Intelligent cockpit rapid popularization, penetration rate will exceed 70% this year. Recently, the “China Automotive New Supply Chain Configuration Data Product Launch Conference” hosted by Gaishi Automotive Research Institute was successfully held in Shanghai. Gaishi Automotive Research Institute aims to be a leading think tank in the automotive industry, focusing on intelligent automotive industry insights, outputting complete industry research results and data resources to support industry users in making business decisions. At this China Automotive New Supply Chain Configuration Data Product Launch Conference, Gaishi Automotive grandly introduced three sets of original database products and supporting market analysis monthly reports: passenger car intelligent driving configuration database, passenger car intelligent cockpit configuration database, and passenger car electrification configuration database. In recent years, the vigorous development of smart electric vehicles has driven the emerging technology cluster represented by autonomous driving, intelligent cockpit, and three-electric technology to gradually replace the traditional “big three parts” and become the key to shaping the core competitiveness and product strength of car companies. Intelligent Cockpit Accelerates Penetration The intelligent cockpit, as a complex integrated system, is not clearly defined in the industry. Here, the definition of the intelligent cockpit by the Geely Automotive Research Institute specifically refers to a cockpit system that simultaneously includes a central control screen of 8 inches or more, voice interaction, car networking, and OTA functions. The central control screen and voice interaction mainly provide users with excellent human-machine interaction experience, improving operational convenience and interaction efficiency. Car networking and OTA can greatly expand the functional boundaries and application scenarios of the entire vehicle, better meeting the diverse demands of end users. After all, nowadays, intelligent electric vehicles are no longer just simple means of transportation for many people. They also fulfill users’ multiple demands for leisure, entertainment, social interaction, and emotional interaction, becoming a “third living space” for people besides their living and working spaces. According to relevant analysis data, close to 90% of domestic users consider intelligent cockpit configuration when buying a car, and more than 60% of users are willing to pay for the functions inside the cockpit. In terms of specific functions, end users prefer car chip, voice recognition, car networking, OTA, remote start, high-precision maps, and phone mirroring, all exceeding 60%.

