After the Spring Festival, BYD took the lead in launching the first shot of the price war in the Year of the Dragon car market, pushing the price of new energy vehicles into the 70,000 yuan (9730$) era and shouting the slogan “electricity is cheaper than oil”, followed by SAIC-GM Wuling, Chang’an Qiyuan, and Geely.

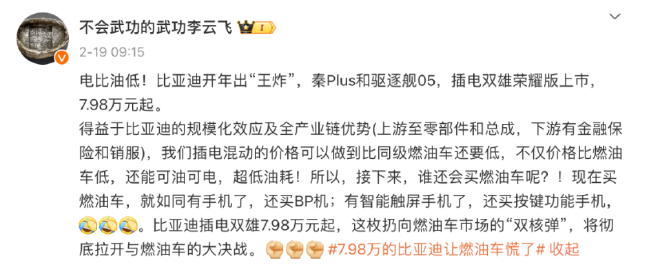

From the “oil and electricity at the same price” in 2023 to the “electricity cheaper than oil” at the beginning of 2024, the change in marketing slogans is also a small reflection of the rapid changes in the Chinese new energy vehicle market. Obviously, this time BYD directly puts the relationship between electric cars and oil cars in opposition, and the competition between the two sides has entered a critical moment. BYD made a move, Wuling and Qiyuan quickly followed suit. On February 19th, BYD announced the launch of two models, the Qin PLUS Honor Edition and the Destroyer 05 Honor Edition, with a starting price of 7.98 million yuan, officially ushering in an era where the price of electric vehicles is lower than that of the same level of fuel vehicles, and comprehensively impacting the A-level car market. Li Yunfei, general manager of BYD Group’s brand and public relations department, said that thanks to BYD’s economies of scale and full industry chain advantages, the price of BYD plug-in hybrids can be lower than that of the same level of fuel vehicles. In 2023, BYD launched the Qin PLUS DM-i Champion Edition, lowering the price to below 100,000 yuan (13900$) for the first time, and shouted the slogan “oil and electricity at the same price.” With its price and product advantages, the BYD Qin PLUS family sold more than 480,000 units last year, exceeding the joint venture fuel vehicles, the Xuan Yi and Lang Yi, by about 100,000 units, and won the annual sales championship in the A-level car market for the first time. After this price reduction, the BYD Qin PLUS is lower in price than the same level of fuel vehicles such as the Xuan Yi and Sagitar, and has advantages over the same level of hybrid vehicles such as Wuling Xingguang, Roewe D7, Fengyun A8, and Qiyuan A05, and even some A0-level small cars seem less appealing.

After BYD released its pricing strategy, many other car companies quickly followed suit. As a benchmark model, SAIC-GM-Wuling took the lead, with the deputy general manager of SAIC-GM-Wuling brand division, Zhou Xin, directly calling out on social media, “One word, follow!” According to official information, the SAIC-GM-Wuling Rongguang 150km advanced plug-in hybrid sedan has lowered its price to 9.98 million yuan, a reduction of 6,000 yuan (830$) from the previous 10.58 million yuan, which is basically the same as the price of the BYD Destroyer 05 120km version. However, unlike BYD, the Rongguang this time only reduced the price of the high-end version of the plug-in hybrid model, competing with the high-end version of the BYD Qin 55km and the low-end version of the Destroyer 05 120km. The standard version of the Rongguang 70 has not been reduced in price and remains at 88,000 yuan (12230$). SAIC-GM-Wuling stated, “The official price of the long-range pure electric hybrid model has officially entered the 90,000 yuan (12510$) level.” From the perspective of SAIC-GM-Wuling’s price reduction policy, it is also carefully considered. Currently, plug-in hybrid cars with long endurance and low-end versions are more popular. Taking the BYD Qin PLUS DM-i as an example, the long-range 120KM leading model accounted for over 40% of the sales of the Qin PLUS DM-i in the second half of 2023. The price reduction of the long-range version of the Rongguang highlights its advantages and also balances costs. Following this, Changan Automobile also joined the price reduction ranks, with the Changan Qiyuan A05 and Changan Yidong PLUS enjoying the latest preferential policies, and releasing a poster with the slogan “Electricity is lower than fuel.” Among them, the starting price of the Changan Qiyuan A05 has been reduced to 78,900 yuan (10970$), with a comprehensive discount of 11,000 yuan (1530$) for the entry-level model, and a discount of up to 23,000 yuan (3200$) for the high-end model, competing with the entry-level price of the BYD Qin PLUS. Geely’s approach is similar to BYD’s, launching the Geely Dihao L HiP Dragon Edition, with the entry-level price directly reduced by 20,000 yuan (2780$), starting at just 89,800 yuan (12480$).

