Recently, the China Association of Automobile Manufacturers released the 2023 annual production and sales data for the automotive industry. The data shows that the annual production and sales of automobiles in 2023 reached 30.261 million and 30.094 million units, respectively, representing a year-on-year increase of 11.6% and 12%. Both production and sales volumes and exports have reached historic highs.

In 2024, the China Association of Automobile Manufacturers predicts that the total sales of cars in China will exceed 31 million, an increase of 3% or more compared to the previous year. Of these, 26.8 million will be passenger cars, with a 3% increase, and 11.5 million will be new energy vehicles, with 5.5 million exported. The industry has high hopes for the 2024 car market. Many car companies have recently announced their sales targets and new product plans for 2024. BYD, a traditional leading car company, has set a sales target of 4.5 to 5 million cars for 2024, while Chery and Geely have targets of 4 million and 1.9 million cars, respectively. New car companies are also confident, with NIO aiming to increase sales from 380,000 in 2023 to 800,000 in 2024. Wuling’s sales target for 2024 is more than 6 times its 2023 sales, while NIO and XPeng have more conservative targets of 230,000 and 280,000 cars, respectively. Chery is no longer polite, aiming just below BYD Facing the rapid rise of new energy vehicle forces such as Tesla, NIO, Ideal, and Xiaopeng in the field of new energy vehicles, old car companies such as BYD, Chery, Geely, Chang’an, and Great Wall Motors are accelerating in the transformation of new energy. The new energy sector reaped rich rewards in 2023, and 2024 has set even more challenging goals. Recently, BYD held its Dream Day event and officially released the vehicle’s intelligent architecture “Xuanji” and “Xuanji AI Big Model”. At the event, BYD Chairman and President Wang Chuanfu said, “Accelerating the popularization of intelligent driving, BYD has the confidence and the ability.” In 2023, BYD’s annual sales reached 3.0244 million vehicles, a year-on-year increase of 61.9%. There are reports that BYD’s sales target for 2024 is set at 4.5-5 million vehicles. Compared to 2023, BYD’s 2024 sales growth is close to 1.5-2 million vehicles. Industry insiders believe that such a target is not unattainable. As of now, BYD has a rich product lineup in the new energy vehicle market. Consumers highly approve of its products and the market penetration continues to increase. As a leading new energy vehicle company, BYD will naturally increase its efforts to compete for more market dividends. In terms of technology, BYD has introduced the DM-i hybrid, e3.0 platform, Easy 4.0, cloud vehicle body control system, blade battery, etc., showing very strong strength in mechanical hardware.

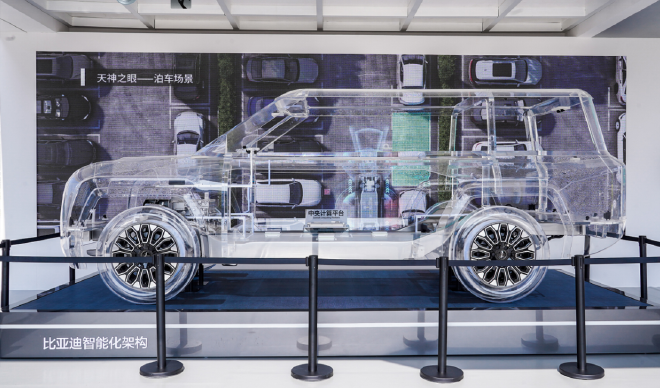

In addition, the recent release of the Xuanji architecture is a signal of BYD’s push into the field of intelligence. The Xuanji architecture consists of a main control system, cloud AI + vehicle AI, vehicle networking + 5G network + satellite network, sensor chain + control chain + data chain + mechanical chain, integrating software and hardware deeply, and applying intelligent technology to the entire vehicle through the new Xuanji AI model. Not only that, BYD also has strong capabilities in overseas markets, having already opened multiple overseas markets, including Europe, North America, and Southeast Asia. With the growing global demand for new energy vehicles, BYD’s overseas sales are expected to achieve significant growth in the coming years. Even more astonishing is Chery, with a sales target for 2024 second only to BYD, and a sales growth rate exceeding the industry average by 10-20 percentage points. It is reported that Chery Automobile may aim to achieve an annual sales target of 4 million vehicles in 2024. In 2023, Chery Group sold 1.881 million vehicles, achieving a year-on-year growth of 52.6% in revenue, sales, and exports, creating “three historical highs” and achieving the 2023 annual business target of “far exceeding the industry growth rate”. In comparison, Chery’s sales in 2024 are expected to double compared to 2023. Is this what the Secretary of the Chery Holdings Group Party Committee and Chairman Yin Tongyue said, “In 2024, we will be aggressive in the new energy vehicle market”? From Chery’s recent plans, it will launch over 20 new models in 2024, including 11 fuel vehicles and 10 new energy vehicles, with a focus on hybrid models, represented by the Chery Fengyun series. At the 2023 Guangzhou Auto Show, Li Xueyong, Vice General Manager of Chery Automobile Co., Ltd., stated that the sales target for the Chery Fengyun series in 2024 is 200,000 units, and the Fengyun series will focus on hybrid products. Currently, Chery classifies the plug-in hybrid version of its fuel vehicle models under the Fengyun series, with the first model Fengyun A8 already on the market, equipped with the Kunpeng C-DM hybrid system, with excellent performance in terms of range and price competitiveness.

