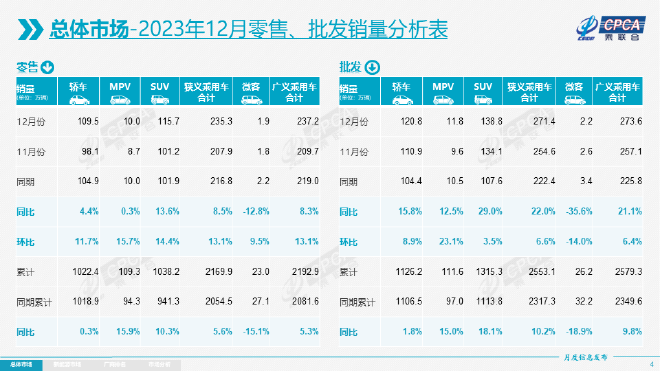

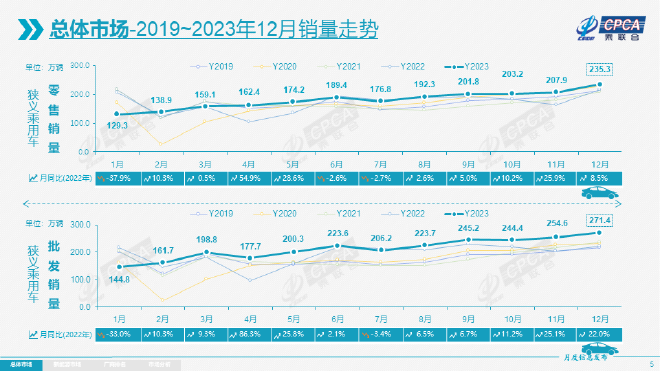

Recently, the China Passenger Car Association released its latest data report. In December 2023, retail sales of passenger cars reached 2.353 million units, an increase of 8.5% year-on-year and 13.1% month-on-month. The annual retail sales volume for 2023 reached 21.699 million units, a year-on-year increase of 5.6%.

According to the data, the retail sales of the car market in December 2023 continued to strengthen month-on-month. The China Association of Automobile Manufacturers (CAAM) analysis indicates that the promotional efforts in December were greater than in previous years, combined with regional car purchase subsidies mostly facing monthly and annual settlements in January 2024, thus promoting early release of consumption and driving year-end sales. Car market: Retail sales significantly strengthen month-on-month Since entering 2023, the national guidance policies for the automobile industry have been frequent, aiming to further stabilize and expand automobile consumption. With the support of various promotional fee policies, car companies have strengthened their promotional efforts and breadth to boost sales, combined with the support of local policies, thus providing stable support for the car market in December.

From the perspective of brands, in December 2023, independent brands still dominated, with retail sales reaching 1.24 million vehicles, a year-on-year increase of 17% and a month-on-month increase of 8%; in December, the market share of independent brands in wholesale was 58.2%, an increase of 0.8 percentage points from the same period last year. It is worth noting that in December 2023, the domestic retail market share of independent brands was 52.9%, a year-on-year increase of 4 percentage points; the cumulative market share of independent brands in 2023 was 52%, an increase of 4.6 percentage points compared to the same period in 2022. In addition, independent brands have gained significant growth in the new energy market and export market, and leading traditional car companies have performed well in transformation and upgrading, with significant increases in market share for brands such as Chery, BYD, Changan, and Geely. In terms of exports, the strong growth trend of automobile exports continued in 2023. According to the China Association of Automobile Manufacturers, 385,000 passenger cars were exported in December, a year-on-year increase of 49% and a month-on-month increase of 3%. From January to December, 3.83 million passenger cars were exported, a year-on-year increase of 62%. With the improvement of export capacity, independent brand exports reached 331,000 vehicles in December, a year-on-year increase of 45% and a month-on-month increase of 3%; joint venture and luxury brand exports reached 54,000 vehicles, a year-on-year increase of 81%.

