Technology News After much anticipation, the Xiaomi SU7 is finally set to debut on March 28th. In the past three months, the industry has been preparing for the arrival of the Xiaomi SU7 in various ways: 1) GAC Motors announced a production halt after the Spring Festival, casting a shadow over the industry; 2) Companies like Xiaopeng and Li Auto continue to lower prices, with Xiaopeng G6 announcing a 20,000 yuan (2780$) price drop on March 3rd, and Li Auto adjusting the prices of the 2024 models, with L7Air and L8Air prices reduced by 18,000 yuan (2500$) on March 12th; 3) The entry-level version of the NIO ES8, the WE edition, dropped from 300,000 yuan (41670$) to 269,000 yuan (37370$), seen as a precise blow to Xiaomi by the industry. Due to space constraints, we do not need to list everything, but the above-mentioned items have vividly outlined the intense competition in the new energy vehicle market. Even Tesla announced price cuts for the Model 3 and Model Y in the Chinese market at the beginning of 2024, extinguishing the sense of “internal competition”. As we have previously analyzed: The increase in supply of vehicles has surpassed total demand, forcing car companies to rebalance prices. In this process, the new phenomenon of three major state-owned car companies using new energy vehicles as a key performance indicator has emerged. Under pressure from cash flow, market share, and other indicators, a price war has become the only option. On the other hand, as a capital-driven industry, the price war is a competition of profits, capital tolerance for losses, and the operational efficiency of companies. The process is extremely brutal, with companies exiting the battle before it even begins, which can be seen as an early stop-loss. With the imminent launch of the Xiaomi SU7, the market has become so fierce. What awaits Xiaomi? Core points of the article: First, compared to Sailessi, the entrepreneurial environment of Xiaomi SU7 is better; Second, influenced by the external environment, Xiaomi’s cornerstone business shows signs of recovery, providing greater tolerance for SU7; Third, Xiaomi SU7’s pricing should be aggressive for market share, not conservative for financial stability. Both are car manufacturers, but Sailessi is more courageous. The current market is particularly concerned about the pricing of Xiaomi SU7. The price range of 200,000-250,000 has been “grabbed” by manufacturers such as Xiaopeng, Jike, and Galaxy, which means that Xiaomi, as a newcomer, has not achieved leveling up and will enter the “valley of villains” to fight. The pressure can be imagined. If Xiaomi chooses to be below 200,000, it can certainly avoid competition, but the fully configured SU7 is likely to face the dilemma of “losing one for every car sold.” Going for low prices means thin profits, and the more units sold, the more losses. Going for high prices means facing the ruthless law of the jungle. From a financial perspective, which reference company should we choose for Xiaomi SU7? I personally prefer Sailessi, mainly for the following reasons: First, before cooperating with Huawei to release the Wanjie series of cars, Sailessi’s main business core was the three electric, traditional cars, and it was not well known in the industry. It was not until 2021, after cooperating with Huawei to release the Wanjie M5, that it became famous. Second, the handover of old and new businesses makes it easier to observe Sailessi’s financial information from a financial perspective, such as in urban store sales, where Sailessi mainly relies on Huawei’s channels. Compared with the new forces represented by WeSmall and LaiSi in the early stage, which chose to build their own direct sales network at high cost, Xiaomi is closer to LaiSi. Car dealers can sell Xiaomi, wearable devices, and smart home products at the same time, maximizing the efficiency of space utilization. In 2022, the sales volume of the Wanjie M5 is expected to be around 56,000 units, and recently, some institutions estimated that the first-year sales of Xiaomi SU7 will be between 40,000 and 50,000 units, and the two are closer in terms of scale effect.

