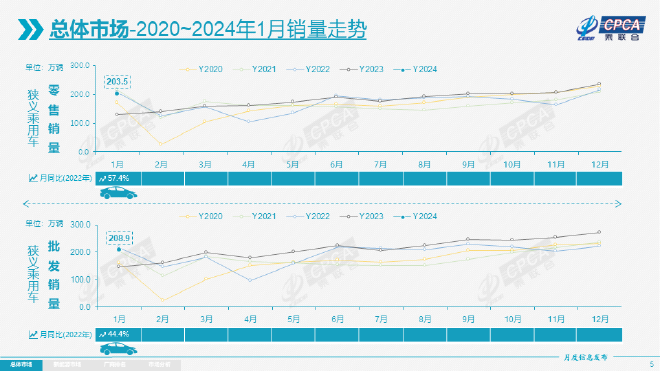

According to the latest national passenger car market analysis report released by the China Passenger Car Association, retail sales of passenger cars reached 2.035 million in January 2024, a year-on-year increase of 57.4% and a month-on-month decrease of 13.9%.

The Secretary-General of the China Association of Automobile Manufacturers, Cui Dongshu, stated that the retail sales of the automobile market in January achieved the expected strong start, with the significant year-on-year growth being an important factor due to the pre-holiday consumption peak brought by the Spring Festival, and the month-on-month decline being a normal trend mainly caused by the rush in sales volume by car companies in December last year. Car market: Retail growth meets expectations Nowadays, the automobile industry has become an important pillar of our country’s economy, so the national guidance policies for the automobile industry are frequently issued with the aim of further stabilizing and expanding automobile consumption. With the support of various promotional policies, especially the Ministry of Commerce’s promotion of the “Hundred Cities Linkage” Automobile Festival and the “Thousand Counties and Ten Thousand Towns” New Energy Vehicle Consumption Season, the effects of the activities are evident, and many regions continue to exert efforts in promoting consumption, providing stable support to the car market in collaboration with enterprise promotions.

From the sales trend in January, the overall market continued the hot market at the end of last year. This month’s car retail achieved the expected red trend, with a high year-on-year growth factor due to the pre-holiday consumption time difference brought by the Spring Festival. However, due to the overdrawn sales of some models in December 2023, combined with the price increase of some car models and the reduction of local promotions, it is not conducive to a significant increase in sales in January. In terms of brands, independent brands still dominate in January, with retail sales reaching 1.12 million units, a year-on-year increase of 77%, a month-on-month decrease of 10%. The domestic retail market share of independent brands in January was 55.1%, an increase of 5.9 percentage points year-on-year; the wholesale market share of independent brands in January was 60.5%, an increase of 8.2 percentage points from the same period last year. Unlike the increasing sales of Chinese brands, the market share of mainstream joint venture brands in China is shrinking, with most joint venture car companies experiencing a declining trend in sales. According to the sales data of joint ventures released by the China Association of Automobile Manufacturers, the retail sales of mainstream joint venture brands in January were 670,000 units, a year-on-year increase of 43%, and a month-on-month decrease of 15%. Among them, the retail market share of German brands in January was 19.2%, a year-on-year decrease of 3.8%; the retail market share of Japanese brands was 16.7%, remaining the same year-on-year; the market retail share of American brands reached 6.5%, a year-on-year decrease of 1.3 percentage points. In the traditional luxury car market, 240,000 luxury cars were retailed in January, a 30% year-on-year increase but a 22% decrease from the previous month. Despite the gradual improvement of the luxury car shortage issue caused by chip supply shortages last year, the demand in the traditional luxury car market is not very strong. Looking at the trend of passenger car sales in January, there is a significant difference in the month-on-month trend between joint ventures and independent car companies. This is mainly due to the fact that in December of last year, joint venture car companies had a greater year-end sales promotion, while independent car companies remained relatively stable. As a result, the retail sales of fuel cars from joint venture car companies decreased by 15% month-on-month, while the retail sales of fuel cars from independent car companies increased by 23%. Therefore, independent brands such as Geely, Chery, and Changan showed a strong sales trend in January. However, the entry-level fuel cars currently have a very high cost-performance ratio, but the consumption of the first-time buyers before the Spring Festival is not very strong. It is worth noting that independent brands have achieved significant growth in the new energy and export markets, and top traditional car companies have shown excellent performance in transformation and upgrading. The market share of traditional car brands such as Geely, BYD, Chery, Changan, and Great Wall has increased significantly. In terms of exports, January continued the strong growth trend of automobile exports in 2023. According to the China Passenger Car Association, 355,000 passenger cars were exported in January, a 51% year-on-year increase but a 7% decrease from the previous month. With the increase in export capacity, independent brand exports reached 296,000 vehicles in January, a year-on-year increase of 61%, and a month-on-month decrease of 10%; joint venture and luxury brand exports reached 59,000 vehicles, a year-on-year increase of 40%.

