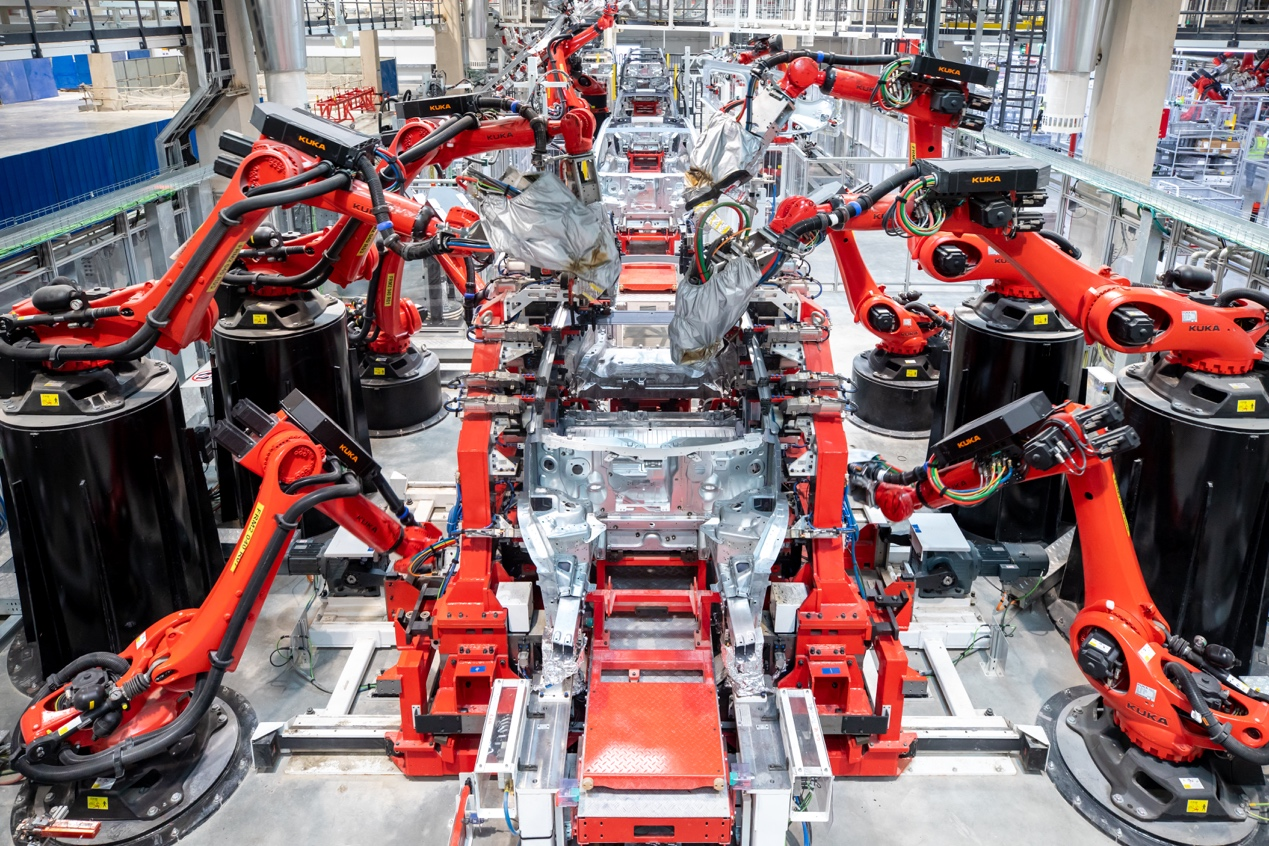

New phase in the electric vehicle market: oil and electricity at the same price, or accelerated arrival, the market opens the “elimination match” Gartner, an information technology research and analysis company, points out that by 2024, automakers will continue to strive to adapt to the changes brought about by software and electrification, thus opening a new phase for electric vehicles. The cost of oil and electricity is realized faster than expected Battery costs are declining, but due to the emergence of innovative technologies such as “integrated die-casting,” the production costs of electric vehicles will decrease even faster. Therefore, Gartner predicts that due to new manufacturing technologies and the reduction of battery costs, the manufacturing cost of electric vehicles will be lower than that of internal combustion engine vehicles by 2027. In this regard, Pedro Pacheco, Vice President of Research at Gartner, said, “New OEMs hope to redefine the current situation of the automotive industry. They bring innovative technologies, simplify production costs, such as centralized vehicle architecture or integrated die-casting, which helps reduce manufacturing costs and assembly time. Traditional car manufacturers have no choice but to adopt these innovations in order to survive.” “Tesla and other companies have already looked at the manufacturing industry in a completely new way,” Pacheco told European Automotive News before the report was released. One of Tesla’s most famous innovative technologies is “integrated die-casting,” which refers to casting most of the car as a whole, rather than using dozens of welding points and adhesives. Pacheco and other experts believe that Tesla is the innovative leader in reducing assembly costs and a pioneer in integrated die-casting. In some major markets, including the United States and Europe, the popularity of electric vehicles has already slowed down, so experts say that it is crucial for car manufacturers to launch low-cost models.

