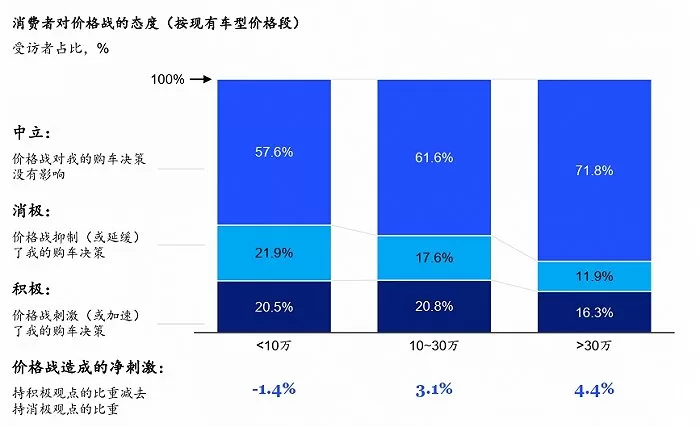

TSN reporters | Zhou Shuqi TSN editor | Chen Xiaotong The car price war that started in 2023 is still ongoing. Since the beginning of this year, no less than 9 car companies have announced varying degrees of price reductions. However, a recent report from consulting firm McKinsey pointed out that the impact of price competition on stimulating consumption is quite limited. On March 12, McKinsey released the 2024 China Automobile Consumer Insight Report, which stated that over 80% of consumers believe that the price war has not had a positive effect on their car purchasing decisions. Especially for cars priced below 100,000 yuan (13910$), the price war may even have a detrimental effect. Most of these car buyers believe that the price war has suppressed their purchasing decisions. Despite the lack of positive impact on consumers, most car companies are still actively involved in the price war. McKinsey’s Global Managing Partner and Head of Automotive Consulting in China, Guan Mingyu, stated in an interview with Interface News and other media outlets that the Chinese car market is undergoing a structural transformation, with Chinese brand market share increasing by 20% in three years. During this period, price adjustments are an important means utilized by every market participant to gain market share.

The price war has not affected the demand for Chinese consumers to upgrade their consumption, and the number of respondents holding the “downgrade” view of buying cars has significantly decreased. Among them, more than half of consumers in the price range below 150,000 yuan (20870$) have upgraded their car models. McKinsey believes that on the one hand, consumers’ enthusiasm and confidence in buying cars after the epidemic have relatively recovered, and on the other hand, China’s auto market continues to launch highly competitive new smart electric car models, gradually expanding their attractiveness to consumers, shifting their attention to higher-priced car models.

