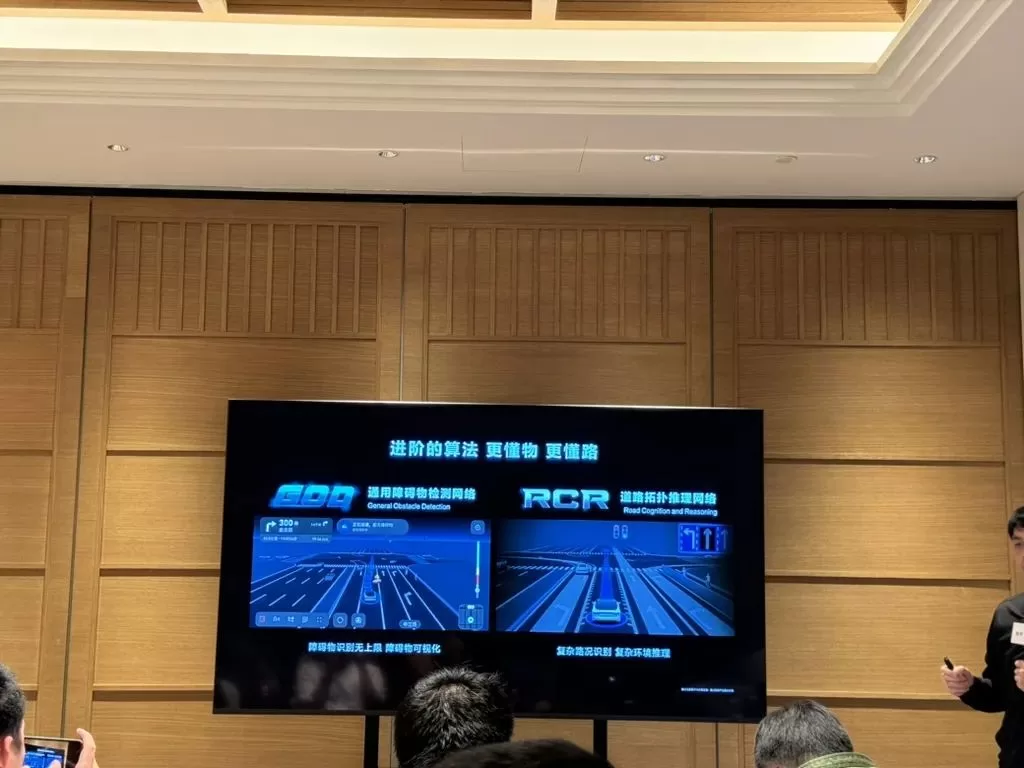

City NOA should be spelled as ‘daily activity’ rather than ‘city opening number’ Author | Cao Siqi Editor | Jing Yu Departing from Nanxiang Town, Jiading District, Shanghai, and passing through Liuxiang Highway, Huxiang Expressway, and Jiamin Viaduct, after a total of 25 kilometers, we arrived at the departure floor of Terminal 2 of Hongqiao Airport Last October, when Geek Park drove a Xiaopeng G6 along this unplanned non-centralized test drive route, XNGP almost took over the operation control of the accelerator and steering wheel, including recognizing straight and left and right turning lanes, identifying traffic lights at intersections, overtaking slow cars in front, and switching to different city expressways through entrance and exit ramps In 2023, intelligent assisted driving has become the new battlefield for emerging forces. In the closed road scenario dominated by highways and city expressways, leading players such as Huawei and Xiaopeng are gradually able to score high marks McKinsey’s report shows that Chinese high-end emerging forces are able to grab market share from traditional luxury brands, with ‘more advanced autonomous driving’ being the second reason. Terminal data can also support the above view. In the fourth quarter of 2023, the proportion of orders for intelligent driving versions of models such as Wenjie New M7, Xiaopeng G6, and Baojun Cloud exceeded 50% The exam begins to go ‘beyond the scope’, from closed roads to urban areas. Almost every high-end product launch of every car company will introduce the research and development progress and investment in intelligent driving, as well as the next ‘city opening’ target. The numbers on the PPT have changed from single digits to double digits and then to triple digits. In the communication system, this number has become more and more important, and has even become the most critical standard for evaluating the level of intelligent driving that affects user volume However, in the face of various traffic participants in urban areas, and even uncertain traffic rule violators, even players who are the first to open ‘City NOA’, their functions are still in the ‘usable’ stage, and there is still a considerable distance from ‘usable’ in terms of user experience. From the perspective of user experience, the current City NOA function is mainly divided into two categories: First, relatively easy to use but not continuous. For various reasons, the available sections of city smart navigation assistance driving are not continuous, which causes drivers to frequently take over the driving rights of the vehicle when the function is downgraded. Geek Park also experienced the smart navigation assistance driving function, which is available on almost all city roads, in some concentrated media test drive events. However, when facing deliverymen running red lights, temporary stalls, or lane changes due to road repairs, the system frequently operates the acceleration and deceleration, which seriously affects the passenger experience and can even cause motion sickness. Even Tesla, which is at the forefront of technology in the industry, has experienced a delay in the full automatic driving after Musk’s public live test of FSD V12, and he shouted that the full automatic driving that he had been promoting for 4 years is still delayed. So, why does the city battle of smart driving continue to be delayed and what should the future involve? The so-called city NOA, short for Navigate On Autopilot, is ideal for the driver to set the destination and choose a route before the vehicle starts, and the smart driving system can control the acceleration and deceleration pedals and steering wheel throughout the journey. City