Hydrogen fuel cell cars enter the C-end, why is it so difficult? | Please answer by 2024 “Hydrogen fuel cell cars are more difficult to commercialize on a large scale than L4” The above remarks generally reflect the views of most people in the industry on the future prospects of hydrogen fuel cell vehicles: there are prospects, but the prospects are very distant… This somewhat pessimistic judgment can be seen from the stock market performance of hydrogen-related companies It is reported that as of now, there are only two domestic hydrogen energy-related listed companies, Yihuatong and Guohong Hydrogen Energy. Among them, Yihuatong is the earliest company in China to enter the hydrogen energy field. Its main business is the research and industrialization of hydrogen fuel cell engine systems. It successfully listed on the Sci-Tech Innovation Board of the Shanghai Stock Exchange in August 2020, and then landed on the Hong Kong Stock Exchange in January 2023, achieving dual listing. In November 2023, Guohong Hydrogen Energy was listed on the main board of the Hong Kong Stock Exchange, becoming the “second hydrogen energy stock” in China. The company’s main business is the research, production, and sales of hydrogen fuel cells Specifically, looking at the stock market performance of the two companies mentioned above, when Yihuatong was listed on the Hong Kong Stock Exchange in January last year, a total of 17.628 million shares were sold globally, and the issue price was 60 Hong Kong dollars. On the first day of listing, Yihuatong opened flat, and the intraday price once fell to 58.45 Hong Kong dollars per share, with a total market value of less than 7 billion Hong Kong dollars Similarly, on December 5, 2023, Guohong Hydrogen Energy landed on the Hong Kong Stock Exchange. On the same day, the company’s stock price fell by more than 26% at the beginning of trading, followed by a volatile recovery. On December 6, Guohong Hydrogen Energy closed down 16.16%, at 16.60 Hong Kong dollars per share, with a total market value of about 8.6 billion Hong Kong dollars It must be admitted that even if the stock market performance is not good, Yihuatong and Guohong Hydrogen Energy are still among the best in domestic hydrogen energy-related companies. After all, apart from these two, the IPO road for most hydrogen energy companies is full of difficulties In 2022, Reshaping Shares and Guofu Hydrogen Energy withdrew their application documents; Jie Hydrogen Technology was accepted at the end of June of the same year, and after a round of inquiries, it also stagnated due to expired financial information starting on September 30 of the same year… So, what exactly makes the hydrogen fuel cell vehicle industry “difficult”? How can the entire vehicle products of hydrogen fuel cell vehicles cross the industry cycle and move from the business to consumer side? From a global perspective as a supplement to the electrification of automobiles, is China’s hydrogen fuel cell vehicle industry really lagging behind Japan and South Korea? The cost of batteries is difficult to reduce: the difficulty lies in the process, not the raw materials. As two major branches of the technological path to vehicle electrification, today’s hydrogen fuel cell vehicles and early electric vehicles face similar challenges: the high cost of power batteries, which is one of the key factors affecting the large-scale commercialization of the hydrogen fuel cell vehicle industry. However, it is worth noting that the cost factors affecting lithium-ion batteries and hydrogen fuel cells are not entirely the same. After many years of development, the technological path and manufacturing process of lithium-ion batteries have become quite clear, and the factors affecting the power batteries of electric vehicles are mainly the supply of raw materials. First, looking at the raw material side, for a long time, the rising price of battery-grade lithium carbonate has been an obvious pain point in the downstream of the electric vehicle industry chain. During the peak development period of the electric vehicle power battery industry, in October 2022, Huaxi Securities bluntly stated: the current point in time is the peak of the annual demand in the industry chain, and it is expected that the supply in the fourth quarter will become increasingly tight, not ruling out the possibility that the price of battery-grade lithium carbonate will rise to 60,000 yuan (8430$)/ton this winter. Affected by this, downstream new energy electric vehicle companies are full of complaints. Even Guangqi Group Chairman Zeng Qinghong “complained” at the 2022 World Power Battery Conference: “Currently, except for Tesla, other new energy vehicle manufacturers are basically losing money. The power battery cost has accounted for 40% to 50%, or even 60%, of new energy vehicles. Am I not working for CATL now?” But fortunately, after the dividend period, the price of lithium carbonate gradually decreased to below 100,000 yuan (14050$)/ton. As of February 5th, Shanghai Steel Union released data showing that the average price of battery-grade lithium carbonate was 97,500 yuan (13700$)/ton. As a result, the contradiction between power battery manufacturers and downstream host factories is no longer as “sharp” as before. Looking at the electric vehicle battery manufacturing process, even though the price of lithium carbonate has fallen to a reasonable range, the fact that power batteries still account for a large share of the vehicle production cost cannot be ignored. In addition, due to the intensifying “price war” among electric vehicle host factories, the demand for cost reduction has also increased. Therefore, innovating power battery manufacturing processes to reduce battery costs has become the choice of most host factories. Currently, electric vehicle host factories have already figured out various ways to reduce the cost of lithium-ion battery production. For example, in June 2023, Thomas Schmall, Chairman of the Supervisory Board of PowerCo, the battery department of Volkswagen Group, stated in a declaration that Volkswagen Group and its technology partner Koenig & Bauer have mastered a battery manufacturing process called dry coating. If widely promoted, it can reduce the annual battery production cost by hundreds of millions of euros. Volkswagen stated that the company has already used this process to produce hundreds of batteries on a pilot production line and is expected to start industrial production before 2027. Schmall says, expanding production and using cheaper materials, Volkswagen hopes this process will help reduce battery costs by about 50%.

