2023 is a historic year for the Chinese automotive industry. It marks the 70th anniversary of the industry and the first time car production and sales surpassed 30 million, maintaining its global top position for 15 consecutive years.

This year, China’s production and sales of new energy vehicles exceeded 9 million, with a penetration rate of over 30%, continuing to lead the world. China’s export volume of 4.91 million vehicles also makes it the world’s largest automobile exporter. The development of China’s automobile industry has gradually become an important part of industrial and economic growth after more than 70 years, from a slow start to surpassing 30 million in production and sales. Standing at the new stage of development with 30 million vehicles produced and sold, it is still worth discussing how China’s automobile industry will continue to develop with high quality. With a production volume of 30 million, China is stepping towards a new starting point as an automotive powerhouse. According to statistics from the China Association of Automobile Manufacturers, the annual automobile production in China in 2023 was 301.61 million, a year-on-year increase of 11.6%, and the annual sales volume was 300.94 million, a year-on-year increase of 12%. This is the first time that production and sales have exceeded 30 million, and China has ranked first in the world for 15 consecutive years. In addition, China’s new energy vehicles continue to lead the world. In 2023, the production and sales of new energy vehicles reached 9.587 million and 9.495 million, respectively, an increase of 35.8% and 37.9% over the previous year. The penetration rate of new energy vehicles reached 31.6%, an increase of 5.9 percentage points from 2022. It is worth mentioning that in 2023, China’s automobile industry exports were also a highlight. The total vehicle exports for the whole year reached 4.91 million, an increase of 57.9% over the previous year, ranking first in the world for the first time. Among them, the export of new energy vehicles reached 1.203 million, an increase of 77.6%, providing global consumers with diverse consumption choices. Looking ahead to 2024, the China Association of Automobile Manufacturers predicts that China’s total vehicle sales will exceed 31 million, an increase of 3% or more over the previous year. Among them, passenger car sales will reach 26.8 million, an increase of 3%, and new energy vehicle sales will reach 11.5 million, with exports reaching 5.5 million. It can be seen that despite the difficult times in the automotive industry in 2023, a series of pleasing numbers represent the achievements of China’s automotive industry, marking a new milestone in the development of the industry. Industry professionals say that 30 million vehicles is a huge volume, basically equivalent to the annual sales of the United States, Japan, South Korea, and Germany; 30 million vehicles means that China’s car sales will exceed the historical high of 28.88 million in 2017, reaching a new level.

Since 2009, China’s automobile production and sales have surpassed the United States to become the world’s number one, a record that has been maintained for 15 years. In 2017, China’s automobile production and sales reached 29.015 million and 28.879 million, respectively, reaching their peak for the first time. Despite subsequent declines, they have always remained above 25 million. In 2023, the global automotive industry is full of challenges. However, China’s automotive industry has shown strong resilience, potential, and vitality, which also reflects the scale advantage of the Chinese market. At the same time, while the production and sales volume are breaking through, China’s automotive industry structure is also adjusting at an accelerated pace, promoting qualitative and effective improvement. Of course, achieving 30 million units in production and sales is of great significance to the Chinese automotive industry. First, this means that the domestic automobile market has developed to a newer and higher stage, which can be seen from production and sales and export data, which are the best evidence. Second, from the perspective of the domestic market sales structure, the market share and sales volume of Chinese brand models are constantly increasing, especially new energy vehicles, with a market penetration rate of over 40% in the domestic market. They are highly competitive in the same level market in terms of intelligence, configuration, design, and have become consumers’ first choice for car purchase. According to data released by the China Association of Automobile Manufacturers, the cumulative market share of domestic brands in 2023 reached 52%, an increase of 4.6 percentage points from the same period in 2022, making them important participants in the automotive market. Unlike the increasing sales of Chinese brands, the market share of mainstream joint venture brands in China is shrinking, with most joint venture automakers experiencing declining sales. Additionally, it is worth noting that the automotive industry has become a major driving force for industrial economic growth and an important carrier for high-quality development. Volkswagen’s partnership with Xiaopeng, Stellantis’s investment in Leapmotor, and Chinese companies exporting technology and brands to foreign companies have made the previous “market for technology” a thing of the past. However, reaching a new level of 30 million units cannot be achieved without effective government policies. In June 2023, the Ministry of Finance, the Ministry of Industry and Information Technology, and others issued a notice to extend and optimize the policy of tax exemption for the purchase of new energy vehicles, explicitly extending the tax exemption policy for new energy vehicles for another four years until the end of 2027. On July 21 of the same year, the National Development and Reform Commission and other departments jointly issued “Several Measures to Promote Automobile Consumption,” proposing ten measures such as optimizing the management of automobile purchase restrictions and supporting the consumption of old cars.

