Two consecutive limit up! A-share company urgently speaks out as it rides the wave of “solid-state battery concept stocks”, with Fengshan Group hitting limit up for two consecutive trading days.

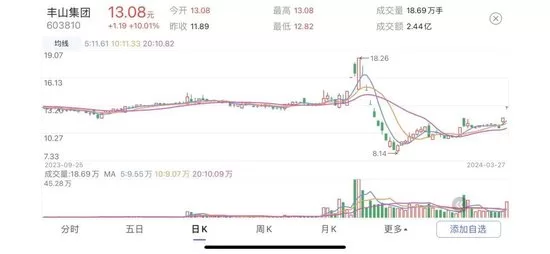

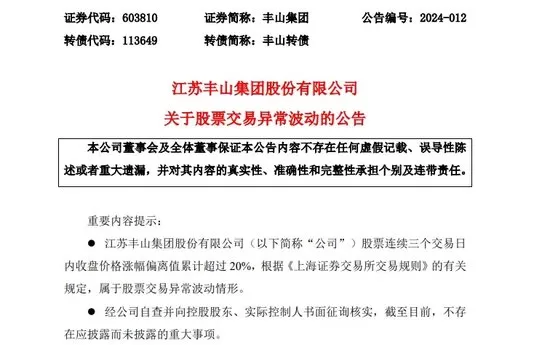

On the evening of March 27, Fengshan Group announced that the revenue from electrolyte accounted for less than 0.5% of the company’s total revenue. Electrolyte revenue less than 0.5%. Fengshan Group focuses on research, production, and sales of pesticide active ingredients, formulations, and intermediates. As of the close on March 27, Fengshan Group’s stock price rose by the daily limit for two consecutive days, reaching 13.08 yuan (0$) per share with a trading volume of 244 million yuan and a total market value of 2.123 billion yuan. On the evening of March 27, Fengshan Group announced a joint investment with Nantong Quannuo New Energy Materials Technology Co., Ltd. to establish Jiangsu Fengshan Quannuo New Energy Technology Co., Ltd. with a registered capital of 100 million yuan. The company contributed 66 million yuan, accounting for 66% of the registered capital. Fengshan Quannuo is mainly engaged in the research, production, sales, and technical services of electrolytes. “The revenue from electrolyte sales is still in the initial stage, accounting for less than 0.5% of the company’s total revenue. It does not have a significant impact on the company’s financial situation at the moment. The release of production capacity depends on changes in electrolyte market demand and the company’s business development.” Fengshan Group further stated that the semi-solid battery electrolyte is still in the research and development stage, and whether the subsidiary’s operational capabilities can achieve the expected results will depend on market changes, with a certain level of uncertainty.

On November 9th last year, Fengshan Group disclosed an investor relations activity record, stating that the company is cooperating with domestic excellent battery factories and battery factories owned by automobile companies in new technology fields and the field of semi-solid-state batteries. The company has launched two series of electrolyte formulations for sodium batteries and lithium batteries in the semi-solid-state battery field, with excellent battery performance. Recently, the focus of the research and development in solid-state batteries is on the electrolyte of semi-solid-state batteries. Performance forecast disclosure led to four consecutive trading limits after the expected loss. Fengshan Group has experienced four trading days on the third board this year, with the stock price hitting three limits from January 22nd to January 25th. The company also warned of risks, stating that sales of Fengshan Quannuo electrolyte are in the initial sales stage, accounting for less than 0.5% of the company’s operating income; while the electrolyte of semi-solid-state batteries is still in the research and development stage. On the evening of January 25th, Fengshan Group announced that the company expects a net loss of 19.18 million to 38.06 million yuan in 2023 compared to the same period last year. The company explained that in 2023, due to the downturn in the pesticide industry and weak demand from downstream customers, sales volume and sales revenue have decreased significantly, while the decrease in product sales prices exceeded the decrease in raw material prices, resulting in a significant decrease in the company’s product gross profit margin. After the performance forecast disclosure, Fengshan Group’s stock price hit the trading limit for four consecutive trading days. On January 31st, Fengshan Group was once again asked about the progress of semi-solid-state battery electrolytes in an investor relations activity. The company stated that “the electrolyte of semi-solid-state batteries is in the development research stage.” At that time, Fengshan Group mentioned that in the industry as a whole, the commercialization of semi-solid-state batteries may come earlier than solid-state batteries, although there are different opinions in the industry. It is worth noting that as early as August 2022, Fengshan Group announced a joint investment with Nantong Quannuo to establish Fengshan Quannuo, and the latter has obtained the project filing certificate for the annual production of 100,000 tons of secondary battery electrolyte. It wasn’t until the announcement of the progress of the project construction on November 30, 2023, that Fengshan Quannuo had just obtained the “Construction Engineering Planning Verification Certificate” and other administrative approval certificates. Multiple companies respond to solid-state battery business Recently, solid-state batteries once again attracted market attention. Zhiji Auto announced on March 25 that the upcoming Zhiji L6 will be the first to be equipped with the industry’s first mass-produced “ultra-fast charging solid-state battery,” leading new energy vehicles into the “solid-state battery era.” In addition, CATL also recently expressed their views on solid-state battery technology. CATL introduced that there are three technical routes for solid-state batteries: oxide route, sulfide route, and polymer route. After overcoming some technological issues with solid-state batteries, CATL believes the industry will face industrialization issues. The company attaches great importance to solid-state batteries, has been laying out for many years, and recently increased a lot of investment. In addition to CATL, Coslight Technology also saw a continuous surge in stock prices due to being associated with the “solid-state battery concept.” On the evening of March 27, Coslight Technology issued a stock trading risk warning, stating that the company has been recently listed by the media as a solid-state battery concept stock. After the company’s self-inspection, it was found that the company does not produce solid-state battery products. The company’s main business is consumer electronic structural components and medical device structural components. Coslight Technology stated that the company holds 0.24% of the shares of solid-state battery production and research enterprise Qingtao Energy Development Co., Ltd., with a low shareholding ratio. At the same time, as a supplier to Qingtao Energy, the company provides battery peripheral structural component products to Qingtao Energy and its controlled companies. From 2023 to the present, revenue of 745,700 yuan (103180$) has been generated. As of the close of March 27, Coslight Technology has been limit-up for three consecutive trading days. Furthermore, several A-share companies responded to solid-state battery-related questions through the investor interaction platform. Taihe New Materials stated that the company’s related products are being validated in semi-solid-state batteries. Jinlongyu stated on the investor interaction platform on March 27 that the company’s solid-state battery and key material related technologies are still in the research and development stage, and solid-state batteries are expected to be applied in consumer electronic devices, new energy vehicles, and other fields in the future. Baichuan shares stated that the company has conducted relevant research and attention to this technical route, but currently does not produce solid-state batteries. The company’s technical team will continue to monitor the development trend of batteries, prepare technical reserves, and consider subsequent layouts as appropriate.