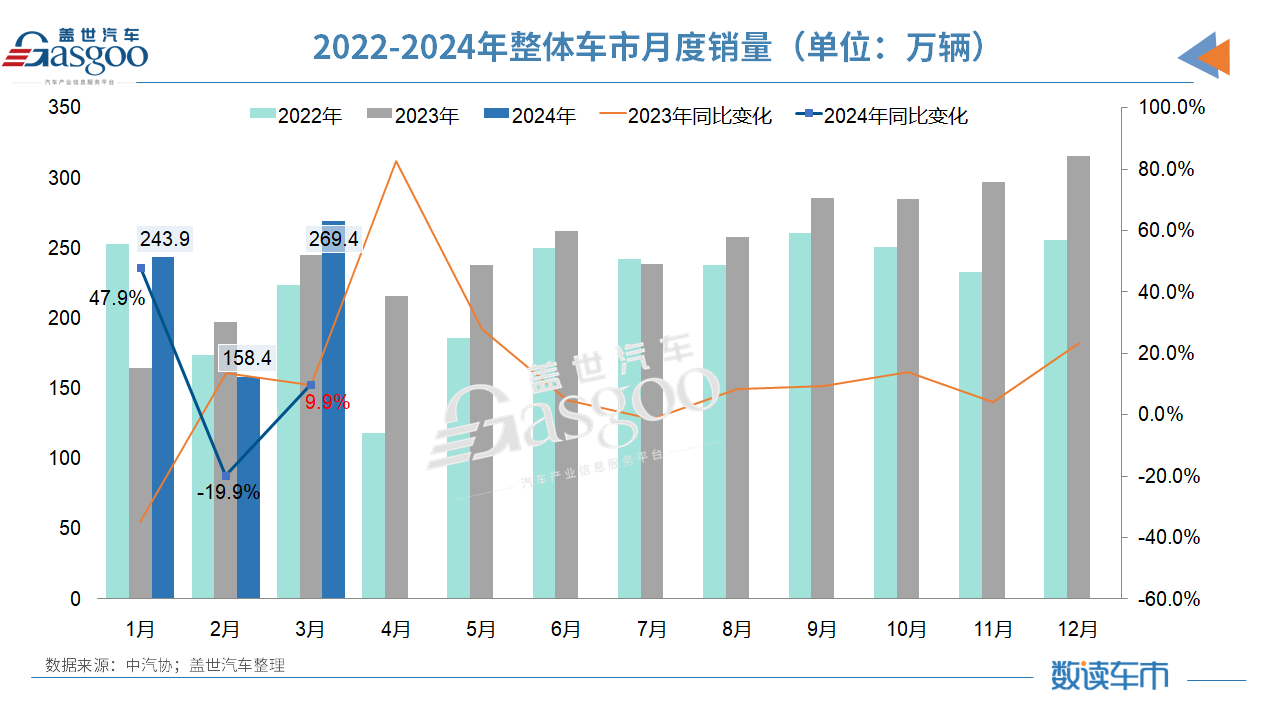

First quarter auto market hits new high since 2019, CAAM: annual trend may be high at the beginning and low at the end On April 10, CAAM released the latest production and sales data. In March this year, China’s automobile production and sales reached 2.687 million and 2.694 million respectively, with month-on-month growth of 78.4% and 70.2%, and year-on-year growth of 4% and 9.9% respectively. From January to March, automobile production and sales reached 6.606 million and 6.72 million respectively, with year-on-year growth of 6.4% and 10.6%, achieving a strong start in the first quarter, hitting a new high since 2019. “The growth in the first quarter of this year is largely influenced by the low base in the same period last year,” said Chen Shihua, deputy secretary general of CAAM, at the monthly production and sales data release. He also pointed out that exports are an important growth aspect currently, while insufficient domestic demand is a key issue to be addressed this year. With a year-on-year growth of 33.2% in the first quarter, exports have become an important growth driver for the auto market Data shows that in March, China’s domestic automobile sales were 2.193 million, up 5.1% year-on-year; automobile export sales were 0.502 million, up 37.9% year-on-year, with growth significantly higher than domestic sales.

