On March 12, Porsche released its 2023 financial report. Compared to the first fiscal year after its IPO, Porsche’s overall performance in 2023 still showed an upward trend. In the 2023 fiscal year, Porsche achieved a revenue of 40.5 billion euros, an increase of 7.7% year-on-year. Sales profit increased by 7.6% to 7.3 billion euros; the sales return rate was as high as 18%, the same as in 2022. From a financial perspective, this financial report demonstrates Porsche’s healthy operating condition and meets investors’ expectations. Moreover, Porsche generously distributed 2.1 billion euros as dividend, equivalent to 40% of after-tax net profit.

Despite still shining data, Porsche’s top management reveals a cautious view of the market in the short term due to the decline in the Chinese market and the continuous escalation of competition in the electrification field in 2023. Therefore, Porsche will further increase its product offensive in 2024, hoping to make better use of group resources to maintain performance growth. China’s decline, North America takes over as the largest single market In 2023, for Porsche, the Chinese market lost the title of the largest regional market for the first time after reaching the top, and this honor was taken over by the North American market. However, the average transaction price in the Chinese market still remains above 900,000 RMB, which is not bad. In fact, there were some signs in 2022, when the delivery volume in China dropped by 2.5%. Among Porsche’s main markets in 2023, the Chinese market was the only one to decline, but the good news is that the increase in demand in other markets compensated for the decline in the Chinese market. In 2023, North America delivered 86,000 vehicles, an increase of 9% year-on-year; China delivered 79,000 vehicles, a decrease of 15% year-on-year, Europe delivered 70,000 vehicles, an increase of 12% year-on-year, and emerging overseas markets delivered 52,000 vehicles, an increase of 16% year-on-year. China’s share of Porsche’s global deliveries fell from 31% to 25%.

As mentioned above, despite a good performance in the past year, Porsche still maintains a cautious estimate for 2024. Porsche expects a sales return rate of 15%-17% in 2024, which is slightly lower than last year. CFO Meske insists that the medium and long-term financial targets remain unchanged. Porsche is prepared for the upcoming intense competition and is trying to counterattack with an aggressive approach. This inevitably leads to increased marketing expenses. Lowering the sales return is possible, but Porsche still refuses to engage in a price war. This is because a price war is the enemy of all super luxury brands and can even damage short-term financial goals. In other global markets, Porsche faces familiar rivals and strategies, but in the Chinese market, Porsche faces new competitors and a new generation with more aggressive consumer preferences. This is a challenge that Porsche must confront. The pressure in the Chinese market remains, and pricing becomes the moat. Models like 918 and 911 have solidified the Porsche brand’s prestige, while models like Panamera, Cayenne, and Macan target the upgrading needs of the middle class. Unlike relying solely on historical accumulation, brand stories, and various commercial tactics to create scarcity, Porsche’s positioning comes from performance support and technological leadership. The latter is being challenged by Chinese electric vehicle brands. In the context of electrification, horsepower has become cheap, and the unique skills of power system matching have been abandoned. Mechanical capabilities such as chassis suspension tuning are being replaced by electronic control methods. Even Porsche itself is no exception. Transparent chassis and variable stiffness suspension can no longer be a brand’s moat. Even the 3-chamber air suspension has been broken through by Chinese suppliers and has been implemented in products priced at around 200,000 yuan (27790$). In the Chinese new energy vehicle market, the development of new vehicle models has reached a “crazy” speed of over two years. As a result, the slow iteration of electric vehicles, slow software iteration, outdated car-machine interaction styles, and the inability to keep up with leading levels of intelligent driving have become weaknesses that are magnified. Despite the fact that all multinational car companies are inferior to Chinese competitors in these areas, the response of the new generation of consumers to ultra-luxury brands remains dissatisfied. Their oscillating attitude is quite different from that of their parents, in the face of the opposing social value of the brand and personal experience. Porsche has repeatedly claimed that the age composition of its Chinese customers is the youngest in the world, but now this may backfire in the era of electric intelligence. However, according to the data of the China Association of Automobile Manufacturers, fuel vehicles in the 400,000-500,000 yuan (69480$) range have remained strong since the beginning of the year, with a 12% year-on-year increase in January and February, second only to the high-end new energy products in the 100,000-150,000 yuan (20840$) range. This proves that the product offensive of new energy is still focused on the 400,000 yuan (55590$) boundary, with the left side gaining an advantage and the right side only making tentative attacks. Even BBA’s defensive circle is not reliably broken through. Porsche, which is positioned above BBA, is not facing an imminent threat. The decline of Porsche’s business in China is attributed by some to the problem of the upgrading demand of the middle class. People tend to be conservative in their economic expectations and the decision to spend hundreds of thousands of yuan on luxury cars, which is a greater burden than before. At the recent annual financial report meeting, Porsche’s global chief financial officer, Meske, expressed similar views, saying that due to the complexity of the Chinese economy, coupled with multiple influences such as the stock market and real estate market, customers’ car purchasing decisions and fund arrangements have become more cautious. This is a possible indirect pressure that Porsche is facing in China, and it must remain vigilant and strengthen investment in electrification and intelligentization, but it still needs to maintain the right rhythm. If not directly purchased, it is sometimes difficult to significantly compress the R&D time by just spending money. On the contrary, Porsche only needs to ensure that the existing production line does not delay, such as the current situation of the two-year delay in the launch of the electric Macan, which has been criticized by the outside world. Increasing product offensive, further accelerating electrification. In 2024, officially designated as the “year of new products”, 4 electric products will be delivered this year, entering the strongest year of product offensive in history. This implies that 2023 is not a year with a lot of new products. After all, except for the annual regular updates, only the Cayenne has been replaced in this somewhat flat year. Porsche delivered 320,000 vehicles, a small increase of only 3%, still at a historical high point. Combined with the revenue growth, it indicates that the average transaction price per vehicle is rising. This is difficult to explain with inflation, because the inflation index in multiple regional markets around the world is different. This reflects the overall recognition of the Porsche brand in the global market is on the rise. In 2024, the Panamera, Taycan, Macan, and 911 will all undergo major redesigns. Porsche’s new product rhythm is clearly accelerating, and electrification is deepening. Unlike the previous solo performance of the Taycan, a pure electric Cayenne and a pure electric SUV will both be unveiled in 2025. Porsche’s official originally only vaguely stated that a pure electric 718 will be launched in the mid-2020s. Now, the delivery of the new Taycan marks the further streamlining of Porsche’s electric platform and supply chain, and the electric 718 may also be expected to debut in 2025. Different from household car brands and also different from BBA, the market never expects ultra-luxury brands to have a fast new product rhythm. Short product lines are not only a brand tone strategy, but also related to the resources that can be mobilized for operation. After all, expanding the market rapidly and quickly increasing production are not in line with the style of ultra-luxury brands.

