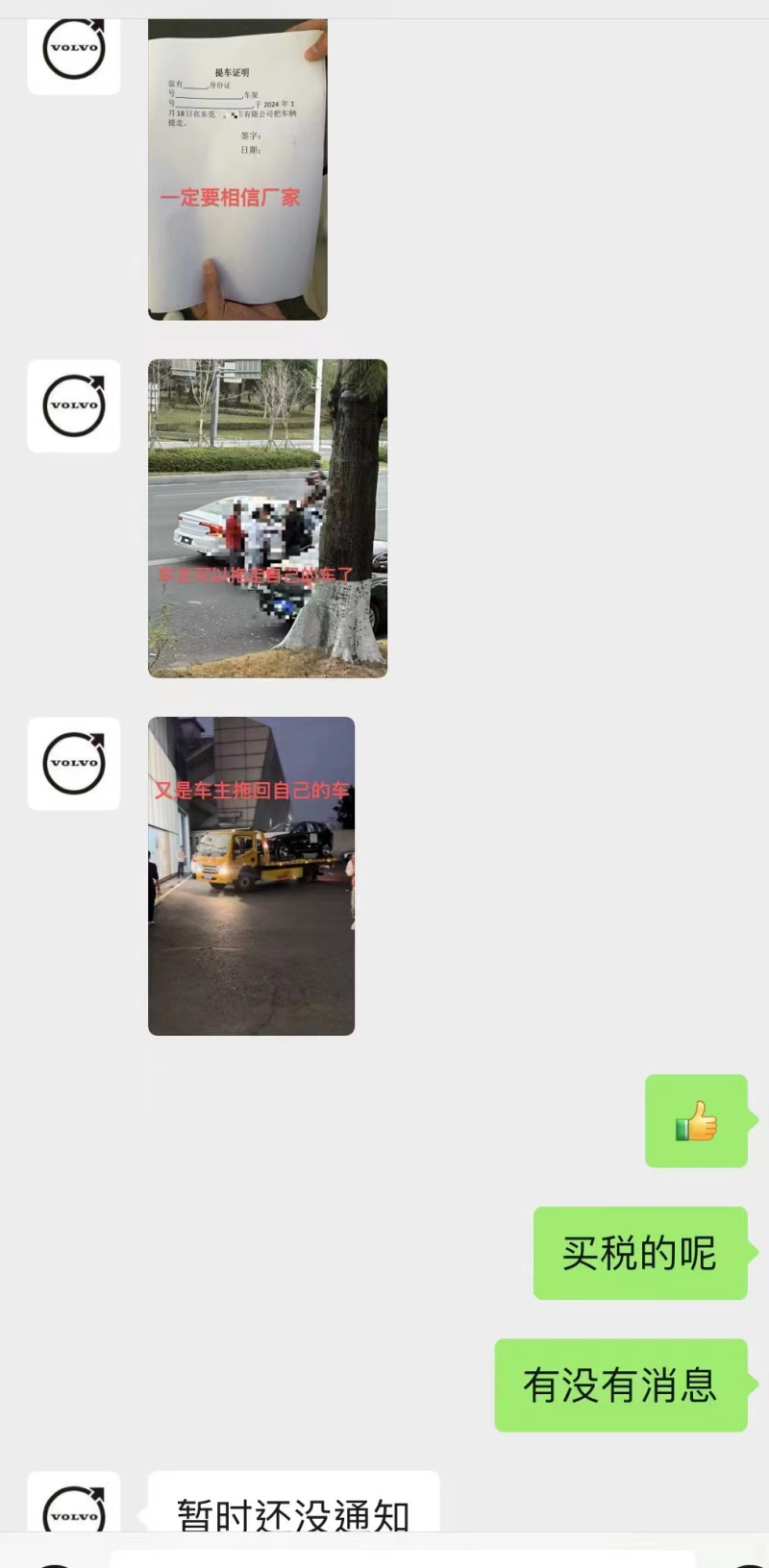

Guangdong Yongao Investment Group Co., Ltd., a car dealer, recently “exploded”, and its 4S stores of multiple brands have been closed. A large number of car owners are currently seeking justice, and local authorities have intervened in the investigation. Banks towed cars to recover debts late at night, and some manufacturers promised solutions. Recently, several Guangdong Yongao stores in Dongguan have temporarily closed, with the display cars being cleared out. An employee revealed, “Guangdong Yongao Investment Group Co., Ltd., with over 80 car brand stores, is in an emergency situation, facing bankruptcy and liquidation risks. The Nan Cheng store has 28 undelivered cars and 35 cars waiting for registration without paying purchase tax.” Videos and photos circulating online show that several vans were towed away from the stores with sales vehicles on the night of January 17th. According to financial news reports, the store had previously mortgaged the vehicles to the bank, and the bank sent tow trucks to tow the cars away for asset preservation. The next day, bank staff were stationed in the store to prevent customers from towing cars away without permission.