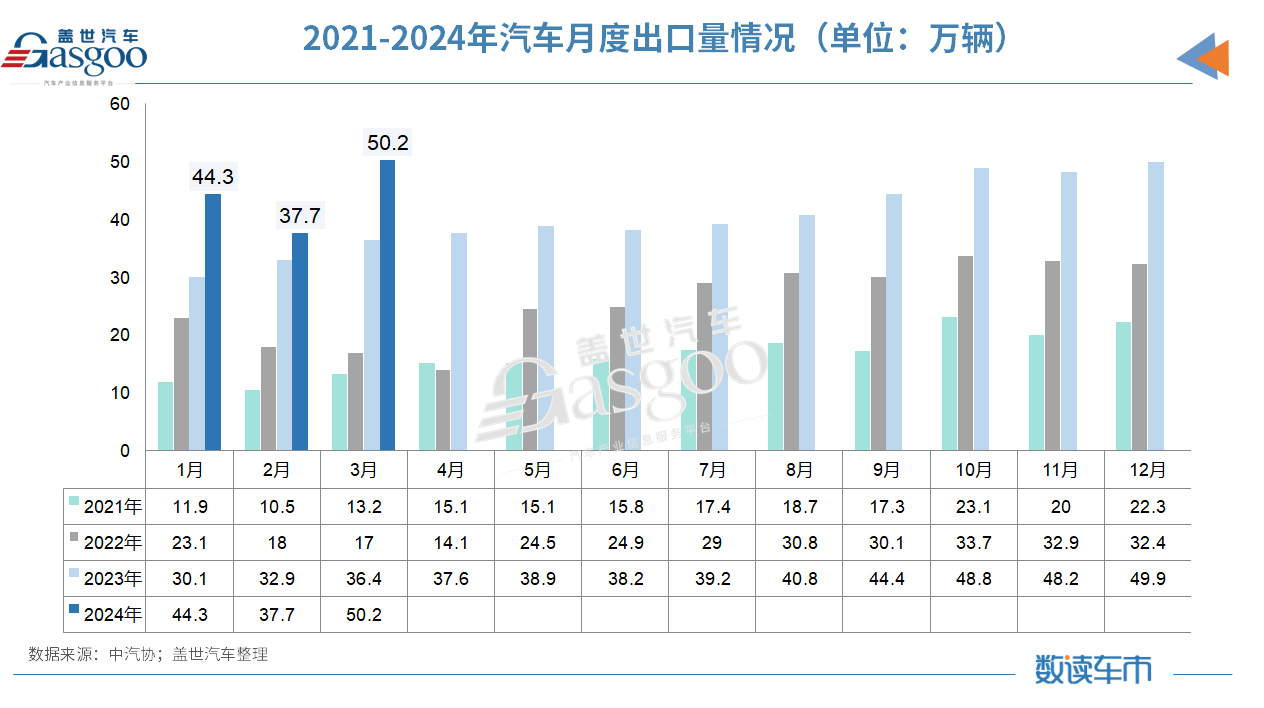

In March, China exported 502,000 vehicles. Passenger car exports reached 424,000 units, up 34.6% month-on-month and 39.3% year-on-year. Commercial vehicle exports totaled 78,000 units, up 24.9% month-on-month and 31% year-on-year. In terms of fuel type, traditional fuel vehicle exports reached 377,000 units, up 27.7% month-on-month and 32% year-on-year. New energy vehicle exports reached 124,000 units, up 52% month-on-month and 59.4% year-on-year. Specifically for new energy vehicle exports, pure electric vehicles reached 100,000 units in March, up 50.9% month-on-month and 41% year-on-year. Plug-in hybrid vehicles continued to show high growth, reaching 24,000 units in March, up 56.7% month-on-month and 2.4 times year-on-year. In the top ten export companies in March, SAIC returned to the top spot with 96,000 units exported, up 10.6% year-on-year, accounting for 19.1% of total exports. BYD had the most significant export growth, reaching 39,000 units, up 1.7 times year-on-year. In the first quarter, China’s vehicle exports reached 1.324 million units, up 33.2% year-on-year, accounting for nearly 20% of total sales. Domestic vehicle sales reached 5.396 million units, up 6.2% year-on-year. The data shows that both monthly and quarterly vehicle export sales have continued to perform well since last year, with growth rates significantly higher than domestic sales. According to the General Administration of Customs, in February, China exported 394,000 vehicles, up 21.5% year-on-year. Of these, 132,000 were new energy vehicles, up 8.1% year-on-year. In January and February, vehicle exports reached 831,000 units, up 21.9% year-on-year. New energy vehicle exports 285,000 units, a year-on-year increase of 11.1%. Russia, Mexico, and Belgium are the top three countries in terms of automobile exports. The top three countries for new energy vehicle exports are Belgium, the United Kingdom, and the Philippines. According to Xu Haidong, Deputy Chief Engineer of the China Association of Automobile Manufacturers, China’s automobile exports will face challenges and pressure in 2024. The domestic car market in the first quarter met expectations, with policies continuing to boost domestic demand. Although domestic sales growth is not as high as exports, it remains the foundation of the overall car market. China’s domestic passenger car market share still stands at around 60%. Since the Lunar New Year, a large number of new cars have been launched, offline events such as auto shows have gradually resumed, and some regions have introduced policies to promote sales, leading to a significant increase in car sales month-on-month and year-on-year. In March, domestic passenger car sales reached 1.812 million units, an increase of 78.1% month-on-month and 5.8% year-on-year. Traditional fuel passenger car sales decreased by 67,000 