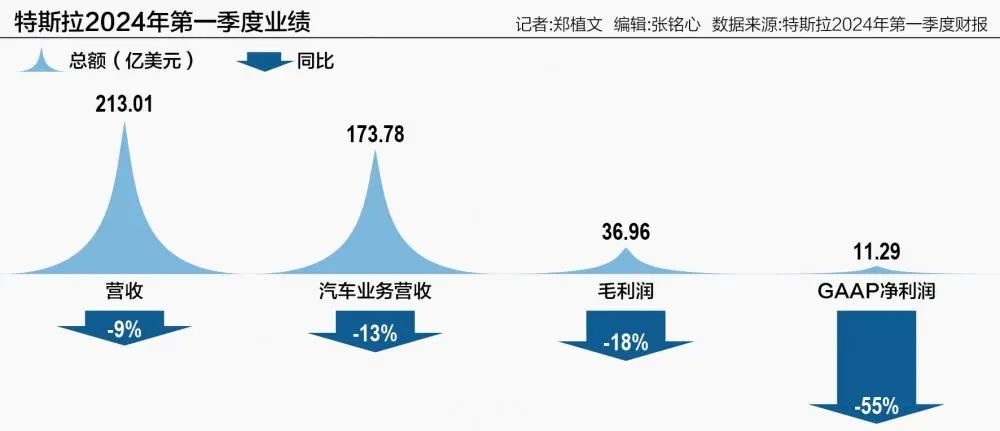

Author: Zheng Zhiwen Editor: Zhang Mingxin Source: Xinhua News Agency On April 23, local time, Tesla released its financial report for the first quarter of 2024. Despite the performance falling short of expectations, Tesla’s stock price surged by about 13% after hours. In detail, Tesla’s total revenue for the first quarter reached $21.301 billion, a 9% decrease compared to the same period last year. This marks the first year-over-year revenue decline for Tesla since early 2020, with the largest drop in 12 years. Specifically, Tesla’s main automotive revenue decreased by 13% year-over-year, to $17.378 billion. Tesla attributed this decline to lower average selling prices and reduced vehicle deliveries this quarter. Recently, Tesla’s latest global production and delivery report for the first quarter of 2024 showed that Tesla produced 433,371 electric vehicles, a 1.7% decrease from the previous year, and delivered 386,810 electric vehicles, an 8.5% decline. This fell far short of Wall Street’s expectations. Tesla explained that the drop in sales was due to the early production stage of the refreshed Model 3 at the Fremont factory, shipping route changes due to the Suez Canal crisis, and production disruptions from a fire at the German factory. However, the fact that there was an oversupply of electric vehicles in the first quarter cannot hide Tesla’s weak growth in its main business. In the same period, Tesla’s GAAP gross margin was 17.4%, a decrease of 1.99 percentage points year-on-year; GAAP net profit was $1.129 billion, a 55% decrease year-on-year; adjusted earnings per share dropped from $0.85 in the same period last year to $0.45, below Wall Street’s expectations of $0.50, the lowest level in ten quarters. At the same time, Tesla’s free cash flow in the first quarter turned negative, from $20.6 billion at the end of the previous quarter to -$25.3 billion this quarter, attributed to $2.7 billion in inventory backlog and $1 billion in “AI infrastructure” capital expenditures. Despite underperforming expectations, Tesla’s stock price surged over 12% before the opening of the U.S. stock market on April 24. This market confidence stems from Tesla’s potential to accelerate the launch of more affordable economy models, countering rumors of the cancellation of the Model 2. Tesla CEO Musk stated during the first quarter earnings call that Tesla will continue to update its vehicle lineup, accelerate the introduction of new models, and some production plans originally scheduled for the second half of 2025 may be brought forward to early 2025 or even late 2024, including cheaper models that will complement existing ones. The new models will utilize next-generation platform and current platform technology, enabling production on the same assembly lines as existing models. Analysts point out that more affordable entry-level Tesla models are seen as key to achieving Musk’s ambitious sales growth goals. Elon Musk said in 2020 that Tesla aims to sell 20 million cars annually by 2030, twice the current sales of Toyota, the world’s largest car manufacturer.