A while ago, when the Geely Emgrand L HiP was launched, many people compared it to the BYD Qin PLUS DM-i. However, the sales of this car were average after it was launched, and it was even replaced by the Geely Borui L6 according to the market performance. In the past year, the sales of the Emgrand L HiP were 3729 units. This time, the starting price of the Geely Emgrand L HiP Dragon Edition has been reduced to 89,800 yuan (12480$), which is 10,000 yuan (1390$) higher than the BYD Qin PLUS DM-i Honor Edition. However, its entry-level model has a pure electric range of 100 kilometers, equipped with a 1.5T engine and a 3-speed DHT hybrid system, with lower fuel consumption in the case of power loss. Not only traditional car companies quickly joined the price reduction camp. On February 19, NIO announced that all models would be reduced by up to 22,000 yuan (3060$). The NIO X series was reduced by 22,000 yuan (3060$), and the new 400 Air version was priced from 99,800 yuan (13870$), reducing the starting price to within 100,000 yuan (13900$). The NIO S series was reduced by 5,000 yuan (690$), now priced at 154,800 yuan (21520$). NIO’s total sales in 2023 were 127,500 units, a decrease of 16.20% from the same period, and it was the only company among the mainstream new car forces to experience a decline in sales. At the end of the year, the company underwent a large-scale adjustment, and the CEO also served as the president of the marketing company to personally supervise the battle. In January 2024, under the leadership of Zhang Yong, NIO finally dispelled the cloud hanging over its head, delivering over 10,000 units in that month, achieving a significant increase compared to the same period last year. In response to BYD’s new round of price war, NIO also chose to follow suit, with the goal of increasing sales. It is worth noting that this year’s opening price war is not only centered around new energy brands, but also fuel vehicle brands have announced price reductions. Beijing Hyundai announced that the price of its A-class sedan, the Elantra, has been reduced by 24,000 yuan (3340$), with a starting price of 75,800 yuan (10540$), lowering the price to within the 100,000 yuan (13900$) range, and throwing out the slogan “Stronger than Electricity.” SAIC-GM’s Buick brand has announced a limited-time price reduction or replacement subsidy for some models, with discounts of 35,000-65,000 yuan (9030$) for the Buick Regal, Velite Pro, and Enclave Plus models, with prices dropping to the 100,000-150,000 yuan (20850$) range, aimed at consolidating the position of fuel vehicles. Will joint venture fuel vehicles be defeated by new energy vehicles? In the past, joint venture brands have maintained the price of fuel vehicles at 100,000-120,000 yuan (16680$) due to mature production and supply chain management, but now, with the price reduction of new energy brands, the original price of fuel vehicles is no longer an advantage. This time, the debut of BYD’s new models has made many traditional fuel vehicle manufacturers feel a crisis, realizing that electric vehicles have become an irreversible trend, and future competition will be more intense. It can be seen that this wave of price reductions at the beginning of the year is mainly focused on hybrid models in the 100,000 yuan (13900$) range, which used to be the territory of joint venture fuel vehicles. It seems that independent brands will have to use new energy hybrid vehicles to carve out market share. Previously, industry insiders also stated that plug-in hybrid models will experience a surge in sales in 2024, and the market share of plug-in hybrids and extended-range models in January has also grown significantly. According to data from the China Passenger Car Association, in January, the proportion of pure electric vehicle wholesale sales reached 59%, while in the same period last year, this type of vehicle accounted for as much as 70%. It is worth noting that the proportion of plug-in hybrid models is rising, reaching 28%, while the proportion of extended-range models is 13%, compared to only 24% and 6% in the same period last year, respectively. Cui Dongshu, secretary general of the China Passenger Car Association, has previously stated that the increase in plug-in hybrid models is mainly in the low-price range, and after independent plug-in hybrid technology matures, it has already gained a large market share in the mid- to low-price range. According to the China Passenger Car Association, the market share of plug-in hybrid vehicles in the 50,000-100,000 yuan (13900$) segment was 0.6% in 2023. By January 2024, the market share of plug-in hybrid vehicles in this segment had increased to 2.4%.

