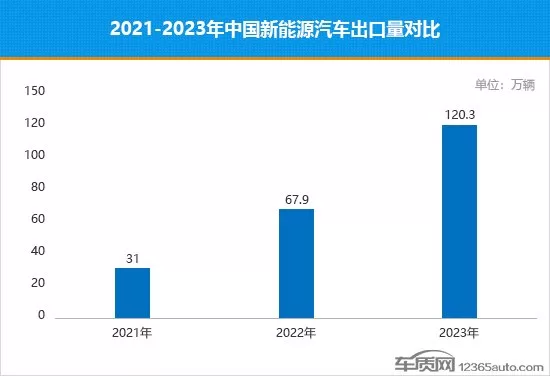

According to data from the China Association of Automobile Manufacturers, China’s automobile export volume reached 4.91 million vehicles in 2023, surpassing Japan to become the world’s largest automobile exporter. Among them, the export volume of new energy vehicles was 1.203 million vehicles, accounting for 24.5% of the total automobile export volume. In comparison, the export volume of new energy vehicles was 679,000 vehicles in 2022 and 310,000 vehicles in 2021. Driven by this, the total export of “new three samples” products such as electric passenger cars, lithium-ion batteries, and solar cells reached 1.06 trillion yuan in 2023, breaking the trillion mark for the first time, a year-on-year increase of 29.9%.

Behind the shiny export data, there is tremendous pressure from overcapacity and the difficult operating environment for manufacturers. This also provides an inherent driving force for the export of new energy vehicles. According to data from the China Association of Automobile Manufacturers, this year’s automobile production and sales in China are expected to exceed 30 million vehicles. However, according to data from the China Automobile Dealers Association, the inventory warning index for Chinese automobile dealers in November 2023 was 60.4%, above the boom-bust line, indicating that dealers are generally facing huge financial pressure and have to sacrifice profit margins to ease the pressure. According to data from the China Association of Automobile Manufacturers, the profit margin of the Chinese automobile manufacturing industry was 4.9% in the first 10 months of 2023, which is still lower than the average profit margin of 5.5% for the entire industrial enterprises. Some multinational car companies’ profits in Q3 this year were almost higher than the profit margin of the Chinese automobile industry during the same period, such as Toyota at about 11%, Honda at about 6.6%, Mercedes-Benz at about 10%, and Hyundai at about 7.8%. Both sets of data prove that Chinese automobile exports have surpassed the single economic sector of the automobile industry and become a key factor influencing the export of the entire manufacturing industry and foreign trade growth. From my recent observations and analysis of third-party research data, Chinese automobile exports are in a crucial period of rapid development, and I have three new insights to share with industry insiders. Urgency of accelerating infrastructure investment

When it comes to China’s car exports, BYD is a prominent case. According to statistics, BYD has exported over 243,000 cars to more than 50 countries in 2023, with nearly half of them going to “Belt and Road” countries and the Asia-Pacific market, followed by Europe, South America, and Africa. A recent video test of BYD Dolphin, Volkswagen ID.7, and Tesla MODEL3 by a British media has provided a more intuitive understanding of the user experience, advantages, and difficulties of Chinese cars going abroad, especially in developed markets in Europe and America. The three testers drove the three cars from London to the southern bay and back to the starting point, carrying a Christmas tree of the same weight. The overseas version of the BYD Dolphin used in the program is at least four times more expensive than the domestic product of the same price. After deducting 15% of the tariff and other fees, it still has a considerable profit per car, which is the value of exporting overseas, especially to the European and American markets. When the FAW-Volkswagen ID.7 VIZZION was officially launched in December last year, its price was 227,000 to 262,700 yuan (36930$), which is half the price of the British version, indicating that reverse exports are also profitable for foreign brands. From this perspective, the meaning of exports is obvious. However, there was a problem in the return charging phase: Tesla had an early advantage in infrastructure construction, and it was almost effortless to find a charging pile, while Volkswagen and BYD’s testers took half a day to find a Polestar 4S store, and there were multiple small episodes during the app download process, causing Volkswagen to delay charging for several hours, and BYD to start charging even later, the total charging time was even slower than the Volkswagen ID7. Although BYD’s battery life and