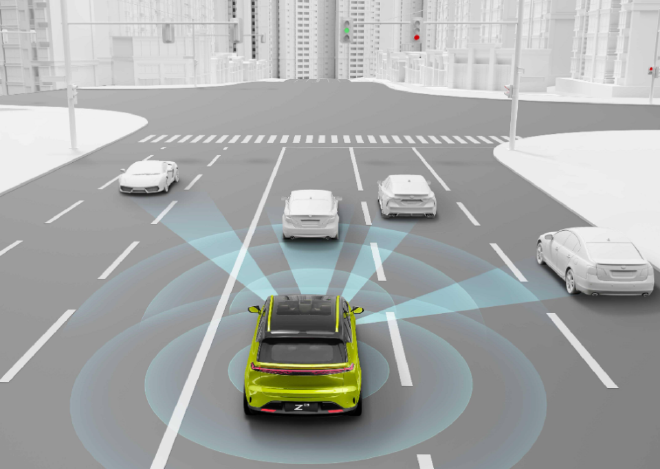

Subsequently on December 11, the Ministry of Industry and Information Technology, the Ministry of Finance, and others issued an announcement on adjusting the technical requirements for vehicle purchase tax reductions and exemptions for new energy vehicles, guiding companies to continue to improve product quality and performance, and promoting high-quality development of the industry. Amid various policies to promote car consumption, local governments have also provided assistance by launching car purchase packages, supporting policies such as issuing car consumption vouchers, relaxing license plate restrictions, and electric grid upgrades to effectively promote car consumption. With the accelerated implementation of various promotion policies, the automobile market continues to strengthen, and the potential for consumption is further unleashed, stimulating the industry to achieve its stable growth target for the whole year, and helping the annual production and sales of automobiles to reach new highs. The penetration rate is increasing, and new energy technology continues to break through. In recent years, China has been unwavering in the development of new energy vehicles, and has continuously made breakthroughs in core technologies, with the market size and penetration rate also continuing to rise. Data shows that in 2023, China’s production and sales of new energy vehicles reached 9.587 million and 9.495 million units, respectively, an increase of 35.8% and 37.9% year-on-year, accounting for more than 60% of global new energy vehicle sales. According to the latest data from the Ministry of Public Security, as of the end of 2023, China’s stock of new energy vehicles has reached 20.41 million units. Looking back at history, it took China 27 years to produce the first new energy vehicle and 17 months to reach 10 million vehicles, fully demonstrating “China speed.” In recent years, driven by policies and the market, China’s new energy vehicle production and sales have ranked first in the world for eight consecutive years, becoming a bright spot in the entire automotive industry. It is worth mentioning that in 2023, the market share of new energy vehicles exceeded 30% for eight consecutive months, indicating steady growth. Notably, as intelligent new energy vehicles develop, the Chinese automotive industry is actively transitioning, with many traditional fuel vehicles achieving energy saving and emission reduction through hybrid power, and significant improvements in core component technology levels. China’s acceleration in the new energy race has attracted praise from many multinational companies. The management of Volkswagen Group stated that China is unleashing enormous innovation potential, and they see positive and fierce competition here. Additionally, at the 2023 Munich Motor Show, China became the country with the most exhibitors after the host country, Germany. Of course, the rapid development of China’s new energy vehicles is due to the continuous breakthroughs in key technologies, and technological innovation is an important driving force for the sustained development of China’s new energy vehicle industry. From the perspective of intelligent networking, with the continuous improvement of the level of intelligent networked automobile technology and the comprehensive integration of related industries, the intelligent networked automobile industry is entering a new stage of development.