NOA is considered an important stage from assisted driving to full automatic driving. How to achieve technical cost reduction is an important engineering topic for smart driving in 2023. In order to achieve technical cost reduction, with the support of the AI boom, the smart driving field has switched or attempted three technical routes in the past year. The entire industry is gradually switching from map-based solutions to non-map solutions. The reason why high-precision maps have almost become the consensus core technology of the entire industry in 2023 is that the Transformer-based BEV perception model has matured, enabling vehicles to greatly improve their real-time perception of surrounding information during driving. Huawei introduced the perception capabilities of its intelligent driving system at several technical exchange meetings last year: using the GOD universal obstacle detection network and RCR road topology inference network, a perception area of 2.5 football fields can be achieved.

In a few car companies or autonomous driving companies that have already opened NOA in cities, Huawei and Xiaopeng have publicly stated that they have switched to a mapless solution. In actual test driving experience, Geek Park can also clearly feel the changes brought by the transition from a mapped to a mapless solution: when passing through intersections without lane markings, the autonomous driving system will exhibit a noticeable “dragon drawing” phenomenon – in the absence of high-precision map operations, the vehicle needs to plan the travel route in real time. Yu Chengdong once said that Huawei has invested one to two years in Shanghai, but has not completed the collection of high-precision maps in urban areas. Therefore, relying on the evolution of vehicle perception capabilities, transitioning away from high-precision maps can bring two results: a significant reduction in autonomous driving costs and a substantial increase in autonomous driving generalization capabilities. Second, some niche players have begun to try a pure visual solution without LiDAR, with Jue Yue representing this technological route in China, while Tesla is another important player. If “mapless” is hoped to significantly reduce costs on the industrial supply side, then the “pure visual” stream hopes to use powerful computing capabilities to reduce hardware costs on the vehicle side, which is LiDAR. Guotai Junan Securities’ research report shows that the price of most high-performance LiDAR is around $1000 per unit. Although the era of “less than 4, don’t speak” mentioned by a brand leader of a certain host plant in 2021 has passed, the flagship models of domestic new forces still have at least one LiDAR, and some models support the option of 2-3 LiDARs to achieve hardware-level safety redundancy. Compared to the “camera + algorithm” solution, the “camera + LiDAR” solution can improve vehicle perception capabilities, ensuring perception range and stability from the hardware side. A typical example is that in the scenario of a stationary start, a model equipped with only a camera may collide with obstacles that are very close, while a model equipped with LiDAR will significantly improve the recognition rate of obstacles at close range. Another scenario that LiDAR can handle is the recognition of irregular obstacles. In a pure visual solution relying solely on cameras, due to the heavy reliance on “pre-labeling” priors, unmarked irregular obstacles can easily go unrecognized. Therefore, to improve the recognition of irregular obstacles at the computational level, it is necessary to add Object Category Classification (OCC) to achieve the ability to know “even if I don’t know what I’m looking at, I can still know where it is.”

