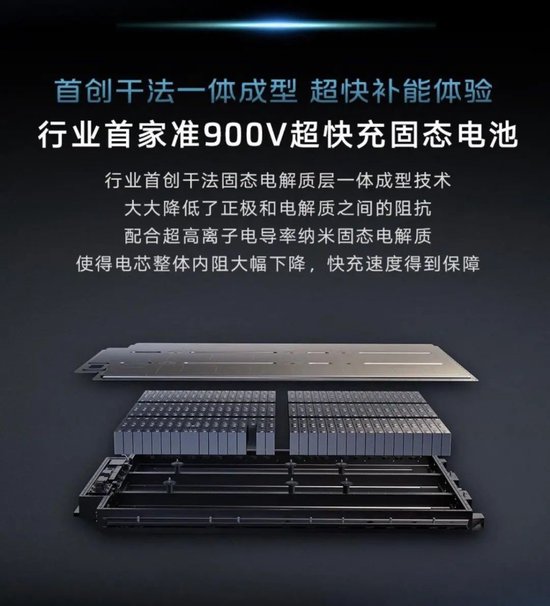

Source: Market Value Storm Ternary positive pole leader. By the end of March 2024, SAIC Group announced that the upcoming Zhiji L6 will be equipped with the industry’s first mass-produced on-board quasi-900V high-voltage ultra-fast charging solid-state battery; In early April, Chongqing Tailan New Energy announced the successful preparation of a ultra-high energy density, reaching 720Wh/kg, solid-state lithium metal battery; Shortly thereafter, GAC also released solid-state battery technology.

With the release of results from many companies, the popularity of solid-state batteries remains high. Solid-state batteries are expected to break through the constraints of liquid batteries in terms of energy density, lifespan, and safety performance, triggering a new round of changes in the power battery industry chain. In the cost structure of power batteries, the cathode segment, which accounts for the highest proportion, will prefer high-nickel ternary series materials due to the need to match higher energy density and voltage platforms. When it comes to high-nickel ternary materials, Fengyun Jun has conducted multiple studies on the industry leader, Conti Technology. At that time, the new energy industry chain was still in a thriving atmosphere, but 2023 is different now, with Conti Technology’s performance not meeting expectations. Its total annual revenue and net profit attributable to shareholders decreased by 24.8% and 57.1% respectively, and the net profit attributable to shareholders in the fourth quarter alone was -35 million yuan, a far cry from the 435 million yuan in the same period last year.

Massive expansion efforts failed to yield results, product price cuts dragging down performance. In 2023, the industry for ternary cathode materials saw a significant decline in prosperity, with dismal performances from industry peers. Companies like CATL, Farasis, and GEM were all affected to varying degrees. Compared to others, GEM had the smallest drop in revenue, while CATL saw the smallest decline in profits, showing a more favorable situation for the industry leader.

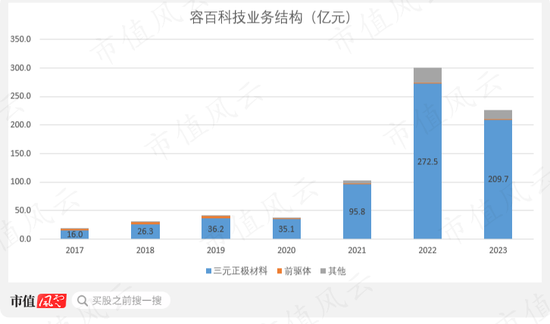

In 2023, the main business of Rongbai Technology, ternary cathode materials, achieved revenue of 20.967 billion, a year-on-year decrease of 23.1%, accounting for over 90%, basically explaining the overall revenue decline that year.