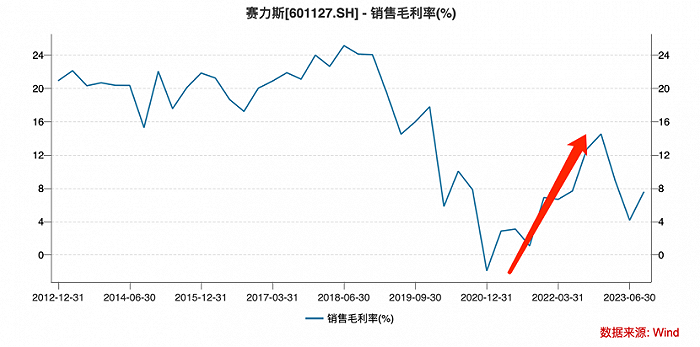

Before cooperating with Huawei, Siles was actually facing tremendous survival pressure. Not only did its total revenue decline continuously, but the overcapacity of the fuel vehicle industry at that time had caused the company to lose its pricing power. The gross profit margin continued to decline, and even a negative gross profit margin appeared in 2020. After officially selling the WENJIE M5 in 2022, the gross profit margin improved significantly. Although the first generation WENJIE M5 was not satisfactory in terms of product and sales volume, its pricing was still relatively cautious.

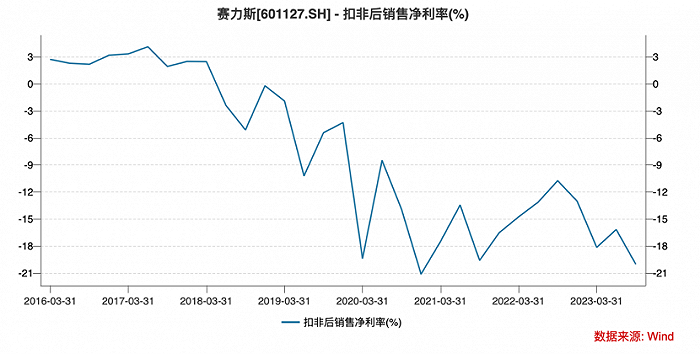

However, the non-deductible net profit of the Siles is still in deficit. Since 2021, Siles has been unable to escape the shadow of losses. After the launch of the M7 in 2023, the losses have increased. The reason is simple. As mentioned earlier, Huawei has obtained 2% technology package services and 8% sales service fees from sales channels and technical input. If the M5 is to achieve financial balance in 2021, the sales expenses should be 8%, the technical package should be reduced by 2%, and there are also administrative, financial, and other expenses. Its gross profit margin should not be less than 15% in order to avoid too much impact on the parent company’s performance. From the previous chart and the analysis above, it is obvious that the M5 in 2022 did not achieve the above-mentioned goals. The product did not achieve financial balance. The reason we spent so much space reviewing the impact of the 2021 version of M5 on Siles is simply to provide reference for the analysis of Xiaomi SU7: 1) The reason why the M5 has been difficult to contribute net profit to Siles is not mainly because “Huawei has made all the money”, but more importantly, it is the pricing. 1) The domestic new energy vehicle track is already quite crowded, and the most important thing for companies to consider is “market share.” Only with high market share can there be a high possibility of high reputation, otherwise making cars can only be for self-entertainment; 2) Although the pricing of the WENJIE M5 is higher than that of Xiaopeng and NIO, it is still conservative, coupled with the fact that the macro economy is still facing severe “input inflation”, and the gross profit margin has not yet been able to match the period expenses; 3) The biggest difference between the Xiaomi SU7 and the Tesla is the different starting point. If its sales channels are shared with Xiaomi’s original business, the sales market share should be less than 8%. At this time, commodity prices are still in a downward trend, which is very beneficial for alleviating cost pressures. In summary, we believe that the breakeven gross profit margin for the Xiaomi SU7 should be between 10% and 15%, with the midpoint being 12%. Xiaomi’s car wants to “do it if they don’t agree” As mentioned earlier, the reason why 200,000 is the watershed for the pricing of the Xiaomi SU7 is mainly whether it is “quantity guarantee” or “value guarantee”, and the market can read the focus of Xiaomi’s operations from it. Tesla and Huawei tend to “guarantee quantity” in the operation of the WENJIE series, hoping to leverage pricing to leverage competitiveness, and Tesla has incurred losses in the sales growth with unlimited glory, and the market is still relatively tolerant of this, giving it extremely high pricing power. In economics, industrial development often follows a cycle of “germination-rapid growth-excess-elimination-survival of the fittest”. This cycle is constantly repeated in the consumer internet and various traditional industries, and market share is often highly valued by the market. Only a high market share has pricing power, and it can control pricing after the market elimination period. Car companies that have ceased operations since last year are not just suffering from losses, but are no longer receiving market support. They are finding it difficult to turn the tide in the competition for market share, and capital injection is like a bottomless pit. This is also the main reason why NIO is still controversial but the market is still willing to finance the company. Cyrus is backed by Huawei. Despite the short-term pressure of losses, the market remains very optimistic and positive about it. After the big battle, Cyrus is highly likely to be the survivor, and profitability will not be a problem at that time. Xiaomi is also the same. The SU7 technology launch has fully demonstrated the high quality of the product. In business, short-term profits should be ignored, and focus should be placed on long-term market share and pricing power. Based on this, I personally tend to continue observing the pricing strategy of Xiaomi’s SU based on the “priority of cost-effectiveness” principle. Since JiKe 001 has anchored the entry-level price at 269,000 yuan (37370$), the pricing of Xiaomi SU7 should be between 200,000 and 250,000 yuan (34730$). If the annual sales volume is 50,000 units, the total sales will be around 11 billion yuan. Referring to Cyrus’s pricing strategy and non-GAAP profit situation, it is estimated that Xiaomi’s car will incur an operating loss of about 1-1.5 billion yuan in 2024. In 2023, Xiaomi Group’s operating profit exceeded 20 billion yuan, and the above-mentioned loss figures are still within Xiaomi’s safety threshold. The question world is no different from recreating Siles, and the rise and fall of the question world is fundamental to Siles, which makes Siles very active in the operation of the question world. Therefore, after M5 was not satisfactory, there were high points in the sales of M7 and M9. Xiaomi, on the other hand, is different. The original business of mobile phones, AIOT and other businesses still contribute profits and cash flow to the group. In 2023, the mobile phone business achieved a revenue of 157.5 billion yuan, and both revenue and gross profit margin improved in the fourth quarter. Overall, there are clear signs of recovery in China and even the global smartphone market, and the previously depressed market sentiment in the industry has been somewhat relieved.