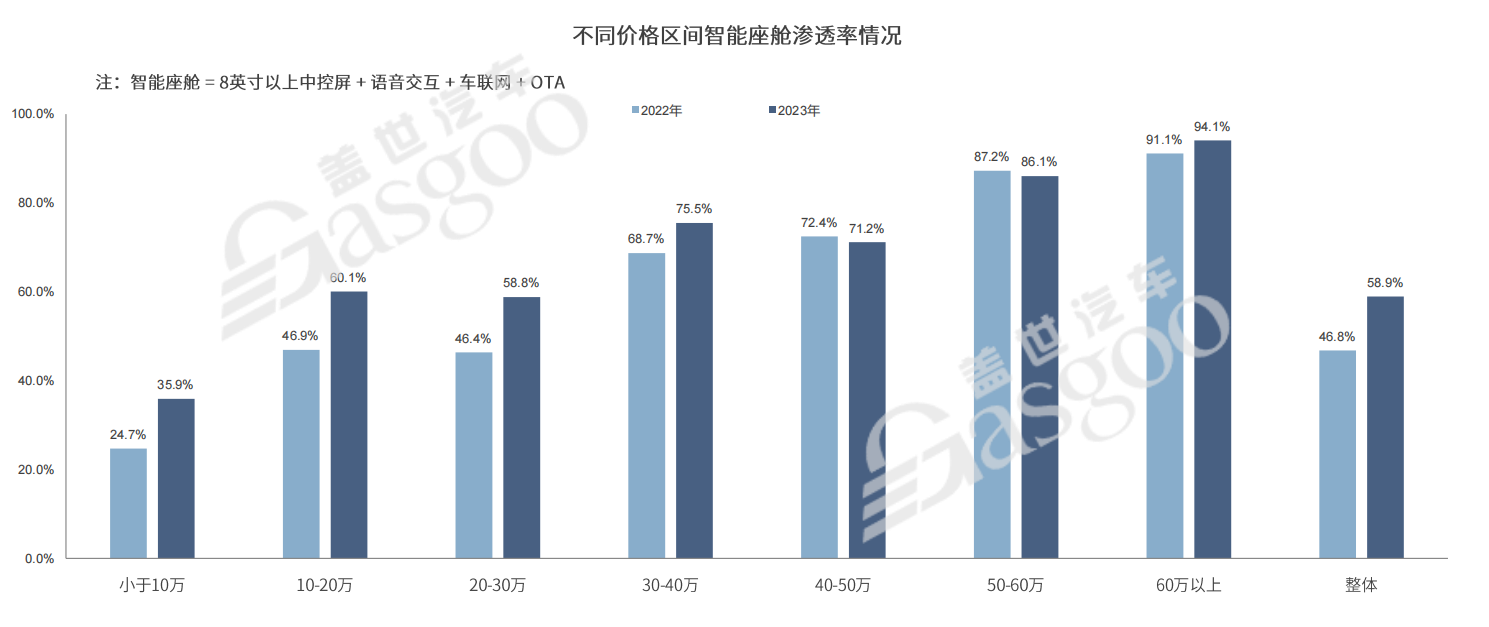

However, the richer intelligent cockpit functions also mean more complex software and hardware system integration, as well as higher mass production costs. From the perspective of terminal market penetration, the overall configuration rate of intelligent cockpits in the market above 300,000 yuan (41470$) is higher. The market penetration rate of intelligent cockpits in the 300,000-500,000 yuan (69120$) range is as high as 70% in 2023, and it exceeds 80% in the market above 500,000 yuan (69120$). This is not difficult to understand, after all, the higher the vehicle price, the stronger the cost tolerance for intelligent cockpit systems. In the market below 300,000 yuan (41470$), the penetration rate of intelligent cockpits is higher in the 100,000-200,000 yuan (27650$) range, reaching about 60%, while the penetration rate in the market below 100,000 yuan (13820$) is less than 40%. However, looking at the incremental part, the penetration rate of intelligent cockpits in the market below 300,000 yuan (41470$) increased significantly last year. Especially in the 100,000-200,000 yuan (27650$) market, the penetration rate of intelligent cockpits in 2023 reached 60.1%, even higher than the 200,000-300,000 yuan (41470$) market, increasing by nearly 13 percentage points compared to 2022. This means that after the popularization in the mid-to-high-end market, intelligent cockpits are now showing a clear trend of configuration exploration, with a significant increase in configuration rate in the mid-to-low-end market. According to data from the Gaishi Automotive Research Institute, the overall penetration rate of intelligent cockpits in China has reached nearly 60%. With the further maturity of the entire industry chain and the continuous cost reduction, it is expected that the penetration rate of intelligent cockpits will continue to increase, and the overall penetration rate is expected to exceed 70% this year. The rise of the local supply chain is just in time. As an important carrier of automobile intelligence, the evolution and innovation of intelligent cockpits depend deeply on the deep integration and efficient collaboration of core technologies such as in-vehicle displays, in-vehicle acoustics, advanced human-machine interaction, and high-performance chips. It is precisely because of this that the rapid development of intelligent cockpits in the past few years, in addition to bringing a revolutionary improvement in the driving experience for end users, has also strongly driven the maturity and prosperity of related core industry chains, especially the strong rise of the independent supply chain.

