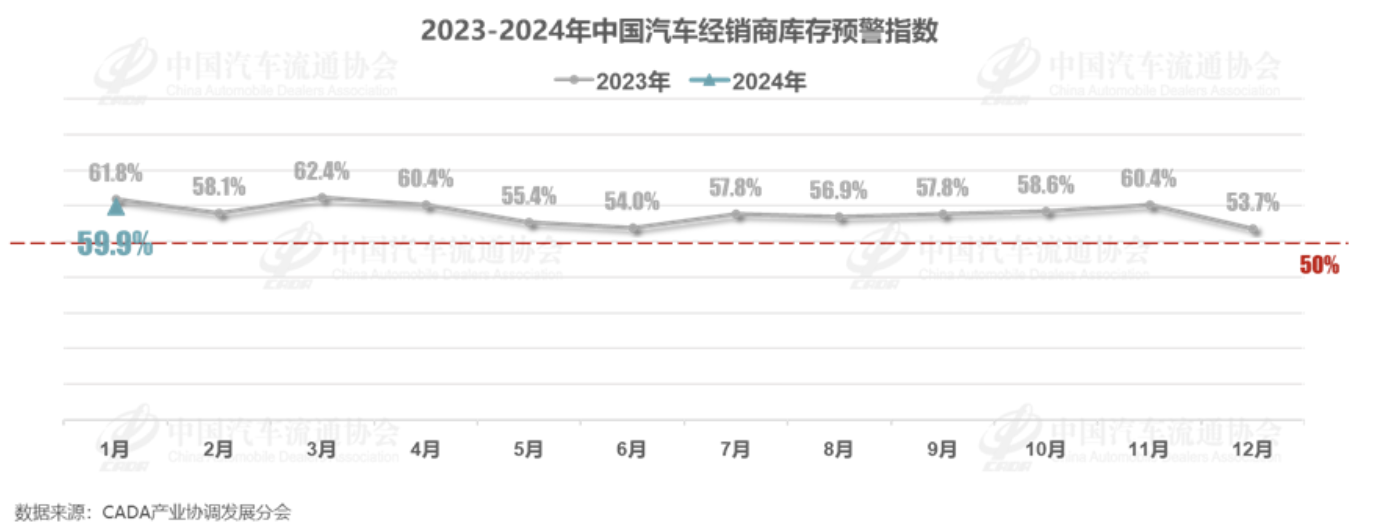

January saw a “good start” for the car market, with the dealer inventory warning index at 59.9% On January 31, the China Automobile Dealers Association released the latest “China Automobile Dealer Inventory Warning Index Survey,” which pointed out that the retail volume of passenger cars is expected to be around 2.2 million in January 2024, with a significant year-on-year increase, which is undoubtedly a good start for the 2024 car market. However, from the survey data, it is clear that dealers are still under pressure. Data shows that the dealer inventory warning index for January was 59.9%, a decrease of 1.9 percentage points year-on-year, an increase of 6.8 percentage points from December last year, and the inventory warning index is above the boom-bust line.