According to reports, Chery’s Fengyun series will launch various models in 2024, including A8 Pro, A9, T6, T8/T8 MAX, T9, T10, T11, covering different market segments. In addition, there are JETOUR’s hybrid products and models under the Xingtu brand, all contributing to Chery’s sales. Chery’s performance in overseas markets cannot be ignored. Chery has been the top Chinese brand for passenger car exports for 21 consecutive years. In 2023, Chery exported 937,148 vehicles, a 101.1% increase from the previous year, with a total global user base of over 13 million, including 3.35 million overseas users. Chery, which has been slightly late to the new energy field, is making a strong push in 2024 with the launch of the Kunpeng Super Energy Hybrid C-DM, redefining hybrid technology and demonstrating its strong technical expertise to the market once again. We look forward to its performance at the end of the year. GAC Group achieved a total sales volume of 2.505 million vehicles in 2023, a year-on-year increase of 2.92%. In 2024, GAC Group aims to challenge a 10% sales growth, aiming to achieve a sales volume of 2.75 million vehicles. In 2023, Changan Automobile sold 2.5531 million vehicles, an increase of 8.82% year-on-year. Both the sales of independent brand new energy vehicles and overseas markets reached a record high. The group’s target for 2024 is to challenge 2.8 million vehicles. Independent brands are expected to achieve sales of more than 1.1 million vehicles, an increase of more than 22% year-on-year. Looking at the sales structure of GAC Group, thanks to the rise of independent models such as GAC Trumpchi and GAC Aion, the annual sales of independent brands in 2023 reached approximately 890,000 vehicles, a record high, an increase of nearly 40% year-on-year. At the 2024 Guangzhou Auto Show, GAC Aion stated that it aims to challenge a sales target of 800,000 vehicles, with an increase of 66.6%. From the perspective of product layout, Aion’s new models, Aion S, Aion Y, and Haobo HT, will be key targets for the sprint. In addition, one of the effective methods to increase sales is to launch new cars, reduce prices, and improve the car experience. Haobo brand has announced in a high-profile manner that from January 1st to March 31st, customers who purchase Haobo models can enjoy free lifetime charging services. If combined with the launch of multiple new models by GAC Aion, the target of 800,000 vehicles in 2024 is promising. In Changan Automobile’s sales structure, the sales of independent brands reached 2.204 million units, new energy vehicle sales reached 750,000 units, and overseas market sales reached 480,000 units.

In terms of its brands, Changan Yinqi sold 1.25 million units, Changan Qiyuan sold 250,000 units, Shenlan Automobile sold 280,000 units, Avita sold 90,000 units, Changan Kaicheng sold 230,000 units, and overseas sales reached 480,000 units. Looking at the new car layout, in the first quarter of 2024, Changan Hunter extended-range pickup began delivery, Shenlan G318 was launched in the second quarter, and in the third quarter, Avita’s second SUV E15, Shenlan C857, and Changan Kaicheng G393 will be unveiled. In the fourth quarter, Changan Qiyuan CD701, Avita mid-size coupe E16, Changan Qiyuan C798, and Changan Mazda J90A will join the product lineup. At the 2024 Changan Automobile Global Partners Conference, Changan stated that Changan Qiyuan is the new cornerstone of future development. In terms of product planning and sales targets, Changan Qiyuan plans to create 3 products with sales of 300,000 units, 2 products with sales of 200,000 units, forming a classic product combination of the A series, Q series, and E0 series, and achieving a scale of 1.2-1.5 million units by 2030. In addition, Changan’s latest SDA platform architecture will be first used in Changan Qiyuan, and the first product CD701 will meet with everyone in October this year and will be officially launched later this year. It is reported that including CD701, Changan will have 8 new energy products launched on schedule this year. In addition, Changan also announced that the group’s sales target for 2025 is 3.5-4 million units; by 2030, the group’s sales target is 5 million units, and it aims to become a world-class automobile company.