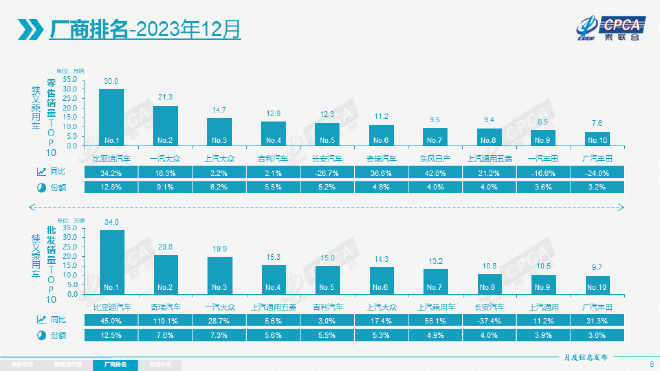

The export volume of new energy vehicles continues to rise. In December, the export of new energy passenger vehicles was 102,000, an increase of 39.8% year-on-year and 19.4% month-on-month, accounting for 26.6% of passenger vehicle exports, a decrease of 1.8 percentage points from the same period last year. Among them, pure electric vehicles accounted for 90% of new energy exports, and A0+A00-level pure electric vehicle exports accounted for 57% of new energy exports. The China Association of Automobile Manufacturers stated that with China’s scale advantage in new energy and the expanding market demand, more and more Chinese new energy product brands are going abroad. Overseas recognition continues to improve, and service networks are continuously improving. Therefore, the new energy export market is still promising. According to the monitoring of overseas market retail data for independent exports, A0-level electric vehicles account for nearly 60%, becoming the absolute main force in exports. Independent brands such as SAIC have performed well in Europe, while BYD has risen in the Southeast Asian market. In addition to the outstanding performance of traditional export car companies, the export of new forces has gradually increased, and overseas market data is also beginning to show. In contrast to the rising sales of Chinese brands, the market share of mainstream joint venture brands in China is shrinking, with most joint venture car companies experiencing declining sales. According to the data released by the China Association of Automobile Manufacturers, mainstream joint venture brands sold 790,000 vehicles in December, a 7% year-on-year decrease and a 20% month-on-month increase. The retail share of German joint venture brands in December was 20.5%, the same as the same period last year, while the retail share of Japanese joint venture brands was 16.5%, a decrease of 2.3 percentage points year-on-year. The market retail share of American joint venture brands reached 7.3%, a decrease of 1.1 percentage points year-on-year. The reason for the decline in sales of mainstream joint venture brands is simple, mainly due to the weak performance of the new energy sector, which has led to poor overall sales performance and is the biggest weakness of all joint venture car companies at present. Although joint venture car companies are making efforts in the new energy field, the results are not clear. In December, luxury car retail sales reached 320,000 vehicles, a 23% year-on-year increase and an 18% month-on-month increase. The shortage of luxury cars due to chip supply shortages last year has gradually improved, but the demand for traditional luxury cars is not very strong. Auto companies: Volkswagen in the north and south overtakes Geely. As the closing month of 2023, the sales of most domestic mainstream car companies in December have mostly maintained growth. According to the retail sales ranking of manufacturers, seven of the top ten automakers had higher sales than the same period last year. Only Changan Automobile, FAW Toyota, and GAC Toyota had lower sales than the same period last year. BYD remains the champion, and Volkswagen North and South surpassed Geely in the rankings.

