Tong Mei, a little bit of finance Editor: Yuanshuo “Wait-and-see faction” wins again! On January 12th, Tesla China announced a price reduction for the Model 3 and Model Y. The new version of the Model 3 has been reduced by 15,500 yuan (2150$), and the long-endurance version of the Model 3 has been reduced by 11,500 yuan (1600$); the price of the rear-wheel drive version of the Tesla Model Y has been reduced by 7,500 yuan (1040$), and the price of the long-endurance version of the Tesla Model Y has been reduced by 6,500 yuan (900$). In fact, starting from New Year’s Day this year, Tesla has offered preferential policies, announcing the launch of insurance subsidies and low-interest financial policies for the Model 3 rear-wheel drive in stock, with a total discount of 22,000 yuan (3060$). This time, it is a direct price reduction, attempting to directly stimulate sales. As a leader in the electric vehicle industry, every move of Tesla is highly anticipated. At the beginning of 2023, Tesla threw out a price reduction plan, which then led to other car manufacturers following suit, and the Chinese car market ushered in a comprehensive price reduction trend. In the beginning of 2024, with the price reduction, will Tesla still continue to lead the entire car industry like a catfish? 2023 can be said to be a year of accelerated reshuffling in the car market: the momentum of new energy has not changed, accelerating the replacement of fuel vehicles; the new energy vehicle market, with some falling, some adjusting, and some accelerating entry. Bleeding on one side, triumphantly celebrating on the other, this magical situation will surely continue in 2024. Tesla, which once stood still, has gradually turned from an observer to a participant. Pressure in 2023

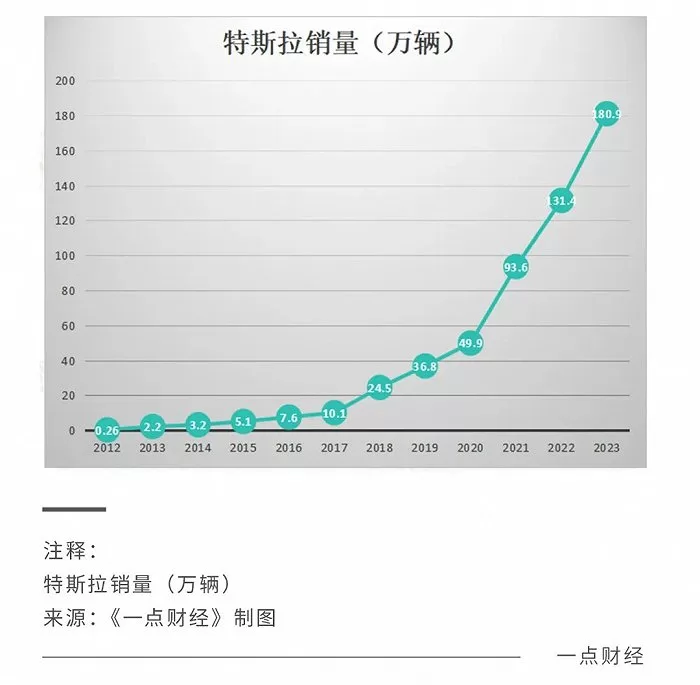

In 2023, Tesla faced pressure to grow. The company barely met its target of 1.8 million vehicles. Its global production and delivery report for 2023 showed that Tesla produced approximately 1.85 million electric vehicles and delivered about 1.81 million, representing a 35% and 38% year-on-year increase, respectively. Tesla once again topped the global pure electric vehicle delivery list.