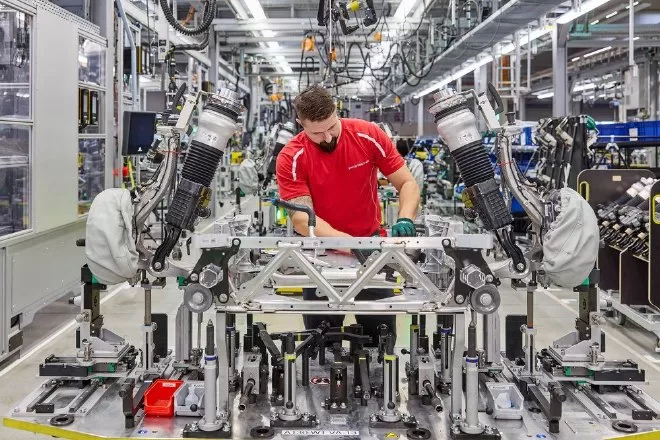

Resource reuse, the strategic significance of the all-electric Macan The recent delivery of the Taycan signifies the untapped potential of the J1 platform’s 800V, while the all-electric Macan indicates the maturity of the PPE platform. The true strength of the PPE lies in its ability, as a shared platform between Porsche and Audi, to spread the development costs of the PPE through high-volume products, providing cost competitiveness for the all-electric Macan. Essentially, this is a form of resource reuse. The Volkswagen Group and its suppliers have established a set of 800V and 400V charging interfaces and standard cooling solutions, becoming shelf products within the group, allowing the electric Macan to be easily reused without the need for separate development. Porsche’s proud technologies such as active suspension, rear axle steering, and traction management systems are utilized by the brand’s models like calling up a standard software library, as long as the interface is good enough. This saves time and money to the greatest extent, while the standard quality system provides assurance. This also once again confirms that, regardless of whether the ultra-luxury brand is financially independent, sharing R&D and supply chain within the group is like “transfusing blood”. This also explains why the SSP platform led by Porsche matured later than the PPE platform. Although most existing ultra-luxury brands are backed by the group, few can utilize the group’s resources as fully as Porsche. This has little to do with Obram, who serves as both CEO of the Volkswagen Group and CEO of Porsche. Because Porsche has been doing this for over a decade. What Obram can do is strengthen this connection.

Porsche appointed former Mercedes CTO Sajjad Khan to the board at the end of 2023. The software executive will be in charge of intelligent infotainment, in-car operating systems, and intelligent driving. Porsche is pursuing intelligent development on multiple fronts. One is increasing investment and urging CARIAD to speed up software development, and the other is acquiring multiple Silicon Valley companies to quickly improve Porsche’s software capabilities and enhance customer experience. The benchmark, of course, is the software capabilities of Chinese products. In the future, Porsche may also find some new value from cooperation between Volkswagen and Xiaopeng. In 2024, Porsche launched a larger new energy offensive. Porsche board member Feng Peide said, “Although the entire Chinese market continues to see new brands and products entering, there is no clear winner in the luxury segment, and we will still make our mark.” This actually implies that Porsche is not facing too much strategic pressure. In balancing financial goals, maintaining brand identity, and strengthening new energy competitiveness, Porsche is still trying to maintain a balance, which is a clearer attitude compared to the 2022 financial report.