Looking specifically, BYD Auto is still the leader. In December 2023, it retained the title of passenger car sales champion with a retail sales volume of 300,000, an increase of 34.2% year-on-year, and its share in the passenger car market reached 12.8%. According to BYD’s sales data for 2023, the annual sales volume was 3.024 million, a year-on-year increase of 61.8%, successfully achieving the annual production and sales target of 3 million vehicles set at the beginning of the year. In overseas markets, BYD Auto achieved a year-on-year increase of 334% in 2023, with an annual export of over 240,000 vehicles. Undoubtedly, the main reason for BYD’s sales growth is that its products are rich and cost-effective. Star products in various segmented markets, such as the BYD Qin PLUS family, the Song PLUS family, and the contributions of the Tang D9 and Yuanwang brands, as well as the start of the Leopard 5, have contributed to the overall sales growth. In second place is FAW-Volkswagen, with sales of 213,000 vehicles in December 2023, an 18.3% year-on-year increase, a market share of 9.1%, and annual sales of 1.91 million vehicles, a 4.8% year-on-year increase. In order to stimulate end-of-year sales, FAW-Volkswagen also introduced multiple limited-time car purchase subsidies for December. During the boom of new energy vehicles, FAW-Volkswagen has managed to hold its ground with fuel cars, but the need to accelerate transformation is imminent. Despite the good market performance of the ID series, more new products are still needed to enrich consumer choices. Thanks to the price reduction promotion in December 2023, SAIC Volkswagen also achieved good results. In December, SAIC Volkswagen’s wholesale sales reached 143,000 vehicles, a year-on-year increase of 17.4%, and retail sales reached 147,000 vehicles, a year-on-year increase of 2.2%, ranking third, surpassing Geely, Changan, and other domestic independent brand car companies. The reason for the increase in sales of SAIC Volkswagen is due to the sales contribution of its new energy vehicle ID family. In December, the ID family delivered 19,000 vehicles, achieving a new sales record, while the cumulative sales in 2023 reached 109,700 vehicles, with the ID.3 model achieving cumulative sales of over 100,000 vehicles since its launch. However, according to the SAIC Group’s production and sales report, the cumulative sales of SAIC Volkswagen in 2023 reached 1.215 million vehicles, a year-on-year decrease of 8%. In December 2023, Geely Automobile sold 129,000 vehicles, a year-on-year increase of 2.1%, with a market share of 5.5%, ranking fourth. According to official data from Geely Automobile, the total annual sales for 2023 reached 1.6865 million vehicles, exceeding the annual target of 1.65 million vehicles.

Geely’s explosive car sales are mainly due to the rapid growth of new energy vehicles, especially the Geely Galaxy, represented by the Galaxy L6 and L7 new energy vehicles. By 2024, Geely plans to challenge a sales target of 1.9 million vehicles, with the new energy sales target growing by over 66%. Geely has recently launched several new models, including the Galaxy brand’s new large and medium-sized pure electric car E8 and the Jike 007, which will all become Geely’s new sales growth points. In December 2023, Changan Automobile’s retail sales were 123,000 vehicles, a 26.7% year-on-year decrease, with a market share of 5.2%, ranking fifth. Official data shows that the annual sales in 2023 exceeded 2.55 million vehicles, an 8.7% year-on-year increase, achieving sales of over 2 million vehicles for three consecutive years, and 91% of the annual sales target of 2.8 million vehicles. Recently, Changan Automobile’s actions have been frequent. It reached a battery swapping business cooperation with NIO, signed a cooperation memorandum with Ganfeng Lithium, and will also invest in Huawei’s independent business new company. With the continuous layout in the new energy field, Changan Automobile has formed a multi-brand strategy for new energy vehicles including Deep Blue, Changan Qiyuan, and Avita, and will also have good performance in sales in the future. Chery Automobile, ranked sixth, sold 112,000 vehicles in December, a 36.6% year-on-year increase, with a market share of 4.8%. In December, Chery Automobile achieved wholesale sales of 208,000 vehicles, a 110.1% year-on-year increase. The large gap between wholesale sales and retail sales is mainly due to Chery’s outstanding performance in overseas markets. However, Chery, which is currently mainly focused on fuel vehicles, will fully enter the plug-in hybrid market in 2024, and the Fengyun series is already poised for action. Official data shows that Chery Group achieved a “twelve consecutive increases” in sales in 2023, with cumulative sales reaching 1.88 million vehicles, a year-on-year increase of 52.6%, and 94% of the 2 million sales target for 2023. Exports exceeded 937,000 vehicles in 2023, ranking first in China for 21 consecutive years. Dongfeng Nissan squeezed into the top ten list of sales in December 2023, with retail sales of 95,000 vehicles, a year-on-year increase of 42.8%, ranking seventh with a market share of 4%. According to official data from Dongfeng Nissan, the cumulative terminal sales in 2023 were 791,000 vehicles. In terms of products, the Xuan Yi’s sales exceeded 370,000 vehicles, becoming the first choice for family users due to its fuel efficiency, comfort, and technology, and the sales of the Teana and X-Trail also contributed to the sales, coupled with end-of-year discounts, resulting in relatively strong sales. SAIC-GM Wuling’s performance was also relatively average, with retail sales reaching 94,000 vehicles in December 2023, a year-on-year increase of 21.2%, and a market share of 4%. According to official data released by SAIC-GM Wuling, the total sales for the full year of 2023 were 1.4031 million vehicles, including 500,200 passenger cars. Despite a recent decline in sales, the Wuling Hongguang MINIEV has benefited from the launch of the Wuling Bingguo in 2023, which has helped to recover sales in the micro and small car segments for Wuling to a certain extent.