According to the current market trend, plug-in hybrid cars are not only squeezing the market share of pure electric cars, but also that of traditional fuel cars. By 2023, the price of the BYD Qin PLUS DM-i Champion Edition will drop to 99,800 yuan (13870$), which is basically the same as the official guide price of the classic version of the Nissan Sylphy. For a long time, the 100,000-yuan-level sedan market has been dominated by joint venture fuel vehicles. The prices of similar new energy compact cars are generally higher than those of fuel cars, and their cost-effectiveness and product strength are not very outstanding, so at that time, the joint venture brands mainly dominated the market for this level of cars. According to the statistics of the China Passenger Car Association, the core mainstream models of passenger cars in the country are concentrated in the 50,000-150,000 yuan (20850$) range, and traditional fuel cars account for the highest proportion in this main market. The arrival of hybrid models such as the BYD Qin PLUS DM-i, the Geely Emgrand L HiP, the GAC Trumpchi L6, and the Roewe D7 DMH have brought impact to the fuel car market at this level. Under the impact of new energy vehicles such as the BYD Qin PLUS, the fuel car market also faces great pressure, especially in the compact sedan segment represented by the Sylphy and the Lavida. Therefore, price reduction has become the killer move to maintain competitive advantage, and both have entered the 80,000-yuan-level sedan market, along with the Corolla and the Bora. According to third-party platforms, the terminal starting price of the Nissan Sylphy is as low as 75,600 yuan (10510$), with discounts exceeding 30,000 yuan (4170$); Toyota Corolla also has dealer discounts close to 30,000 yuan (4170$); and the prices of the Volkswagen Bora and Santana have already dropped to 60,000 yuan (8340$). However, the sales performance of the discounted compact fuel cars is not ideal. According to the China Passenger Car Association’s January car sales rankings, the sales crown was taken by the Volkswagen Lavida, with monthly sales reaching 32,419 units, a decrease of 16.4% compared to the previous month; the monthly sales of the Nissan Sylphy also surpassed the 30,000-unit mark, reaching 30,384 units, a decrease of 37.2% compared to the previous month. Meanwhile, the Toyota Corolla, Levin, and others have dropped out of the top 20 in sales. In contrast, the BYD Qin PLUS family has maintained monthly sales of over 40,000 units in 2023, steadily leading the domestic A-level sedan sales, and with the launch of the Qin PLUS Honor Edition, the price is the same as the new Sylphy and classic Sylphy, and it has the advantages of low cost of ownership and no range anxiety. With similar prices, plug-in hybrid models have a greater advantage in purchasing, and the Honor Edition models will continue to help the Qin PLUS to capture market share from the Sylphy, Sylphy, and Sagitar fuel cars.

On social media, Li Yunfei, General Manager of BYD Group’s brand and public relations department, stated that the price of BYD plug-in hybrid can be lower than that of the same level of gasoline vehicles, which will completely open up the big battle with gasoline vehicles. “Who will still buy gasoline vehicles next?” Of course, gasoline vehicles will not sit idly by. However, industry analysts believe that although there is some room for price reduction for gasoline vehicles such as Elantra and Lang Yi, the decline has bottomed out, and the market for mainstream gasoline vehicles in the 100,000-level will still be eroded by electric vehicles. Regarding the development of the automobile market this year, Cui Dongshu, Secretary-General of the China Passenger Car Association, said: “From the perspective of gasoline vehicles, the cost of new energy is decreasing, and the ‘same price for oil and electricity’ is putting tremendous pressure on gasoline vehicle manufacturers. The updating and replacement of gasoline vehicle products is relatively slow, the degree of product intelligence is not high, and it relies more on discounted prices to continuously attract customers.” In addition, Cui Dongshu pointed out that as the penetration rate of new energy vehicles is rapidly increasing, the market size of traditional gasoline vehicles is gradually shrinking, and the contradiction between the huge traditional production capacity and the gradually shrinking gasoline vehicle market has brought about a more intense price war. In recent years, due to the rapid development of new energy vehicles, there have been more and more voices in the industry calling for the “killing of gasoline vehicles”, and many car companies have even announced their timetable for stopping the sale of gasoline vehicles. However, at present, it is too early to sing the decline of gasoline vehicles.

