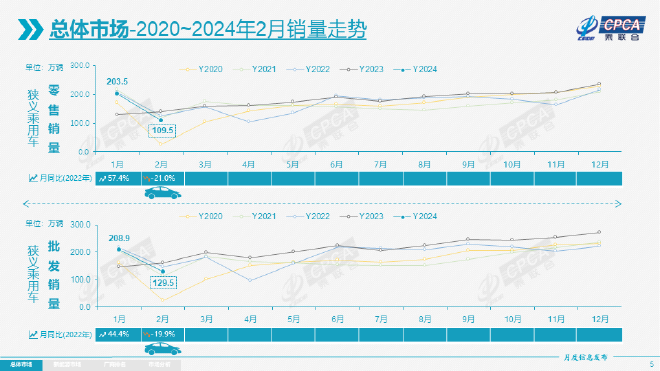

According to the latest national passenger car market analysis report released by the China Passenger Car Association, retail sales of passenger cars reached 1.095 million units in February 2024, a year-on-year decrease of 21.0% and a month-on-month decrease of 46.2%; the cumulative retail sales from January to February reached 3.133 million units, a year-on-year increase of 17.0%.

The Secretary-General of the China Association of Automobile Manufacturers, Cui Dongshu, stated that the retail sales of cars in January achieved the expected strong start, but the year-on-year and month-on-month decline in February was due to the difference in consumption time before the Spring Festival, with some sales being overdrafted in January, affecting the sales in February. In addition, the rapid escalation of price wars after the Spring Festival has led to a significant wait-and-see trend, combined with the expectation of the release of detailed policies in March, all of which have contributed to the unfavorable sales trend in February. Significant decline in retail sales month-on-month Looking at the sales trend in February, both retail and wholesale sales have shown a downward trend, mainly due to the impact of the Spring Festival holiday and the price war, both of which have had a negative impact on the car market sales.

During the Spring Festival, the popularity of internet-famous cities continues to grow, and the tourism and consumer service industries have improved significantly. This has led to an increase in demand for car purchases, and there are more and more channels and stores for consumers. The overall popularity of stores has been good. The automotive industry has become an important pillar of the Chinese economy. Therefore, the government has issued a series of policies to guide the industry, aiming to further stabilize and expand car consumption. With the support of various promotional policies, especially the “Hundred Cities Linkage” Automobile Festival and the “Thousand Counties and Ten Thousand Towns” New Energy Vehicle Consumption Season activities promoted by the Ministry of Commerce, the effect of these promotions has become evident. Many places continue to implement consumption promotion policies, providing stable support to the car market. In terms of brands, independent brands still dominate in February, with retail sales reaching 620,000 units, a 13% decrease year-on-year and a 45% decrease month-on-month. The domestic retail market share of independent brands in February was 56.1%, an increase of 4.9 percentage points year-on-year. The wholesale market share of independent brands in February was 60.4%, an increase of 7.2 percentage points compared to the same period last year. Unlike the increasing sales of Chinese brands, the market share of mainstream joint venture brands in China is shrinking, and most joint venture car companies are experiencing declining sales. According to the data released by the China Association of Automobile Manufacturers, the retail sales of mainstream joint venture brands in February were 330,000 units, a year-on-year decrease of 31% and a month-on-month decrease of 51%. In February, the retail market share of German joint venture brands was 20.5%, a year-on-year decrease of 0.2 percentage points; the retail market share of Japanese joint venture brands was 14.4%, a year-on-year decrease of 3.4 percentage points; and the market share of American joint venture brands reached 6.4%, a year-on-year decrease of 0.9 percentage points. For the traditional luxury car market, the retail sales of luxury cars in February were 160,000 units, a year-on-year decrease of 21% and a month-on-month decrease of 35%. It is worth noting that independent brands have achieved significant growth in the new energy market and export market. Leading traditional car companies have performed well in transformation and upgrading, with significant increases in market share for traditional car brands such as Geely, BYD, Chery, Chang’an, and Great Wall. In terms of exports, the strong growth trend in automobile exports in 2023 continued in January and February of this year. According to customs statistics, 298,000 passenger cars were exported in February, an 18% increase year-on-year and a 17% decrease month-on-month; 831,000 cars were exported in January and February, a 22% increase, with exports amounting to $15.7 billion, a 13% increase. With the increase in export capacity, independent brand exports reached 248,000 vehicles in February, a year-on-year increase of 28% and a month-on-month decrease of 16%; joint venture and luxury brand exports declined by 15% year-on-year to 50,000 vehicles.