In terms of industry scale, China’s intelligent networked passenger car sales with assisted driving systems are expected to reach approximately 7 million units in 2022, with a market penetration rate of 34.9%. By the first half of 2023, this figure has continued to rise to 42.4%, and is expected to further increase by the end of the year. In terms of key technologies, the new generation of electronic and electrical architectures, vehicle operating systems, and high-power computing chips have been implemented in vehicle applications, achieving breakthroughs in cross-domain integration and controller technology. In addition, the sensing range of high-performance LiDAR has reached 250 meters, and L2-level automated driving models are widely used, with several car companies already preparing for mass production of L3-level vehicles. Data shows that China has opened more than 22,000 kilometers of test roads and conducted over 70 million kilometers of test mileage, providing a good experimental environment for the innovation of intelligent networked technologies. With the relaxation of road testing for L3 and higher-level automated driving vehicles, the development and application of automated driving technology will further accelerate, driving advanced technologies such as LiDAR, new generation electronic and electrical architectures, and high-power computing chips to iterate and upgrade faster. In terms of battery technology, the cost of China’s power batteries has also decreased significantly, and there have been new breakthroughs in structural innovation. In 2023, battery companies and research institutions such as CATL, Contemporary Amperex Technology, and China’s Academy of Sciences have all released innovative solutions for power batteries. In addition, the speed and power density of the new energy vehicle motor continue to increase. The new generation of products with features such as flat wire, oil cooling, and high voltage are constantly being launched and gradually achieving mass production. In terms of motor control, China’s electronic control product accuracy, dynamic response rate, and switch loss have reached the international advanced level. The technology continues to mature, and the industrial chain continues to improve. Furthermore, China’s electric charging and swapping infrastructure is continuously improving. According to the data released by the China Electric Vehicle Charging and Swapping Alliance in the “2023 National Electric Vehicle Charging and Swapping Infrastructure Operation Report,” the increase in charging infrastructure in 2023 was 3.386 million units, with a pile-to-vehicle ratio of 1:2.8. Regarding swapping stations, as of December 2023, the total number of swapping stations in China was 3,567, with Zhejiang, Guangdong, Jiangsu, Beijing, and Shanghai ranking among the top five provinces and cities. The China Electric Vehicle Charging and Swapping Alliance stated that the construction of charging infrastructure basically meets the needs of the rapid development of the new energy vehicle industry. In order to provide consumers with more convenient charging and swapping services, the domestic new energy vehicle supplementary power race is also rapidly developing. Currently, swapping and supercharging are popular options. After NIO joined hands with Chang’an, Geely, Jiangqi Group, and Chery to form a swapping alliance, the National Industrial and Information Work Conference recently proposed to support the development of the new energy vehicle swapping mode in 2024. Currently, the battery swapping mode is continuously evolving, with some companies claiming to complete the process in less than 1 minute, making it faster and more convenient than refueling.

In addition, fast charging in the new energy supplement era is also very popular. Many car companies have built their own 800V super fast charging piles, such as Xiaopeng, Jike, Ideal, Weilai, and so on. Earlier, GAC Aian released a super charging pile, it is reported that the super charging station is matched with a 1000V super charging system, which can charge an electric vehicle from 12% to 96% in just 35 minutes. In addition, Huawei has also launched a fully liquid-cooled super charging pile, which can achieve efficient heat dissipation and temperature control of the equipment, with a maximum output power of 600kW and a maximum current of 600A. It is currently the highest power charging pile in use, and can achieve “charge 1 second, run 1 kilometer”, an ordinary electric vehicle can be fully charged in less than 10 minutes. It can be seen that, in the face of fierce competition in the automobile market, Chinese car companies are actively investing in research and development, strengthening technological innovation and product iteration, continuously improving the performance and quality of new energy vehicles, and further promoting the popularization and growth of the new energy vehicle market. Industry insiders have stated that new energy vehicles are not only the main driving force for the growth of the Chinese automobile market, but also the main focus for domestic automobile brands to achieve overtaking on the curve and build core competitiveness. Strong export drives, Chinese cars head overseas As early as the 1950s, Chinese cars began to set sail overseas, but at that time, due to the lack of obvious competitive advantages in products and technology, the market sales performance was mediocre. By 2021, Chinese car exports broke through the 2 million threshold for the first time, reaching 2.015 million, especially with the export of new energy vehicles increasing by 304.6% year-on-year, reaching 310,000, making this year the first year of Chinese cars going overseas. In 2022, the competitiveness of Chinese car exports continued to increase, with a total export of over 3 million for the year, reaching 3.111 million, a year-on-year increase of 54.4%; new energy exports reached 679,000, a year-on-year increase of 120%. In 2023, China’s car export business achieved a new breakthrough. Data from the China Association of Automobile Manufacturers shows that the country’s total annual car export volume reached 4.91 million, a year-on-year increase of 57.9%, and the number of car exports has surpassed Japan, taking the top spot in the world. Of course, the excellent performance of Chinese cars going overseas is not only due to the outstanding contributions of several companies, including SAIC and Chery, with the export volume of these two car companies accounting for nearly 50% of the total export volume.