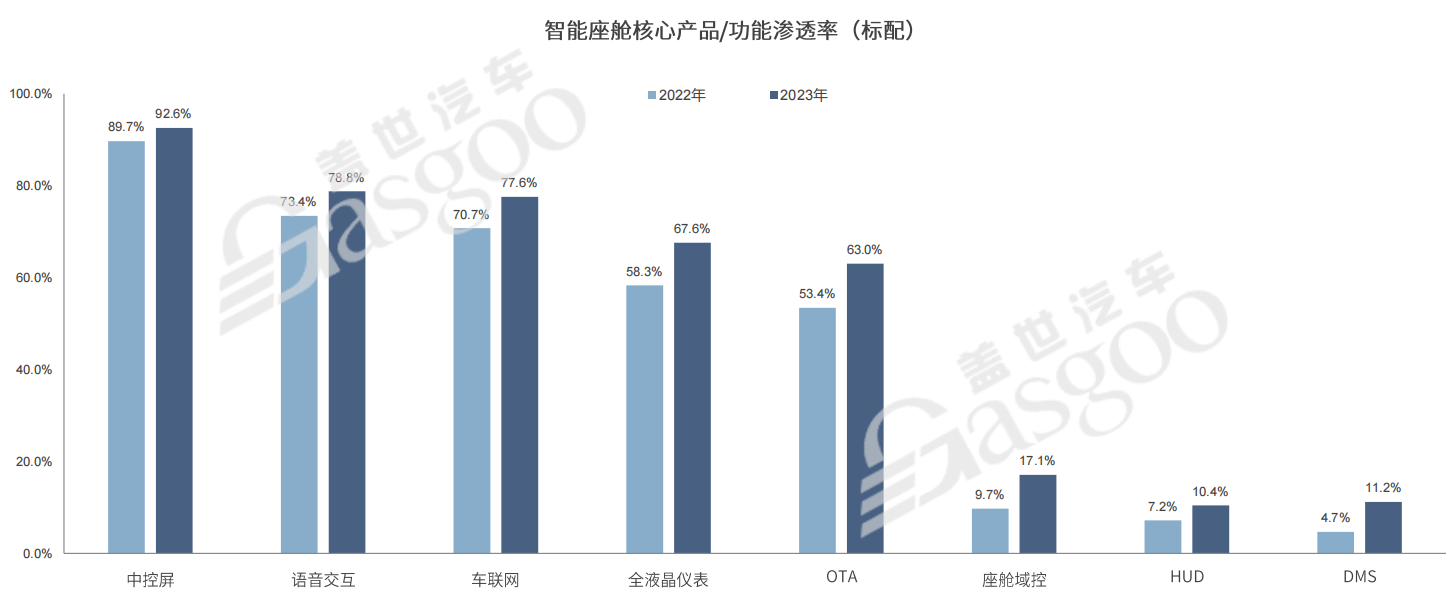

In the case of in-vehicle displays, due to the continuous increase in the complexity of vehicle functions and the continuous upgrading of end users’ digital and personalized space requirements, the cockpit display screen has become the core carrier and key human-machine interface for in-vehicle information display, showing a clear trend of “large screen” and “multi-screen” in recent years. According to data from the Gaishi Automotive Research Institute, by 2023, the penetration rates of central screens and LCD instrument panels in the new car market have reached 92.6% and 67.6% respectively, with different degrees of increase compared to 2022. Last year, the installation rate of 12-16 inch central screens in the cockpit reached as high as 42.1%, an increase of over 10 percentage points compared to 2022; although the installation rate of 8-12 inch central screens has declined, it still reached 42.2%; in addition, larger screens of 28 inches and even 40+ inches have started to be installed in new cars, such as the Galaxy E8, which is equipped with a 45-inch large central screen. In contrast, the installation rate of central screens below 8 inches has declined significantly, with only 14.4% last year, a decrease of nearly 10 percentage points compared to the previous year. As for the LCD instrument panel, the penetration rate of configurations above 10 inches has increased significantly, reaching 53.9% in 2023, especially for 10-12 inch LCD instrument panels, with a penetration rate of 28% in 2023, an increase of 6 percentage points compared to 2022. The installation rate of panels below 10 inches has shown a certain degree of decline, dropping to 46.1%.

