Under the combined influence of policy support and the overall environment, the sales of new energy vehicles achieved rapid growth in 2023. However, the pain points such as range anxiety and difficulty in charging still exist for pure electric vehicles. Therefore, the replenishment of new energy vehicles in 2024 has received more attention, and many car companies are also building their own replenishment networks in different ways to establish their own competitive barriers.

Currently, the hot options for new energy vehicle charging and swapping are in the spotlight. After NIO joined hands with Changan, Geely, Jiangling Motors Group, and Chery to form a swapping alliance, the National Industrial and Information Work Conference recently proposed to support the development of the new energy vehicle swapping model by 2024 in the field of new energy vehicles. In addition, fast charging is also hot in the new energy era, with many car companies building their own 800V fast charging piles, such as XPeng, Jinko, Ideal, and NIO. With the intensifying competition in the new energy vehicle market, car companies’ charging plans are constantly improving, and charging is no longer just a sales promotion and after-sales service guarantee, but has become a necessary support for enterprise development. So, what will be the development of new energy vehicle charging in 2024, and what is the market demand for the two charging methods of swapping and fast charging? What problems need to be solved next in order to provide better services? Strong market demand for charging Currently, China’s stock of new energy vehicles has reached 20.41 million, and the market is still growing rapidly. Along with the “crazy” growth in vehicle production and sales, the charging infrastructure has also seen rapid development. Recently, the “2023 National Electric Vehicle Charging and Swapping Infrastructure Operation Report” released by the China Charging and Swapping Alliance shows that in 2023, the increment of charging infrastructure was 3.386 million units, with a ratio of 1:2.8 between charging piles and vehicles. Among them, the increment of public charging piles was 929,000 units, and the increment of privately-owned charging piles was 2.458 million units, a year-on-year increase of 30.6%. As for swapping stations, as of December 2023, the total number of swapping stations in China was 3,567, with the top five provinces and cities being Zhejiang, Guangdong, Jiangsu, Beijing, and Shanghai. The China Charging Alliance stated that the construction of charging infrastructure basically meets the rapid development needs of the new energy vehicle industry. Despite the rapid development of charging and swapping layout, it is crucial for the charging industry to provide better services in order to keep up with the “crazy” growth of new energy vehicles and provide consumers with a more convenient charging and swapping experience.