In addition, Miao Wei, a member of the National Committee of the Chinese People’s Political Consultative Conference and deputy director of the Economic Committee, has suggested reducing the size of battery specifications to reduce production costs. “By providing different battery capacities to meet different needs for range and power while keeping the installation design unchanged, large-scale automated production can be achieved at both the single-cell and module ends, significantly reducing production costs,” Miao said. In contrast to lithium-ion batteries, hydrogen fuel cells are less affected by battery raw material supply. However, it should be noted that hydrogen fuel cells still face significant challenges in manufacturing processes, which have a considerable impact on hydrogen fuel cell prices. Unlike common lithium batteries, hydrogen fuel cell systems are more complex, consisting mainly of the stack and system components. The stack, which is the core of the entire battery system, includes various battery units composed of membrane electrodes and bipolar plates, as well as current collectors, end plates, sealing rings, and more. It is reported that fuel cell systems account for over 60% of the purchase cost of hydrogen-powered vehicles, and the stack cost accounts for over 60% of the fuel cell system, making it the highest cost item for hydrogen fuel cell vehicles. Therefore, reducing stack costs is key to improving the economics of hydrogen fuel cell vehicles. However, the production process for stacks is extremely complex and costly. Take, for example, the Toyota Mirai fuel cell stack, which has achieved a global leading power density of 3.1kW/L, along with self-humidifying performance, 3D fine-mesh titanium alloy flow fields, high durability, and strong environmental adaptability.

According to Toyota’s fuel cell stack production process diagram, the process of forming the stack mainly starts from the preparation of the catalyst slurry, then the intermittent groove mold coating prepares the catalytic layer, then transfers to the proton exchange membrane, and then hot presses the gas diffusion layer after waterproof treatment to prepare MEA, and finally assembles with the surface modified titanium metal plate to form the Mirai fuel cell stack. According to GesAuto analysts, in the cost of the stack, the cost of the catalyst accounts for more than one-third. With the increase in the shipment volume of the stack, the economies of scale will be further enhanced, and the remaining high-cost components such as proton exchange membrane and gas diffusion layer will further reduce costs, and the catalyst will become the largest single cost component. It is reported that Toyota’s Mirai catalyst is prepared by the intermittent groove mold coating method. SAI has conducted research on the cost of Toyota’s Mirai fuel cell stack, and its research mentions that the cost of preparing the catalytic layer through the intermittent groove mold coating method is approximately $800 per stack. It is worth mentioning that, up to now, from a global perspective, Japanese car companies represented by Toyota have been deeply cultivating in the field of hydrogen fuel cell industry-related technologies for a long time, and the manufacturing cost of their fuel cell stacks is still so high, not to mention other companies in the same field. From the B end to the C end, the price of the whole vehicle needs to be reduced to 100,000 to 300,000 yuan (42160$). The difficulty in reducing production costs naturally makes it difficult for hydrogen fuel cell vehicles to achieve large-scale commercialization. As Gesi Automotive analysts said: “At present, hydrogen fuel cell vehicles are still mainly used in B-end commercial vehicle applications.” It is reported that China’s commercial hydrogen fuel cell vehicles have entered the early stage of industrial development. In the field of commercial vehicles, forklifts, buses, light and medium-sized trucks have always been at the forefront of hydrogen fuel cell commercial vehicle applications. With the development of hydrogen energy and fuel cell technology, cost reduction, and the improvement of infrastructure, hydrogen fuel cell vehicles will expand to more scenarios such as ports, mines, and specific routes. According to data released by the China Association of Automobile Manufacturers, in the first half of 2023, the sales of domestic hydrogen fuel cell commercial vehicles were 2,085, a year-on-year increase of 102%, about twice the overall growth rate of new energy commercial vehicles during the same period. Yihuatong once told the media that hydrogen fuel cell vehicles will achieve large-scale commercialization in the logistics, heavy-duty truck, and bus sectors; The Zhongguancun Hydrogen Energy Industry Alliance also told the media that bulk applications have already been achieved in heavy-duty trucks and public transportation, with a promising future.

