At the beginning of the new year, BYD once again made a big move, with the launch of the BYD Qin PLUS and the Destroyer 05 Honor Edition, with a starting price of 79,800 yuan (11090$). “Electricity cheaper than oil” quietly arrived after the new year’s resumption of work, and then various car companies followed suit, and the “battle” of 2024 officially began. Ideal’s L6 and MEGA are about to be officially launched, will they become the hot sellers of Ideal Cars this year? GAC Motor has again revealed production stoppages, can it survive the multiple crises? Let’s review this week’s hot topics in Weibo’s automotive industry together. #Electric cars are even cheaper than gasoline cars#

On the second working day after the end of the Spring Festival holiday, BYD launched the first shot of the “price war” in the Year of the Dragon! The BYD Qin PLUS and Tang 05 Honor Edition are on the market, with the new car configuration unchanged, but the price has dropped to 79,800 yuan (11090$). The price is even lower than some fuel vehicles, “lower than oil with electricity”, which is achieved in BYD.

BYD kicked off the Year of the Dragon with a “royal flush”, with a price of 79,800 yuan (11090$), attracting both new energy vehicles and fuel vehicles into a “showdown” stage. It is predicted that 2024 will be even more intense, and BYD is still the first to take action. In 2022, it stopped selling fuel vehicles and fully developed the fuel vehicle market. From the same price of oil and electricity, to the production of 5 million vehicles, to the current “oil is cheaper than electricity”, BYD’s move can be said to be a thorough “challenge” to fuel vehicles. It is not difficult to predict that the competition between fuel vehicles and new energy vehicles will be more intense this year. In just over two years, BYD has achieved today’s results, which is inseparable from its early strategic layout. It also reflects that in the development of new energy vehicles, BYD has mastered the most core technology. With the advantages of economies of scale and the entire industry chain, BYD has the initiative in pricing its products. It can also support its two-pronged approach, continuously launching new products targeting different markets, and also having cost control that allows it to be more flexible in pricing. Another point that cannot be ignored is that many consumers may also have the same question: if the price is lower, does it mean that the configuration is also lower? Looking at the two new cars that have been launched, the starting versions have not sacrificed configuration for price. This is undoubtedly very consumer-friendly. On the other hand, in the fuel vehicle market, mainly represented by the domestic mainstream family sedan market such as the Lavida and the Sylphy, at present, because the price of new energy vehicles has a competitive advantage, and also has certain advantages in key parameters such as configuration and space, it will indeed affect the choices of some consumers. The goal of new energy vehicles is very clear, to seize a broader market in third and fourth-tier cities, and increase their penetration in these areas. In conclusion, there is not much time left for fuel vehicles. If they want to continue to retain market share, change is imperative. In a sense, it is actively seeking change, but at the same time, it has also been led into a more intense stage by its competitors. Who will have the last laugh remains to be seen. #Li Xiang sarcastically reviews 2023#

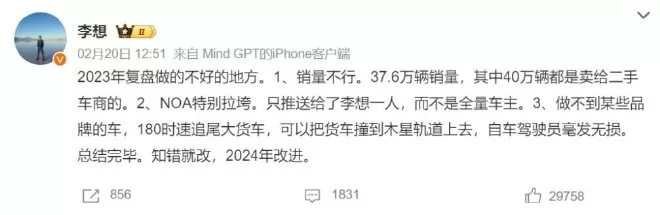

On February 20th, Li Xiang, CEO of Ideal Cars, sarcastically reviewed the shortcomings of 2023. 1. Sales were poor. 2. NOA was particularly disappointing. 3. Couldn’t make certain brands of cars, could crash a truck into Jupiter’s orbit. Finally, he stated: Recognize mistakes and make improvements in 2024.