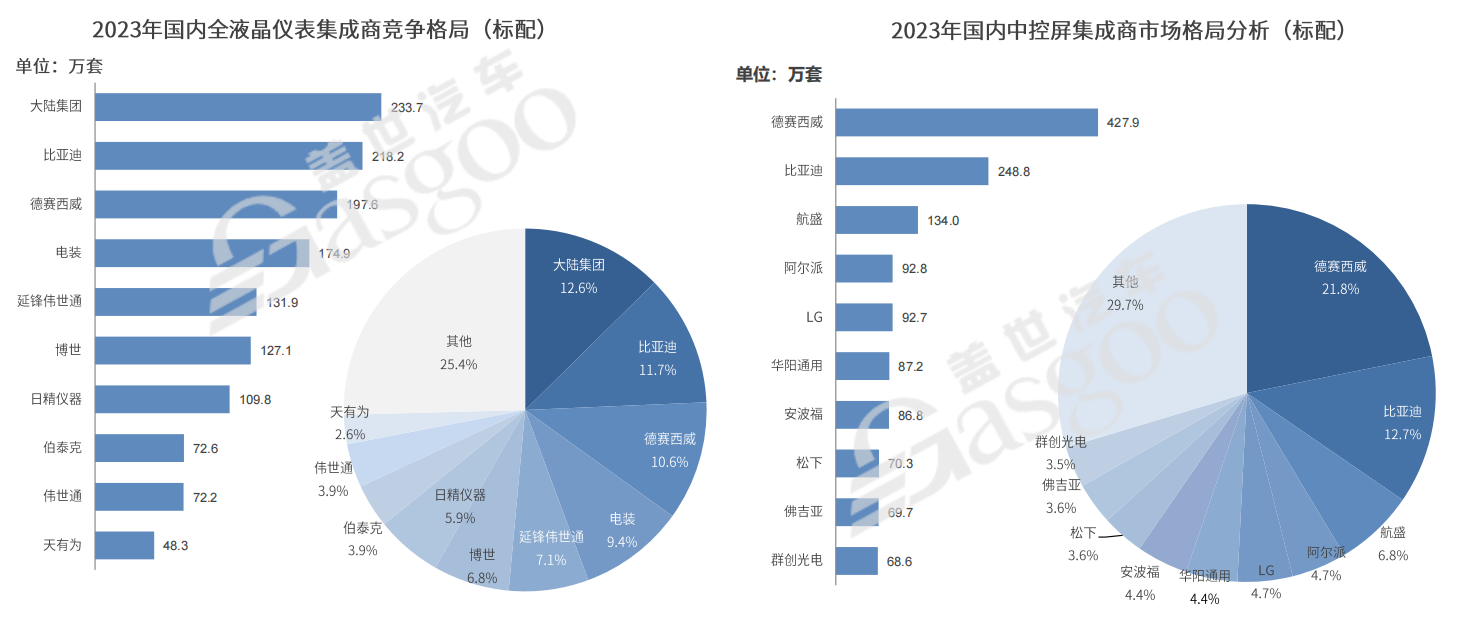

From the perspective of core suppliers, Desay SV and BYD account for a high proportion of central control screens, with installation volumes of 4.279 million and 2.488 million in 2023, corresponding to market shares of 21.8% and 12.7% respectively. LCD instrument panels are relatively well-performed by Continental Group, BYD, and Desay SV, with installation volumes of 2.337 million, 2.182 million, and 1.976 million in 2023, totaling a CR3 market share of 34.9%. In addition, cross-border players such as BOE and TCL have also started to provide related accessories. In addition to the trend of large screens, innovative display technologies such as HUD, co-pilot screens, rear entertainment screens, streaming rearview mirrors, and transparent A-pillars have begun to be installed in more and more new vehicles, driving the evolution of smart cabins towards a multi-screen direction.