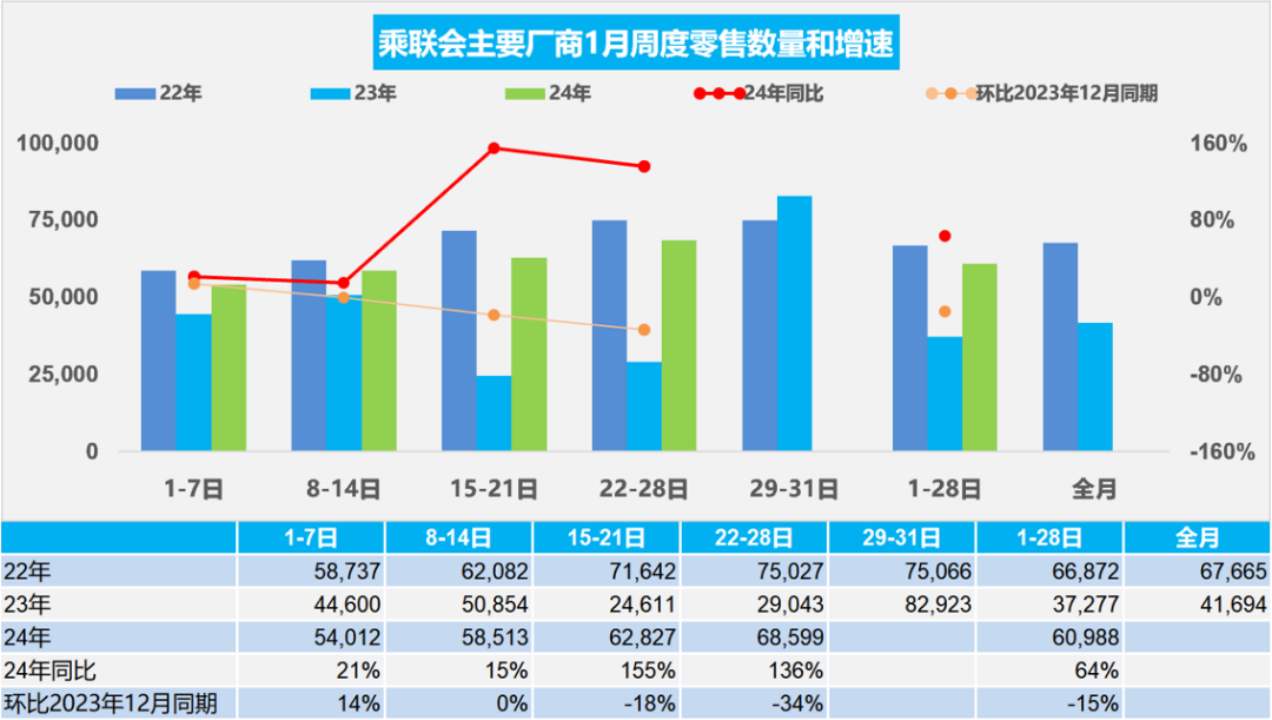

January car market “opened red” with obvious effects In addition to the China Association of Automobile Manufacturers, the China Passenger Car Association also pointed out that the effect of the January car market opening will be more prominent. Statistics show that from January 1st to 28th, the retail sales of passenger vehicles reached 1.708 million, a year-on-year increase of 64% and a month-on-month decrease of 15%. Among them, the retail sales of new energy vehicles reached 596,000, a year-on-year increase of 92%.