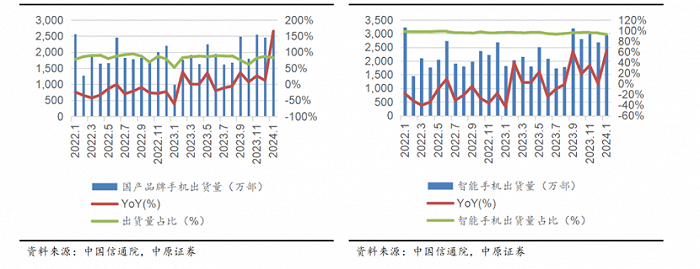

In January 2024, domestic smartphone shipments reached 31.78 million units, a year-on-year increase of 68.1%, the highest growth rate since March 2021. The new generation of AI-driven replacement wave is coming, and Xiaomi’s internal environment is improving. If Xiaomi adopts an aggressive business approach to cars, it should ignore short-term losses and expand the group’s bottoming ability in the current market competition. The Xiaomi Automotive Group has reserve strength, but a conservative approach would lead to higher pricing, with entry-level models priced at over 250,000 yuan (34730$), which is clearly not suitable for the industry. The Xiaomi SU7 could set an entry-level price just above 200,000 yuan (27780$) and a high-end model priced at over 250,000 yuan (34730$), with the former contributing substance and the latter responsible for prestige. Although the new energy vehicle market is becoming increasingly crowded and many voices are skeptical of Xiaomi’s entry into car manufacturing, objectively speaking, Xiaomi is in a much better position today than it was in 2022. While at that time, Sailes and Huawei could still use low-price strategies to compete in the market, as the smartphone and AIOT businesses were recovering, Xiaomi might consider being more aggressive in car pricing, showing the courage to “just do it.” All of this will be revealed on March 28th.