However, it is worth noting that the application scenarios are limited to the commercial vehicle field and cannot meet the long-term commercialization of hydrogen fuel cell vehicles. This is also the reason why the capital market does not favor the hydrogen fuel cell vehicle industry in the short term. Gaisi automotive analysts believe: “The single commercial vehicle application scenario has a limited scope, and the hydrogen fuel cell industry is slow in vehicle application, which directly leads to a lack of interest in capital investment.” Therefore, it is a long-awaited thing for the hydrogen fuel cell vehicle industry to promote the market from the B end to the C end and expand the business from commercial vehicles to passenger vehicles. However, the sales performance of hydrogen fuel cell passenger cars is currently unsatisfactory. For example, in the U.S. hydrogen fuel cell vehicle market, data released by hydrogen fuel cell partners show that in the first quarter of 2023, 725 hydrogen fuel cell new cars were sold in the U.S. market, a decrease of nearly 30% compared to the same period in 2022. By comparison, in the first quarter of 2023, the total sales of new cars in the U.S. market reached 3.7 million, and the proportion of hydrogen fuel cell vehicles can be described as negligible. In comparison, the first quarter sales of pure electric vehicles in the U.S. were 257,507, a 63% increase year-on-year. In California, the first quarter sales of pure electric vehicles were 87,525, and the sales of plug-in hybrid vehicles were 16,470. As mentioned earlier, one of the main obstacles to the large-scale commercialization of the hydrogen energy electric vehicle industry is the high production cost. So, what level must the price of a hydrogen fuel cell vehicle reach in order to capture the “heart” of consumers? In this regard, Gaisi Automotive Research Institute analysts believe that the key to whether hydrogen fuel cell vehicles can be affordable to C-end consumers lies in whether the prices of related models can reach the mainstream price range of the new energy vehicle market. For example, in the domestic market, the mainstream price range of new energy electric vehicles is roughly between 100,000 and 300,000 yuan (42160$). “If hydrogen fuel cell cars can be sold at mainstream prices, they will occupy a place in the C-end market in the future. Otherwise, they will be limited to commercial vehicle applications,” the analyst said. For example, “the domestic price of the Deep Blue S103 hydrogen fuel cell car is over 600,000 yuan (84310$). If this model is to be sold to the C-end, the price conservatively estimated to be reduced to around 300,000-400,000 yuan (56210$), a decrease of almost 50%,” said an analyst at Gaishi Automotive Research Institute. But it is worth noting that price reduction is only one of the difficulties faced by hydrogen fuel cell cars entering the C-end market. In addition, hydrogen fuel cell cars also need to solve many other problems such as energy replenishment infrastructure, vehicle safety, adaptability to different environmental power, and battery cycle life. For example, according to the China Hydrogen Energy Alliance Research Institute, as of the end of June 2023, there are a total of 385 hydrogen refueling stations in China, with the cost of operating 280 hydrogen refueling stations being approximately 15 million yuan per station, while the cost of operating a charging station is approximately 2.5 million yuan. Currently, the average cost of hydrogen per hundred kilometers for hydrogen fuel cell cars is 30 to 80 yuan (10$), while the cost of electricity per hundred kilometers for electric cars is less than 20 yuan (0$). Chinese companies are not “inferior in technology,” and it is still too early to discuss “who will prevail.” Based on the above arguments, we can all infer that the hydrogen fuel cell car industry is still on the eve of a long outbreak. But even so, it cannot be denied that there are still companies and capital going against the tide, aiming to seize the initiative and gain a relatively large share of the hydrogen fuel cell car market. Among them, foreign car companies represented by Japan and South Korea are the most “focused.” Take Japanese companies as an example. It is important to know that Japan has been betting on “hydrogen energy” for a long time. As early as 1973, Japan, in response to the crisis, established the “Hydrogen Energy Association” and implemented a series of plans. With government support, after many years of development, Japan’s hydrogen energy technology has outstripped others, holding over 80% of global patents. Its hydrogen fuel cell technology is also among the best in the world.