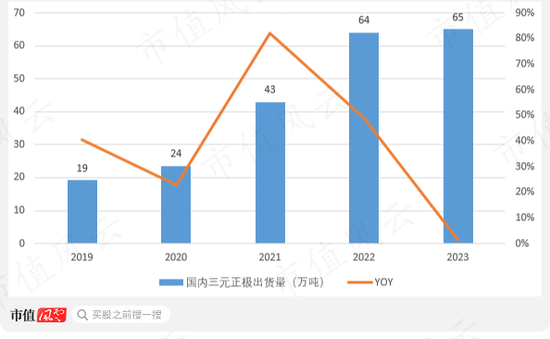

Domestic ternary cathode materials shipments totaled about 650,000 tons in 2021, similar to 640,000 tons in 2022, marking the end of rapid growth in recent years.

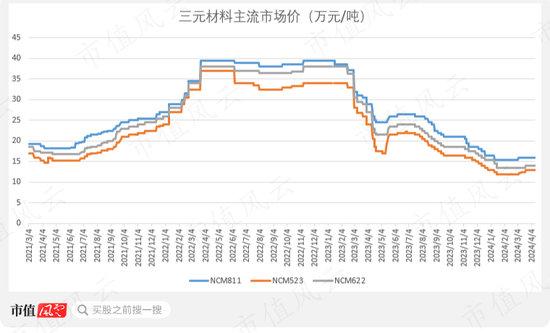

In terms of prices, the market average prices of NCM523 and NCM622 cathode materials for 2023 dropped by 35.3% and 33.3% respectively. Even the high-nickel products that Capchem is proud of did not escape the second round of price declines, with NCM811 also experiencing a 29.4% decrease in average price. Comparing the highest and lowest prices, the price declines of the three types of cathodes are all above 50%. In the first quarter of 2024, the prices of ternary cathodes continued to decline, falling below the levels of the same period in 2021.

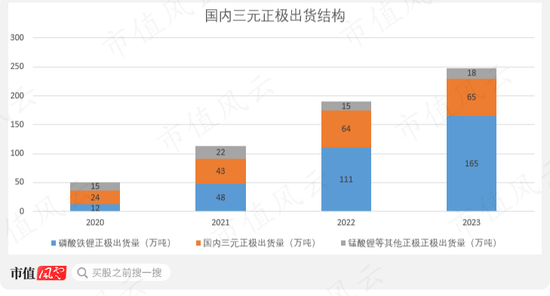

From the perspective of shipments, Rongbai Technology’s annual production and sales of ternary cathode materials were 10.28 tons and 9.94 tons respectively, with a year-on-year increase of 12.4% and 11.7% in a situation where the industry basically had no increase in output. However, in 2022, its production capacity increased significantly from 120,000 tons to 250,000 tons. Against this background, the performance of shipments in 2023 was obviously lower than expected, with a capacity utilization rate of only about 40%. Calculations show that Rongbai Technology’s product prices decreased by about 31%, slightly higher than the decrease in the market price of NCM811, which was the main reason for the decline in revenue. Against the backdrop of a significant price reduction, Rongbai Technology also made provisions for inventory impairment losses of 253 million, more than 2 billion more than last year, further reducing profits. In this way, the decline in Rongbai Technology’s performance is more attributed to industry factors. After the large-scale expansion of production, not only did the output not increase, but prices also plummeted. So, what are the reasons for the industry downturn? The iron-lithium route monopolizes downstream benefits, and supply and demand imbalances are revealed. 01 Ternary proportion continues to decline Let’s start by explaining the stagnation in shipment growth. In 2023, the domestic shipment of power battery cathodes is about 2.48 million tons, still with a growth of over 30% year-on-year. The dividend of new energy vehicles is still there, but it has been taken over by another technology route – lithium iron phosphate. In response to the downstream car manufacturers’ cost reduction demands, lithium iron phosphate, with its price advantage, has further increased its share in cathode materials, occupying two-thirds in 2023, further squeezing the space for ternary materials, whose share has dropped to 26%.