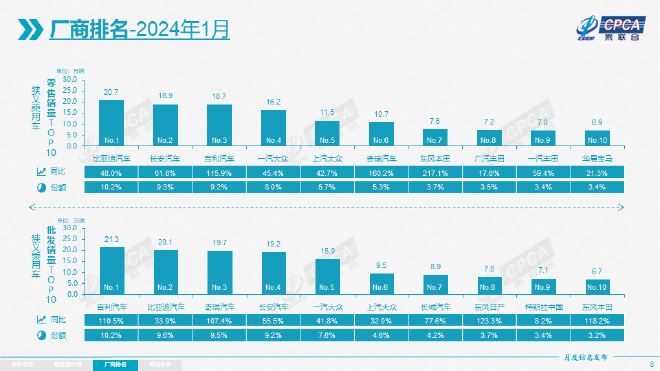

The export volume of new energy vehicles continues to rise, with 95,000 new energy passenger cars exported in January, a year-on-year increase of 27.1% and a month-on-month decrease of 6.9% from December, accounting for 26.8% of passenger car exports, a decrease of 5.2 percentage points from the same period last year. Pure electric vehicles account for 75% of new energy exports, and A0+A00 level pure electric vehicles account for 55% of new energy exports. The China Association of Automobile Manufacturers stated that with the scale advantage and expanding market demand for new energy vehicles in China, an increasing number of Chinese new energy product brands are gaining recognition overseas. The continuous improvement of service networks and increasing acceptance overseas indicate a promising future for the new energy export market. From the monitoring of retail data in overseas markets for independently exported vehicles, A0-level electric vehicles account for nearly 60%, making them the absolute main force in exports. Independent brands such as SAIC have performed well in Europe, while BYD has risen in the Southeast Asian market. In addition to the impressive performance of traditional export car companies, new forces in exports are gradually increasing, and data is beginning to emerge in overseas markets. Car companies: Changan and Geely surpass FAW-Volkswagen and SAIC Volkswagen As the first month of 2024, most mainstream car companies achieved a good start, with sales maintaining a growth trend. Looking at the ranking of retail sales volume by manufacturers, the top three are all independent brands, with Changan and Geely even surpassing FAW-Volkswagen and SAIC Volkswagen. The luxury brand Huachen BMW also entered the top ten ranking list.

In January, BYD’s retail sales reached 207,000 units, an increase of 48.0% year-on-year, maintaining the top spot in passenger car sales with a market share of 10.2%. According to official data released by BYD, the Wangchao and Ocean series remain the main sales force, accounting for 91.86% of January sales. Tengshi brand’s sales in January were 9,068 units, a year-on-year increase of 40.8%, while Yangwang brand sold 1,652 units and Fangchengbao sold 5,203 units in January. BYD’s sales growth is mainly due to its rich product lineup and high cost performance. Popular models such as the Dolphin, Seagull, Yuan PLUS, Song PLUS, and Song Pro have stable sales. The contribution of Tengshi D9 and Yangwang brands, as well as the Fangchengbao Bao5, has also led to rapid overall sales growth. In addition, BYD has launched the fifth generation DM-i hybrid system this year, reducing fuel consumption while upgrading power and chassis to enhance market competitiveness. In terms of products, BYD will launch the Song L, Yuan UP, Fangchengbao Bao8, Fangchengbao Bao3, Yangwang U7, and Sea Lion 07 EV to further enrich its product lineup. In January, Changan Automobile ranked second with sales of 189,000 units, a 61.8% year-on-year increase. The impressive performance is attributed to the contribution of new energy products, and it is expected that the sales of Changan Qiyuan and Shenlan Automobile still have great potential.