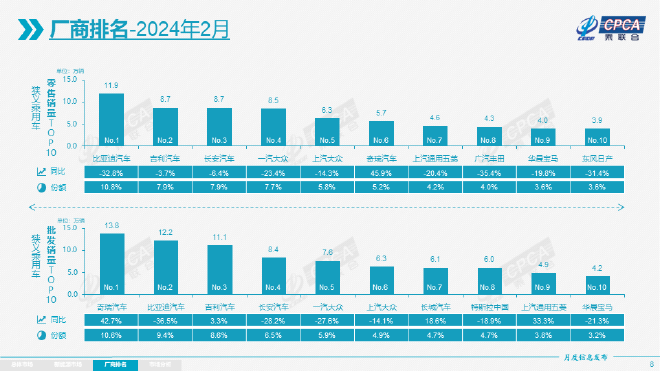

The export volume of new energy vehicles continues to rise, with 79,000 new energy passenger cars exported in February, a year-on-year increase of 0.1% and a month-on-month decrease of 20.0%. They accounted for 26.4% of passenger car exports, a decrease of 4.8 percentage points from the same period last year. Pure electric vehicles accounted for 81.4% of new energy exports, and A0+A00 level pure electric vehicles accounted for 53% of independent new energy exports. The China Association of Automobile Manufacturers (CAAM) stated that with the scale advantage of China’s new energy and the expanding market demand, more and more Chinese new energy product brands are gaining recognition overseas. The continuous improvement of service networks has led to a promising outlook for the new energy export market. According to overseas market retail data monitoring for independent exports, A0-level electric vehicles account for nearly 60%, making them the absolute main force in exports. Independent brands such as SAIC have performed well in Europe, while BYD has risen in the Southeast Asian market. In addition to the impressive performance of traditional export car companies, new forces are gradually increasing their exports, and data is beginning to emerge in overseas markets. Most car companies saw a significant year-on-year decline in sales Looking at the top ten list of car companies in February, only Chery Automobile achieved a year-on-year increase, while the other nine companies all experienced varying degrees of year-on-year decline. Among them, Guangzhou Toyota had the highest decline, with a 35.4% year-on-year decrease.

BYD ranked first in terms of retail sales in February, with 119,000 vehicles sold, a 32.8% year-on-year decrease, and a market share of 10.8%. The sales decline is mainly due to increased market competition and the impact of holidays. BYD launched several new, cheaper models in February to attract consumers’ attention. Since February 19, BYD has released several “Honor Edition” models, covering a range of car types and SUVs. The Ocean Network and Dynasty Network have both launched 10 Honor Edition models, promoting the slogan “electricity is cheaper than gasoline.” With many Honor Edition models offering price cuts and added features, BYD’s market sales in March are expected to rebound. Geely Group’s overall market performance was relatively stable, with retail sales reaching 87,000 vehicles in February, a 3.7% year-on-year decrease, and a market share of 7.9%, ranking second.

Geely’s new energy and export performance are worth noting. In February, new energy sales reached 33,508 units, an increase of about 48% year-on-year; overseas export sales reached 24,373 units, a 39% year-on-year increase. To stimulate sales, Geely has launched the “Dragon Edition” of several models, including the Geely Panda mini Dragon Edition starting at 39,900 yuan (5550$), and the Geely Galaxy L6 and L7 Dragon Edition starting at 103,800 yuan (14450$), while also initiating car purchase subsidies and other activities. By 2024, Geely aims to challenge a sales target of 1.9 million units, with the target for new energy sales to increase by over 66%. Recently launched models such as the Geely Galaxy E8 and JiKe 007 will become new sales growth points for Geely. In February, Changan Automobile sold 87,000 units, a 6.4% year-on-year decrease, ranking third. The brand’s fuel vehicles and new energy products are popular, but its high-end market products are not diverse enough. According to official data, Changan Automobile’s new energy and overseas sales have performed well, with a cumulative retail of 89,374 units for its independent brand new energy vehicles from January to February, a 119.1% year-on-year increase; and a retail volume of 75,661 units for its independent brand overseas, a 106.2% increase year-on-year. Currently, Changan Automobile has formed a multi-brand strategy for new energy vehicles, including Deep Blue, Changan Qiyuan, and Avita. With the enrichment of Changan’s new energy vehicle product lineup and increased competitiveness, the company will also see a joint effort in fuel vehicles and new energy vehicles. FAW-Volkswagen and SAIC Volkswagen ranked fourth and fifth, with sales of 85,000 and 63,000 units in February, a year-on-year decrease of 23.4% and 14.3% respectively.