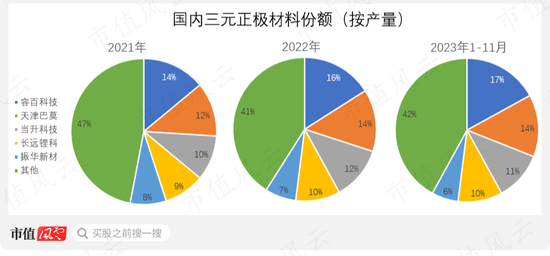

Further splitting of high nickel ternary cathode, domestic high nickel ternary shipments reached 289,000 tons in 2023, with a slight increase in penetration to about 45%. According to Xinluo Information and GGII data, domestic high nickel ternary shipments reached 269,000 tons in 2022, with a penetration rate of about 42%. As a leader in high nickel ternary, Rongbai Technology maintained a market share of one-third in this field in 2023. The weakest link in the competitive landscape With the advantage in high nickel products, Rongbai Technology’s market share in the first 11 months of 2023 further increased to 17% compared to 2022, solidifying its leading position. In recent years, the market structure of ternary cathode has not changed significantly, with little movement in the ranking and market share of top companies, especially since 2022, where CR3 has remained at 42%.

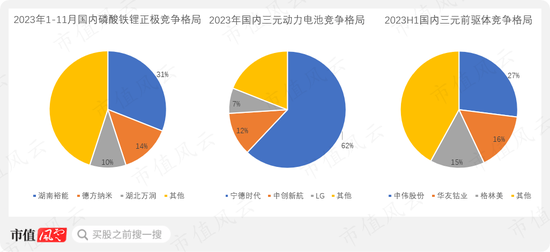

In comparison, in November 2023, the market share of the domestic lithium iron phosphate cathode industry’s top 3 (CR3) reached 55%, with leading company Hunan Yunneng’s market share exceeding 30%, firmly holding the leading position. As the direct downstream of ternary cathodes, the CR3 of the ternary power battery industry in 2023 reached 81%, with CATL as the absolute leader, also the sole major customer of EVE Energy, with a market share of 62.08%. In the upstream of the industry chain, in the first half of 2023, the CR3 of ternary precursors also reached close to 60%, with leading company GEM holding 27% of the market share, sitting in a more stable position than EVE Energy.

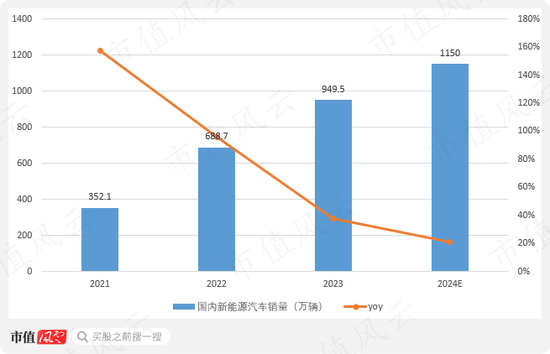

In the new energy vehicle industry chain, the CR3 of the negative electrode, electrolyte, and lithium iron phosphate battery is about 49%, 63%, and 81% respectively in 2023. This shows that while the ternary cathode is the most valuable part of the power battery, it also has the relatively worst competitive landscape. Overcapacity and lack of cost support are issues. The supply-demand relationship is the main factor affecting product prices. By November 2023, domestic ternary cathode production capacity had reached 1.072 million tons, with an additional 300,000 tons added during the year. With domestic ternary cathode shipments of 650,000 tons in 2023, there was an excess capacity of over 400,000 tons, revealing the contradiction of oversupply. The industry’s average capacity utilization rate was about 85% in 2022, dropping to 60% in 2023. As a segment with dispersed competition and weak bargaining power, it is natural for the price of ternary cathode materials to decline. Looking ahead to 2024, domestic ternary cathode production capacity is predicted to exceed 2 million tons, with a utilization rate of less than 45%, and most new capacity will be ineffective or inefficient. Despite the exaggeration of the 2 million ton figure, further industry expansion is certain. According to the China Association of Automobile Manufacturers, the sales of new energy vehicles in 2024 will be 11.5 million units, a 21% year-on-year increase, the lowest in nearly four years, indicating the gradual decline of the downstream new energy vehicle industry’s dividend.