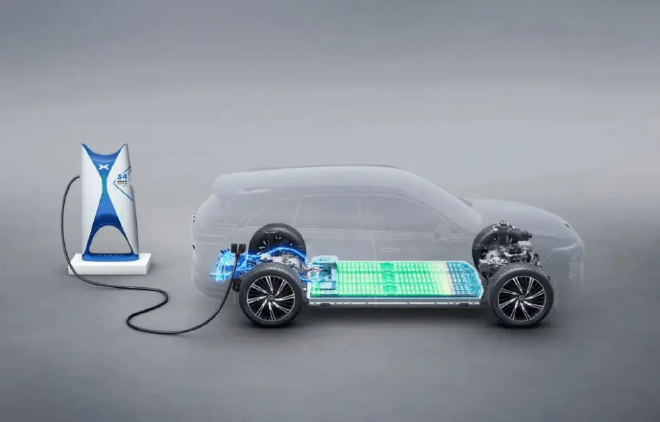

Insiders also said that accelerating the construction of high-quality charging infrastructure mainly based on battery swapping, supercharging, and fast charging can solve the problem of charging difficulty and alleviate range anxiety. In fact, the industry has also learned from user charging surveys that most people are more sensitive to charging time, with over 90% of users choosing fast charging piles, especially for the higher demand for operational vehicles. In terms of charging pile power, 72% of users tend to choose high-power charging piles of 120kW and above, with over 18% of users choosing supercharging piles of 180kW and above, indicating a further increase in user demand for supercharging. Currently, China’s new energy vehicle industry has entered a comprehensive market expansion period, and the service capacity of charging and swapping infrastructure networks has become a focus of the industry’s attention. Supercharging using high-power direct current charging can greatly reduce charging time and effectively improve the user’s charging experience. Previously, the deputy secretary-general of the Charging Alliance of the China Association of Automobile Manufacturers also stated that the demand for higher power charging is gradually increasing, but with the marketization of faster vehicle energy supply solutions such as supercharging and battery swapping, the diversified development of charging and swapping services is inevitable. Undoubtedly, as a way to supplement new energy vehicles, the demand for charging piles and battery swapping stations continues to expand with the continuous growth of new energy vehicle ownership. However, despite China, Europe, and the United States being the world’s major new energy vehicle markets, the construction of charging facilities lags behind the development of the new energy vehicle market, especially with the public charging piles in Europe and the United States being as high as 14:1 and 23:1, resulting in a huge gap. Not long ago, the General Office of the State Council issued the “Guiding Opinions on Further Building a High-Quality Charging Infrastructure System,” which requires the construction of a high-quality charging infrastructure system based on scientific layout, moderate advancement, innovation integration, and safety and convenience as the basic principles. The opinions clearly stipulate that by 2023, a high-quality charging facility system covering a wide range, with a moderate scale, reasonable structure, and complete functions should be built. At the same time, the proportion of parking spaces with charging conditions in large and medium-sized urban commercial parking lots should be increased, and the charging coverage rate in rural areas should be steadily improved. In addition, the basic improvement of standardization, market supervision system, and the modernization of industry supervision and governance capabilities should also be achieved.

The Spring Festival holiday is coming soon, and it is expected that there will be a phenomenon of electric cars lining up to charge at the highway service area. The slow charging, difficulty in charging, and car owners waiting in line for hours to charge have almost always become a hot topic during each holiday, seriously affecting the driving experience of new energy vehicle owners. Therefore, in the period of the widespread popularity of new energy vehicles, which has brought about the difficulty of charging electric vehicles and the transformation of the energy industry chain, it is more necessary to accelerate the transformation of energy infrastructure. From the perspective of car companies, building a supplementary energy network to alleviate the difficulty of car owners in supplementing energy can drive up the sales of the brand’s cars. Take NIO as an example, relying on the logic of where the battery swapping stations are and where the users are, it can quickly open up the market in third- and fourth-tier cities with a lack of charging facilities. Recently, many companies have announced their 2024 supercharging layout plans, among which, GAC Group’s subsidiary GAC Energy has announced the “Ten Thousand Stations Plan,” which will accelerate the high-quality charging and swapping action and speed up the layout and construction of 1000V high-voltage platform supercharging terminals by 2024. Ideal car’s plan is to have more than 2000 supercharging stations online by 2024, and to build a “Nine Vertical and Nine Horizontal” supercharging network, achieving 70% coverage of the national main highways and 50% coverage of the core urban areas of third-tier cities and above. As of now, Ideal car has opened 316 Ideal 5C supercharging stations. It seems that the demand for new energy vehicle charging and swapping stations is booming, and it is becoming the next battleground for car companies. Building a charging and swapping network can provide higher quality services for car owners, enhance user loyalty, and increase the likelihood of potential users choosing their own products, which is helpful for increasing car sales. The standardization issue of swapping stations urgently needs to be solved. According to data from the China Electric Vehicle Charging Infrastructure Promotion Alliance, the number of swapping stations in China has increased 11.6 times in four years, from 306 at the end of 2019 to 3567 at the end of December 2023, leading to a surge in the number of swapping stations in the country. In order to promote the development of swapping and charging methods, the country has issued a series of documents, including the “New Energy Vehicle Industry Development Plan,” the “Notice on Launching the First Batch of Pilot Areas for Comprehensive Electrification of Public Vehicles,” and the “Announcement on Adjusting the Technical Requirements for Exemption of Vehicle Purchase Tax for New Energy Vehicle Products,” encouraging the application of swapping stations. Nowadays, car companies have raised their focus on the replenishment of new energy vehicles to a new level. Swapping technology, as an important innovation in China’s electric vehicle field, provides a fast energy supply and method, with significant advantages in improving efficiency and reducing waiting time, which is of great significance for improving user experience and promoting the development of electric vehicles. In other words, the biggest advantage of swapping stations is the fast speed, and users do not need to wait. During the Spring Festival, Labor Day, National Day and other long holidays, many people need to travel long distances, and long-distance buses are often driven by several people taking turns. When people rest, the car does not rest. The switch to electric mode can significantly improve efficiency and reduce travel time.