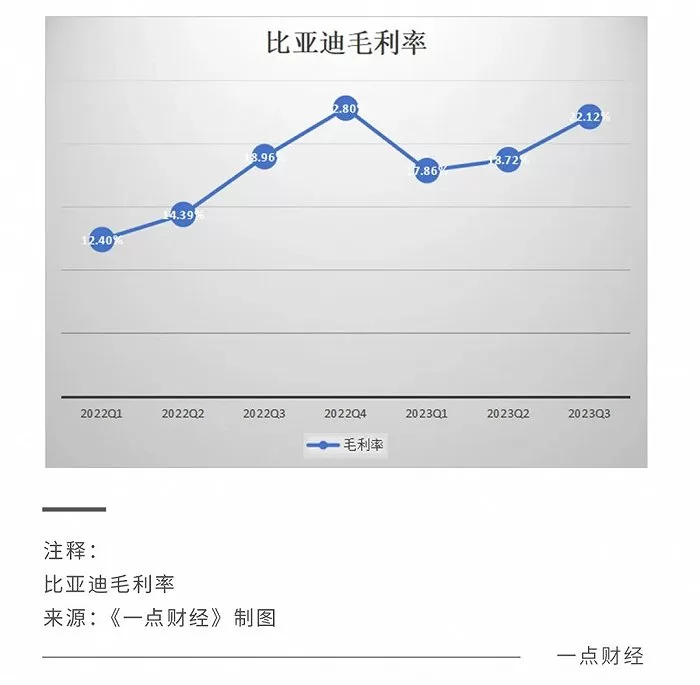

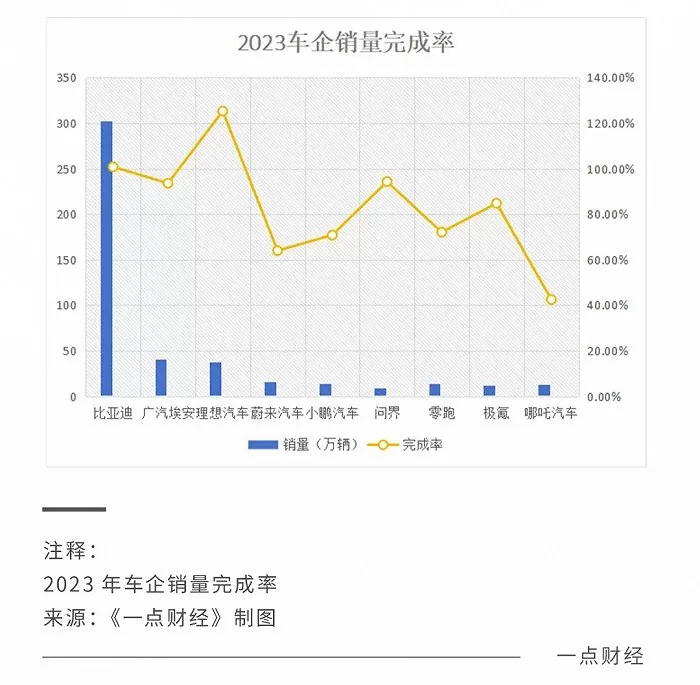

But overall, the situation facing Tesla is not optimistic. In 2023, Tesla’s sales growth fell from 87.6% in 2021 to 40.4% in 2022, further dropping to 37.7% in the first two weeks of 2024. Tesla’s market value has evaporated by more than $94 billion due to concerns about the company’s stagnant growth. Demand growth slowing down has become a “sword of Damocles” hanging over all car manufacturers. In the Chinese market, for example, according to statistics released by the China Association of Automobile Manufacturers, domestic car sales in 2023 reached 25.184 million units, a 6% increase compared to the previous year, but not at a historical high. All manufacturers have to face the fact that the Chinese car market has entered a period of slow growth. Last year, with Tesla leading the way, the automotive industry saw a year-long price war, from new energy vehicles to fuel vehicles, all in pursuit of a little “slow growth.” But in any price war, there are no clear winners. Data shows that Tesla’s gross profit margin declined in 2023, with the first three quarters at 19.3%, 18.2%, and 17.9%, respectively. According to media reports, after this price reduction, the profit per vehicle was less than 20,000. “We are forced to reduce prices. After the prices come down, everyone loses money and we make only a small profit. If the monthly sales volume falls below a certain level, it will result in a loss, so we must scale up and ensure sales volume,” said Li Yunfei, general manager of the BYD brand and public relations department, at the 2023 Guangzhou Auto Show, expressing helplessness about the price war. In terms of the popularization of new energy vehicles, it is still in the early stage, but with the slowing demand growth, the development of the new energy vehicle industry has been accelerated, moving from the early stage of “hundred flowers bloom” and each showing their strengths, to the later stage dominated by bloodshed and elimination. In the early 2024, Tesla once again resorted to the “killer move” of price reduction, attempting to replicate last year’s growth miracle. Last year, amid protests from old car owners, Tesla’s price reduction quickly paid off, with data from the China Passenger Car Association showing that Tesla’s cumulative retail sales in China from January to March 2023 reached 137,000 units, a 26.9% increase from the previous year. In the top 15 retail car companies, only Tesla and BYD resisted the market’s downturn and achieved increased sales. Lowering prices can prompt some people to buy quickly, while others may hesitate. After Tesla announced the price reduction, the market’s reaction varied. However, the price reduction is still the best way to stimulate sales. Data shows that from January 1st to 8th, 2024, Tesla sold 32,000 units. From the 8th to the 14th, they sold 74,000 units, doubling the sales and returning to the top three in new energy vehicle brands. 