NIO’s 2023 performance report just released, with a net loss of 21.147 billion yuan, ranking second in history. From 2018 to 2023, NIO’s total revenue exceeded 170 billion yuan, but the total net loss reached 86.631 billion yuan. Despite annual revenue growth, the company continues to incur losses due to high costs. The focus now is on how long NIO’s funds can last. Founder Li Bin and seven investment banks recently held a public meeting, with the banks showing more interest in Li Bin’s plans for 2024 and 2025 than in questioning the company’s losses. Li Bin aims to increase the company’s gross profit margin to 15-18% in 2024, maintain prices for NIO brand models, and deliver the “Alps” sub-brand in the fourth quarter, opening at least 200 new sales outlets. Whether the investment banks will believe Li Bin’s plans is now more important than the company’s losses.

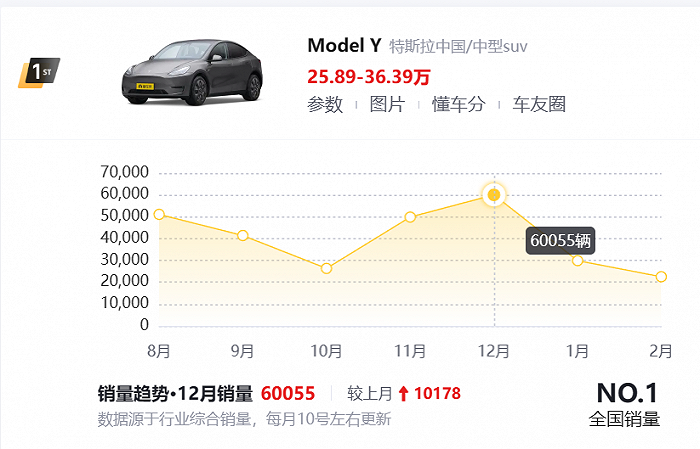

Is 10,000 vehicles per month enough? Facing increasingly intense price wars, the investment bank is most concerned about whether NIO will reduce prices for promotions. In response, Li Bin stated clearly that NIO’s cars will not be “traded for quantity with price.” NIO previously set a relatively practical annual target: sales of 230,000 vehicles for the whole year. Compared to other new energy brands such as Aiways, Xiaopeng, and Li Auto, NIO is the only one to lower its annual sales target. Due to the actual delivery of NIO in 2023 being only about 160,000 vehicles, the achievement rate is less than 70%. Whether the target of 230,000 vehicles for this year can be achieved remains to be seen by the market. Moreover, from Li Bin’s statement, his estimated sales volume and annual target still “don’t add up.” Li Bin expects, “approximately 31,000 to 33,000 vehicles in the first quarter of 2024, with sales expected to increase after March, and confident that monthly sales will return to 20,000 vehicles.” Compared to Ideal Auto, the gap between the two new forces in the automotive industry is evident, as 20,000 vehicles per month is only the minimum target for Ideal Auto. Data shows that Ideal Auto delivered over 30,000 vehicles in January, 20,000 vehicles in February, and is expected to recover to a level of 50,000 vehicles per month in March. To boost sales, Li Bin stated that the sub-brand “Alps” will prioritize sales volume. Earlier reports stated that Alps plans to sell 50,000 vehicles per month. Based on the above budget target, considering only NIO’s models, its annual sales still do not reach 230,000 vehicles; but if the delivery target of 50,000 vehicles per month for “Alps” is included, it will greatly exceed the annual target of 230,000 vehicles. The price of “Alps” is under 300,000 yuan (41760$), and according to data from D1EV in the past six months, the delivery volume of 50,000 vehicles per month in the price range of 200,000 to 300,000 yuan (41760$) is already the highest achievement. Data shows that among all new energy vehicle models with pure electric, range-extending, and plug-in hybrid technologies in the 200,000 to 300,000 yuan (41760$) range, only Model Y has achieved monthly sales of over 50,000 vehicles, with the highest monthly sales of the Li Auto One approaching 30,000 vehicles, while the monthly sales of other brand models are around 10,000 vehicles.