It is worth mentioning that the battery swap mode is constantly evolving. The current efficiency can be measured in seconds. Some companies claim to be able to complete a battery swap in “less than 1 minute,” making it faster and more convenient than refueling. Another point that cannot be ignored is that battery swapping has the advantages of “saving money, saving people, and saving land.” As the core component of electric vehicles, batteries usually account for about 30%-40% of the total vehicle cost. The “separation of vehicle and battery” model has significantly reduced the purchase price of electric vehicles. Compared to charging stations, battery swap stations are easier to operate without human intervention, reducing operating costs. It is reported that the first batch of “unmanned” heavy-duty truck battery swap stations have been launched and put into the market in 2023. In addition, the battery swap model can also save land. Faced with the land constraints of first and second-tier cities, as well as the complex and diverse terrains in some domestic cities, battery swap stations can occupy smaller areas. Some operators have already introduced micro battery swap stations. Industry insiders believe that in the future, battery swap stations have great potential in energy storage, grid regulation, carbon reduction, and other fields compared to single charging stations. However, battery swap stations still face many challenges, such as the gap in consumer expectations, the inability to unify standards, and the high operating costs of heavy assets in the real world. From the user’s perspective, some people are unwilling to replace a new battery with a damaged one, and it is psychologically difficult to accept this battery swapping model. For battery swapping stations, the heavy operating costs of capital assets are far higher than building charging stations, and many businesses have operated for years without making a profit. Additionally, the current battery swapping model still faces standardization issues. The existing battery swapping station service model can only serve a single brand on a “one-to-one” basis and cannot be shared. In order to popularize the battery swapping model on a large scale, companies need to develop battery swapping chassis interfaces and unify battery pack parameters. Industry insiders have been calling for the industry to promote the implementation of standards for battery swapping batteries, vehicles, and swapping stations, including standardizing and unifying aspects such as battery swapping interfaces, battery swapping mechanism cooling interfaces, and communication interaction protocols, to promote the interoperability, mutual recognition, and interchangeability of battery swapping systems. In fact, establishing a unified battery swapping standard system is no easy task. Due to differences in understanding and requirements for standards among different manufacturers and regions, the process of coordinating interests and opinions is quite complex. In addition, the development of standards involves multiple aspects such as technology, regulations, and the market, requiring the participation and cooperation of all parties. Therefore, in the next few years, we need to address the standardization of the battery swapping mode. This will not only make the battery swapping stations a more diverse and open energy supplement network, but also reduce the cost of the battery swapping mode, thus promoting its further popularization and widespread adoption.

Recently, NIO has reached strategic cooperation agreements with Changan, Geely, Jiangqi Group, Chery and other car companies to promote the standardization and expansion of the battery swap network. This will enhance the competitiveness and attractiveness of the battery swap model. At the National Industrial and Information Work Conference, it was mentioned that by 2024, the development of the electric vehicle battery swap model will be supported, and pilot projects for comprehensive electrification of public sector vehicles will be carried out. The Ministry of Industry and Information Technology has repeatedly encouraged the development of the battery swap business. Vice Minister Xin Guobin stated in a policy briefing that the new energy vehicle industry will receive more policy support, including an extension of the new energy vehicle vehicle purchase tax exemption policy until the end of 2027. It was also mentioned that high-end vehicle models are relatively advanced in intelligence, and the “battery swap model” adopted by some models plays a leading role in the development of the new energy vehicle industry and needs to be supported with a certain amount of tax reduction and exemption. It can be seen that, previously, battery swap stations faced problems such as high construction costs and limited selection of battery swap models. However, with policy support, more companies are entering the battery swap track, and the battery swap model will play an increasingly important role in the new energy vehicle replenishment system. The outbreak of 800V super fast charging As the competition in the new energy vehicle market intensifies, the focus of car companies has shifted from competing in battery capacity and range to the higher-value super fast charging ecosystem, with 800V being the iconic keyword.

