The rapid development of smart electric vehicles and the intensification of the internal competition among car companies are driving the rapid increase in the penetration rate of air suspension. According to the latest statistics from the GAC Research Institute, the sales of new cars equipped with air suspension in the first 10 months of 2023 reached approximately 439,000 units, with a penetration rate of 2.6%, compared to only 156,000 units and a penetration rate of less than 1% in the same period in 2022, representing a year-on-year increase of 181%.

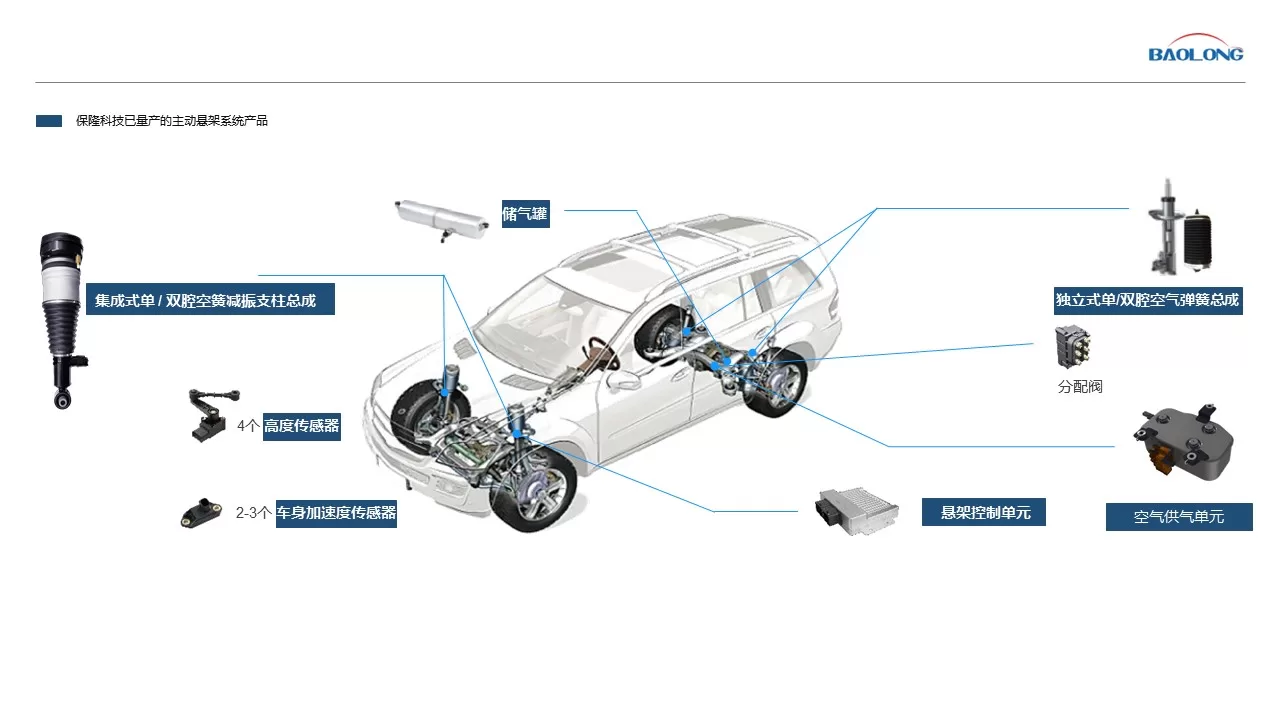

It can be foreseen that the air suspension market will continue to grow, and with this process, the competition in this field will become increasingly fierce. On the one hand, more and more new players are vying to enter the market, while on the other hand, suppliers who have already established a certain position in this field are gradually engaging in intense competition. The traditional black box delivery model is gradually being broken, and the market needs more “flexible” solutions. The traditional head suppliers in the field of air suspension usually hope to provide a black box system from perception-decision-execution to the host factory in order to obtain high profits, but this approach is becoming less and less viable. Nowadays, major host factories tend to independently develop algorithms and integrate systems, while externally procuring perception components, execution components, and controller hardware, because opening the black box system is not only convenient for cost evaluation, but also for subsequent OTA upgrades and iterations, which is beneficial for business and planning expansion. In fact, benefiting from the drive for outsourcing demands, domestic air suspension suppliers have rapidly developed in the past two years, continuously expanding and improving their product lines in the process. Taking Polycon Technology as an example, currently, in the main components of the air suspension system such as front and rear air springs, controller hardware and control algorithms, ASU air supply unit, height and acceleration sensors, air tanks, and pipelines, except for the electromagnetic valves in the pipelines and ASU, all other main components are deeply laid out, and all have mass production projects in progress.