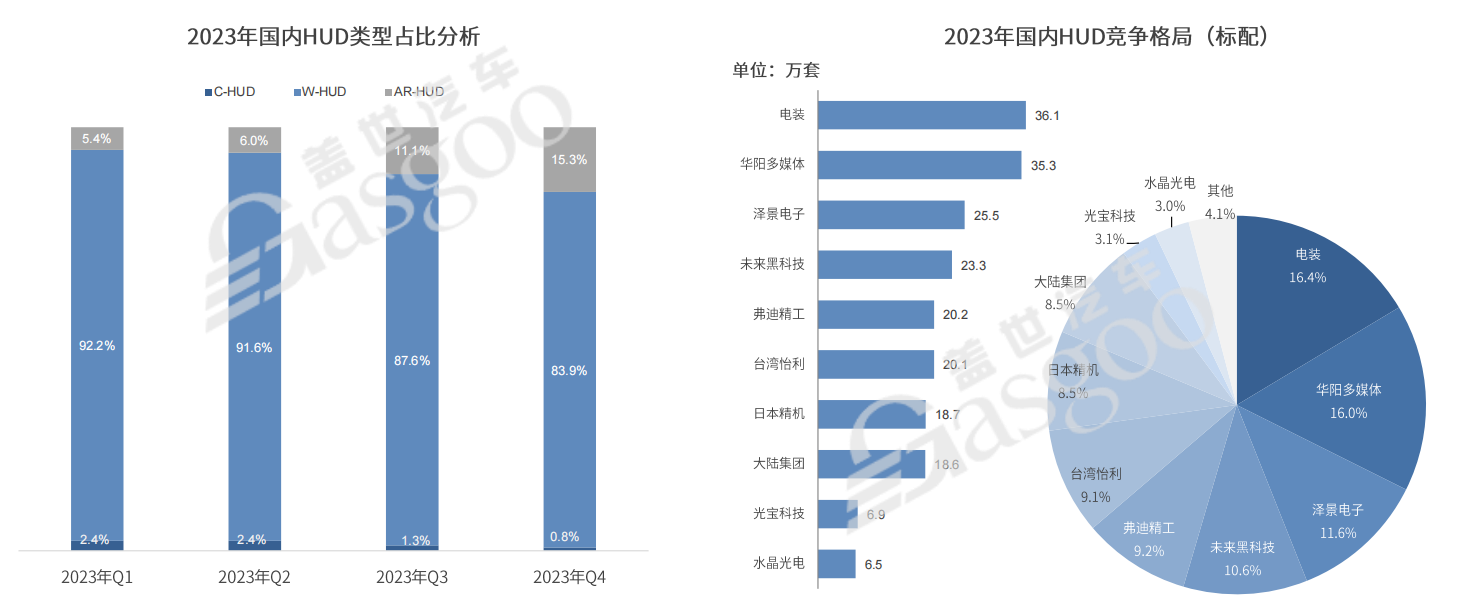

For example, in 2023, the penetration rate of HUD has reached 10.4%. W-HUD remains the mainstream configuration, accounting for nearly 90% in 2023. However, with the cost of the next generation AR-HUD continuously decreasing, it has also begun to scale up, with the configuration rate increasing from 5.4% in Q1 2023 to 15.3% in Q4. In terms of the HUD market structure, Denso, Huayang Multimedia, Zejing Electronics, Future Black Technology, and Fredy Precision are the main supporting suppliers. In 2023, their installation volumes reached 361,000 sets, 353,000 sets, 255,000 sets, 233,000 sets, and 202,000 sets respectively, with corresponding market shares of 16.4%, 16%, 11.6%, 10.6%, and 9.2%. The top five suppliers collectively occupy 63.8% of the market share.