Since Porsche released its first 800V model Taycan in 2019, international giants including Kia and Hyundai have followed suit. Subsequently, domestic car companies such as BYD, Geely, Great Wall, GAC, Xiaopeng, Ideal, and Xiaomi have also launched 800V platforms. The high-voltage super fast charging experience will become an important standard for the differentiated experience in the electric vehicle market. Currently, high-voltage super fast charging can effectively solve the range anxiety and fast charging problems of electric vehicles, and has become a new trend in the future energy replenishment technology evolution. Corresponding 800V high-voltage platform models and high-voltage high-power super charging networks are in the accelerated layout stage. Guangqi Aion previously released super charging piles, reportedly matched with a 1000V super charging system, which can charge an electric vehicle from 12% to 96% in just 35 minutes. At the same time, it pioneered the “wheel-to-wheel” technology and “120kW-480kW adaptive high-power charging pile”, which can achieve intelligent dynamic distribution of charging power. In addition, Huawei has also launched a fully liquid-cooled super charging pile, which can achieve efficient heat dissipation and temperature control of the equipment, with a maximum output power of 600kW and a maximum current of 600A, making it the highest power charging pile currently in use, capable of “charging 1 second for 1 kilometer”, allowing an ordinary electric vehicle to be fully charged in less than 10 minutes. In addition, several companies have announced or plan to accelerate the layout of super charging by 2024. BMW and Mercedes-Benz also plan to establish at least 1000 charging stations and 7000 super charging piles in China by 2026. At the same time, some cities have put forward plans and goals for the vigorous layout of super charging. Shenzhen aims to build a “city of super charging” by 2025, Hainan plans to build an “island of super charging” in the same year, and Guangzhou plans to build a “capital of super charging” by 2024… In addition, with more and more car companies launching electric vehicles based on the 800V high-voltage platform, 800V seems to have become the standard configuration for new electric vehicles, which also means that super charging will become one of the mainstream energy replenishment methods for new energy vehicles.

It is worth noting that, with the intensification of market competition, the prices of 800V high-voltage models are constantly falling. Models like Xiaopeng G6 and Zhiji S7, which support 800V charging, are now priced at less than 250,000 yuan (35060$). Industry forecasts predict that with the price of 800V models falling, the selling price of this type of product is expected to enter the 150,000-200,000 yuan (28050$) range by 2025, and the penetration rate of 800V models will also enter a period of explosive growth. Entering 2024, the 800V battle in the automotive industry is about to begin. At the launch event of the Geely Galaxy E8, this car brought 800V to the mass market of 200,000 yuan (28050$). The official claimed that the car can travel 180 kilometers in 5 minutes, making it the fastest charging speed in the mainstream electric vehicle market. It was recently reported that the all-new electric SUV Audi Q6 e-tron under the Audi’s new platform will be officially put into production in 2024. The new car is built on the latest PPE platform of the Volkswagen Group and is equipped with an 800V ultra-high-voltage fast charging system. In addition, models like Xiaopeng G6, Zhiji S7, Jike 007, Zhiji LS6, and others are all built on the 800V platform. There are also upcoming models like Xiaopeng X9, Jike 001, Startrek Star Era ES, and future models like Wenjie M9, Xiaomi Car SU7, etc. With the popularization of 800V technology, the driving experience of electric vehicles will continue to improve. In 2024, the construction of supercharging networks will enter a period of rapid development, and many iconic technologies will make new breakthroughs, with 800V high-voltage fast charging quickly becoming popular and mass-produced. However, despite being a good solution, the road to popularizing 800V high-voltage fast charging still has a long way to go. Industry insiders say that the 800V high-voltage system needs to overcome three major impacts: safety, cost, and the capacity of the entire power grid, with power grid capacity being a longstanding challenge for the large-scale application of 800V. Currently, there are not many charging piles that can match the 800V high-voltage platform, and the most common ones on the market are charging piles that are compatible with the 400V platform. In addition, the problem of boosting needs to be solved, and the power of the charging pile does not necessarily represent the real power under user usage scenarios. It depends more on the power grid capacity. When too many users charge at the same time, it can lead to unstable voltage output throughout, posing a major challenge to the power grid. Previously, He Xiaopeng, CEO of Xiaopeng Motors, also stated that in order to achieve full vehicle support for 800V silicon carbide, there needs to be a certain amount of technical accumulation, and this process requires breakthroughs in many technological boundaries. There is still a lot to be done in the future. Summary: In 2024, with strong market demand and technological advancements, both new energy vehicle charging and swapping methods have seen rapid development. Swapping and supercharging complement each other, and solving challenges and accelerating development will undoubtedly be the focus of future charging infrastructure and the industry’s goals for the new year.