Author: Song Doudou Editor: Zhang Mingyan Image source: TuChong

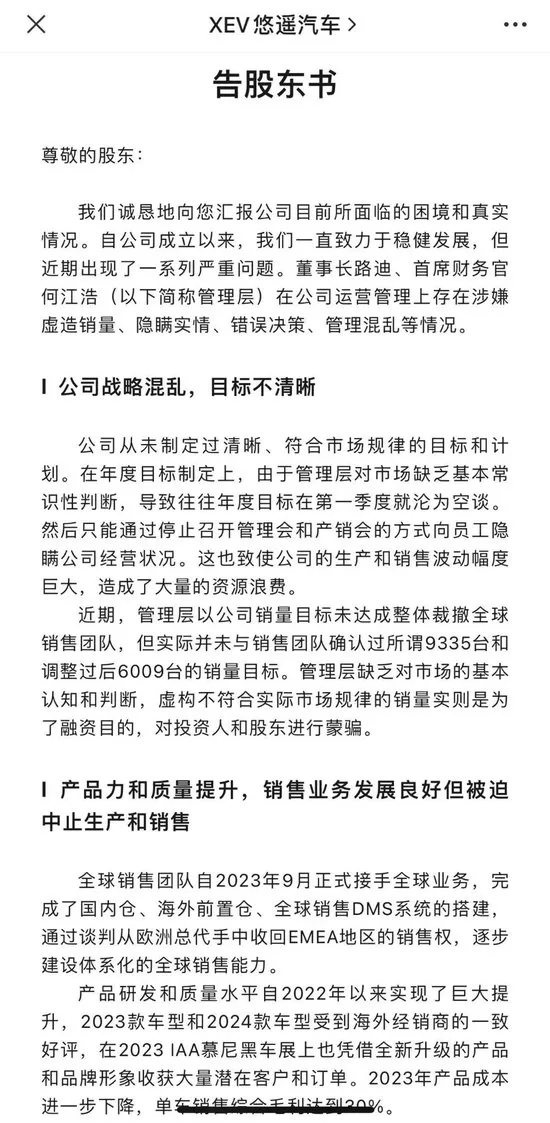

Another Chinese new energy vehicle brand is in trouble. On the evening of April 9, Youyao Technology, in the name of all employees, published a letter to shareholders on social media, stating that the company has recently encountered a series of serious problems. Chairman Lu Di and CFO He Jianghao are suspected of fabricating sales, concealing the truth, making wrong decisions, and causing management chaos in company operations. The 2500-word statement listed the “five major crimes”.

In a letter to shareholders, the company admitted to never setting clear, market-oriented goals and plans, leading to unreasonable sales targets and financial chaos. By the end of 2023, the company’s cash flow was on the brink of collapse. Currently, XEV Group’s total external debt exceeds 300 million, while its assets are worth less than 100 million, resulting in severe insolvency. Due to a lack of basic market judgment by management, annual targets often became unattainable by the first quarter. This led to significant fluctuations in production and sales, wasting resources. Furthermore, the management’s lack of long-term financial planning and absence of a clear budget system resulted in investing in numerous continuously losing projects. The letter to shareholders revealed that management fabricated 70 million in sales expenses in the annual report, with over 44 million being overdue after-sales claims for old vehicle models handled by the chairman, which were never accounted for in previous reports. Despite deteriorating cash flow in December of last year, management still leased a sea-view office in Hong Kong and carried out luxurious renovations, which did not help the company’s core business. After the aforementioned situation, the company’s management not only did not adjust the strategy to solve the problem but overall disbanded the global sales team due to “failure to achieve sales targets.” Starting from January 2024, payments to all suppliers were stopped, factory production was halted, and employee reimbursement approval processes were delayed. Not only the global sales team was laid off, but in January and February of this year, XEV Technology carried out two rounds of company-wide layoffs and implemented mid-level salary reductions. Payments of February salaries and severance pay to laid-off employees were stopped in March. The latest round of layoffs had no prior communication or negotiation, and no compensation plan was provided, sparking strong reactions from all employees. Employees in Shanghai and Hefei simultaneously began to seek legal rights. The shareholder letter included the fingerprints and signatures of employees, as they believed shareholders had the right to know the truth. Public information shows that XEV Technology was founded in 2018. Founder and Chairman Lu Di worked at the Jianghuai Automobile Italian Design Center for 12 years. Co-founder Lu Bin has rich experience in traditional car companies such as SAIC-GM, Geely, and Chery, and held important positions at WM Motor. In its founding year, XEV Technology designed and developed its first pure electric car, YOYO, which debuted at the Turin Motor Show. With the support of the Hefei State-owned Assets Supervision and Administration Commission, in 2020, XEV Technology and the Hefei government established a joint venture company to fully engage in research and development, production, and complete vehicle export business. The official statement once claimed that “XEV electric vehicles do not require molds used in traditional car manufacturing, truly achieving flexible production tailored to demand, reducing vehicle development time and cost input by over 80%. Hefei XEV has already achieved 3D printing of door panels, front face, and rear wings.” In May 2021, XEV YOYO entered the European market with a retail price of 13.9-15.9 thousand euros. It has features like frameless doors and a sunroof that other cars in the same price range do not have. That year, its cumulative sales became the highest among Chinese new energy brands in Europe.

Youth Technology has been focusing on overseas markets since its establishment, mainly in Europe. “We never thought about the Chinese market from day one. XEV’s advantage lies in understanding the European market,” said Ludi in an interview. Relying on China’s research and development, production, and supply chain, Youth Technology took a different path from most Chinese new energy vehicle companies in the early stages of entrepreneurship by creating a “special” small car for Europe. It was once considered a successful representative of Chinese automotive companies going global, and successfully secured two rounds of undisclosed financing. In October 2023, Ludi stated in an interview that the company was close to achieving financial break-even. According to the previous shareholder letter, the company previously only had a stable and scaled sales channel in Italy, with 1904 units registered at the end of 2023, accounting for 75% of the total L7e category in Italy. The official statement claimed it was “a very outstanding achievement,” but also confirmed the management’s unreasonable sales target claims to investors. In terms of the Southeast Asian market, in November 2023, Youth Technology’s right-hand drive model was approved to enter the Thai market, and in February 2024, it obtained registration and roadworthiness qualifications. At the same time, it signed an agreement with Thai customers for the sale of 2000 units annually and an initial order of 300 units. However, despite the accelerated growth in global markets, Youth Technology’s financing situation in the past two years has not been ideal. According to the shareholder letter, the financing team continued to fabricate false sales data to make the books look good, calculating the financing of inventory as sales revenue to falsify sales reports, and forcing the sales team to cooperate. They also forced the production of a large amount of inventory, then conducted short-term inventory financing and confirmed it as sales revenue, leading to a quick expiration of inventory financing, resulting in buybacks and cash flow deterioration.