Without a doubt, the new forces of car manufacturing need more attention. Through a lot of attention and moderate marketing, it seems that this is the “old trick” of the new car companies to attract attention through public opinion. Does ideal still lack attention? I don’t think so. The latest MPV model MEGA is about to be launched, and the all-new L6 will also enter the lower-priced market. Given the overall delivery performance of Ideal last year, which car company is not afraid of such opponents? But the market changes constantly. Ideal is still not enough to sit firmly on the Diaoyutai. Pressure comes from all sides, but the opponents often give more fatal blows. From the points pointed out by Li Xiang on Weibo, it must be referring to something specific. I won’t do too much analysis here, but there are indeed many problems surrounding Ideal itself that still need to be solved, such as order issues, NOA function installation, and the traffic accident involving the L7 at the end of last year, which raised doubts about vehicle safety. Do you still remember last year when the MEGA design was exposed, Li Xiang also said on Weibo, “If it’s really designed like this, I will fire the design team and jump off the building myself,” which immediately sparked the popularity of MEGA, and was jokingly called the “jump off the building model” by everyone. But now these few summaries seem to have far less effect than they did at the time, and even drew the scorn of netizens. As mentioned earlier, the terrifying opponent may be the root cause of the ideal “losing its mind.” Li Xiang has admitted that Wenjie will be Ideal’s biggest competitor and has spoken on Weibo multiple times, saying that Wenjie has directly crippled Ideal. We have never encountered such a powerful opponent, and even left us powerless. Of course, this may be Li Xiang’s modest side, but Wenjie’s performance is indeed very eye-catching. With the release of Wenjie M9, the title of the strongest SUV on the market gradually became familiar to everyone. During the Spring Festival, Wenjie’s CEO’s few moments on WeChat once again heated up the Wenjie M9, showcasing the car while also putting Huawei’s self-developed intelligent driving assistance system in the spotlight. In terms of sales, Wenjie surpassed Ideal in the first 2 months, losing its position as the top new force. This is obviously what makes Ideal most anxious. Ideal has set a target of 800,000 vehicles for this year, and the upcoming L6 and MEGA will be important growth points for Ideal this year. Xiaopeng’s X9 has already achieved nearly 3,000 units in January, with tens of thousands of orders, which is also pressure for Ideal’s MEGA. The road ahead is equally arduous. How to view the price war of new energy vehicles?

As BYD’s new energy vehicle prices enter the 70,000 range, the “lower cost of electricity than gasoline” has attracted attention. Following this, Wuling, Changan, and Beijing Hyundai also joined the price reduction trend.

BYD released a big move in the year of the dragon, bringing the price into the range of 70,000 yuan (9730$). It can be said that this seemingly unconventional move is actually the inevitable result of BYD’s deep cultivation of the new energy vehicle market in recent years. From “oil and electricity at the same price” to “oil cheaper than electricity”, this process is so fast that many people still can’t believe it. While BYD is making a big move, we also see that other car companies are moving quickly to follow suit. The “rolling” is still the theme of 2024, and it also heralds the official start of the real “battle” between new energy vehicles and fuel vehicles. So, which side are you more optimistic about? Achieving “oil cheaper than electricity” is by no means accidental. This is certainly thanks to BYD’s mastery of core technology, as well as the advantages of economies of scale and the entire industry chain, combined with cost control. It must be said that this combination of advantages has an immediate effect. The BYD Qin PLUS family won the championship in the A-class sedan market last year. According to this logic, there should be no problem this year. So, is it really the end of the road for fuel vehicles? It is still too early to say that there is no chance at all, but at least there are two points that traditional car companies should pay enough attention to. One is the sense of crisis. BYD’s new cars are starting to penetrate the market below 100,000 yuan (13890$), especially targeting third- and fourth-tier cities, which has always been the domain of joint venture fuel vehicles, such as the popular Lavida, Sylphy, and Corolla. BYD is now targeting this big cake and has a great opportunity to leverage this market, especially with better parameters and configurations than its competitors. BYD is promoting the plug-in hybrid, which has more power and a wider range of applications, which will make this part of the market more favored. With the continuous advancement of technology, plug-in hybrids, including extended-range models, will see a stronger outbreak in 2024. Although traditional fuel vehicles have been plowing here for a long time, the new energy storm is indeed very strong. It has seized on the slow replacement of fuel vehicles and the lack of innovation, and this sweeping is ruthless. Stimulating sales with prices is a common and direct means, but the initiator is well prepared. “BYD is going to use prices to leverage the market in the future. The company is well prepared,” said Wang Chuanfu, the head of the company. Compared with the initiative, the entry of fuel vehicles and other car companies seems a bit “forced”. It is more difficult to achieve both profit and market. In any case, BYD’s big move has already been unveiled. The next step is how other car companies will respond. The difference between following or not following is quite different. #GAC will stop production for 6 months# On February 18th, the first day of work after the Spring Festival of the Dragon Year, GAC held an internal meeting and announced that it will stop production for 6 months starting today. According to an internal source, GAC stated that the wages of employees before February 18th will be paid as usual; employees who remain at GAC before March 15th will only receive basic wages; after March 15th, employees will only receive basic wages in Shanghai. It is reported that GAC pays salaries on the 15th of each month. Prior to this, GAC held a company-wide meeting to announce the postponement of January salaries, the cancellation of year-end bonuses, and a reduction in salaries for all employees. The January salary will be paid at the end of February.

