TESLA STOCK PLUNGES OVER 12% AFTER CEO ELON MUSK WARNS OF SLOWING SALES GROWTH AND COMPETITION IN CHINA Tesla CEO Elon Musk warned that despite price cuts hurting profit margins, the company’s sales growth will slow this year, exacerbating investor concerns about weak demand and competition in China. Musk said Tesla’s sales growth will “significantly slow” this year, and the company will focus on producing the next generation affordable electric cars at its Texas factory in the second half of 2025, which is expected to spark a new wave of deliveries. However, Musk noted that increasing production of the new car model will be challenging due to advanced technology. On January 25, Tesla’s stock experienced its largest intraday percentage drop in over a year, wiping out $80 billion in market value, bringing its total losses this month to around $210 billion.

TD Cowen analyst says: “Tesla’s news is basically getting worse.” They point out that Tesla’s revenue and profits for the fourth quarter of 2023 are also lower than expected. Stock prices of other electric car manufacturers have also fallen, with Rivian, Lucid, and Fisker falling between 4.7% and 8.8%. For over a year, the electric car industry has been struggling to cope with slowing demand, and Tesla’s price cuts could exacerbate the pressure faced by startups and car manufacturers like Ford. CMC Markets chief market analyst Michael Hewson says: “The problem facing Tesla is that any attempt to significantly boost sales from now on may require further declines in operating profit margins, as the company must compete with BYD in the Chinese market, and competition in other regions is also intensifying.” At least nine brokerages have downgraded Tesla’s stock rating, while seven have upgraded the rating. The company’s average rating is “hold,” with a median target price of $225, 23% higher than the January 25 closing price of $182.63. Data from the data and analysis company Ortex shows that Tesla shortsellers have made a profit of $3.45 billion so far this year, making it the most profitable short trade in the United States.

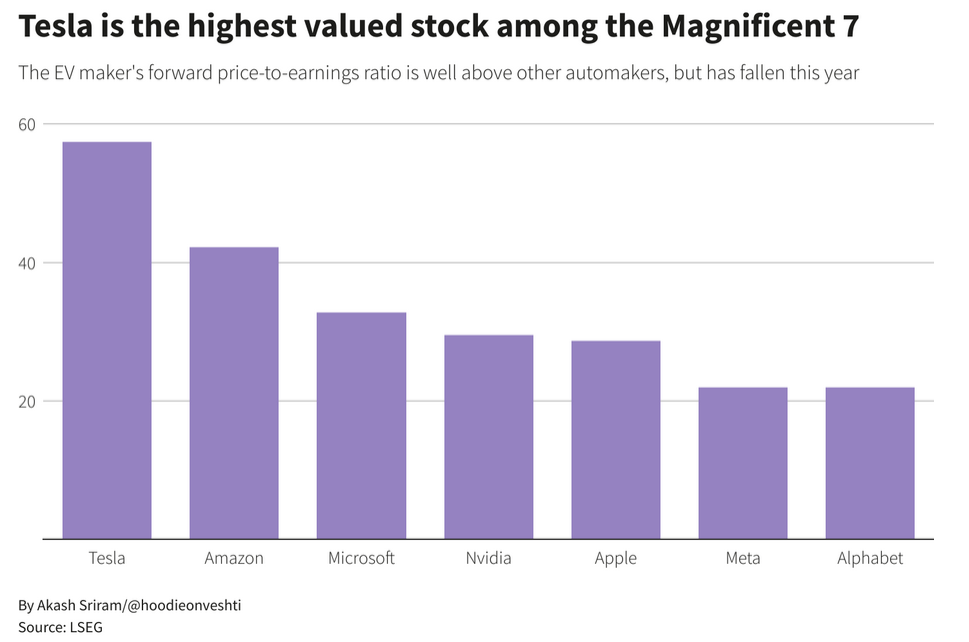

According to LSEG data, Tesla’s stock price is close to 60 times its 12-month earnings expectations, making its valuation higher than other “fabulous seven stocks.” The “fabulous seven stocks” are said to include Apple, Alphabet, Microsoft, Amazon, Meta, Tesla, and NVIDIA. Some analysts say that if Tesla’s sales growth and profit margins continue to weaken, it may be difficult to prove its valuation is justified. Bernstein analyst Toni Sacconaghi said, “Tesla is becoming more and more like a traditional car company.”