According to official data from Changan Automobile, the retail sales of Changan’s independent new energy brand in January were 62,387 units, a year-on-year increase of 208.6%. Changan Qiyuan delivered 10,578 units; Shenlan Automobile delivered 17,042 units; and Avita delivered 7,059 units. Changan Automobile has formed a multi-brand strategy in the field of new energy, including Shenlan Automobile, Changan Qiyuan, and Avita. With the rich product lineup of Changan’s new energy vehicles and the strengthening of competitiveness, Changan Automobile will also usher in a situation where fuel vehicles and new energy vehicles work together. As one of the members of the 1 million annual sales club, Geely Group’s overall market performance is relatively stable, with retail sales reaching 187,000 units in January, a year-on-year increase of 115.9%, and a market share of 9.2%. Geely Automobile’s surge in sales is also due to the hot sales of new energy products. In January, Geely Automobile’s new energy sales reached 65,826 units, a year-on-year increase of 591% and a month-on-month increase of 14.3%, ranking third. If we look at wholesale sales, Geely Automobile is in the top position, surpassing BYD. It is worth noting that Geely has recently launched several new models, including the Galaxy brand’s new mid-to-large-sized pure electric car E8, and the Jike 007, which just hit the market, delivered 5,853 units. By 2024, Geely Automobile will challenge a sales target of 1.9 million units, with the new energy sales target increasing by more than 66%, and these models will become Geely’s new sales growth points. Ranked fourth and fifth are FAW-Volkswagen and SAIC-Volkswagen, with sales of 162,000 units and 115,000 units respectively in January, representing year-on-year increases of 45.4% and 42.7%. Currently, under the trend of the hot sales of new energy vehicles, these two major car companies are gradually losing market share to many independent car companies. However, Volkswagen is also stepping up its layout of new energy vehicle models. Previously, Volkswagen announced that it will launch at least 30 pure electric vehicle models by 2030, but whether these new cars will be accepted by consumers remains to be seen. In terms of new energy vehicles, SAIC-Volkswagen’s ID. family achieved sales of 10,000 units again in January. As for fuel vehicles, Volkswagen Passat sold 27,800 units in January; Volkswagen Touareg sold 20,000 units in January; and the Lavida family sold over 40,000 units in January.