After the store involved was temporarily closed, consumers faced problems such as being unable to pick up their cars, lack of vehicle registration certificates, and the store’s failure to pay purchase taxes on behalf of the car owners. Some manufacturers and local government departments have intervened to address the above issues, and the official response from Yongao has not yet been made public. According to Netease Auto, insiders revealed that Yongao Group suddenly faced significant financial risks, and the group’s accounts were frozen. Rumors suggest that Yongao Group owes its employees over 40 million yuan in wages, and about 120 million yuan is involved in cases where prospective car owners have paid but not received their registration certificates. Some main OEMs have recently learned of the account freeze issue and have arranged to take away the inventory cars overnight, allowing users to pick up their cars at other delivery centers. Blue Whale has learned that some car owners mentioned the cars they purchased on the day the bankruptcy news broke. A car owner who purchased a car at a Yongao 4S store revealed that the salesperson drove her car directly to her yesterday, but the spare key, registration certificate, and other documents are still at the bank. In addition, some car owners have reported that some brand manufacturers, such as Volvo, have offered solutions for picking up the cars, but the issue of unpaid purchase taxes has not yet been addressed.

Guangdong Yongao official information shows that the company was established in 1997 and is a 4S modern automobile trading group company that integrates car sales, maintenance services, and spare parts supply. It currently has more than 40 well-known brand 4S car dealerships in Shenzhen, Dongguan, Zhuhai, Xiangyang, Jining, and other places in Guangdong, Hubei, and Shandong, representing brands such as Honda, Audi, Volkswagen, Mercedes-Benz, BMW, Volvo, and Wanjie. It was previously reported that Yongao was once among the “top 100” in the country, but it has not appeared in the top 100 dealer group rankings in the past two years. Tianyancha information shows that the company directly holds shares in 82 enterprises, 10 of which have been deregistered or revoked. In addition, the company has 13 debt-related information and 13 operating debts, involving an amount of 111 million yuan. Previously, the company’s investments in Dongguan, Zhongshan, Huizhou, and other places had some equity in a state of pledge. In fact, Guangdong Yongao has long had signs of bankruptcy. The Dongguan Sunshine Hotline’s governance platform shows that in 2023, several employees complained that Yongao Group owed them wages, and consumers also reported that Yongao’s 4S stores had delayed delivery several times.

