Tesla supplier annual revenue of 2.3 billion, now second time going public. How much does it cost to replace a Tesla bumper? According to official data, replacing the Model 3 bumper in the Chinese market costs about 4000 yuan (560$). The bumper, as the outermost covering component, is undoubtedly prone to damage. Therefore, whether it is original factory or repair replacement, bumper parts are a good business. Shanghai Yousheng Aluminum Industry Co., Ltd., as one of Tesla’s suppliers, mainly supplies threshold beams, bumpers, and battery tray series products. In addition to the Tesla supplier label, behind Yousheng’s stock, there is the inspirational story of former professional manager Luo Shibing, from general manager to controlling shareholder of IPO company, which has also increased his net worth from 430,000 yuan (59780$) to 6.9 billion yuan.

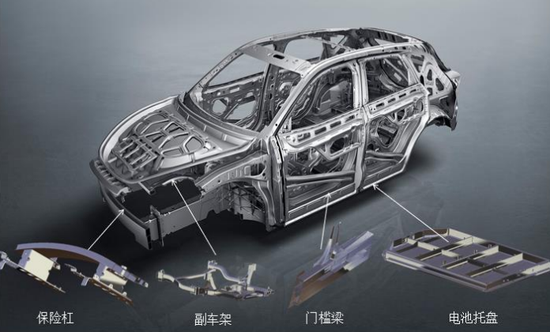

Tesla and NIO are major customers with an annual income of 2.3 billion. A car consists of thousands of components, including braking systems, driving systems, and body structural parts, all of which require many component products. The main differences in components between new energy vehicles and fuel vehicles are the three electric systems: motors, batteries, and electronic controls, as well as additional products such as battery trays. With the continuous development of the new energy vehicle industry, the “blue ocean” of new energy vehicle components has also emerged. Yousheng shares mainly focus on the field of new energy vehicles, with main products including threshold beams, battery trays, subframes, and bumpers.

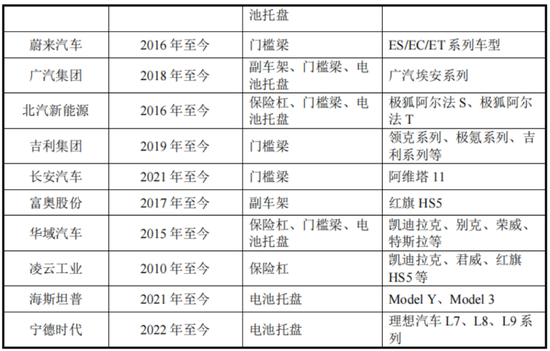

In the automotive industry, parts suppliers are divided into different levels, forming a pyramid structure of whole vehicle manufacturers, first-tier parts suppliers, second-tier parts suppliers, and third-tier parts suppliers. The higher the level, the higher the “value”. Whole vehicle manufacturers are at the top of the pyramid; first-tier suppliers directly supply to vehicle manufacturers and are involved in product design and development, with high involvement in the vehicle manufacturing process; second-tier suppliers mainly provide support to first-tier suppliers; third-tier suppliers are at the bottom of the automotive parts supply system, with relatively small scale. Yousheng Holdings is a first-tier automotive supplier to well-known domestic and foreign whole vehicle manufacturers such as Tesla, GAC Group, NIO, BAIC New Energy, Geely Group, as well as well-known companies such as Hengst, Fuyao Holdings, and Huayu Automotive. NIO, GAC Group, BAIC New Energy, and Tesla are Yousheng Holdings’ top five customers year-round, and Yousheng Holdings’ main products are installed in many well-known models, such as NIO ES6, ES8, Tesla Model Y, Model 3, Li Xiang L7, L8, L9 series, Hongqi HS5, Jihu Alpha S, T, etc.

Yousheng Corporation has been collaborating with Tesla since 2020, and the revenue from Tesla has rapidly increased to nearly 30%. According to the prospectus, in 2021, 2022, and the first half of 2023, the revenue from Tesla for Yousheng Corporation was 180 million yuan, 475 million yuan, and 318 million yuan, accounting for 11.94%, 20.2%, and 27.31% of the total revenue, respectively. The company is a major supplier of aluminum alloy parts for new energy vehicles in China, with long-term stable cooperation with leading global new energy vehicle manufacturers and well-known tier-one component suppliers. With advanced technology and scalable supply capabilities, the company continues to expand its customer base in the field of new energy vehicles, and has established cooperation with industry-leading customers in 2022 and 2023. Yousheng Corporation stated that there is no reliance on major customers. Thanks to the rapid development of the new energy industry, Yousheng Corporation’s revenue and net profit have also increased rapidly. From 2020 to 2022, and the first half of 2023, the company achieved revenue of 810 million yuan, 1.511 billion yuan, 2.35 billion yuan, and 1.164 billion yuan, with net profits of 56 million yuan, 129 million yuan, 233 million yuan, and 110 million yuan, respectively.