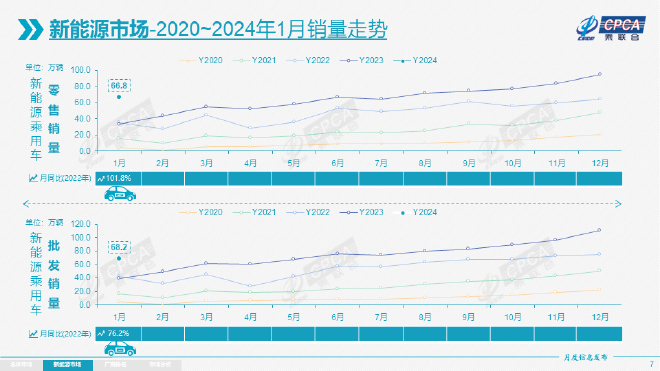

In addition, SAIC Volkswagen will focus on the new energy market in 2024. The monthly sales target for the Volkswagen ID.3 will exceed 20,000 units. The ID series will also aim to introduce the ID.Buzz product and adopt a “high-low” strategy. Chery Automobile ranked sixth, with sales of 107,000 units in January, a year-on-year increase of 160.2%, and a market share of 5.3%. Chery Automobile achieved wholesale sales of 197,000 units in January, a year-on-year increase of 107.4%. The significant difference between wholesale and retail sales is mainly due to Chery Automobile’s outstanding performance in overseas markets. However, Chery, which is currently focused on fuel vehicles, will fully enter the plug-in hybrid market in 2024, with the Fengyun series poised for action. Among joint venture brands, Dongfeng Honda achieved sales of 76,000 units in January, a year-on-year increase of 217.1%, and a market share of 3.7%. According to official data, the CR-V model’s monthly sales exceeded 15,000 units, and the Civic model’s monthly sales exceeded 10,000 units, becoming sales leaders. As the two major joint venture companies of Toyota, GAC Toyota and FAW Toyota ranked eighth and ninth, with sales of 72,000 units and 70,000 units in January, respectively, representing year-on-year increases of 17.6% and 59.4%. Toyota’s two joint ventures in China have launched new cars using a dual-car strategy. Under the impact of price wars and new energy, the performance of both joint venture automakers in the field of new energy is poor, and their market share in the fuel vehicle market is being squeezed. Currently, Camry not only faces competition from the same level of fuel vehicles but also competes with new energy vehicles such as Deep Blue SL03 and BYD Sea Lion for market share. Corolla and Levin are the same. Among the joint venture brands, BMW Brilliance is the real “dark horse”, squeezing into the rankings and being the only luxury brand to enter the top ten. In January, BMW Brilliance sold 69,000 vehicles, a year-on-year increase of 21.3%, ranking tenth. The reason is expected to be related to the upcoming Spring Festival and the consumer psychology of buying luxury cars to take home. However, other joint venture brands are not so lucky. SAIC-GM, SAIC-GM Wuling, GAC Honda, and Dongfeng Nissan are all unable to enter the top ten in the rankings, perhaps due to intense price wars and overall competitive pressure. New Energy: Market growth remains stable. Data from the China Association of Automobile Manufacturers shows that in January, the retail sales of new energy vehicles reached 668,000 units, a year-on-year increase of 101.8%, and a month-on-month decrease of 29.5%. Overall, new energy vehicles continue to show steady growth in the domestic market, especially plug-in hybrid models are more popular, relieving users’ range anxiety.

It is worth mentioning that with the increase in sales of new energy vehicles, the market retail penetration rate reached 32.8% in January, an increase of 7.2 percentage points from the same period last year, but a decrease of 7.5 percentage points from the 40.3% penetration rate in December last year. Looking at the car brand, the penetration rate of new energy vehicles in independent brands in January was 51.8%; the penetration rate of new energy vehicles in luxury cars was 22.3%; and the penetration rate of new energy vehicles in mainstream joint venture brands was only 5.1%. In terms of monthly domestic retail market share, the retail share of new energy vehicles from mainstream independent brands in January was 70.3%, an increase of 10 percentage points year-on-year; the share of new energy vehicles from joint venture brands was 4.9%, an increase of 0.9 percentage points year-on-year; the share of new forces was 14.8%, an increase of 3.7 percentage points year-on-year; and the share of Tesla was 6.0%, a decrease of 0.9 percentage points year-on-year. From the data, it can be seen that the retail penetration rate of new energy vehicles in China in January 2024 is steadily increasing, indicating that the market’s acceptance of new energy vehicles is gradually rising. With the continuous improvement of infrastructure and the launch of high cost-effective products, the number of new energy vehicles will continue to rise. However, it is worth noting that the growth rate of new energy vehicle sales in the market is slowing down, gradually transitioning from incremental competition to stock competition. Combined with the impact of price wars, sales growth has entered a period of stable growth, and future market competition will certainly become more intense. From the production side, the production of new energy passenger vehicles reached 734,000 units in January, an increase of 85.1% year-on-year, and a decrease of 33.3% month-on-month. In terms of wholesale sales, the wholesale sales of new energy passenger vehicles reached 682,000 units in January, an increase of 76.2% year-on-year, and a decrease of 38.8% month-on-month, with no significant pressure on channel inventory. Looking at the performance of new energy vehicle companies, the overall trend of new energy passenger vehicle companies in January was strong, with BYD consolidating its leading position in the independent brand new energy sector. Extended-range electric vehicles represented by Tesla, Changan, Ideal, and Zero Run also performed particularly well. In addition, with independent car companies adopting a multi-pronged approach to new energy routes, the market base continues to expand. Data from the China Association of Automobile Manufacturers shows that 18 companies have surpassed 10,000 units in wholesale sales, accounting for 90.7% of the total new energy passenger vehicle volume.