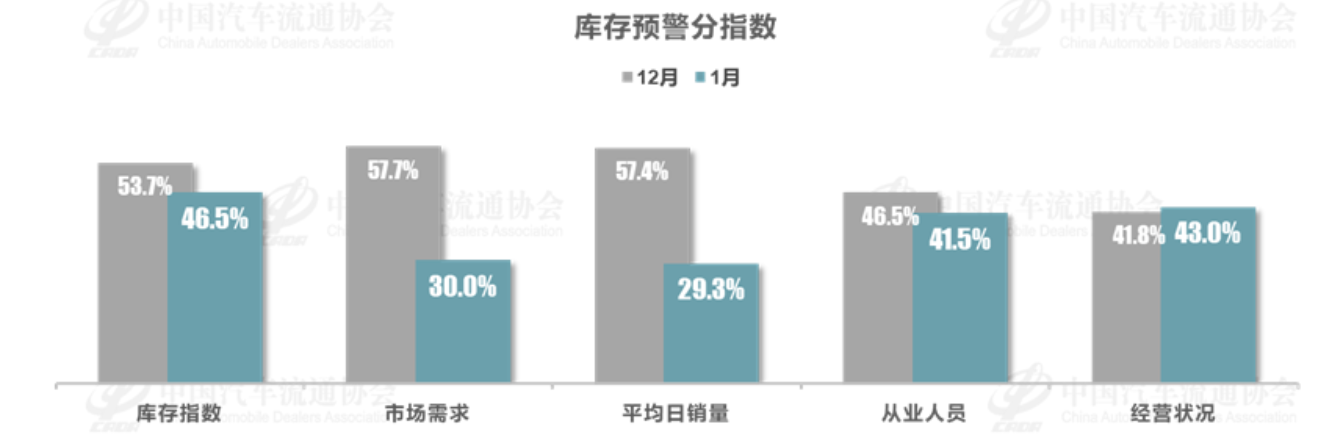

In January, the car market saw a significant year-on-year increase for two main reasons. First, the low year-on-year base. In January 2023, due to factors such as the withdrawal of traditional fuel vehicle purchase tax incentives and new energy vehicle subsidies, the Spring Festival holiday, and the impact of the epidemic, retail sales of passenger vehicles were only 1.293 million units, showing the lowest data since the beginning of this century in both year-on-year and month-on-month growth rates. From this perspective, the strong start in January 2024 is not a big surprise. Second, the return home tide and the pre-holiday car purchase demand still have a supporting effect on the car market sales volume. Although some demand was overspent at the end of last year, under the stimulus of subsidy policies in some places and new year promotional activities of car companies, pre-holiday car consumption still brought some incremental growth to the January car market. Overall, the retail situation of the car market in January is generally stable, but the heat of the car market has cooled down compared to the previous month. Dealers still face great pressure, and their willingness to replenish inventory is low. From the inventory warning index, the January inventory, market demand, average daily sales, and number of employees all decreased month-on-month. The China Automobile Dealers Association pointed out that this is related to the expiration of last year’s consumption promotion policies and the incomplete introduction of a new round of subsidy policies, leading to a heavy consumer wait-and-see attitude.

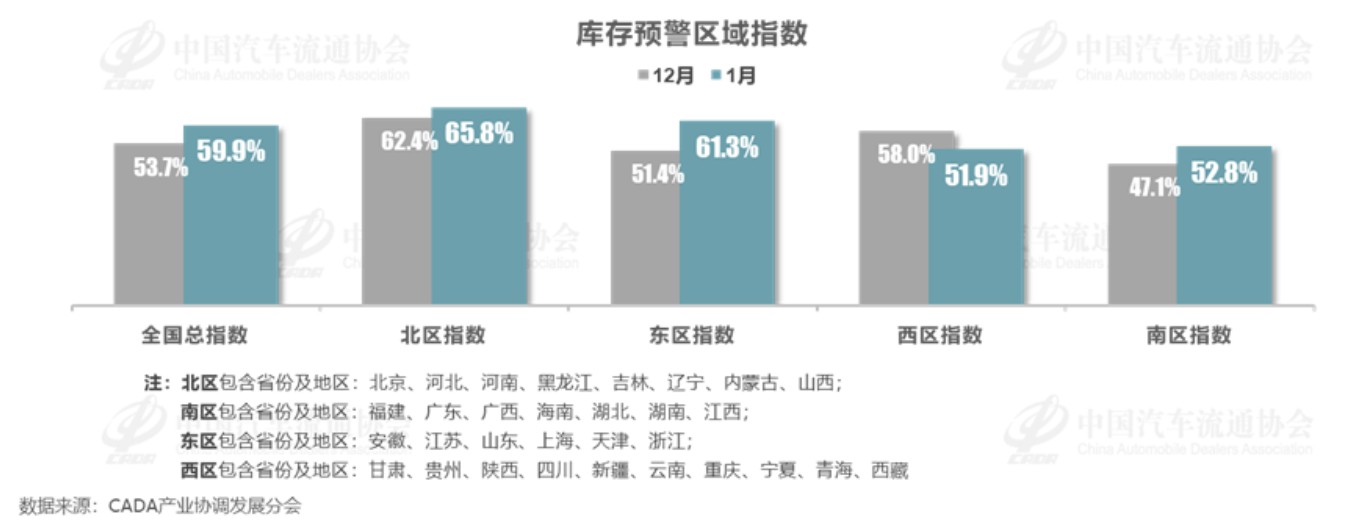

Looking at the inventory warning area index, the inventory warning index in the northern region is relatively high, reaching 65.8%, which may be related to the cold winter weather. In addition, from the perspective of the brand index, the inventory index of joint venture car companies is still the highest, reaching 67.3% in January, while the luxury car and independent brand are relatively lower at 55.5% and 56.9% respectively, but the pressure is still significant.

To travel light for the Chinese New Year, dealers continue to clear inventory, with low willingness to replenish. It is understood that the national passenger car inventory at the end of December 2023 was 3.81 million, including 780,000 in manufacturer inventory and 3.03 million in channel inventory. The pressure to digest industry inventory remains high. Therefore, car companies need to track policy environment and market changes in a timely manner, cautiously set production and sales pace, and promote sales reasonably according to the structure of dealer inventory, and clear historical inventory in a timely manner. Entering February, affected by the Spring Festival and reduced working days, dealer traffic and sales volume will see a significant decline, and the car market will enter the traditional off-season. It is expected that the internal turmoil in the automotive industry will continue in 2024. The China Automobile Dealers Association suggests that dealer groups should be cautious in investing during the brand switching process, adjust inventory structure, strengthen fund control, and ensure the safety of cash flow.