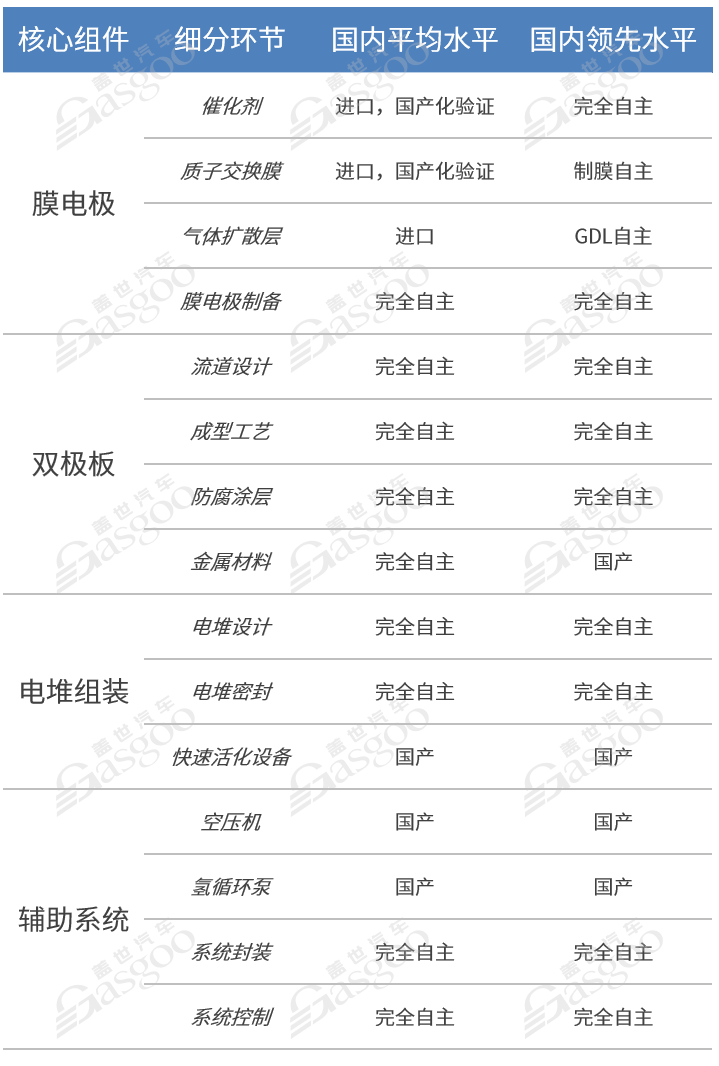

According to data, 70% of the world’s hydrogen fuel vehicle technology patents are held by Japanese companies, with Toyota alone holding over 6,000 patents, accounting for half of the global patents in this area. Some in the hydrogen energy industry have stated, “We do have a lot of hydrogen energy technology that we need to learn from Japanese companies.” However, due to the limited size of the domestic market in Japan, the majority of the country’s new energy vehicle and fuel vehicle sales are focused on overseas markets. China is the most lucrative soil for the new energy vehicle industry, and it is also the largest and most potential new energy vehicle market globally. In addition to electric vehicles, China still strongly encourages the development of hydrogen fuel cell vehicle industry, seeking multiple new energy vehicle technology routes. Some in the industry believe that compared to Japan and South Korea, China is slightly behind in the field of hydrogen energy technology and needs more technical interaction. In the future, a model similar to the “exchange of market for technology” in the era of fuel vehicles will be repeated in the Chinese hydrogen fuel cell vehicle market. However, analysts at the Global Automotive Research Institute do not agree with this view. They believe that at present, China’s technical accumulation in the field of hydrogen fuel cell systems is not behind that of Japanese and Korean companies, and the relevant indicators of hydrogen fuel cell vehicles are already comparable to those of Japanese and Korean companies. “The reason for this stereotype is that Japanese and Korean companies can promote the application of hydrogen fuel cell vehicles globally, with more market opportunities, while China currently has more applications in the commercial vehicle sector,” the analyst said. This is not an empty statement. In recent years, China’s basic research in hydrogen fuel cell technology has been quite active, and in some technological directions, it has the conditions to “compare” with developed countries. In addition, some domestic companies have already mastered the research and development technology of hydrogen fuel cell systems, and the performance of related products such as cold start and power density has also significantly improved, with the ability for mass production of tens of thousands of units per year.

According to the “2023 Hydrogen Fuel Cell System Supply Chain Report” released by the Gaishi Automobile Research Institute, the domestication rate of membrane electrode is currently high, with representative companies including Dongyue Future, Hongji Chuangneng, Tangfeng Energy, Qingdong Technology, and Reshape. Among them, Dongyue Future’s membrane electrode current density is 1.5A/m2, with a lifespan of 5,000-10,000h and a proton membrane thickness of 15μm. In the upstream materials of the membrane electrode, the domestication rate of catalyst is 28%; the domestication rate of gas diffusion layer is 2.36%, and so on. In terms of auxiliary systems, the development of high-power, low-energy consumption BOP products is accelerating, and the technology is relatively mature, so industrialization can achieve rapid cost reduction. Many fuel cell companies have successively released 250kW systems, 300kW stack products, and many air compressor companies are vigorously promoting the research and development of expanders, with some having made significant progress. As the analyst of the Gaishi Automobile Research Institute said, “The exchange of market for technology no longer exists. The domestic hydrogen fuel cell industry chain is relatively complete, and the progress of domestic substitution of core components is accelerating. In addition, the entire track is still in the early stages of growth, and everyone has the opportunity. The key competition lies in the establishment of the ecological foundation of the hydrogen fuel cell vehicle industry.”