Li Bin did not mention the goal of “Alps single-month delivery of 50,000 vehicles” at the communication meeting with his peers, but instead said “It is reasonable for a domestic car factory to produce 10,000 vehicles in a single month.” Li Bin mentioned the above statement when answering UBS’s question about “Alps cost being 10% lower than Model Y’s cost.” In 2023, the global sales of Model Y exceeded 1.1 million vehicles, and the prices of different versions in China ranged from 258,900 yuan (36040$) to 363,900 yuan (50650$) in the second half of 2022 to 2023. Model Y has lowered its price several times, thanks to cost reduction and increased sales, leading to a decrease in scale costs. Therefore, UBS inquired about the statement that the cost of the Alps brand is 10% lower than that of Tesla Model Y. But Li Bin said, “We don’t need a particularly large output to offset costs. The low cost advantage of Alps comes from the mature domestic supply chain system and the technological advantage formed by NIO’s huge investment in research and development.” Li Bin said, “We don’t need to reach a scale of one million vehicles to achieve lower costs than Model Y. In China, a factory producing 10,000 vehicles in a month is a reasonable production level.” So, how confident is Li Bin in the sales of the Alps brand? What does NIO use to ensure profits? NIO’s gross margin target for 2024 is 15% to 18%, and its management even said that in the long term, the gross margin of NIO’s vehicle models could reach 20%. “Starting from the second quarter, our gross margin will improve, thanks to the sales of our 2024 new models and further cost optimization,” NIO’s management said. In terms of delivery progress, NIO delivered ES8, EC7, ES6, EC6, and ET5T in March; ET5 2024 will be delivered in April, and the 2024 ET7 will be released and orders will be taken; ES7 2024 will be delivered in May, while the sub-brand “Alps” will not begin delivery until the fourth quarter. Li Bin stated that, unlike the Alps, the NIO brand will not lower prices to increase sales, but will prioritize increasing gross profit margin. He believes that the 2024 NIO market is very strong, due to the improvement in its smart computing power, including intelligent driving technology, large-scale vision and language model technology, and these intelligent experiences will soon cover second-generation car owners. On March 8th, NIO stated that the NIO Full-Range Navigation Assistance NOP+ has covered 99% of prefecture-level and county-level cities in mainland China, totaling 726 cities. Compared to February, NIO’s intelligent driving network has added 120 cities, and nearly four hundred stores will be open for experience by the end of March. In terms of competition, brands such as XPeng Motors, Tesla, NIO, and Weimar are all improving their intelligent driving platform technology, along with the aspiring Xiaomi Motors, which are strong competitors for Li Bin. Currently, NIO’s NIO Pilot includes basic functions, as well as navigation assistance NOP, high-speed/congestion automatic driving assistance Pilot, turn signal-controlled lane change ALC, road sign recognition TSR, front side vehicle warning CTA-F, driver fatigue monitoring AMP, and vehicle close-range summoning NBS and other driving assistance functions. But to dominate the competition, NIO probably still needs to continue to improve. In addition to competition in the smart driving field, Li Bin faces challenges in store sales efficiency and charging and swapping businesses. Due to the lack of new car support and promotional activities, NIO’s sales staff will face greater sales resistance than other car companies. To boost sales, Li Bin is expanding sales outlets to second, third, and fourth-tier cities, which presents both opportunities and challenges. The main challenge is that the charging network in these cities cannot currently meet the demand for vehicle use. NIO needs to install more charging equipment in these cities. However, Li Bin has faced the danger of being overtaken by Ideal Car in the charging field, which has already accelerated the layout of its 5C supercharging stations. Li Bin has also sought partners to share the pressure of investment costs and competition acceleration. NIO’s charging business has achieved a balance between revenue and expenditure, with 80% of the business serving other brands of vehicles. However, NIO’s total current liabilities have exceeded its total funds by the end of 2023. Additionally, its operating costs in 2023 have exceeded 240 billion yuan, including sales, general, and administrative expenses of about 12.117 billion yuan and research and development expenses of 11.914 billion yuan. Therefore, NIO’s reserve of 57.3 billion yuan is not ample in comparison. Facing competition from peers, time and space for NIO and Li Bin are increasingly limited. Whether it’s sales or profits, Li Bin needs to pick up the pace.