According to reports, in the field of air springs, Baolong Technology is currently one of the top two domestic companies; in the field of air tanks, over 80% of the new fixed points in China are at Baolong Technology; ECU products have currently obtained fixed points for 6 projects from two major customers, some of which are already in production; ASU gas supply units have also obtained fixed points for 5 projects from three major customers; sensors have also obtained fixed points for multiple projects. In addition, Baolong Technology is currently laying out CDC shock absorber products, meaning that in the entire air suspension system, Baolong Technology has a layout for high-value air springs, ASU gas supply units, and CDC shock absorbers. Thanks to the full product layout, Baolong Technology has long had the ability for system integration. Recently, a well-known brand’s high-end electric car went into production, and Baolong Technology provided air spring assemblies, controller hardware and algorithms, air supply units, and air tanks as a system integrator. Reportedly, this is the first time Baolong has delivered such a system project, and it is also the first air suspension system developed by a supplier in China, developed according to the AutoSAR architecture, meeting the ISO26262 functional safety system ASIL B standard, and with software development processes meeting ASPICE L2 requirements. Wang Shengquan, Vice President of Baolong Technology, recently revealed in an interview with Gasgoo that the consideration behind providing a complete solution is that some OEMs cannot yet master the control algorithms and system integration know-how when using air suspension for the first time, so in the short term, they tend to let suppliers with system integration capabilities supply the system as a package. However, it should be noted that even when choosing to outsource integration, OEMs are more willing to choose a white box rather than a black box delivery of the system integration solution for future development needs. Wang Shengquan stated that from the current situation, there are still some car companies using air suspension for the first time, so the number of integrated fixed point projects will increase in the near future. In the long run, top car companies will still choose a strategy of separate procurement, while other car companies will choose a strategy of white box delivery for system integration procurement. It is not difficult to see that Baolong Technology’s delivery method is very flexible. “If the host factory wants to disassemble and subcontract, Baolong will bid separately according to the host factory’s requirements. If the host factory needs an integrated solution, we will provide an integrated solution,” said Wang Shengquan, Baolong’s vice president of the ECAS unit. He also revealed that due to the comprehensive layout of Baolong’s products, the company usually wins orders for multiple sub-parts even if the host factory is tendering separately. “Whether it is disassembled or integrated supply, we do not use a black box system to grab excessive profits. We only earn reasonable profits,” added Li Ling, vice president of the ECAS unit of Baolong Technology. The internal volume is intensifying, and air suspension is shifting from “single chamber” to “double chamber” on a large scale. The permeability of air suspension is rapidly increasing, and the configuration models are even sinking to the passenger car market below 300,000 yuan (42070$). For example, the Star Travel Star Era ES, which started pre-sale in November 2023, is equipped with air suspension + CDC as standard, with a pre-sale price starting at 248,000 yuan (34780$). And as the air suspension-equipped models continue to explore, in order to compete differentially, the host factories are bound to roll into new dimensions and launch more superior differential products in terms of comfort and other aspects, one of which is an important idea, from single-chamber air springs to double-chamber air springs. It is understood that double-chamber air springs can provide two sets of variable stiffness curves, and can be used in combination to obtain more stiffness combinations, which can improve vehicle handling at high speeds, increase comfort on normal roads, and better control the vehicle’s posture during acceleration, braking, double shift lines, and steady-state turning. According to industry insiders, in the future, models priced just over 300,000 yuan (42070$) or below will change from not being equipped with air springs to being equipped with single-chamber air springs, while models priced over 300,000 yuan (42070$) will gradually shift from single-chamber air springs to double-chamber air springs. “This has become a major industry trend.” This trend can also be seen from the information disclosed by related suppliers. According to reports, Bolong Technology’s dual-chamber air spring under development has already received 8 production designations. Next, the dual-chamber air spring for two heavyweight MPV models will be put into production. Other production models will also be launched in 2024 and 2025.