Let’s take a look at Geely Auto. The total sales volume for the full year of 2023 was 1.6865 million units, an increase of about 18% year-on-year. This exceeded its set sales target of 1.65 million units for the full year of 2023 and set a new historical high. In 2024, Geely Auto Group will set a target of 1.9 million units, with new energy vehicle sales growing by over 66%. In addition, in 2024, Geely will launch advanced new technologies and achievements such as a new pure electric architecture, new electric drive, CTB chassis, self-developed batteries, AI intelligent cockpit, urban commuting NOA, satellites, and other advanced three-electric and intelligent technologies to continue deepening the transformation of new energy and intelligence. Since the rapid rise of Geely’s Galaxy series products, the sales of Geely’s new energy vehicles have also seen rapid growth. In the past 2023, the cumulative sales of Geely’s new energy vehicles reached 487,400 units, an increase of over 48% year-on-year, with a market penetration rate of over 40%. Therefore, its sales growth target for 2024 is to exceed 66%. Next, with the arrival of the heavy new cars such as Lynk 08, Ji Ke 007, and Galaxy E8, Geely’s new energy main line is becoming clearer. However, it is worth noting that the competition in the new energy vehicle market is becoming increasingly fierce. Geely, which aims for sales of 1.9 million units in 2024 and a growth of over 66% in new energy sales, must continue to improve and be prepared for a protracted battle. In 2023, Great Wall Motors sold a total of 1.23 million vehicles, achieving 77% of its sales target of 1.6 million vehicles. Sales of new energy vehicles reached 262,000, a 98.74% year-on-year increase, thanks to a low base. Overseas sales reached 316,000, an 82.48% year-on-year increase. In 2023, Great Wall Motors failed to achieve its vision of “squatting and jumping.” In 2024, Great Wall Group set a sales target of 1.9 million vehicles, with brands such as Haval, WEY, Tank, Great Wall Pickup, and Ora forming a matrix to jointly challenge this sales target. They also plan to continue deepening their presence in the new energy field to find sales growth points. In 2023, the ambition of NIO and Xiaopeng seems somewhat conservative. After experiencing a brutal baptism in 2023, some new carmakers have disappeared from people’s sight as others forge ahead. In 2024, various new carmakers will hand in their reports from last year and set new sales targets for the new year. In 2023, Ideal Motors achieved its sales target and is confident in its future prospects, so it has set a goal of doubling its annual delivery volume to 800,000 vehicles in 2024, with monthly deliveries of 100,000 vehicles, monthly deliveries per vehicle reaching 30,000, and the number of supercharging stations reaching 2,000. Although the sales target seems challenging, there is a basis to follow.

From the perspective of product launch, in 2024, Ideal Cars will have 8 products, including the three old models Ideal L7/L8/L9, which will be upgraded in March, and the first pure electric MPV Ideal MEGA, which will also start delivery at the same time. In addition, Ideal L6 will be launched in April, entering the market below 300,000, and three pure electric models will be launched in the second half of the year. By the end of 2024, Ideal Cars will have 4 extended-range SUVs and 4 pure electric models, with a total of 8 models. Ideal Cars’ goal of challenging 800,000 deliveries for the entire year in 2024 cannot be said to be completely without a chance. However, Ideal’s target of 800,000 vehicle sales is not without pressure. On the one hand, the competition in the extended-range market is fierce, and the impact of this dark horse is very strong. On the other hand, Ideal is entering the pure electric market, and the competitive strength of MEGA’s competitors is also very strong, so it will not be easy to seize the market. If Ideal Cars’ sales target is somewhat aggressive, then WENJIE’s ambition is even greater. According to the 2024 sales target conveyed to suppliers by WENJIE, WENJIE Cars plans to deliver 600,000 new vehicles for the entire year, more than 6 times the total sales in 2023. Although the new WENJIE M7 has been greatly successful with the blessing of Huawei’s smart selection technology, and the WENJIE M9 broke through 10,000 units in 2 hours after its launch, the momentum of WENJIE has shocked the industry, but the 6-fold sales target still makes people “nervous.” In terms of product planning, in addition to the WENJIE M9, WENJIE also plans to launch a new SUV model, WENJIE M8. Currently, the hot-selling model for WENJIE is the new M7. If the popularity of this model fades, there is a question mark on whether the sales can continue to grow. Relatively speaking, NIO and XPeng are more practical. NIO has set a sales target of around 230,000 units, with an average of 20,000 units per month to complete the task, even lower than the goal of “30,000 units per month” in 2023. In 2023, NIO completed 64% of its sales target, and Li Bin admitted that last year was a challenging year for NIO. The overall performance did not meet the expected goals, and there is a need to learn lessons and improve organizational capabilities.