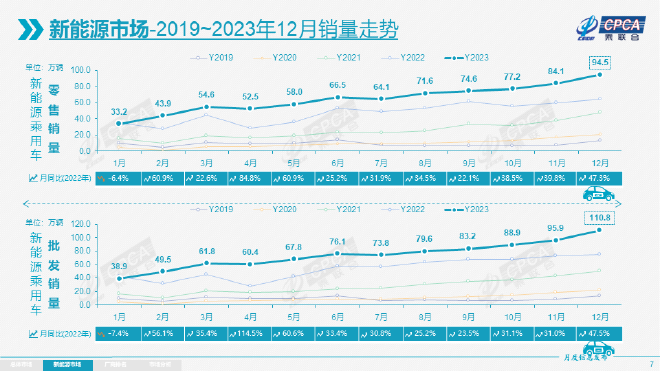

Looking at the sub-segment of vehicle models, the Hongguang MINIEV has 237,900 units; the Wuling Bengu has 231,100 units, becoming another “hot-selling” “magic car” after the “Hongguang MINIEV” for SAIC-GM Wuling. Officially, the Wuling Bengu has sold over 30,000 units for two consecutive months, with a total sales volume of 231,100 units, which is basically on par with the Hongguang MINIEV. As the two major joint venture companies of Toyota, FAW Toyota and GAC Toyota ranked ninth and tenth, but their sales volume in 2023 showed a declining trend year-on-year. Data shows that Toyota’s cumulative sales volume in China in 2023 was 1.701 million units, a decrease of 12.36% year-on-year. The new cars launched by the two joint ventures of Toyota in China both adopt a dual-car strategy. Under the impact of price wars and new energy, the performance of the two joint venture companies in the field of new energy is not good, and the market share of fuel vehicles is being squeezed. Currently, the Camry not only faces competition from fuel vehicles of the same level, but also competes with new energy vehicles such as the Shenlan SL03 and the BYD Dolphin in the market, and the Corolla and the Levin are the same. Unfortunately, in December 2023, the top ten sales rankings did not include SAIC-GM, GAC Honda, or Great Wall Motors, perhaps due to intense price wars and overall competitive pressure. New energy: Market penetration continues to increase Data shows that in December 2023, the retail sales of new energy vehicles reached 945,000 units, an increase of 47.3% year-on-year and 12.1% month-on-month. From January to December 2023, the cumulative retail sales reached 7.736 million units, an increase of 36.2% year-on-year.