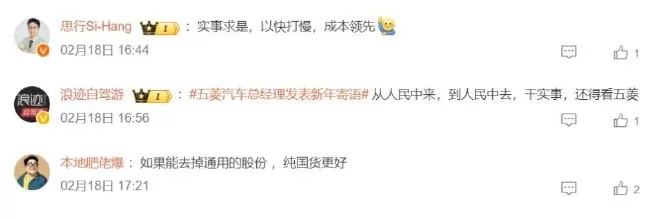

“Several joys and several sorrows,” the beginning of the Year of the Dragon has seen companies like BYD making great strides, and also news of Gaohe Auto’s production halt. New energy vehicles have become the theme of the times. In the competitive development, companies need to focus not only on innovation and technology, but also on strong market insight, brand influence, and comprehensive service capabilities. The road ahead for Gaohe Auto will be difficult in the more intense competition of 2024. The market is so vast, how can new energy vehicle companies like Gaohe not be accepted? Perhaps looking at the positioning of their models can provide some answers. Gaohe Auto has always been positioned in the high-end luxury electric vehicle market, with prices ranging from 45.9 to 80 million yuan. This does not seem like a strategy for quickly seizing the market, but rather a long-term strategic marketing approach. The positioning also means that the market for Gaohe will be very niche, with a small market capacity. If it cannot quickly increase sales, the economic benefits of Gaohe cars will be significantly weakened. In recent years, BYD, Ideal, NIO, and BBA have continuously invested in products in the segmented market, leading to fiercer competition. With high prices, Gaohe cars are struggling to break through sales. In terms of costs, the high price of Gaohe cars means that if annual sales do not reach a certain scale, the R&D, management, and marketing costs per car will be very high. Even companies like Xiaopeng and NIO, with sales over 100,000 units, are not profitable. Without profit, Gaohe can only rely on burning money to continue operating. Lastly, without profit, the only way to keep Gaohe running is to “burn money.” Although Huaren Yuntong welcomed a $5.6 billion agreement with the Saudi Investment Department in June 2023, no further information or progress has been announced, meaning that this funding is no longer reliable. The general manager of SAIC-GM-Wuling Automobile Co., Ltd., Lv Juncheng, delivered the 2024 New Year’s greetings and made several requests: 1. Free your mind, seek truth from facts, 2. Unify thinking, act quickly, 3. Lead in cost, be different

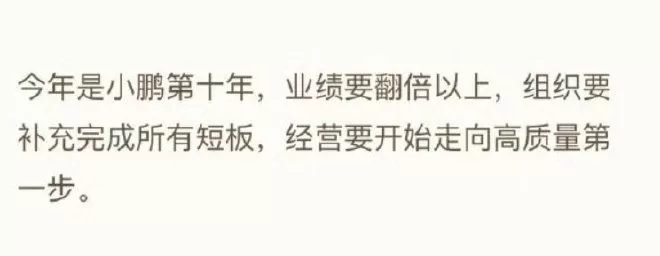

On the first workday after the holiday, He Xiaopeng said, “This year is the tenth year for Xiaopeng. Performance needs to double, the organization needs to make up for all shortcomings, and operations need to take the first step towards high quality.”

Not only the CEOs of the above-mentioned car companies have issued New Year’s greetings, but everyone is carrying dreams and looking forward to tomorrow in the Year of the Dragon. People have also expressed their aspirations to work hard and achieve new heights. There is no reason not to strive, because the future is promising. In his New Year’s message, the CEO of Geely pointed out that the “youthful era” of Chinese cars has arrived, not just in terms of age, but in terms of the courage to change old thinking and the desire to try new things. The rapid changes in Chinese cars are immeasurable. This also deeply expresses the need to be sensitive to changes in consumer attitudes, and how to reflect product innovation characteristics in different user scenarios and values. Undoubtedly, the younger generation is the future main force of the Chinese car market. In addition, various car companies have also summarized the past 2023, such as Xiaomi, which has set clear goals for the new decade, a new overall strategy, and a fresh interpretation of Xiaomi’s cultural values. Xiaopeng also aims to address organizational weaknesses. Due to space limitations, they cannot be listed one by one. In summary, since the goals are clear, let’s work hard and make the Chinese car market in 2024 even more exciting.