Pacheco points out that the cost of the white car body can be reduced “at least” 20% by just integrating die-casting technology. Other cost reductions can be achieved by using the battery pack as a structural component. He says that the cost of batteries has been decreasing over the years, but the unexpected decrease in assembly costs will make electric cars reach price parity with internal combustion engine cars faster than imagined. “We reached this critical point earlier than expected,” he said. Specifically, a dedicated electric vehicle platform allows car manufacturers to freely design assembly lines that suit their characteristics, including smaller powertrains and flat battery bottoms. In contrast, platforms for “multi-power systems” have some limitations, as they need to accommodate space for a fuel tank or engine/transmission. Although this means that the speed at which pure electric cars achieve cost parity with internal combustion engine cars will be much faster than initially expected, it will also significantly increase some maintenance costs for pure electric cars. Gartner predicts that by 2027, the average repair cost for electric vehicle bodies and batteries in serious accidents will increase by 30%. Therefore, because repair costs may exceed their residual value, owners may be more inclined to choose to scrap electric cars that have been involved in collisions. Similarly, because collision repairs are more expensive, vehicle insurance premiums may also be higher, and may even lead to insurance companies refusing to insure specific models. Rapidly reducing the production cost of electric vehicles should not come at the expense of higher maintenance costs, as this could cause consumer backlash in the long run. New methods for producing electric vehicles must be deployed alongside processes to ensure low maintenance costs. The electric vehicle market is entering a “survival of the fittest” stage. Pacheco stated that whether the cost savings from electric vehicles will translate into lower prices and when, depends on the manufacturers. However, the average price of electric vehicles and internal combustion engine vehicles should be at the same level by 2027. He also pointed out that electric vehicle companies like BYD and Tesla have the ability to lower prices without causing too much damage to their profits, because their costs are low enough. In addition, Gartner still predicts strong growth in electric vehicle sales, with half of all cars sold in 2030 being pure electric vehicles. However, the market is entering a “survival of the fittest” period compared to the “gold rush” of early electric vehicle manufacturers. Pacheco described 2024 as a year of transformation for the European electric vehicle market, with Chinese companies like BYD and MG establishing their own sales networks and lineups, while traditional car manufacturers like Renault and Stellantis will launch lower-cost models locally. He said, “Many of the things happening now may not necessarily affect sales, but they are preparing for bigger things.”

Meanwhile, in the past year, many high-profile electric car startups have fallen into trouble, including NIO, whose stock price has plummeted since going public, and Lucid, which has lowered its 2024 production forecast by 90%. Other struggling companies include Fisker and Canoo, with Fisker in negotiations with Nissan and Canoo recently reported to have halted production. Pacheco said, “Many startups flocked to the electric car sector in the past year, believing it would be easy to make a profit – from car manufacturers to electric car charging companies – some of which still heavily rely on external funding, making them particularly susceptible to market challenges.” Gartner predicts that by 2027, 15% of electric car companies founded in the past decade will be acquired or go bankrupt, especially those heavily reliant on external investment to sustain operations. However, “this does not mean the electric car industry is in decline, it is just entering a new phase, where companies with the best products and services will prevail over others,” Pacheco said. Additionally, he also stated, “Many countries are gradually phasing out incentives related to electric cars, making the market more challenging for existing companies.” However, “we are entering a new phase, in which pure electric cars cannot rely on incentives or environmental benefits as selling points. Compared to internal combustion engine cars, pure electric cars must be a all-around excellent product.” While the electric car market is consolidating, shipment volume and penetration rate will continue to grow. Gartner estimates that electric car shipments will reach 18.4 million in 2024 and 20.6 million in 2025.