From the production side, the production of new energy passenger cars reached 1.095 million units in December 2023, an increase of 45.4% year-on-year and 10.5% month-on-month. The cumulative production in 2023 reached 8.92 million units, an increase of 33.7% year-on-year. From the wholesale sales perspective, the wholesale sales of new energy passenger cars reached 1.108 million units in December 2023, an increase of 47.5% year-on-year and 15.3% month-on-month. The cumulative wholesale sales in 2023 reached 8.864 million units, an increase of 36.3% year-on-year. In addition, the market penetration rate of new energy vehicles is continuously increasing. In December 2023, the domestic retail penetration rate of new energy vehicles reached 40.2%, an increase of 10.6 percentage points from the 29.6% penetration rate in the same period of 2022, and the annual penetration rate of 35.7% increased by 8.1 percentage points. In terms of car brand penetration, in December 2023, the penetration rate of new energy vehicles in independent brands was 64.6%; in luxury cars, it was 29.5%; and in mainstream joint venture brands, it was only 6.0%. Looking at the monthly domestic retail market share, in December, the retail market share of new energy vehicles for independent brands was 70.3%, a decrease of 0.4 percentage points year-on-year; the market share for joint venture brands was 4.8%, a decrease of 2.2 percentage points year-on-year; the market share for new forces was 14.9%, an increase of 0.9 percentage points year-on-year; and Tesla’s market share was 8%, an increase of 1.5 percentage points year-on-year. From the data, it can be seen that in December 2023, the domestic retail penetration rate of new energy vehicles continued to increase, exceeding 60%, and is still steadily increasing. This indicates that the market’s acceptance of new energy vehicles is gradually increasing. With the continuous improvement of various infrastructure and the introduction of high-performance cost-effective products, the number of new energy vehicles will continue to rise. However, it is worth noting that the growth rate of new energy vehicle sales in the current market is slowing down, gradually shifting from incremental competition to stock competition. In addition, the impact of price wars has led to a stable growth period for sales, and future market competition will certainly become more intense. Looking at the performance of new energy vehicle companies, in December 2023, the overall trend of new energy passenger car companies was strong, with BYD’s pure electric and plug-in hybrid dual-drive solidifying the leading position of independent new energy brands. Range-extended electric vehicles represented by Changan, Sailesi, Li Xiang, and Zero Run also performed particularly well. In addition, with the simultaneous development of independent car companies in the new energy route, the market base continues to expand. Data from the China Passenger Car Association shows that 21 companies with wholesale sales exceeding 10,000 vehicles accounted for 92.8% of the total sales of new energy passenger cars. It is worth mentioning that new forces in car manufacturing are also continuing to exert their efforts. In December 2023, the retail market share of new forces increased by 0.9 percentage points year-on-year to 14.9%. Companies such as NIO, Xiaopeng, and Li Xiang still showed strong overall performance in year-on-year and month-on-month sales. Furthermore, among mainstream joint venture brands, both Volkswagen in the north and south have shown strong leadership, with wholesale sales of new energy vehicles reaching 30,585 units, accounting for a strong share of 50.2% in the mainstream joint venture pure electric market. Volkswagen’s firm electrification transformation strategy is beginning to show results, but other joint venture and luxury brands still need to make efforts. In the data released by the China Passenger Car Association, we also see that there is a market demand for ordinary hybrid passenger cars. In December 2023, wholesale sales of ordinary hybrid passenger cars reached 95,000 units, an increase of 28% year-on-year and 21% month-on-month. However, mainstream hybrid models are mainly from joint venture brands such as GAC Toyota, FAW Toyota, Dongfeng Honda, Changan Ford, and Dongfeng Nissan, and the sales of independent hybrid brands are gradually increasing.

BYD ranks first in the new energy vehicle industry, with no company currently able to challenge its position. In addition, the sales of new energy vehicles from traditional leading companies are also impressive. In December 2023, Geely’s new energy vehicle sales reached 59,500 units, a year-on-year increase of 52.4%; Changan’s new energy vehicle sales reached 42,200 units, a year-on-year increase of 23%; SAIC-GM-Wuling’s new energy vehicle sales reached 67,200 units, a year-on-year increase of 72.8%. Of course, Tesla’s sales are also very impressive, with 75,800 new vehicles delivered in December 2023, an 80.8% year-on-year increase. The total sales for 2023 have exceeded 603,700 units, a 37.3% year-on-year increase, surpassing Tesla’s global sales total for 2020. It is worth mentioning that the market performance of new car companies in December 2023 was also very good. Among them, NIO delivered 50,400 new vehicles, a year-on-year increase of 137.1%, with a total sales of 376,000 units from January to December, exceeding the annual target of 300,000 units for 2023. In addition, although XPeng, NIO, and Lixiang did not enter the top ten rankings, their sales performance in 2023 was also very good. NIO delivered 160,000 new vehicles throughout 2023, a 30.7% year-on-year increase, and Lixiang delivered 144,200 new vehicles, a 29% year-on-year increase, with a cumulative delivery of over 300,000 vehicles. XPeng delivered a total of 141,600 new vehicles throughout the year, with a year-on-year increase of about 17%. It is worth noting that Huawei’s AITO Wanjie, under the HarmonyOS Smart Mobility division, has also begun to make efforts. In December, the entire series delivered 30,000 vehicles, a year-on-year increase of 195.8%. The official statement indicated that 20,611 units of the new M7 were delivered in December, with a total of 94,380 units delivered throughout 2023. The cumulative orders for the new M7 have now exceeded 120,000 units, showing a significant boost in sales for the Wanjie series. In summary, overall, the car market in December 2023 had particularly strong promotional pricing, which released some of the demand for car purchases early. It is expected that in January of this year, car companies will gradually recover from the promotions and achieve a phase of stable sales. However, the China Association of Automobile Manufacturers also stated that due to the early Chinese New Year and the adjustment period after policy exits, there is still a high expectation for significant retail growth in January due to the low base from the previous year.