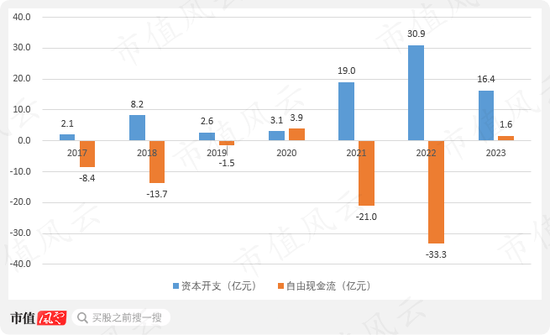

According to predictions, imbalance of supply and demand is unlikely to end in the short term. Global strategy + cutting-edge new products, planning to expand production on a large scale. After a significant expansion in 2022, the production capacity of Rongbai Technology did not show a clear increase in 2023, but this does not mean that it has stopped expanding production.

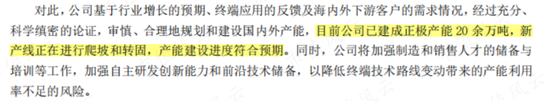

Rongbai Technology in Hubei Xiantao has an annual production capacity of 400,000 tons of ternary cathode materials, which is being built in three phases. The completion of the first phase project has been delayed to 2026. Against the backdrop of the domestic market being caught in a vicious circle, Rongbai Technology is focusing more on overseas markets. In 2023, Rongbai Technology announced its globalization strategy, establishing a factory in South Korea to further expand into the European and American markets as a new growth point. The US “Inflation Reduction Act” plans to invest $370 billion in the climate and clean energy sectors, and products produced by countries that have signed free trade agreements with the US can receive a certain percentage of subsidies, with South Korea included in this list. By 2023, the penetration rate of new energy vehicles in China has exceeded 30%, far higher than in European and American countries, indicating that the latter still have a broader new energy space.

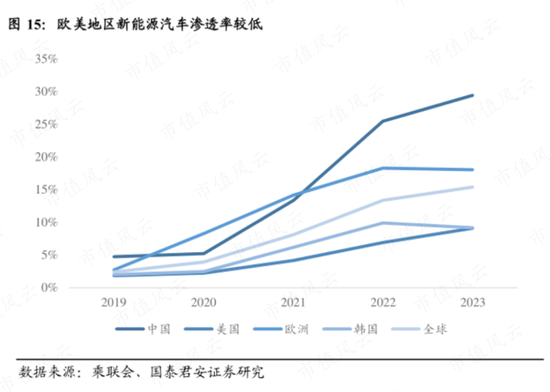

Currently, Lishen Technology has completed a 20,000-ton high-nickel cathode capacity in Chungju, South Korea. In the fourth quarter of 2023, it achieved shipments of thousands of tons to European and American customers, and plans to expand the capacity of its South Korea base to 100,000 tons by 2025, further expanding to 200,000 tons by 2030. However, compared to Lishen Technology, which has SK and LG as major customers year-round, Rongbai Technology has no advantage in overseas markets and it is difficult to achieve the same status as in the domestic market. In addition, Rongbai Technology acquired Tianjin Scoland Technology in 2022, entering the manganese iron lithium phosphate route, currently with a capacity of 6.2 million tons. Manganese iron lithium phosphate is a new type of lithium ion battery cathode material formed by doping a certain proportion of manganese on the basis of lithium iron phosphate, with higher battery voltage and energy density. According to GGII’s forecast, the shipment volume will reach 200,000 tons in 2024.