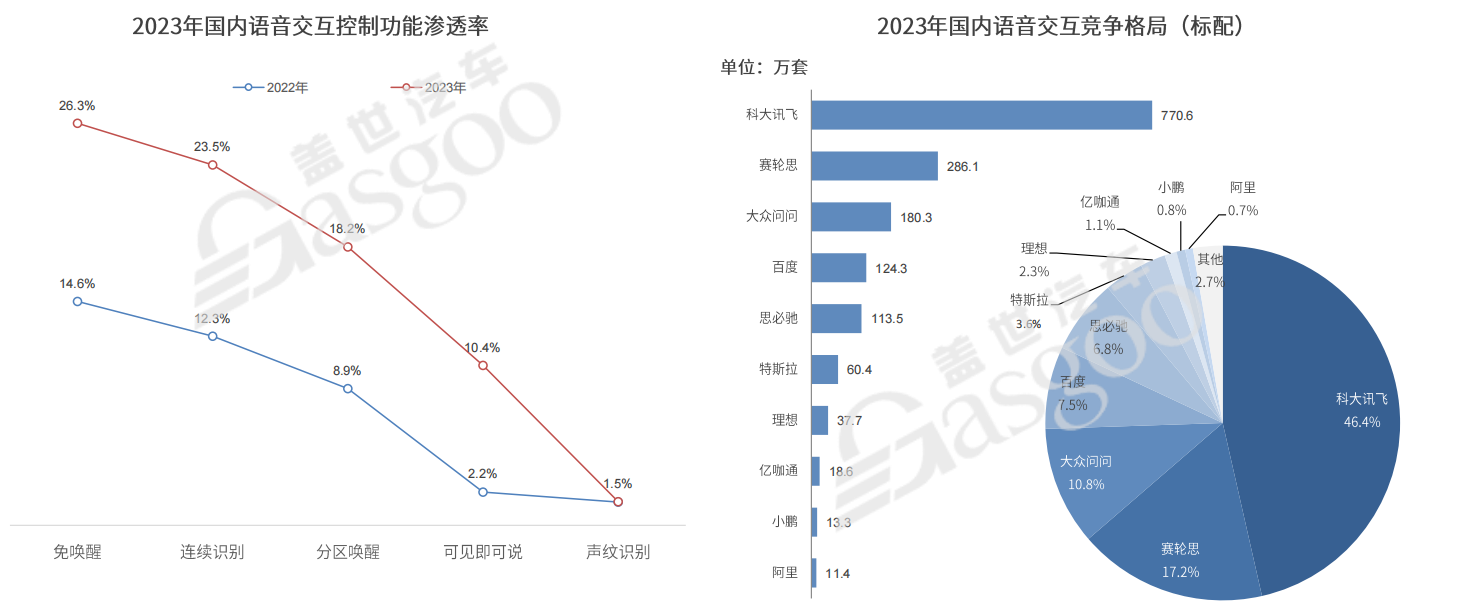

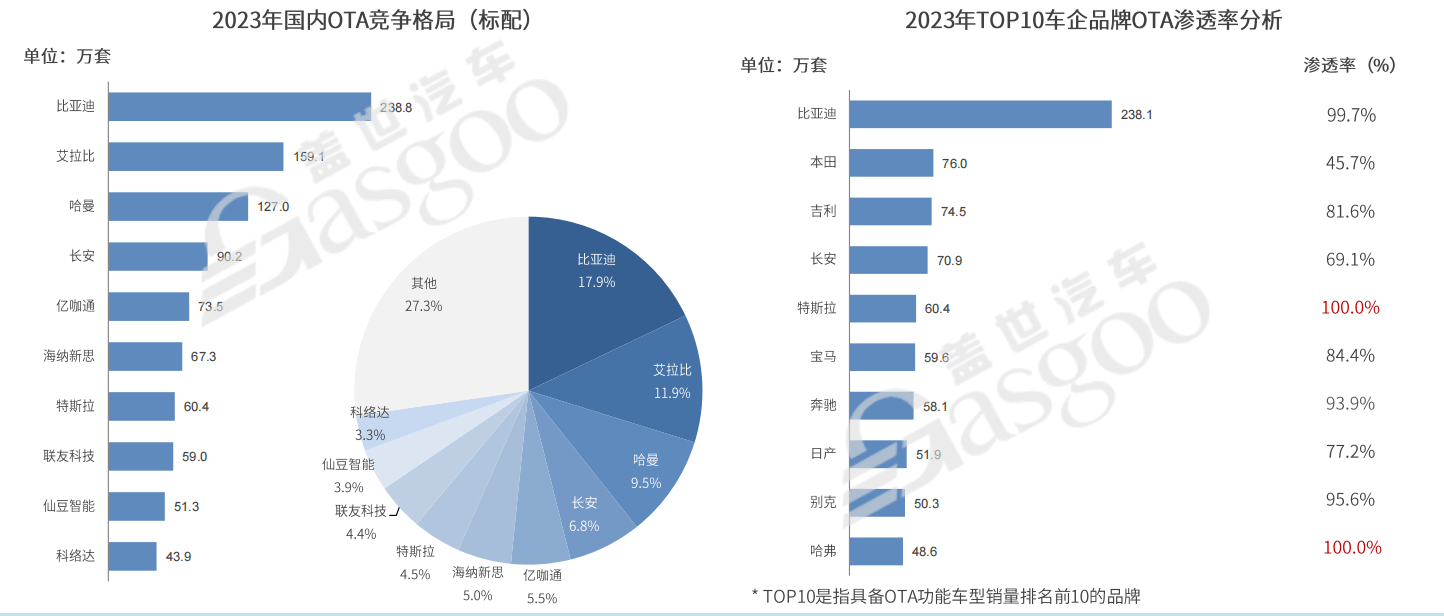

Voice interaction, as the most direct communication channel between people and cars, benefits from the rapid development of AI technology. In 2023, the penetration rate reached 78.8%, an increase of 5 percentage points compared to 2022. Features such as wake-up-free, continuous recognition, partition wake-up, visible and speakable, and voiceprint recognition all saw significant increases in adoption in 2023. In terms of installation volume, iFlytek almost dominates the market, with a shipment of 7.706 million sets of voice interaction systems in 2023, corresponding to a market share of 46.4%. Following closely are SAILUNSI and Volkswagen’s WENWEN, with installation volumes of 2.861 million sets and 1.803 million sets in 2023, corresponding to market shares of 17.2% and 10.8% respectively. The combined market share of the top 3 (CR3) exceeds 70%. For smart electric vehicles, in addition to diversified cockpit displays and intelligent voice interaction, OTA, which endows the entire vehicle with continuous evolution capabilities, has also become a standard feature in more and more new cars. Brands like Tesla and Haval have already made OTA standard across their entire lineup, and BYD is also close to achieving OTA standardization, with a penetration rate of 99.7% in 2023.

From the perspective of OTA core suppliers, BYD had the highest installation volume last year, reaching 2.388 million units, corresponding to a market share of 17.9%. Among third-party suppliers, AilaBei performed the best, with a total installation volume of 1.591 million units last year, with a market share of 