Of course, the new forces of car manufacturing are also continuing to exert their efforts. In January, the retail market share of new forces increased by 3.7 percentage points year-on-year to 14.8%; NIO, Xiaopeng, and Ideal, among other new forces, still showed strong overall performance in sales volume year-on-year and month-on-month. In addition, among mainstream joint venture brands, both Volkswagen in the north and south showed strong leadership, with 19,428 units of new energy vehicles being wholesaled, accounting for a strong 47% share of mainstream joint venture pure electric vehicles. Volkswagen’s firm electrification transformation strategy is beginning to show results, but other joint ventures and luxury brands still need to make efforts. In the data released by the China Passenger Car Association, we also see that there is market demand for ordinary hybrid passenger cars, with the retail market share of new forces increasing by 3.7 percentage points to 14.8% year-on-year in January. However, hybrid models are mainly dominated by joint venture brands, such as GAC Toyota, FAW Toyota, Dongfeng Honda, Changan Ford, Dongfeng Nissan, and so on. In addition, the sales of hybrid independent brands are gradually increasing.

BYD ranks first in the ranking of new energy vehicle companies, and no company can currently shake its position. It is rumored that BYD’s sales target for 2024 is 4.5 million vehicles, with an increase of 48%. To achieve this goal, BYD will launch several new heavy-duty vehicles, including the Qin PLUS and the Evacuator 05 Honor Edition, starting at 79,800 yuan (11090$), further threatening joint venture gasoline vehicles. Traditional independent car companies are growing rapidly in the field of new energy. In January, Geely’s new energy sales reached 64,300 vehicles, a year-on-year increase of 632.1%. Among them, Jike cars delivered 12,537 new cars in January, and the Jike 007 is becoming the main driver of Jike’s sales growth. Changan’s new energy vehicle sales reached 51,100 vehicles in January, an increase of 181.9% year-on-year. Among them, Changan Qiyuan delivered 10,578 vehicles, Shenlan delivered 17,042 vehicles, and Avita delivered 7,059 vehicles. It is worth mentioning that the market performance of the new forces in car manufacturing in January was also very good. Among them, Huawei’s HarmonyOS Smart Mobility under AITO Wanjie delivered 3,297.3 new vehicles, an increase of 34.76% month-on-month. Currently, the AITO Wanjie series includes the M5, M7, and M9 models. The new M7 is the sales leader, with deliveries reaching 31,253 vehicles in January. AITO Wanjie officials said that since its launch in September 2023, the new M7 has accumulated more than 140,000 orders.

In terms of new models, AITO announced that the new M5 will be launched in the first half of next year, followed by the new M8 in the second half, showcasing its strength in the high-end smart car market. Ideal car deliveries in January were good, with a total of 31,200 new cars delivered, a 105.8% year-on-year increase. In order to boost sales, Ideal car announced a price reduction of 33,000 to 35,000 yuan (4860$) for its L series models. In addition, Ideal car’s 2024 new models are about to be released, and the new L6 model has appeared in the Ministry of Industry and Information Technology’s declaration directory. The new car is positioned as a 5-seat mid-size SUV with extended range and will be launched in April, potentially becoming a new sales driver. In January, Leapmotor delivered 12,800 new cars and will release its 2024 “product package” in early March, including the C10, 2024 C11, and 2024 C01, further consolidating its sales. At the same time, NIO’s January sales exceeded 10,000, with 10,055 new cars delivered, an 18.2% year-on-year increase. The 2024 models will begin delivery in early March, with upgrades to the vehicle’s hardware configuration. In summary, the overall passenger car market in January showed strong exports, relatively conservative production and wholesale, and stable retail, thereby reducing channel inventory pressure. Due to the Chinese New Year falling in February, the holiday will also lead to a very short effective production and sales time for car companies, and it is expected that the February car market sales will be at an absolute low for the year.