unit power consumption are better than the two competitive models, due to the disadvantage of charging time and the small energy supplement discount, the final cost of use only leads the Volkswagen ID7 by about 15 pounds, but it is nearly 60% more expensive than Tesla. After watching the show, the conclusion given by the evaluators was that although BYD leads in most technical aspects, the cost of use and infrastructure will be the main obstacle for Chinese brands to expand in overseas markets. At a media communication meeting held at the end of last year, Qin Lihong also mentioned the infrastructure, saying that it was originally planned to build 120 battery swap stations in Europe this year, but only 28 were actually built, because there were many unforeseen execution issues. Speaking of infrastructure, there is also an unexpected difficulty related to logistics, which is the tension in the export shipping industry. According to the Financial Times, shipping companies scrapped a large number of old freight ships in 2020, and at that time, car factories around the world were shut down due to the epidemic, causing many alternative old ships for car transportation to take three to five years to be ready for operation. However, the global recovery in car demand is faster than expected, coupled with China’s strong promotion of new energy vehicle exports, which has led to a critical shortage of shipping capacity in the industry. The shortage of shipping capacity has also led to a daily charter price increase to $115,000, up 10% from 2022 and 7 times higher than 2019. Last year, there were 80 new ship orders. These orders will take about three years to complete. The Red Sea is often impassable due to climate change and regional armed conflicts, causing shipping costs to soar. Many cargo ships are forced to detour around the Cape of Good Hope, adding 10 days to two weeks to the shipping time. This has significantly increased the marketing costs for China’s car exports to Europe. However, there is good news. BYD, the king of vertical system competitiveness, is producing electric roll-on/roll-off cargo ships for car exports. In mid-January, foreign media observed BYD’s first electric cargo ship departing from China to Europe. BYD also plans to build 6 more fully electric cargo ships. Currently, the main contradiction in China’s car exports is the construction of charging facilities and the increase in the market penetration rate of BEVs. From a regional perspective, there is still room for Chinese manufacturers to accelerate infrastructure construction in Europe. Recently, NIO signed an agreement with RheinEnergie, Germany’s largest private power company, to cooperate in building charging and swapping facilities, which is the first step towards solidifying the European export market. In terms of market penetration rate and market cultivation difficulty, Chinese manufacturers should lay out plans according to different countries. Currently, the Nordic countries, especially Norway, are leading the European electric vehicle industry, with electric car sales accounting for 83% of total sales in the first 9 months of 2023. However, other countries are relatively lagging behind, with the UK slightly behind Germany, which has an electric car penetration rate of 18%; Belgium at 19.3%; and Portugal at 17%. Central and Southern European countries have the lowest market cultivation level. It is suggested that domestic manufacturers should speed up their marketing efforts in the leading Nordic markets, and focus on building infrastructure in important G7 countries such as Germany, France, and the UK. Only when the process of using electric cars is smooth, the penetration rate of electric cars significantly increases, and the brand has a certain level of recognition, can the production capacity be expanded and the market be developed. As for the countries in Central and Southern Europe, they can gradually promote through sales agents, lease-to-own, etc. In conclusion, time is a hurdle we must overcome. A European analysis agency stated that, on average, only one out of ten car consumers in the European and British markets would choose pure electric cars. The time cost of market cultivation is a difficulty that Chinese manufacturers need to be fully prepared to face. Emphasize the necessity of joint venture cooperation.