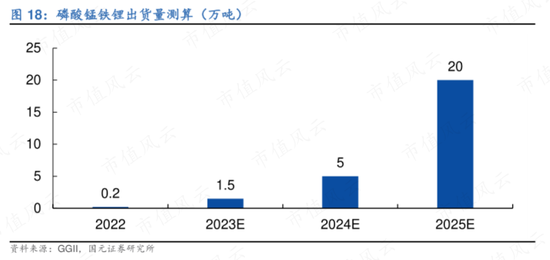

According to the planning of Rongbai Technology, by the end of 2025 and 2030, domestic manganese lithium iron phosphate capacity of 120,000 tons/year and 300,000 tons/year respectively, overseas capacity of 20,000 tons/year and 260,000 tons/year will be built. In addition, by 2023, Rongbai Technology’s layered oxide sodium battery material has been put into mass production, and the development of polyanion sodium battery cathode material has been completed. It is planned to build a 60,000 tons sodium battery cathode capacity in China by 2025, and a 500,000 tons capacity in China, Europe, and the US by 2030. The fundraising from private placement falls short of the plan by one-third, and it is difficult to find funding sources. It can be seen that whether domestically or overseas, or in various sub-categories of cathode materials, aggressive capacity expansion is Rongbai Technology’s usual strategy. According to its plan, various cathode capacities will exceed 500,000 tons by 2025. Based on the cost estimation of 4.4 billion per ton in the recent private placement, at least 11 billion in investment is still needed by 2025. With such a huge capital expenditure plan, where will the money come from? Historically, as an intermediate link with weak bargaining power, Rongbai Technology’s cash-to-revenue ratio has been less than 1 for years, resulting in a tight cash flow, with net outflows in the past two years. In 2023, there was a slight improvement through discounting of accounts receivable and inventory clearance, achieving a net inflow of 1.8 billion for the year, but it is difficult to sustain.

Since 2021, Rongbai Technology’s capital expenditure has increased significantly, putting further strain on its already tight cash flow. Over the two years from 2021 to 2022, the total net outflow of free cash flow exceeded 5 billion yuan. Even in 2023, when operating cash flow improved, it only barely achieved a net inflow.

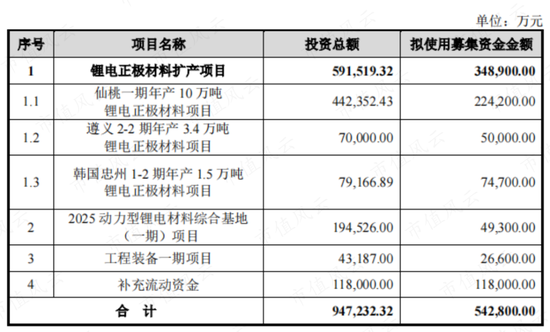

In this way, Rongbai Technology is highly dependent on external financing. It must be mentioned that its latest private placement, including projects such as Xiantao Phase I and South Korea Chungju, received approval as early as September 2022 and was completed only in September 2023, with only 7 days left before the approval expires.

The amount raised through the private placement plan was only 13.34 billion yuan, far less than the planned 54.28 billion yuan. Investors are not optimistic about the prospect of investment and expansion in the current industry situation, making equity financing difficult. This leaves Rongbai Technology with only one option for financing – taking on more debt. The interest-bearing debt ratio has been increasing year by year since 2021, reaching 22.5% in 2023. If the aggressive capacity expansion plan is further implemented, the balance sheet will deteriorate further. By the end of 2023, Rongbai Technology had cash of 5.674 billion yuan and total assets of 24.639 billion yuan. If an additional 5 billion yuan in interest-bearing debt is added, the interest-bearing debt ratio will rise to 36%.

Fengyun noticed that Rongbai Technology has changed 5 finance directors and 4 board secretaries in the past 5 years. Frequent turnover of executives is not a good sign.

Currently, the dividend of the new energy industry is gradually fading, the worst competitive situation of the ternary positive electrode link, the market space is continuously squeezed by lithium iron phosphate, entering the stage of overcapacity and price erosion, it is difficult to see opportunities in the short term from the data on both the supply and demand sides. Rongbai Technology, as a leader in the industry, has leading technology and scale, and its production capacity layout is ahead of its peers, but it still cannot escape the devastation of product price cuts in 2023. For the future, Rongbai Technology is actively expanding overseas markets and diversifying products such as lithium manganese iron phosphate and sodium-ion batteries, still focusing on large-scale expansion. However, constrained by bargaining power, its cash flow is not ample, and with the setback of the 2023 private placement financing, how to obtain funds to support production capacity construction is a difficult problem.