According to data released by SAIC Group, overseas sales reached 1.208 million units in 2023, an 18.8% increase year-on-year. The sales of independent brands accounted for nearly 92%, and the sales of new energy vehicles accounted for nearly 24%, helping SAIC Group become the largest new car exporter in the Chinese automobile manufacturing industry for eight consecutive years. In addition, SAIC Group also revealed that it plans to increase its new car export volume to 1.35 million units in 2024, and then target 1.5 million units in 2025. Chery Automobile also performed well in its export business, with a full-year automobile export of 937,148 units in 2023, an increase of 101.1% year-on-year, and has ranked first among Chinese brand passenger car exports for 21 consecutive years. As of now, Chery Group has accumulated more than 13 million global automotive users, including 3.35 million overseas users. In addition, according to data from the China Association of Automobile Manufacturers, Geely, Great Wall, and BYD also exported more than 270,000, 260,000, and 240,000 units respectively throughout the year, successfully entering the top ten in the export volume rankings. In addition to the growth in sales of Chinese automotive brands in overseas markets, the depth of Chinese companies going global is also expanding. More and more companies are keen to expand overseas markets, with the European market as a top priority. Recently, BYD announced that it will build a new energy vehicle complete vehicle production base in Székesfehérvár, Hungary. The base will be built in stages and is expected to create thousands of jobs in the local area. It is reported that this will be the first passenger car production base built in Europe by a Chinese automotive company. In addition to BYD, independent brands such as SAIC MG, Changan Automobile, and Great Wall Motors are planning to build factories in Europe, and some brands have already started the site selection process. Previously, Changan Automobile announced its overseas strategy “Embracing the World Plan” at the 2023 Shanghai Auto Show, which mentioned the need to accelerate the layout of Europe. It is worth mentioning that Great Wall Motors is also accelerating its overseas layout and plans to fully enter the European market. After the German and British markets, Great Wall Motors plans to further expand to 8 new markets in Europe. Of course, the new forces in car manufacturing are not falling behind. NIO’s European energy factory in Pest County, Hungary, has been put into operation in September 2023. Nezha Motors is also considering building a factory in Europe, and the Nezha GT is about to start its journey of overseas sales. Nezha’s founder and CEO Zhang Yong previously stated that they will initially enter the European market in the form of trade, and will consider building a factory in the future. However, it is highly likely that they will land through cooperation, utilizing the existing local production capacity. In addition to Europe, Chinese car companies are also keen on building factories in Thailand and Brazil. GAC Aion is investing approximately 1.3 billion RMB to build an electric car factory in Thailand. BYD is establishing a large production base complex consisting of three factories in Brazil, and its Thailand factory has also started construction, with plans for production in 2024. Furthermore, in May 2023, Great Wall Motors stated that the Brazilian factory will become Brazil’s first new energy vehicle factory specializing in the production of hybrid and electric cars, and is expected to start operation in the first half of next year. Although the European Commission announced in 2023 that it would launch an anti-subsidy investigation into imported electric passenger cars from China, this has not stopped Chinese car companies from choosing to build factories in Europe. After all, with the continuous increase in export volume, building factories overseas and increasing localization is an inevitable trend. In summary, standing at a new level of 30 million units, the car market in 2024 is still full of challenges, and the industry will accelerate its reshuffle. In this round of elimination, some car companies will grow rapidly, while others will have a more difficult time. This is also the inevitable process that the industry must go through to move forward. For Chinese car companies, innovative technology and cost reduction are the core of their competitiveness and also advantageous chips for leading the global automotive industry.