2023 was a year of change in the car market. Tesla’s leading position was challenged, traditional car companies like BYD showed their strengths, and new forces emerged. In 2023, Tesla’s lead in the electric car market was reduced. In 2022, Tesla sold 1.31 million units, while BYD sold 910,000 electric cars, a difference of 400,000 units. In 2023, Tesla sold 1.81 million, while BYD’s sales increased by 72.8% to 1.57 million, a difference of 240,000 units. BYD’s offensive continues to strengthen. In the third quarter of 2023, Tesla led BYD by 4,000 units in electric car sales. In the fourth quarter of 2023, Tesla sold 485,000 units, while BYD sold 526,000 units, surpassing Tesla. Although the prices of the two sides compete only slightly overlap, the impact on brand momentum is undeniable. The impression of “electric car first” established by Tesla is beginning to be broken in the first half of 2023 with the launch of the U8, making consumers truly look up to its million-dollar price and becoming a key step in the transformation of its brand image. In the same year, the helplessness of catfish and the evolution of sardines are taking place simultaneously. When Tesla reluctantly lowered prices, new forces such as NIO and Xpeng made up for the supply chain management, while traditional car companies such as BYD either independently researched or cooperated with Huawei to improve their intelligence. Tesla, which waves the flag of price reduction, is supported by self-developed technology, marketing model, and supply chain capabilities, and has a cost advantage. When Tesla lowered prices before, Tao Lin, vice president of external affairs at Tesla, explained in a Weibo post: “Behind the price adjustment of Tesla, there are countless engineering innovations, which is essentially a unique law of cost control…insisting on cost-based pricing.” Indeed, Tesla’s gross profit margin has always been at a leading level in the industry. The 2022 financial report shows that Tesla’s gross profit margin in 2022 was 25.6%, while NIO, Xpeng, Li Auto, and Zeekr had gross profit margins of 19.4%, 11.5%, 10.4%, and -15.4%, respectively. In 2023, the new forces that stumbled have been quietly fighting over the supply chain and gradually making up for the course of cost optimization. The financial report shows that Ideal Auto achieved revenue of 34.68 billion yuan in the third quarter of 2023, a year-on-year increase of 271.2%; net profit was 2.81 billion yuan, marking the fourth consecutive quarter of profitability for Ideal Auto. At an earnings conference, senior management at Xpeng revealed that “reducing costs and increasing efficiency” is the current main task. He Xiaopeng, chairman of Xpeng, expressed confidence in achieving a 25% overall cost reduction by the end of 2024 and achieving a balanced budget in 2025. Tesla’s opponents are not only new forces, but all car manufacturers who lack experience in supply chain management and have high investments in technology research and development and production. Unlike the new forces, BYD, although also suffering from a price war, still has an excellent gross profit margin, even better than Tesla. Under the driving force of economies of scale, “sardines” have become or may become the new “catfish.”