units compared to the same period last year, with a month-on-month increase of 70.8% and a year-on-year decrease of 5.7%. From January to March, domestic passenger car sales reached 4.577 million units, a year-on-year increase of 6.2%. Behind the decrease in traditional fuel passenger car sales is the rapid growth in new energy vehicle sales. In March, domestic new energy vehicle sales reached 758,000 units, an increase of 92.1% month-on-month and 32% year-on-year. From January to March, domestic sales of new energy vehicles reached 1.783 million units, a year-on-year increase of 33.3%.

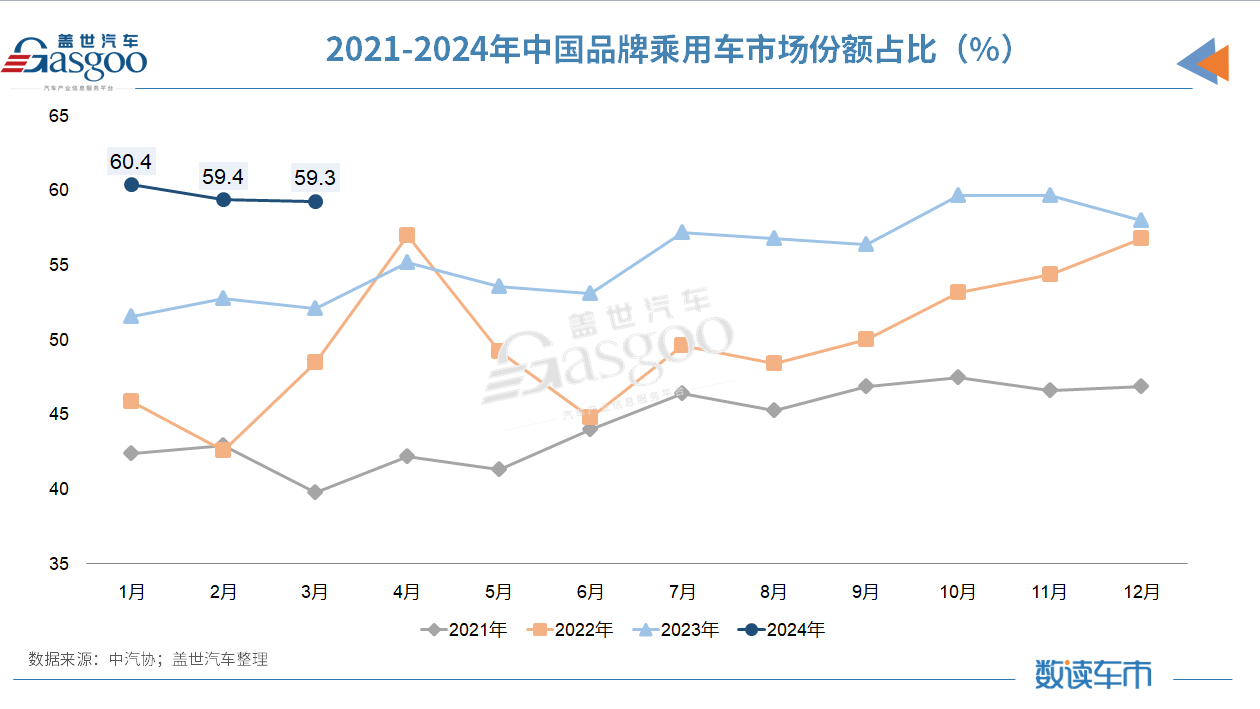

In March, Chinese domestic passenger car sales totaled 1.326 million units, up 67.6% month-on-month and 26.1% year-on-year, accounting for 59.3% of total passenger car sales, with a market share increase of 7.2 percentage points compared to the same period last year. Among major foreign brands, sales of the top five brands increased significantly compared to the previous month; compared to the same period last year, sales of American and Korean brands increased slightly, while sales of the other three major brands decreased to varying degrees. From January to March, Chinese domestic passenger car sales totaled 3.392 million units, up 26.4% year-on-year, accounting for 59.6% of total passenger car sales, with a market share increase of 7.4 percentage points compared to the same period last year. Among major foreign brands, compared to the same period last year, except for double-digit growth in sales of Korean brands, sales of the other four major brands decreased to varying degrees. The association stated that the growth trend of the domestic automobile market in the first quarter of this year is in line with the association’s expectations, continuing the development momentum from the fourth quarter of last year. “With the detailed implementation of the ‘scrappage for new’ policy, we believe it will stimulate domestic automobile market consumption in the later period,” said Xu Haidong. Since the end of last year, after several meetings and clear announcements, consumers have shown a high level of attention and expectations for the ‘scrappage for new’ policy to promote consumption. Some analysis indicates that before 2016, the group of car buyers had strong purchasing power. The group of car buyers who are now looking to upgrade do not have strict time requirements. Their timing for purchasing is flexible. Therefore, the potential for driving car consumption through trade-ins is significant in the future. Furthermore, with the upcoming detailed policies for trade-ins, two departments jointly issued a notice before the Qingming Festival to adjust policies related to car loans. This reflects a comprehensive consideration and precise details in the current optimization of the circulation field for new cars and trade-ins in