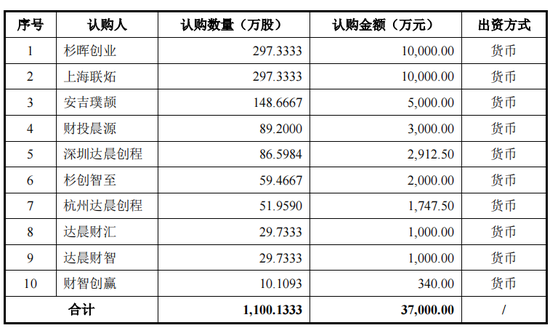

Shanshan Group, Guangdian Media, etc. invest in The capital boom is not only flowing into new energy, as a new energy vehicle parts manufacturer, Yousheng shares, while growing rapidly, also ushered in a wave of capital input. The prospectus shows that Yousheng shares added 10 new shareholders in the 12 months before the application, including Dachen Cai Zhi, Dian Guang Media, Shanshan shares, etc.

In September 2020, Jingu Lin Gang Fund and Jingu Technology Innovation Fund increased their registered capital of Yousheng shares by 70 million yuan and 30 million yuan respectively. The subscription price is 8.33 yuan (0$) per share, and the total shareholding of Yousheng shares by the two funds is 8.29%. The fund managers of Jingu Lin Gang Fund and Jingu Technology Innovation Fund are both Shanghai Jingu Intelligent Technology Investment Management Co., Ltd. The actual controller is Hou Haoxiang, founding partner of Houxue Capital. In December 2023, Hou Haoxiang was selected for the “Forbes China 2023 Top 100 Venture Capitalists” list, ranking 79th. In just the past two years, the share price of Yousheng has tripled. In December 2022, 10 shareholders including Shan Hui Chuangye, Dachen Caihui, and Shan Chuang Zhizhi became shareholders of Yousheng shares through capital increase, with a total subscription amount of 370 million yuan, at a subscription price of 33.63 yuan (10$) per share.

1. Dacheng Chuanglian Fund, Caitou Chenyuan, Shenzhen Dacheng Chuangcheng, Hangzhou Dacheng Chuangcheng, and Caizhi Chuangying Fund Manager are all Dacheng Caizhi, holding a total of 14.28% of Yousheng’s shares. The actual controller of Dacheng Caizhi is Electric Media. Shanhui Entrepreneurship and Shanchuang Zhi hold a total of 2.46% of Yousheng’s shares. The executive partners and fund managers of both are Shanghai Shanshan Chuanghui Venture Investment Management Co., Ltd., with Shanshan holding 40% of the shares and the legal representative being Gong Yi, who is the general manager of Shanshan Venture Investment Co., Ltd. and the supervisor of Shanshan Co., Ltd. Anji Pujie invested 50 million yuan to subscribe for 1.4867 million shares of Yousheng, with a shareholding ratio of 1.03%. The actual controller of Anji Pujie is stock investor Zhang Yibin. In addition, the contributors to Dacheng Chuanglian Fund include Jinlei Stock; and the contributors to Jinpu Science and Technology Innovation Fund also include Zhejiang Yongqiang.

General Manager Becomes Actual Controller Company Paid Tuition for the Children of the Actual Controller The prospectus shows that Luo Shibing and his spouse, Jin Liyan, are the actual controllers of Yousheng shares, with a combined control of 70.44% of the shares, and are a true husband and wife team. In fact, Luo Shibing and Jin Liyan are the second actual controllers of Yousheng shares. Born in 1970 in Shanghai, Luo Shibing became the assistant general manager of Shanghai Ziming Machinery Co., Ltd. in 1994; deputy general manager of CardiO Medical in October 1998; and general manager of Shanghai Jiaotong University Global Information Technology Co., Ltd. in 2000. In 2002, Luo Shibing joined Yousheng shares as the general manager, and it was this job change that allowed him to go from being a general manager to the actual controller of an IPO company.