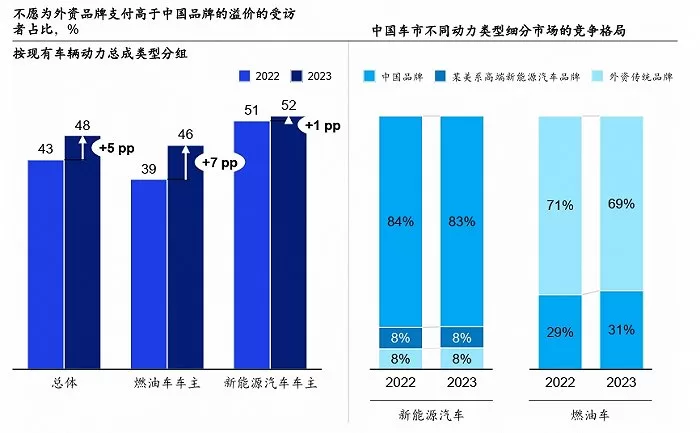

In January of this year, Gong Min, the head of automotive industry research at UBS China, also told Interface News that overall, the models purchased by Chinese consumers are becoming more expensive, larger, and smarter. In particular, Chinese domestic brands are moving towards high-end development, with average selling prices steadily increasing. The arrival of the era of smart electric cars is deeply affecting consumers’ perceptions of Chinese car brands. A McKinsey report pointed out that Chinese high-end new energy car brands have successfully won the favor of consumers through technological advantages such as intelligence, and owners of traditional foreign high-end brands are being transformed into consumers of Chinese high-end new energy car brands in an almost “one-way flow” manner. The top two reasons for consumers to choose Chinese high-end new energy car brands are the more advanced autonomous driving functions and intelligent cabin experience. The core reason for choosing traditional foreign brands is brand effect, as consumers believe that the quality of foreign high-end brands is more reliable, and the discounted prices are very attractive, while also worrying about the risk of new forces going bankrupt. At the same time, the brand premium ability of foreign brands in the Chinese market is gradually disappearing. McKinsey data shows that 48% of respondents are unwilling to pay a premium for foreign brands, higher than the 43% in last year’s survey. Even among consumers willing to pay a premium, only 3% of the relevant respondents are willing to accept a premium of more than 20% above the selling price of Chinese high-end brands.

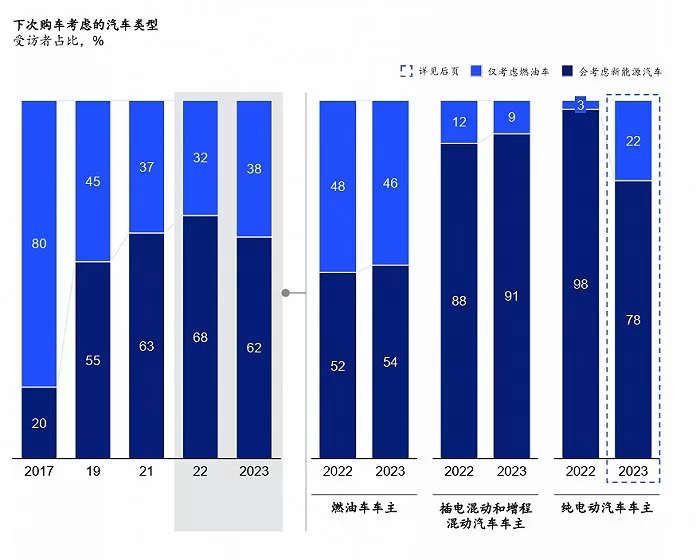

McKinsey believes that if traditional high-end foreign brands can overcome technological disadvantages and introduce technologically advanced models, about two-thirds of Chinese high-end new energy vehicle owners will consider switching. McKinsey’s global director and partner, Peng Bo, said that Chinese high-end new energy vehicle brands have not yet established enough brand loyalty and need to continue to do well in consumer operations, maintain leading models and technological research and development. According to data from the China Passenger Car Association, the penetration rate of new energy vehicles in China has exceeded 35% in 2023. This is due to consumers’ high recognition of the practical advantages of new energy vehicles in terms of cost of use and intelligence. The Chinese new energy vehicle market has shifted from subsidy policy-driven to market-driven. However, McKinsey’s report found that Chinese consumers’ acceptance of new energy vehicles has declined for the first time, with the proportion of respondents considering purchasing a new energy vehicle dropping by 6 percentage points. Among them, 22% of pure electric vehicle owners said they would no longer consider new energy vehicles for their next vehicle, compared to only 3% in previous surveys.

McKinsey Global Managing Partner Fang Yinliang’s analysis suggests that the surge in consumer “regret rate” is due to insufficient charging facilities in third and fourth-tier cities, leading to dissatisfaction with the recharging experience. On one hand, this indicates that the development of new energy vehicles in China has progressed from first and second-tier cities to the hinterland of third and fourth-tier cities. On the other hand, the speed of charging pile deployment in third and fourth-tier cities has not kept up with the growth of new energy vehicles, requiring further development of supporting ecosystem. Additionally, McKinsey found that consumers’ interest in various autonomous driving functions is increasing, but their willingness to pay is decreasing, especially among consumers in first-tier cities. Some car companies are offering advanced autonomous driving solutions as standard or optional packages for car buyers, subtly influencing consumers’ payment tendencies through market “education.”