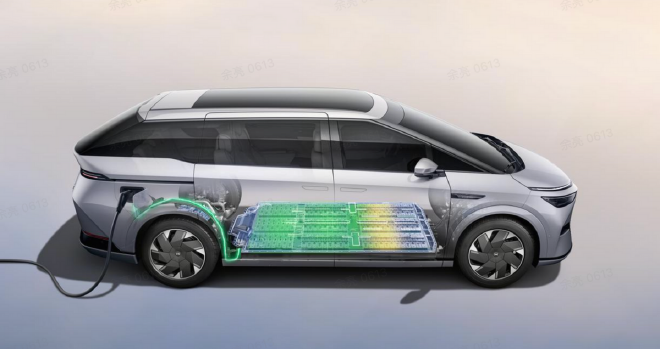

In an internal letter, Li Bin clearly stated NIO’s three high-priority tasks for 2024: ensure long-term investment in core key technologies, maintain a leading edge in technology and products, and ensure timely and high-quality delivery; ensure that sales and service capabilities can cope with fierce market competition, and quickly convert sales capabilities into sales volume; ensure the R&D of three brands and nine core products according to schedule. Looking at NIO’s sales target for 2024, the relatively low target seems to lack confidence. However, upon closer examination of NIO’s 2024 product plan, lowering expectations is actually its most realistic and pragmatic move. NIO’s Li Bin has stated that the most important capability to be improved in 2024 is still the system capability, with relatively few new car launches planned for the market, only continuing to sell the current 8 models, with the sub-brand Alpines planning to launch the first SUV in the second half of the year, providing an opportunity for NIO to enhance its system capability. Xpeng’s sales target for 2024 is 280,000 vehicles, twice the full-year sales in 2023, with an average monthly sales volume of 23,000 vehicles, which is practical. Since the organizational restructuring and the launch of the Xpeng G6, Xpeng has emerged from a low point and has shown a clear upward trend. In terms of products, Xpeng launched the MPV model Xpeng X9 at the beginning of the year, as the flagship model under the SEPA 2.0 architecture. The Xpeng X9 is the first large seven-seater model to break the boundaries of the MPV category, achieving comprehensive innovation from product design to smart driving technology to comfort and safety.

Recently, Xiaopeng Motors has launched new products again. The 2024 Xiaopeng P5 is officially on the market, and the 2024 Xiaopeng G9 is also available for sale, with many new cars helping to increase Xiaopeng Motors’ sales. In addition, in 2024, Xiaopeng will release 3-4 new cars. The medium-sized sedan with the codename F57 will succeed the Xiaopeng P5, the A-class SUV with the codename F61 will succeed the Xiaopeng G3, and the A+ class sedan with the codename F59 will further expand Xiaopeng’s product line, overall positioning the price more affordably. Zeropao Motors aims to reach 200,000-300,000 vehicles in 2024, with a month-on-month growth rate of 42.9%-114%. Considering Zeropao Motors’ sales performance in 2023, combined with the strategic cooperation agreement with Stellantis Group, Zeropao Motors will also launch an overseas expansion plan this year, maintaining a monthly sales volume of around 20,000 vehicles is not difficult. Finally, looking at the “second-generation” of traditional car companies, Shenlan Motors’ target sales volume for 2024 is 450,000 vehicles, an increase of 221% compared to 2023, with an average of 37,500 vehicles needing to be sold each month, which is a significant challenge. To achieve this, Shenlan plans to launch 2-3 new car models in 2024, so that each product can become a popular model in the segmented market. In addition, Deep Blue is also launching several innovations in the field of technology, including super range extension technology and Golden Bell battery, to enhance the competitiveness of its models. As a new energy brand under Geely Group, JiKe cars are developing rapidly, with a sales target of around 230,000 units in 2024, an average of 20,000 units per month. It is understood that JiKe will launch at least two new models, including the JiKe CX1E SUV based on JiKe 007 and a station wagon. Smart car’s sales target for 2024 is 120,000-130,000 units. Based on the product sales structure in 2023, the sales of Smart LS6 accounted for nearly 60% of the total sales of the Smart brand, indicating that Smart L7 and LS7 urgently need to step up their efforts. In 2024, there is still pressure to achieve monthly sales of over 10,000. In summary, industry insiders believe that the performance of traditional car companies’ new energy brands will be better in 2024, because the current best-selling new energy vehicles in the market are mainly plug-in hybrids and range extenders, while new forces are mainly focused on pure electric models, facing greater competitive pressure. From the sales targets of car companies in 2024, some are relatively rational, but some are very aggressive, with little hope of achieving them. Of course, sales targets are just hopeful expectations for the new year. Automakers should focus on how to establish themselves in the competitive market. Only by increasing scale and market share can they avoid being eliminated.