On the morning of the 19th, a Blue Whale reporter called the relevant department to inquire about the progress of handling the situation. The staff of the Liaobu Branch of the Dongguan Market Supervision Administration responded that a part of the consumers had submitted complaints, and the government had set up an investigation team. The Liaobu authorities also stated that there are a total of 11 4S stores of Yongao in the area, and they are currently not operating normally. They are dealing with issues related to vehicle delivery and employee wage arrears, and are still in the process of registration and investigation, waiting for further instructions from the city. It is worth mentioning that a netizen revealed that the Lotus store in Liaobu has been taken over by the manufacturer. When the Blue Whale reporter sought verification from the Liaobu government staff and the person in charge of the Lotus store, they did not receive a clear response. According to reports from Daily Financial News, the final solution to this matter will be provided by the Guangdong Yongao headquarters, and the expected time for its announcement is from January 20th to January 25th. In the first half of last year, over 50% of dealers suffered losses, and less than 40% completed their annual sales tasks. The explosion of Guangdong Yongao may be one of the epitomes of the pressure faced by traditional domestic dealers. A senior industry insider said that in the past, in an incremental market, car dealers had a very easy time making money. At that time, the operation of 4S stores was more resource-oriented, “just desperately getting cars, without considering operational efficiency and personnel productivity”. Moreover, most of the costs of dealer car purchases come from the manufacturer’s supply chain financing, pledging vehicle certificates to banks for loans, etc. Once dealers fall into blind expansion, they are bound to face problems such as poor management and the breakdown of the capital chain. In June 2023, a large group that was once known as the “king of 4S stores” and once had over a thousand car dealers withdrew from the market – the days of the industry making easy money are gone and will not return. In the past few years, the survival difficulties of dealers have gradually become apparent. In 2022, the number of 4S stores that went offline reached 1757, equivalent to an average of 4 dealers going offline every day. According to the “Report on the Survival Status of National Automobile Dealers in the First Half of 2023” previously released by the China Automobile Dealers Association, the proportion of car dealers operating at a loss reached 50.3% in the first half of last year, holding steady at 14.5%. For the first time in nearly five years, the proportion of losses exceeded half. The key word in the 2023 car market is “price reduction,” and dealers’ profits have been greatly squeezed in the price war in exchange for sales volume. The report shows that in the first half of 2023, the gross profit margin of new car sales for dealers dropped significantly. From the perspective of profit structure, the proportion of new car sales profits dropped sharply from 19.7% at the end of 2022 to 4.9%. In addition, industry insiders revealed that manufacturer rebates, subsidies, and incentives are an important source of traditional dealer income. The survey by the China Automobile Dealers Association shows that only 37.4% of dealers completed their annual tasks, and 23.2% of dealers still have a task completion rate of less than 70%. This means that over 60% of dealers will suffer significant losses in this part of their income. It is worth mentioning that, when analyzing the recent bankruptcy event, the above-mentioned industry insiders mentioned that Yongao represented a large number of joint venture brands, which may also be one of the reasons for its business pressure. From the results of the survey in the first half of 2023, the losses of joint venture brands were relatively severe, with the proportion of dealers operating at a loss for joint venture brands and independent brands being 51.3% and 48.0%, respectively. The main reason for the high operating pressure of joint venture brands in 2023 is the impact of independent new energy vehicles, which has led to a rapid decline in the market share of joint venture brands relying on fuel vehicle business. Is embracing new energy the cure-all? Insiders say: Dealers must transform or die Insiders predict that a third of 4S stores may close in the next three years, with more than 30,000 car dealerships nationwide now transforming or closing at an average rate of 10 per day. In response to market changes, abandoning heavily loss-making brands and turning to new energy vehicles is the consensus for many dealer groups. Data from the 2023 China Automobile Dealers Conference revealed that new energy vehicles accounted for 45% of the new stores opened by the top 100 dealers in 2022, up from just 15% the previous year. However, embracing new energy is not a cure-all, as most new energy brands are still in the red. According to a 4S store manager, changes in car owner consumption habits and the emergence of new energy direct sales stores have affected the operation of 4S stores. Young consumers tend to prefer convenient commercial areas for car viewing, and direct stores that can cover the commercial area at a cost of tens of millions per year will not easily go out of business. Under the direct sales model, delivery and after-sales service are handled by the car factory itself, with no middlemen making a profit on the price difference, and the connection between car owners and manufacturers is deeper. However, the cost of building standalone stores by manufacturers is extremely high, and the traditional dealer model that has accumulated a large number of channel resources will not be replaced. Creating new models for the sale of new energy vehicles and improving after-sales service levels are important directions for dealer transformation. In fact, the gross profit from after-sales service at 4S stores is much higher than that from front-end sales. Taking the 2023 semi-annual report of Meidong Automobile as an example, the proportion of new car sales and after-sales service in Meidong’s business in the first half of 2023 was around 86.1% and 13.9%, respectively, with gross profit margins of 0.2% and 50%, respectively. Therefore, the money is made in after-sales, and the competition is also in after-sales. In addition, the above-mentioned senior industry insiders added that, due to the rising costs of rent and personnel, dealers must fully consider the store’s cost-effectiveness, labor effectiveness, capital efficiency, and traffic efficiency. For example, big stores can be exchanged for small stores; for example, if there are 100 people, only 50 people need to work, and 70 people’s wages can still be paid. Cover image source: Visual China.