11.9%, followed by Harman, with an installation volume of 1.27 million units in 2023, corresponding to a market share of 9.5%. Thanks to the rapid development of intelligent driving, it is expected that intelligent electric vehicles will be in a stage of human-machine co-driving for a long time in the future, which will drive the widespread popularity of DMS as a core configuration. Brands such as Ideal Car, Extreme Krypton, and Ask World have all exceeded 95% DMS penetration rate in 2023. Currently, DMS is mainly used for driver monitoring, but in the future, it is expected to be integrated with more ADAS functions to provide passengers with full-scene service applications. Overall, in the current round of cabin intelligence upgrade process, local manufacturers as important change drivers have not only strongly promoted the innovation and iteration of cabin technology but also effectively stimulated the transformation process of the independent new supply chain from nothing to something, from weak to strong, laying a solid foundation for China’s automotive industry to seize the global competitive high ground in the era of intelligence. Next focus: Hand-car integration and large-scale on-board models According to the classification standards in the “White Paper on Grading and Comprehensive Evaluation of Intelligent Car Cabins” previously released by the China Society of Automotive Engineers, the overall intelligent cabin is currently in the L2 cognitive stage, which means it has the ability to actively perceive passengers in the cabin in some scenarios and can actively perform some tasks, including applications across different internal and external cabin scenes.