Fuel-efficient Chinese brand pure fuel vehicles are still the first choice for consumers in most third, fourth, and fifth-tier cities, as they are durable and affordable. Currently, traditional fuel vehicles are still the main sales force for traditional car companies. Most mainstream Chinese brands still rely on the profits from traditional fuel vehicles to support the new energy vehicles. The new energy vehicle business of car companies is still in a loss-making state, so fuel vehicles play a crucial role in the enterprise. Faced with the expanding market for new energy and fuel-efficient vehicles, it is not appropriate to simply oppose the development of new energy vehicles and fuel-efficient vehicles. With the continuous improvement of technology and cost reduction, new energy vehicles are expected to gain a larger market share in the future, but currently, fuel-efficient vehicles still have certain advantages. In the current market, the Chinese new energy vehicle market has gone from a blue ocean to a red ocean, and now to a bloody ocean in just a few years. Many industry insiders have pointed out that 2024 will be a critical year for new energy vehicle companies, and whether they can find their position in the market will determine whether the brand can continue to stay in the game.

Now, the car market is in a fierce competition, with many participants. Before this big cake solidifies, every car company wants a bigger piece, so various promotional methods will emerge, and internal competition will become the new norm in 2024. In 2023, BYD Chairman Wang Chuanfu clearly stated that in the next 3-5 years, BYD will engage in price wars, or price wars in specific areas, and the company is fully prepared for this. Throughout 2023, the Chinese car market, especially the new energy market, has seen continuous direct or indirect price promotions, with all brands pushing hard to secure a place in the second half of the year. Undoubtedly, stimulating the market with prices is the fastest way to see results. Price wars have now become standard configurations, and this year’s price wars started earlier than in 2023, with car companies choosing to lower prices at the beginning of the year to maximize the promotional effect. A spokesperson for a new brand recently stated in an interview that both traditional marketing strategies and the current competitive situation are forcing other car companies to join a new round of price wars. Of course, in 2023, Tesla and BYD, which started the price war, became the biggest winners. Tesla sold over 600,000 vehicles in China, with the Model Y becoming the best-selling new energy SUV, while BYD sold over 3 million vehicles, becoming the best-selling new energy passenger car. In 2024, BYD made a big move by lowering the price of the Qin PLUS DM-i, putting pressure on its competitors and showing its determination to expand market share, as well as “warming up” for the upcoming launch of the Qin L. So, “the beginning of the year is the decisive battle” seems to have become the consensus of the entire automotive industry, and everyone may already be mentally prepared for the intensity of this year’s price war and market competition. However, it is worth mentioning that for car companies that can keep up with price wars, they can naturally respond calmly, but for those weaker brands, they should not blindly follow the trend and should quickly find their own way to save themselves. In fact, behind the price war in the Year of the Dragon in the car market, it is also a prediction of this year’s market competition by major car companies.

Xiaopeng Motors CEO He Xiaopeng stated in a letter to all employees that this year is defined as the first year of “bloodbath” competition for Chinese brands, also the first year of the elimination round. SAIC-GM Wuling General Manager Lv Juncheng admitted that “the era of Wuling’s legendary car is over, going from market leader to follower.” In addition, Geely Automobile Group CEO Gan Jiayue also stated in the letter that 2024 will be the “most intense” year, with increased prices, products, services, and traffic. Zhang Yongwei, Vice Chairman and Secretary-General of the China Electric Vehicle Hundred People’s Association, believes that from 2024 to 2025, the automotive industry will enter a period of deep restructuring. He emphasized that 2024 will be a key period for industry reshaping, with the launch of more new energy vehicle products and models, entering the “Moore’s Law” era. NIO founder Li Bin has also stated that the next two years will see more intense competition in the automotive industry, with a high priority on cost reduction. He warned not to be surprised if a more intense “price war” breaks out after the Spring Festival holiday, as it may become the new normal in the coming years. Zhu Jiangming, Founder, Chairman, and CEO of Leap Motor, previously stated that “rolling” is a good thing, as it can roll out the competitive advantage of new energy vehicles and gain market share from traditional fuel vehicles. However, companies still need to be vigilant, as industry consolidation is accelerating, with companies like WM Motor facing difficulties. In conclusion, car companies should find a development strategy that suits their business in the industry consolidation, as survival is more important than anything else. It won’t be easy to dominate the oil vehicle market with just low-priced, fuel-efficient products.