Believe that Jiyue dared to make a decision to drop 30,000 directly in the fierce price war after listing last year, and cutting off the lidar on the hardware side in the early stage is an important factor. 02. ‘Top student’ Tesla’s ‘trouble’ It can be said that the current round of cost reduction-oriented technological route exploration, most players have adopted the scheme of ‘retaining lidar + removing high-precision maps’, while Jiyue has adopted the ‘retaining high-precision maps + pure visual solution’. At present, it seems to be a choice between one of the two options, either choose lidar or choose high-precision maps, and no one in China can have both. Except for Tesla. If we say that the core premise of achieving urban NOA at the current stage is still ‘having homework to copy’ – either copy high-precision maps or copy algorithm rules – then Tesla’s technological logic is to use the logic of artificial intelligence to let the intelligent driving system learn to think independently when there is no homework to copy. This technology architecture is mainly based on ‘end-to-end’ – compared to the traditional architecture that divides perception, prediction, planning, and control into different modules, end-to-end integrates these modules into a unified architecture. Taking the FSD Beta V12 system demonstrated by Musk on the X at the end of August last year as an example, engineers deleted nearly 300,000 lines of defined rules code, and the system will call relevant scenes from the learned database to decide the next driving operation in a neural network mode. Therefore, similar to the generative language large model LLM, Tesla’s end-to-end technology architecture improves the generalization ability of AI, but also highly depends on the early data feeding. At the 2022 Tesla AI Day, Musk said that training a neural network requires billions of frames of material, but according to “Musk’s Biography,” by early 2023, this data was only 10 million frames. Mass-produced cars equipped with various sensors are important tentacles for subsequent data collection by major manufacturers, but it takes time to accumulate. After all, the “big sale” of several new car models with autonomous driving capabilities only occurred in the last quarter, and many models are still in the early stages of mass production. Moreover, Tesla still faces various localization issues in the Chinese market, which presents new challenges for the implementation of urban NOA. The urban NOA battle: competition on the surface, profit behind the scenes. There are still many technical challenges to overcome for urban NOA. Why does every car company have to include the number of cities opened in their presentations? High emotional intelligence interpretation: to create a more technological corporate image; low emotional intelligence interpretation: to sell cars at a higher price. Currently, although most car companies have launched “smart driving” models, only a few have pushed the urban NOA function in some cities. Therefore, for users, choosing a smart driving model is also a prepayment for product functionality to some extent, and an investment in the capabilities of the company. In this competitive state, the numerical targets for opening cities can also establish the technological attributes of car companies. Yu Chengdong’s “far ahead” hot topic not only reflects Huawei’s confidence in its own smart driving capabilities, but also allows it to take an early lead in the industry’s ecological position in terms of intelligence and technology. At the same time, it is also important not to overlook the fact that smart driving is still an important profit point. As mentioned earlier, at the hardware level, smart driving versions will have additional perception modules and more powerful chips than the regular versions, so they will be more expensive. Using the M9 as an example, the starting price of this model is 469,800 yuan (66040$), and the terminal information states that the average transaction price has reached 560,000 yuan (78720$). In addition to choosing a comfortable interior, the purchase of the intelligent driving version is also an important reason. On the software side, intelligent driving provides car companies or intelligent driving companies with commercial revenue space for subscription-based software income. Whether it is self-developed by companies like WeRide, Huawei, and Tesla, or car manufacturers that work closely with intelligent driving companies, they can open NOA in cities and charge subscription fees for software services annually, monthly, or as a one-time purchase. In terms of price, Huawei’s ADS2.0 one-time purchase price is 36,000 yuan (5060$), while WeRide has reached 50,000 yuan (7030$). 04. Don’t get hung up on “opening cities,” focus on “daily activity.” Entering 2024, the story of opening cities seems to be less impactful. This is related to the product experience – the vast majority of urban users still cannot experience the convenient NOA function smoothly and completely. Of course, this is also related to technological accumulation. After all, in the existing technology and data, the intelligent driving team still needs time to accumulate to produce a powerful product upgrade. In the bottleneck of technological innovation, instead of continuing to focus on the number of cities opened, it is better to return to the user end and optimize the experience. Just like the story of extended range or hybrid vehicles outperforming Japanese cars with excellent fuel economy before the outbreak of pure electric vehicles, if urban NOA cannot arrive temporarily, then from the perspective of software products, launching a memory function for urban commuting mode should be a more practical choice from the user’s perspective. Correspondingly, in terms of communication, changing the number of cities opened to the daily usage time of intelligent driving by users, or the usage ratio of intelligent driving routes in urban areas, should be more persuasive data to reflect users’ cognition, trust, and usage of intelligent driving. After all, understanding user needs is more important than defeating how many opponents in the digital world if you want to make money with software. (From WeChat official account: Geek Park, Author: Geek Park Car Group)