the automotive finance sector. The potential for consumption in the market to “eliminate and upgrade” and “trade-in and upgrade” will gradually be unleashed, benefiting the gradual strengthening of the car market in the coming months. The annual trend in the car market may show a high followed by a low, and caution is needed due to low profits. After closing the first quarter, the China Association of Automobile Manufacturers believes that the trend of the car market in the second quarter will be stimulated significantly by the resumption of the Beijing Auto Show in April, where a large number of new products from car manufacturers will be accelerated. Additionally, the trade-in policy is expected to be implemented on schedule, further boosting demand. Looking ahead to the whole year, CAAM said that in 2024, the growth rate of domestic cars is likely to show a trend of high first and then low. Excluding the stimulus effect that the “scrappage for new” policy may bring, this year’s domestic market sales may be flat with last year.

Last year, domestic car production and sales were low in the first quarter, but by the third and fourth quarters, the overall car market returned to a higher level. Before the “trade-in old for new” policy was implemented, the total annual sales of the domestic car market in 2024 may be flat compared to last year. However, after the policy is implemented, the overall domestic car market will experience significant growth,” said Chen Shihua. Xu Haidong also mentioned that currently, the Chinese auto industry is facing a prominent issue of a severe decline in total industry profits, despite an increase in revenue. According to data compiled by the China Association of Automobile Manufacturers from the National Bureau of Statistics, in January-February 2024, the value added of the automobile manufacturing industry increased by 9.8% year-on-year, 2.1 percentage points higher than the manufacturing industry during the same period. Operating income reached 1,371.45 billion yuan, an 8.1% year-on-year increase; total profits reached 58.69 billion yuan, a 50.1% year-on-year increase; and the industry profit margin was 4.3%. Chen Shihua believes that currently, the overall performance of the car market in terms of production and sales is good, but from the perspective of car companies, the feeling is not as positive as the increase in quantity. He emphasized that some companies are too eager for quick success and have pushed prices extremely low, leading to an overall downward trend in industry prices. Currently, price competition is extremely fierce, and the development of an industry cannot only be judged by an increase in quantity. The profit margin of the automotive industry is only 4.3%, but the automotive industry requires high investment, and low profits will affect the industry’s research and development and innovation.