Wang Shengquan said that most of the new orders are for double-chamber solutions, and some old single-chamber models that have not yet been mass-produced are also transitioning to double-chamber. “2024 will be the year of the double-chamber air spring outbreak.” The transition from “single-chamber” to “double-chamber” precisely reflects the deeper competition among air suspension suppliers, and this competition will continue to evolve.

Geside Auto has noticed that, in response to future demand, some suppliers have begun to layout three-chamber air springs. For example, Baolong Technology is currently developing three-chamber air springs, with samples expected to be available in the first quarter of 2024. Additionally, Baolong Technology is also developing woven bellows, a key component of air springs. This woven bellows plays a crucial role in the overall performance of air springs. Baolong Technology’s European subsidiary is currently collaborating with key equipment suppliers in Europe to develop a production line for woven bellows. In addition, Baolong Technology has three highlights this year, including the mass production of the system-integrated ECU and the dual-chamber air spring. Another highlight is the integrated spinning and pressing air tank, which has already been mass-produced. According to Wang Shengquan, the market is getting bigger, and the competition in comprehensive strength is intensifying. Since 2023, Baolong Technology’s overall performance has basically met expectations, whether in new designated projects or sales volume. More importantly, Baolong Technology has shown unexpected growth in pre-research projects and new technology exchange projects. This indicates a good trend in the air suspension market. Wang Shengquan stated that the air suspension market is still a growing market, and this “pie” will only get bigger. As market demand grows, more and more new players are entering the field. Some new players are willing to enter this field at all costs, offering suicidal bids, not charging development fees to compete for B points, or obtaining projects of little value. According to Wang Shengquan, this is unavoidable. Regardless of how the competition behind them joins, Bolong Technology is confident in maintaining its current advantage. Currently, Bolong Technology’s domestic market share of air suspension air springs is about 25%. New projects in hand and upcoming mass production orders exceed this proportion, indicating that Bolong Technology’s market share will continue to increase. To maintain this advantage, he mentioned the following aspects. First, Bolong Technology excels in every sub-field, ensuring technological leadership. For example, air springs have evolved from single chamber to double chamber to multi-chamber, and the air reservoir tank has transitioned from welding to integral spinning. Second, Bolong Technology’s product technology and quality performance are highly recognized by car companies, becoming strategic partners with NIO and Ideal Auto, and winning the outstanding quality award from NIO and Ideal Auto. This is due to Bolong Technology being a manufacturing enterprise with over 20 years of experience, and its quality development system, including lean production, is very mature. Unlike many competitors, Bolong Technology controls many things, such as hardware development and software design for the controller, and around 50% of the core components of the air suspension project are produced internally by various factories within the group. Furthermore, the construction of the Baolong production line, including personnel recruitment and training, quality assurance system, all have sufficient budget and pre-arranged guarantees.

According to reports, Baolong Technology currently has three new air suspension-related new factories in operation: the new factory of air suspension in Hefei, the new factory for the production and processing of airbags in Ningguo, and the new factory for air tanks. All three new factories will start mass production and delivery in 2023. According to the plan, in the next 1-3 years, Baolong Technology will advance the layout of production lines in accordance with the plan of doubling sales every year to fully guarantee production capacity. In addition, after achieving a large scale, with economies of scale and cost advantages, Baolong Technology will also take the initiative to lower prices and fully participate in market competition. “We have rapidly increased our development resources, development speed, and production capacity. The output of the supply chain has increased, and costs have decreased. While maintaining the same profit margin, we will actively offer competitive prices to gain a larger market share,” Li Ling added. From this perspective, the future air suspension market will be more of a comprehensive strength competition. Based on these advantages, Baolong Technology is confident in its future development. Wang Shengquan stated that in the field of air suspension, Baolong Technology’s goal is to become one of the top three globally in various sub-sectors such as air springs, ASU gas supply units, and air tanks.