On March 19, Audi Group quietly released its 2023 financial report on its official website. Compared to 2022, both profit and profit margin have declined. In 2023, Audi Group’s revenue was 69.9 billion euros, a 13.1% increase year-on-year; operating profit was 6.3 billion euros, with a sales return rate of 9.0%, a 17% decrease year-on-year. Net cash flow was 4.7 billion euros, compared to 4.8 billion euros in 2022.

The position of Audi within the group To some extent, the performance of the “Audi Group” has overshadowed the larger slide of the Audi brand. The Audi Group includes Audi, Bentley, Lamborghini, and Ducati motorcycles. Bentley delivered 13,600 vehicles in 2023, generating revenue of 29.38 billion euros, with sales profit of 589 million euros and a sales return rate of 20.1%, slightly higher than the 20% strategic target. Lamborghini broke the 10,000 vehicle delivery mark for the first time in 2023, adding 912 sports cars and SUVs compared to 2022. Its revenue increased by 12.1% to 2.663 billion euros; sales profit was 723 million euros, with a sales return rate of 27.2%, reaching a historic high. Ducati delivered 58,224 vehicles, achieving the third-best performance in its history, with an operating profit of 112 million euros, a year-on-year increase of 2.3%, and a sales profit margin of 10.5%.

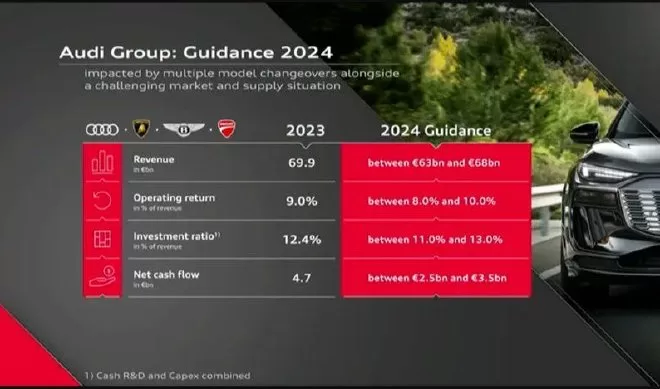

Since the rest of the three brands’ operating profit margins are all above 9.0%, and the higher the unit price of the product, the higher the return rate, it is not difficult to judge that Audi’s own profit decline. Compared with Audi, Mercedes-Benz and BMW, members of BBA, have slightly higher pre-tax profit margins – Mercedes-Benz’s operating profit margin is 12.8%, and BMW’s profit margin is 9.9%. It seems that there is less than a percentage point difference from Audi. However, BMW explained that due to the integration of Huachen BMW, the base period is relatively high. It cannot be ignored that Audi is a sub-brand of Volkswagen. Although theoretically Volkswagen as a group can empower Audi, from the strategic perspective of the two leaders, it can be seen that Audi needs to be more obedient to Volkswagen’s strategy and be subject to a higher level of administrative constraints. For example, during Diess’s tenure, in 2021, he abandoned Mobileye and cooperated with Qualcomm to adopt Qualcomm chips on the all-new SSP platform, while the first car based on the PPE platform, the Porsche Macan, adopted Qualcomm Flex chips, integrating intelligent driving, parking assistance, vehicle and driver monitoring systems. Under the leadership of Obo Mu, Volkswagen has turned the pancake back over. In March 2024, Volkswagen and Mobileye announced a partnership to introduce the latter’s driver assistance technology into brands such as Audi, Bentley, and Porsche. The reason is that Mobileye’s cost value proposition is strong and clear, in other words, Mobileye’s pricing is more affordable. China “trades price for volume.” In 2023, Audi delivered 1.895 million vehicles globally, with 755,000 new cars delivered in Europe, a 19% increase year-over-year; 235,000 vehicles delivered in the United States, a 21% increase; and 729,000 vehicles delivered in China, a 13.5% increase, exceeding by 100,000 vehicles. However, China’s financial profit declined by more than 20%. Audi is widely believed to have chosen to “trade price for volume” in China, meaning that in order to safeguard its market share in China, it is willing to significantly sacrifice profits. For the 2024 market, Audi predicts its revenue to be between 63 billion and 68 billion euros, with an operating profit margin between 8% and 10%. This is an anticipation that the market environment will become more challenging, requiring a more aggressive price war, and less profitability. With profits in the Chinese market declining by so much, it is equivalent to subsidizing the Chinese market with the profits from the other two major markets. Audi calls China its “second home,” clearly underestimating China’s unquestionably crucial market for Audi globally.