In the face of fierce market competition, “catfish” also needs to transform into “sardines”. While other brands are focusing on configurations and luxury to better meet consumer needs, Tesla continues to emphasize the overall user experience, sticking to Musk’s original positioning as a “technology brand”. But technology can only be more widely accepted if it is better perceived by people, just as in the case of smartphones, and it will be the same in the car market. Under the impact of domestic manufacturers, although Apple is still in the lead, its position is no longer as stable, and the shadow of domestic smartphone manufacturers is increasingly visible. Why wouldn’t the car market be the same? New landscape In 2023, along with a year-long price war, a new competitive landscape is forming. Starting from the impact of policies in 2010, to the vigorous development driven by capital in 2015, and then the rapid growth driven by the market, in recent years, China’s new energy vehicle market has formed a situation of interweaving old and new forces, with “a hundred schools of thought contending”: “small players” stand their ground, traditional car manufacturers and entrepreneurs make efforts, and companies like Huawei and Xiaomi accelerate their entry. In 2023, the situation of the past few years is gradually being broken. Traditional car manufacturers, represented by GAC, are gaining momentum, and new forces are reshuffling the old and new. In this year, GAC Aion, a traditional car manufacturer, achieved good results. With the resource advantages of GAC, GAC Aion’s cumulative sales in this year exceeded 480,000 units, a year-on-year increase of 77%, making it “the fastest pure electric brand and new energy brand to surpass one million units globally, and also the fastest car brand to surpass one million units globally”. At the beginning of 2024, according to media reports, GAC Group plans to list GAC Aion in Hong Kong, with China International Capital Corporation and Huatai Securities responsible for related matters, planning to raise $1 billion. For GAC Aion, this is both an independent challenge and a proof of achievement.

This year, Huawei and Xiaomi, which have entered the automotive industry, have caused a stir. With the support of Huawei, WeRide delivered less than 100,000 vehicles in 2023, but gained a high level of discussion. In 2024, it set a new target of 600,000 vehicles. Xiaomi, which has been making cars in recent years, also made a big splash at the end of 2023. Overall, after the price reduction in 2023, the competition in the automotive market will become more intense. According to data released by the China Passenger Car Association, China’s cumulative retail sales of new energy passenger vehicles in 2023 reached 7.74 million, a year-on-year increase of 36.3%, with a penetration rate of 35.7%, an increase of 7.7 percentage points from 2022. It is estimated that the penetration rate of new energy vehicles will reach 43% in 2024 and may exceed 50% in 2025. This indicates that there is not much time left for traditional fuel vehicles in the market, and the window of opportunity for new energy vehicles is getting shorter. The automotive industry is an industry with extremely prominent economies of scale. The larger the scale, the better the cost optimization, and the more competitive in terms of price and product strength, thus further expanding the scale. At the same time, this also means that the later it is, the higher the cost of breaking the situation, and the smaller the opportunity. On one side, there is a market with slow growth, and on the other side, there are new players constantly entering. This is destined to be a fiercely competitive battle, testing technological advancement, production capacity, and cost control, especially as the economic growth slows down and consumer willingness to spend decreases. Recently, there has been a popular joke on the internet, “if you don’t work hard now, you’ll only be able to buy a BBA in the future”, mocking the fact that domestic brands are launching high-end car models priced between 500,000 and 1 million. Overall, with the impact of price cuts and economies of scale, the new energy vehicle market is transitioning from a “dumbbell” shape to a “spindle” shape, moving from high and low ends to the middle price range. This is the inevitable replacement of fuel vehicles by new energy vehicles. The mainstream price range of fuel vehicles is 100,000 to 200,000, which is the most competitive price range and also the most testing for the technological, cost control, and product capabilities of car companies. According to this prediction, companies that can still stand out in fierce competition in the future can be divided into two types: either they have outstanding comprehensive capabilities, deep technological, product, and manufacturing accumulations, and competitive prices, such as BYD and GAC Aion; or they have unique market positioning and product positioning, achieving brand accumulation in a certain niche area, such as the original “dad car” ideal. Bleeding on one side, singing high on the other, only the wheels of new energy vehicles roll forward firmly.