Yu Sheng Co., Ltd. was established in 1992 as a Sino-foreign joint venture, with Xujing Industrial Company and Pacific America holding 60% and 40% respectively. In the early stages of development, the company focused on the industrial aluminum profiles business. The ownership of the company has changed several times, and the foreign shareholders of Yu Sheng’s shares have become First Meiya. In the second year of Yu Sheng Co., Ltd., in 2003, Luo Shibing took over, and the company began to experience poor management, leading to the intention of the foreign shareholders to transfer their shares. In July 3, 2003, First Meiya Fund sold 100% of its shares to Chen Guirong at a price of $60,800. Chen Guirong holds 55% of the shares of Yu Sheng Co., Ltd. and is the spouse of Luo Shibing. The company stated that the determination of the equity price is based on the company’s asset value, profitability, and growth, and is reasonable. On July 30 of the same year, Chen Guirong transferred the shares of First Meiya to American Risheng, which was established on July 21, 2003, with Zhan Qinghua as the shareholder and legal representative. Zhan Qinghua is Luo Shibing’s mother. “Considering Luo Shibing’s position as a company executive, directly revealing the true owner of the foreign-held company’s shares may make it difficult for the company’s bank loan extension application to be approved, which would directly affect the company’s ongoing operations. After considering this, Luo Shibing arranged for Zhan Qinghua and Chen Guirong to act on his behalf in acquiring the foreign-held company’s shares,” Yousheng Holdings stated. After the transfer was completed, the actual controller of Yousheng Limited changed to Luo Shibing, thus completing his transformation from a worker to a boss. Under Luo Shibing’s leadership, Yousheng Holdings gradually extended its backend deep processing business and established a strategic plan focusing on the aluminum alloy automotive parts industry, continuously expanding its market. In 2010, the company began establishing a cooperative relationship with the international renowned automotive parts first-tier supplier Webasto. In 2012, the first aluminum alloy door threshold beam was developed, and mass production began in 2015, being applied to the Cadillac model. In 2016, Yousheng Holdings provided door threshold beam parts to NIO cars, officially launching the layout of aluminum alloy car body parts for new energy vehicles. In addition to Luo Shibing and the couple Jin Liyan, many of Luo Shibing’s relatives hold shares or work in the company. The elder brother of Luo Shibing’s spouse, Yang Xiaoling, indirectly holds 0.28% of the shares; Luo Shibing’s daughter, Luo Chu Jia, indirectly holds 0.09% of the shares; Luo Shibing’s nephew, Luo Deng, serves as a director in the company.

Although Luo Shibing allowed Yousheng shares to grow rapidly, Yousheng shares have engaged in irregular behavior such as fund borrowing, using personal accounts to collect funds, and paying for their children’s education. Before 2020, Jin Liyan used Yousheng shares’ funds and paid interest on the fund use of 65,200 yuan (9060$). However, because it was not within the reporting period before 2020, information such as the amount and time of use was not disclosed. In 2020, Yousheng shares borrowed 2.6 million yuan from controlling shareholder Zesheng Trading for liquidity needs, and Jin Liyan used a personal account to collect and pay 1.9086 million yuan in customer deposits. On July 8, 2022, Yousheng shares paid 100,000 yuan (13900$) in tuition to the Future Leadership School of Lingshui Blue Bay, Hainan, for the education welfare of executive Luo Shibing’s children. The tuition was refunded on September 9, 2022, due to the cancellation of the education plan. On January 5, 2023, Jin Liyan’s brother-in-law Ke Wenming collected 101,300 yuan (14080$) in sales proceeds from customers. “If this is an employee welfare arrangement approved by the board of directors, it is not a personality confusion. If it is not an employee welfare arrangement, it is a personality confusion. If it is determined to be a personality confusion of the company, it will affect the company’s normal listing. Because it will affect the company’s independence in finance, business, and personnel, thereby affecting the company’s standardized operation and performance authenticity. The company’s independence and performance authenticity are necessary conditions for listing,” said Bai Wenxi, vice chairman of the China Enterprise Capital Alliance. Bai Wenxi reminded that this issue needs to be taken seriously, internal control and risk management need to be strengthened to ensure the independence and compliance of the company. At the same time, investors also need to carefully evaluate the company’s operating conditions and risk factors and make rational investment decisions. In any case, Luo Shibing has always had expectations for the capital market. Yousheng shares broke into the main board of the Shanghai Stock Exchange in June 2021 and terminated it in July 2022. After a year and a half of rest, they are now back in the IPO queue. This time, Yousheng shares have benefited from the development of new energy and seem to have much more confidence. The fundraising amount has increased from 633 million yuan to 2.471 billion yuan, with a target valuation of up to 9.884 billion yuan. Based on this valuation, the equity purchased by Luo Shibing for 608,000 US dollars has now skyrocketed to 5.437 billion yuan. In addition to the shares held by his wife Jin Liyan, the net worth of the couple has soared to 6.9 billion yuan.