In 2023, despite “going all out” in China and engaging in a price war, Audi’s European market still surpasses the Chinese market, becoming Audi’s largest market. Audi insists on China’s business as the cornerstone of global operations. According to Audi CEO Gerd Danno, the focus is on Chinese consumers, local innovation, market-specific models, and strengthening development in China. It is worth mentioning that when Audi refers to “local,” it means China, not Germany. Volkswagen Group’s leader, Herbert Diess, has two well-known statements. First, at last year’s Munich Motor Show, Diess stated that Volkswagen’s “10-point action” plan focuses on China’s business. “China has become Volkswagen Group’s ‘fitness center,’ and only in China can we keep up with market trends and remain competitive.” Second, in June last year, Diess said, “Audi is currently lagging behind its competitors, especially in electric vehicles.” Of course, this is a rhetorical technique of understatement. He then promised that new products will be launched in 2024, bringing huge opportunities for the Audi brand. The so-called new product is actually Audi’s Q6 e-tron, the first car based on the PPE platform and the second PPE product of the Volkswagen Group. The good news is that this car, which Diess sees as a trump card, is about to be unveiled. The bad news is that it will not be delivered until early 2025. In fact, according to the timetable set by Diess when he took office, this car should have been launched in 2022. In 2018, Volkswagen launched the MEB platform, and Audi introduced the Audi e-tron based on the MLB evo platform, which later became known as the “oil-to-electric” model. In 2019, Porsche launched the Taycan on the J1 platform, which, despite still having a few traces of gasoline, is undeniably innovative as the world’s first 800V fast-charging model. However, the PPE and SSP are both delayed. This has led Volkswagen to fully and without reservation turn to a new energy strategy, full of regret.

The Q6 e-tron has improved overall system performance by one third compared to the first generation e-tron, with a 30% reduction in unit energy consumption and a 15% decrease in drive unit cost. It features 150KW/800V fast charging, a WLTP range of 625 kilometers, a 100-degree battery pack, and a 285KW four-wheel drive configuration, with reportedly good suspension and driving feel. If it is released in 2022, it will be a mainstream configuration, and even without considering the intelligent driving factor, it will not lose to new competitors like NIO in terms of product strength. However, if the same car is delivered to users in 2025, there is a sense of being out of date. There are unofficial reports that this car will be equipped with Huawei’s intelligent driving software. This is very confusing because Volkswagen and Horizon Robotics established a joint venture last year, claiming to create a “joint venture ceiling for intelligent driving.” Horizon Robotics is a chip + toolchain supplier, while Volkswagen has CARIAD company, with comprehensive software and hardware design capabilities. Suddenly, having Huawei act as a supplier, regardless of whether Huawei provides a “comprehensive intelligent solution,” means that the cooperation results with Horizon Robotics are eagerly awaited by Audi. It is even more unimaginable – how the Huawei smart driving solution is designed and operated under the Horizon computing power hardware and development environment Worn-out exclusive pricing power Audi claims that the Audi China R&D Center has become the largest R&D entity outside the headquarters in Germany, with over 90% of local R&D talent. The result is that the Q6 has extended its wheelbase and become the Q6L e-tron. The new bottle still contains old wine. With the experience of SAIC Audi Q6, it is now difficult to have confidence. However, Audi R&D Director He Lifu said, “We are very clear about what Chinese customers expect from Audi.” He said that Audi will focus on technologies such as intelligent cockpit, innovative display concepts, intelligent voice systems, and digital connectivity services. “Audi’s products in China, while inheriting the DNA of the fuel era, will also have a Chinese-exclusive digital ecosystem with localized configurations and functions.” It seems to be both compatible with the consumption habits and cognitive systems of old customers, and aggressively marketing digital technology to new customers. The challengers of BBA all claim to be the disruptive force of the old era, from overturning tables to lifting the ceiling, all are the violent demolition of the road. 1. Not feeling this is not enough to establish the image of a revolutionary. 2. If one does not feel this way, it is not enough to establish the image of a revolutionary. 3. Feeling this way is essential to establish the image of a revolutionary. 4. This feeling is necessary to establish the image of a revolutionary. 5. Necessary to establish the image of a revolutionary.

In such a vast and deep market in China, user diversity is a fact. But for a first-line luxury brand, meeting niche demands is far from enough. According to the data from the China Association of Automobile Manufacturers, in January-February 2024, regardless of power source, Huachen BMW and Tesla are the only two luxury brands to make the top 10 list of SUV sales. In the 300,000-350,000 and 350,000-400,000 price ranges, sales of new energy vehicles increased by 96.3% and 20.6% respectively. Joint venture brands are marginalized in the high-end new energy vehicle market, and so are BBA brands. The price of the Q6L e-tron will be competitive, starting at no more than 350,000. If competition intensifies early next year, this price may need to be lowered, just like the current pricing difficulties for the Xiaomi SU7. Unlike the SU7, which will start delivery at the end of this month with few uncertainties, the Q6L e-tron will take close to a year, making it difficult to predict market trends. Audi no longer has exclusive pricing power in China, even lagging far behind Mercedes-Benz and BMW, both of which still have some pricing authority for gasoline vehicles. In March, multinational brands such as BMW, Audi, and Volkswagen released their 2023 financial reports. The common theme is that global business has grown larger and more profitable, but the struggle is unique to China. For Audi, global deliveries have increased, but global profits have declined, which may not necessarily reflect a greater challenge in China compared to other multinational brands. However, Audi is hoping to launch a strategic counteroffensive by 2025, meaning that 2024 will still be a “transition year” for new energy. This also means that compared to BMW and Mercedes-Benz, which already have a range of electric products, “Audi’s 2024 transition will be more difficult and painful.”