Last year at the Shanghai Auto Show, Chery Automobile Chairman Yin Tongyue clearly stated that “if we want to eat someone else’s food, we can’t smash their pot, and we have to grow food together and share the harvest together.” Based on the concept of paving the way for cooperation, both vehicle and battery production companies have used joint ventures as a stepping stone to enter the EU market. The most active investment destination is Hungary. Ningde Times officially entered the market in August 2022, igniting the enthusiasm of Chinese battery industry chain companies to go to Hungary. In the past year, Chinese companies have invested close to 9 billion euros in the city of Debrecen. In addition, leading companies such as Xinwanda, CATL, and Huayou Cobalt have also expressed their intention to invest in other cities in Hungary. However, even Hungary, which is friendly to China, faces many difficulties. The most serious challenge is the shortage of technical and labor talents. New factories often need to use temporary workers from the country to maintain operations. For example, at Samsung’s factory in Göd, only half of the employees are Hungarian citizens, and there are less than 100 local residents. Ningde Times is facing the same problem in Debrecen. The local town has only a few thousand people and a very low unemployment rate, so recruiting workers has become a key issue. In addition, Hungarian society still holds a relatively resistant attitude towards large-scale foreign personnel. In May 2023, the Orbán government proposed a “guest labor law draft” to allow foreign-invested enterprises to introduce their own workers, technical personnel, and management to build and manage factories. However, due to opposition from the local public opinion, it was withdrawn before it was implemented on November 1. Ningde Times’ large-scale investment has sparked some social controversy. In November 2022, some female villagers in the investment area, organized under the name “Mother of Mikeperch,” demanded a halt to factory construction until specific information on water supply, noise levels, and pollution was obtained. In January 2023, two public hearings on the construction of the factory were held in Debrecen, where supporters and opponents clashed. Currently, domestic investors pay special attention to compliance and environmental protection requirements. For example, Ningde Times has repeatedly stated that it will increase investment in sewage treatment and promises that 70% of the water used in the first phase of the factory can be met by treated sewage, and will not excessively use local drinking water. On the issue of employment, Ningde Times also stated that it will recruit employees locally in Debrecen as much as possible and expand the recruitment range to areas within a 60-kilometer radius. The number of employees in 2026 can reach 3,000. In January of this year, the highly anticipated BYD also announced plans for new factories overseas, including in Hungary, as well as in Mexico, Brazil, Thailand, and Uzbekistan. The company also launched a $1.3 billion investment in an Indonesian factory. Experts emphasized that the planned Mexican factory, due to its proximity to the United States, is aimed at the challenging North American market, making it more difficult. Therefore, whether it is a vehicle factory or a battery factory, there is still a lot of work to be done in infrastructure construction and joint venture negotiations when going overseas, and they should not be subjected to more pressure and unrealistic expectations. In summary, leasing, cooperation, joint ventures, and wholly-owned enterprises should be the standard roadmap for Chinese cars to go to Europe and the United States in the short term. We cannot expect to achieve the market position that Japanese and Korean counterparts have achieved in three or four decades overnight. The effectiveness of brand strategy A European business analysis institution said that although Chinese electric vehicles have excellent product capabilities, their brands are too young and change too quickly. Every two or three years, a group of brands will be eliminated, but brand loyalty among European consumers is still very high. The head of the institution said, “We are not willing to pay for a brand that will disappear in less than ten years.” Therefore, my third understanding is that in order for Chinese cars to gain a foothold in the developed markets of Western countries, rather than making a quick profit and leaving, the ultimate winner will still be the brand and culture. In order to do a good job of brand communication, the consistent core brand concept must not be vague. The well-known “Donkey Brand” Louis Vuitton has conducted joint activities with MANNER Coffee in dozens of cities around the world this year, including Shanghai, and the effect is said to be very good, and it once sparked a CITY WALK craze. The reason why Louis Vuitton continues to do activities such as “city guides” is because travel and the spirit of adventure behind it are the unchanged genes and core since the birth of the brand. Correspondingly, some domestic car manufacturers are still expanding their marketing overseas through methods such as live streaming on the internet and simple naming partnerships. The language is more flashy than substantial, and there is no clear slogan. Some advertisements even follow domestic thinking, using a large number of blonde models and muscular handsome white models. In fact, European and American countries have a deep cultural identity with ethnic diversity and international taste. The coexistence of multiple races, skin colors, and faiths is a political correctness. Asians and Africans can be seen everywhere on various channels, TIKTOK, X mobile applications, and even outdoor circular billboards on the streets. Although the far-right ideology has been on the rise due to economic downturn and geopolitical conflicts, it is far from being mainstream in society. Domestic companies should heavily utilize local talent and quickly integrate into the local culture to avoid the spread of cultural misunderstandings.