Currently, the two major car companies are gradually losing market share in the hot trend of new energy vehicles. However, Volkswagen is also stepping up its layout of new energy models. In order to seize the market, FAW-Volkswagen recently launched a round of car subsidies. Chery Automobile ranks sixth in sales volume, the only car company with a year-on-year increase in sales. The large gap between wholesale and retail sales is mainly due to Chery’s outstanding performance in overseas markets. SAIC-GM Wuling, ranked seventh, returned to the top ten in February. Since February, SAIC-GM Wuling has reduced prices on several new cars and introduced subsidies, with the hope of helping Wuling Automobile grow in the small pure electric vehicle market.

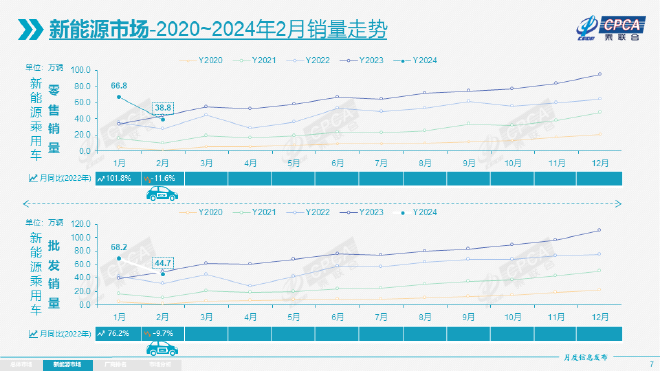

In the joint venture brand of Japanese origin, GAC Toyota ranked eighth, with sales of 43,000 vehicles in February, a year-on-year decrease of 35.4%. Due to the impact of price wars and new energy, joint venture car companies performed poorly in the new energy field, and their market share in the fuel vehicle market was squeezed. Currently, the 9th generation Camry has been launched. As a hot-selling model of GAC Toyota, the new car’s launch is expected to bring substantial growth to GAC Toyota, thanks to the strategy of price reduction and increased configuration. As the only luxury car brand in the top ten car companies, Huachen BMW sold 40,000 vehicles in February, a year-on-year decrease of 19.8%, ranking ninth. The increase in sales is related to the consumer psychology of buying luxury cars during the Spring Festival. With the gradual recovery of the car market, especially the high-end market, BMW is expected to return to positive growth. In addition to GAC Toyota, Dongfeng Nissan also entered the top ten list of joint venture brands of Japanese origin, ranking tenth with retail sales of 39,000 vehicles, a year-on-year decrease of 31.4%. According to reports, in order to stimulate market sales growth, Dongfeng Nissan had previously launched a new round of subsidies for models such as the Sylphy. However, reducing prices is not the best solution, and launching competitive new products is more important. Rare decline in production and sales of new energy vehicles Data from the China Association of Automobile Manufacturers shows that in February, retail sales of new energy vehicles reached 388,000, a year-on-year decrease of 11.6% and a month-on-month decrease of 42.1%; wholesale sales of new energy passenger vehicles in February reached 447,000, a year-on-year decrease of 9.7% and a month-on-month decrease of 35.0%; production of new energy passenger vehicles in February reached 426,000, a year-on-year decrease of 17.7% and a month-on-month decrease of 42.3%.

Overall, in February, the trend of a dual decline in production and sales of new energy vehicles was mainly affected by the Spring Festival and freezing rain, causing consumers to adopt a wait-and-see attitude towards new energy vehicles. Although the retail volume of new energy passenger cars in February decreased year-on-year, its market penetration rate in the country has reached 35.8%, an increase of 3.8 percentage points compared to the same period last year. In terms of vehicle brand, the penetration rate of new energy vehicles in independent brands in February was 55.3%; in luxury cars, the penetration rate of new energy vehicles was 24%; while in mainstream joint venture brands, the penetration rate of new energy vehicles was only 4.9%. Looking at the monthly domestic retail market share, the retail market share of new energy vehicles from mainstream independent brands in February was 60.3%, a decrease of 4 percentage points year-on-year; the market share of new energy vehicles from joint venture brands was 3.4%, a decrease of 0.9 percentage points year-on-year; the market share of new forces was 16.2%, an increase of 5.3 percentage points year-on-year; and the market share of Tesla was 6.7%, a decrease of 0.1 percentage points year-on-year. From the data, it can be seen that the retail penetration rate of new energy vehicles in China in February 2024 is steadily increasing, indicating that the market’s acceptance of new energy vehicles is gradually rising. With the continuous improvement of various infrastructure and the introduction of high-cost-effective products, the number of new energy vehicles will continue to rise. However, it is worth noting that the growth rate of new energy vehicle sales in the current market is slowing down, gradually transitioning from incremental competition to stock competition. Coupled with the impact of price wars, sales growth has entered a period of steady growth, and future market competition will certainly become more intense.

