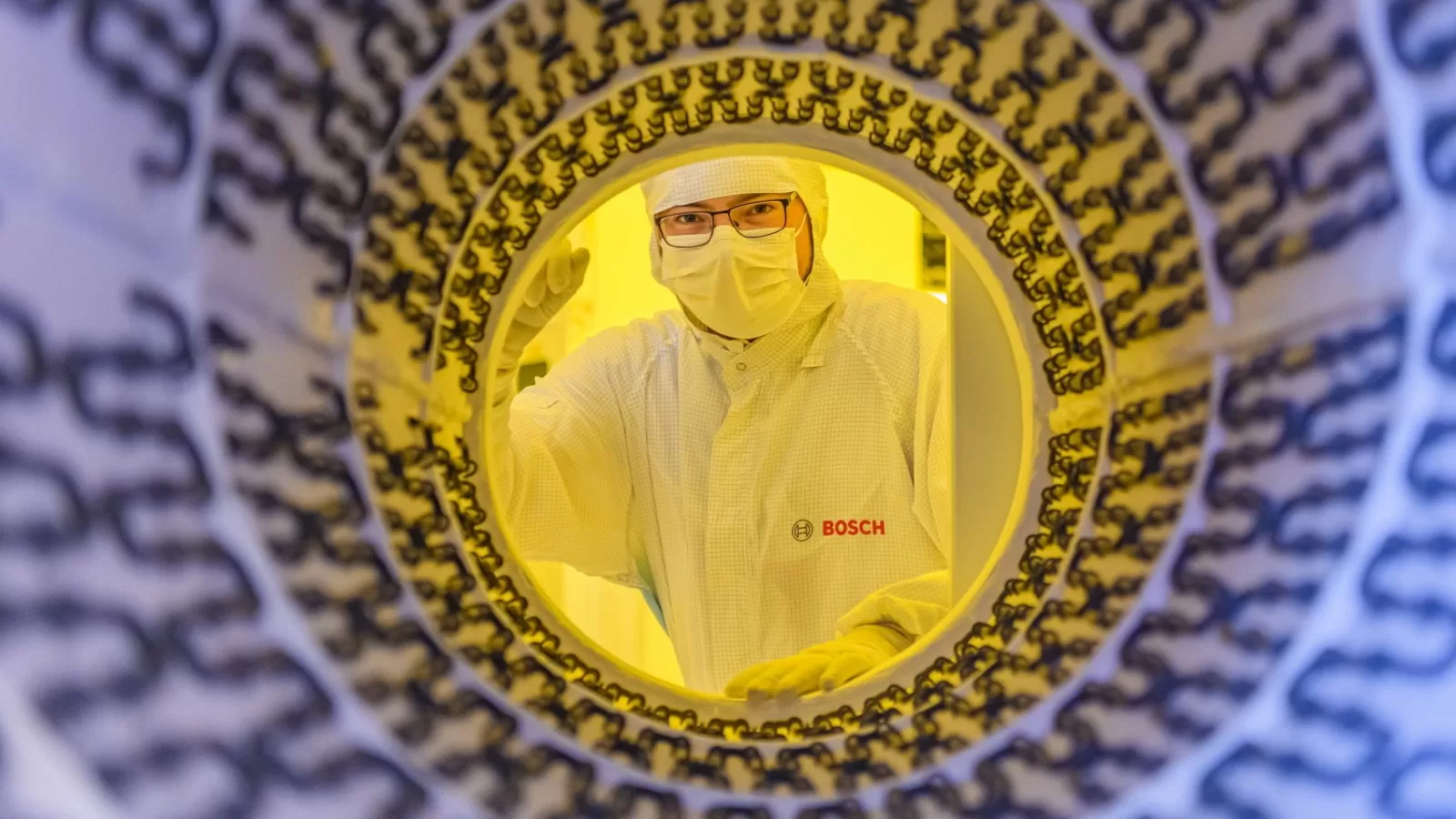

As companies rethink their relationship with the chip supply chain, global governments are also concerned about the supply chain and are introducing chip-related laws to promote local semiconductor industry development and help address future chip shortages. In the case of the United States, the Biden administration is pushing through the “Chip and Science Act” in 2022, providing $52 billion in subsidies for research, design, and production of American semiconductors, including $20 billion for traditional chips used in the automotive industry, and a 25% tax credit for semiconductor manufacturing investments until 2026 to help the US compete with Asian countries such as China and South Korea that dominate the global semiconductor market. With the introduction of the “Chip and Science Act,” the American semiconductor industry has received significant investments. For example, TSMC is investing $12 billion to build a chip manufacturing base in Arizona, USA, which is expected to be operational by 2024. Intel and SK Group have also committed to investing billions of dollars in the US for new facilities and research. Meanwhile, in April of last year, Bosch announced the acquisition of California chip manufacturer TSI Semiconductors and plans to invest $1.5 billion to upgrade its factories to become a center for silicon carbide chip production by 2026. Paul Thomas, President of Bosch Mobility Americas, stated that Bosch is still seeking federal funding for the project but plans to continue with the upgrades. Thomas revealed, “We are still modernizing aspects of the factory to have a good start in the silicon carbide field by 2026, of course, we will not be fully operational by then. This is a meaningful and reasonable industrial upgrade plan, with enough returns and risks, and we are satisfied with it.”

Automakers have begun to establish closer relationships with the chip supply chain and are now combining current industry trends to layout new chip production capacity partnerships. As automakers introduce new electric vehicles, the demand for silicon carbide chips across the industry is expected to rise. When used in electric vehicle inverters, silicon carbide chips have new advantages over traditional silicon chips, speeding up charging and extending range, forcing suppliers to ensure future silicon carbide supply. Last June, Veoneer Technology invested $1 billion in a silicon carbide chip deal with Japanese chip manufacturer Rohm. Veoneer Technology’s North American CEO Sandy Stojkovski said, “We want to ensure an adequate chip supply, which means we need to build strong technology partnerships.” Thomas pointed out that, according to forecasts, demand for new chips will continue to rise, even as automakers scale back some electrification plans due to lower-than-expected consumer demand, “because we need to make existing hybrid and electric vehicles more efficient.” After years of ongoing chip shortages, ensuring chip supply has become a top priority for automakers. But before the chip shortage occurred, this was hard to imagine.