On this basis, how will the next step of the intelligent cockpit iterate and upgrade its functions? Currently, cross-scene integration based on car connectivity, AI big models on board, and the integration and unification of multiple operating systems are becoming new battlegrounds. For example, in terms of cross-scene connectivity, the new generation of operating systems represented by Huawei HarmonyOS, Meizu Flyme Auto, with strong system compatibility and expansion capabilities, has successfully introduced and optimized a large number of mobile applications into the in-car environment, including the intelligent upgrade of traditional in-car functions such as navigation, entertainment, communication, and even spawned many innovative services such as remote control, car-home connectivity, personalized recommendations, greatly enriching the cockpit application matrix. In fact, the cross-scene connectivity between cars and mobile phones is not a new application, but early cross-terminal connectivity between the two mainly relied on Apple CarPlay, Baidu CarLife and other mobile mapping systems, which not only had single functions, but also could only control the phone through the central control screen in one direction.

The current new generation of in-car connectivity solutions not only support more ecological applications, but also enable bidirectional control between mobile phones and car systems, as well as support cross-device computing power sharing. For example, Huawei HiCar supports hardware calls and computing power sharing between car systems and mobile phones, while Meizu Flyme Link and Xiaomi CarWith support computing power sharing between mobile phones and car systems, as well as bidirectional control between mobile phones and car systems. According to data from the Global Automotive Research Institute, the penetration rate of mobile connectivity mapping functions in the new car market is about 56.4% in 2023. Baidu CarLife and Apple Carplay are still the mainstream solutions, with penetration rates of 33.4% and 30.7% respectively last year. Meanwhile, the adoption rate of Huawei HiCar continues to rise, reaching 8.5% last year, an increase of 3 percentage points from 2022. Furthermore, as the degree of car networking increases, remote control of cars through mobile apps is becoming mainstream. Last year, the penetration rate of remote control functions through apps exceeded 60%, with penetration rates of vehicle monitoring, remote control, service appointments, and other functions all exceeding 50%. In terms of brands, overseas luxury brands overall have a higher dependence on mobile mapping functions, while independent brands, due to the relatively complete ecosystem of their car systems, have a lower dependence on mapping functions. Instead, they have a relatively higher dependence on remote control functions through mobile apps, with an overall penetration rate exceeding 75% last year. According to current trends, in the future, mobile phones will not only serve as data collection entry points, but can also achieve cross-device connectivity with cars based on operating systems, as well as share computing power, sensors, etc., to create a true “human-car-life” ecological loop, achieving seamless integration in multiple scenarios. Additionally, large-scale models in cars will also be a key focus in the next stage of competition in intelligent cabins. In the past few years, although significant breakthroughs have been made in the intelligentization of cabins, especially in terms of voice interaction, many in-car voice assistants have shown initial human-like characteristics through deep integration with AI technology. However, it is undeniable that the underlying task-oriented dialogue systems of current in-car voice systems are not yet fully mature, and cannot truly achieve personalized and emotional interactions.

In 2023, the big model explosion has shown the industry a new direction for intelligent cabins, and companies are making moves. For example, Baidu and Geely’s Ji Yue 01 has implemented Baidu’s “Wenxin Yiyuan” voice big model on board, taking the human-machine interaction experience of Ji Yue 01 to a new level. iFLYTEK’s Xinghuo cognitive big model has also been first installed on Chery’s Star Era ES, aiming to create a more emotional ultimate intelligent cabin experience. In addition, companies such as NIO, XPeng, Geely, BYD, and Mercedes-Benz are all actively promoting the installation of big models on board. According to current trends, this year is expected to become the first year for mass installation of cabin big models. It is worth noting that the installation of big models on board can not only help achieve a more personalized and intelligent driving experience, allowing cars to truly have logical, decision-making, and generative capabilities, evolving from functional cars to intelligent cars, but also has the potential to promote the transformation of intelligent cabin business models through personalized owner services. Looking ahead, the development of intelligent electric vehicles is thriving, and the transformation of intelligent cabins is far from over.