From the sales performance of new energy vehicle companies, the overall trend of new energy passenger car companies in February is strong. BYD’s pure electric and plug-in hybrid dual-drive solidify the leading position of independent brands in new energy. Extended-range electric vehicles represented by Tesla, NIO, Ideal, Changan, and Leapmotor also performed particularly well. In addition, with the simultaneous development of independent car companies in the new energy route, the market base continues to expand. Data from the China Passenger Car Association shows that 9 companies have exceeded 10,000 units in wholesale sales, accounting for 76.5% of the total sales of new energy passenger cars. Of course, new forces in car manufacturing are also continuing to exert their efforts. In February, the retail market share of new forces reached 16.2%, an increase of 5.3 percentage points year-on-year. New force car companies such as NIO and Ideal still showed strong overall performance year-on-year and month-on-month. In the mainstream joint venture brands, Volkswagen in the north and south still dominate. The wholesale volume of new energy vehicles reached 11,652 units, accounting for a strong 49% share of mainstream joint venture pure electric vehicles. Volkswagen’s firm electrification transformation strategy is beginning to show results, but other joint ventures and luxury brands still need to make efforts. According to the data released by the China Passenger Car Association, there is also a market demand for conventional hybrid passenger cars. In February, the wholesale volume of conventional hybrid passenger cars was 43,000 units, a decrease of 20% year-on-year and 34% month-on-month. However, conventional hybrid models are mainly dominated by joint venture cars, such as GAC Toyota, FAW Toyota, Dongfeng Honda, Changan Ford, and Dongfeng Nissan. In addition, the sales of independent brands of hybrid vehicles are gradually increasing. According to the new energy vehicle sales data announced by car companies on March 1st, BYD ranks first, and for now, no car company can shake its position. At the same time, BYD has started a price war, and it is expected to have a better performance in March.

According to data from the China Passenger Car Association, Tesla’s sales in China in February reached 60,360 units, making it the second largest domestic new energy vehicle company after BYD. The sales performance of its Model 3 and Model Y has been stable. In the traditional automotive industry, SAIC-GM Wuling has performed outstandingly in the new energy field, with sales reaching 33,600 units in February. Its main models, the Wuling Rongguo, Wuling Hongguang MINIEV, and Wuling Xingguang, have been sales leaders. Geely’s new energy vehicle sales in February also reached 33,500 units, with 9,120 units of the Galaxy series, 10,514 units of the Geometry series, 6,208 units of the Lynk & Co new energy, and 7,510 units of the Zeekr. These new models have all contributed to Geely’s sales growth in the new energy field. Under the empowerment of Huawei’s HarmonyOS, AITO Wanjie delivered 21,100 new vehicles in February. Currently, there are three models, the M5, M7, and M9, being delivered, with the new M7 delivering 18,479 units. Currently, the new M7 of AITO Wanjie has become a new sales leader, while the sales of the M9 are also growing rapidly. On February 21, AITO Wanjie announced the accelerated delivery cycle for the M5 and new M7, stating that it is working to increase production capacity and significantly shorten the delivery cycle for the M5 and new M7. In terms of new models, AITO Wanjie’s new M5 will be launched in the first half of the year, and a new model, the M8, will be launched in the second half of the year, showcasing its strength in the high-end smart car market. Among the new forces in the automotive industry, Ideal Auto delivered a total of 20,251 new vehicles in February, a year-on-year increase of 21.8% but a month-on-month decrease of 35%. On March 1, the first pure electric product, Ideal MEGA, was officially launched, with a new car price of 559,800 yuan (77920$), a battery equipped with a Kirin 5C chip with a capacity of 102.7 kWh, and a CLTC pure electric range of 710 km.

In addition, the 2024 Ideal L series models were also launched simultaneously, and the new car has further advanced the advantages of endurance, comfort, and safety on the basis of the original models. Data shows that NIO delivered 8,132 new cars in February, a year-on-year decrease of 33.1% and a month-on-month decrease of 19%. The decline in sales was mainly due to the impact of the Spring Festival holiday. On February 22, NIO’s 2024 models were launched, with a total of 7 models, becoming the main force in NIO’s sales. In addition, Leapmotor and NIO both had sales of around 6,000 vehicles in February, while Xiaopeng Motors sold 4,545 vehicles, with relatively low sales. All car companies have stated that they will continue to focus on improving sales in various aspects, and we will continue to monitor. In summary: Overall, the sales of passenger cars in February are in a sluggish state. With the resumption of normal operations in various industries after the Spring Festival holiday, it is expected that the month-on-month production and sales growth of the automotive market in March will be rapid, but the competition will also be more intense.