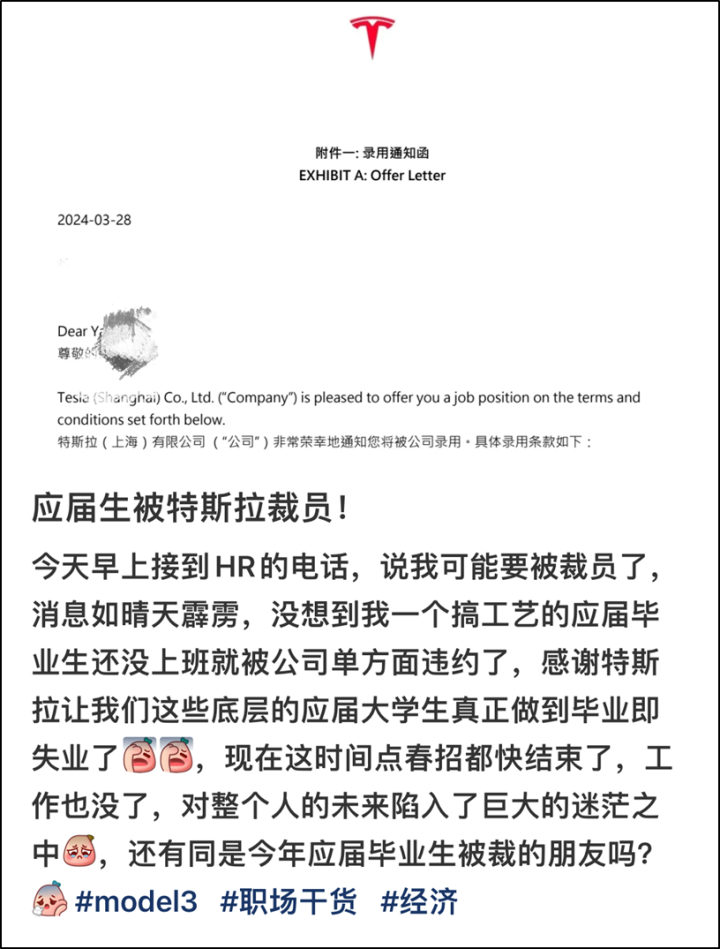

Tesla’s sales The slowdown in demand for electric cars, high interest rates, and intensified market competition have made Tesla’s situation more severe than expected. Tesla recently stated that the growth rate of car sales in 2024 may be significantly lower than in 2023. Morgan Stanley analyst Adam Jonas previously revised Tesla’s full-year delivery volume from 1.998 million to 1.954 million. Bernstein, an American brokerage, stated that Tesla’s growth has stagnated, and there are no clear catalysts for future growth. Bernstein lowered its production expectations for Tesla this year to 1.98 million vehicles, below the market’s general forecast of 2.06 million vehicles. They also expect Tesla to maintain weak growth momentum until the end of 2025. To boost global sales, Tesla has recently been playing the usual routine of “price reduction – price increase – price reduction.” Taking the Chinese market as an example, Tesla started the year with price reductions, but as the “price war” intensifies, many brands are eyeing Tesla’s market share through aggressive pricing strategies. Tesla, with a long product replacement cycle and a relatively fixed product matrix, is finding it increasingly difficult to boost sales through price reductions. In order to stimulate first-quarter sales, Tesla officially announced in late March that prices would increase on April 1, creating anxiety to push for sales. However, the impact on retail was minimal. In the first quarter of this year, Tesla delivered 132,800 vehicles in China, compared to 137,400 vehicles in the same period last year, a decrease of about 3.3%. At that time, analysts at Fuguo Bank warned that demand for electric cars this year would slow down, possibly forcing Tesla to implement larger price cuts on its products. This meant that even after the price increase on April 1, Tesla might continue to reduce prices. As expected, on April 21, Tesla China announced a price reduction of 14,000 yuan (1930$) for all models of Model 3, Y, S, and X. As early as early April, Tesla began offering “3 years 0 interest” and “5 years 0 interest for official replacements” loan benefits. On April 24, Tesla China once again lowered the purchase threshold and introduced a “0 down payment ultra-low interest” heavy-duty benefit for designated versions of Model 3/Y. In addition, Deutsche Bank analyst Emmanuel Rosner wrote in a recent report that Tesla’s aging lineup is facing soft demand and price pressure, suggesting the company is now in cash preservation mode without new vehicles, which could result in more growth resistance. Undeniably, Tesla’s sales bottleneck comes from sluggish growth of existing main models, slow ramp-up of Cybertruck production capacity, and slow progress of new models. Musk has stated that Tesla is in between two major growth waves – the first benefiting from the launch of the Model 3 sedan and Model Y crossover, while the next is expected to come from the upcoming Model 2 priced around $25,000. However, UBS points out that the upcoming Model 2 is unlikely to reassure investors, as its more affordable price means lower profitability, and there is still a long wait. Seeking new growth poles. Facing weak growth, Musk, who claims to “hate” layoffs, also reluctantly announced on April 15 that Tesla will lay off 10% of its global workforce by December 31, 2023. With a global workforce of 140,473 people, a 10% reduction means 14,000 people will be affected. Renowned Tesla bull Dan Ives of Wedbush Securities warns that layoffs are a bad sign for Tesla, signaling tough times ahead. He points out, “Global demand has been weak, and unfortunately, cutting costs is necessary for Tesla in the face of soft growth prospects.” Musk stated in an internal memo, “As we prepare for the next phase of our company’s development, it is extremely important to review all aspects of the company to reduce costs and improve productivity.” A Tesla China employee told 21st Century Business Herald reporters that sales, delivery, and after-sales positions in Tesla China are the hardest hit by the layoffs, with some departments seeing layoffs as high as 40%, and these positions are reportedly no longer being filled. Latest news shows Tesla has withdrawn all offers for recent graduates, providing a one-month salary compensation.

Some netizens said they are not fresh graduates, and their job offer from Tesla was also canceled.

Insiders told 21st Century Business Herald reporters that Tesla’s recent layoffs are part of a shift towards artificial intelligence and robotics. The essence of Tesla’s business is to integrate electric vehicles, energy storage products, AI, and robotics technologies into a unified ecosystem. Tesla is focusing on key elements for achieving Full Self-Driving (FSD) capabilities, including massive driving data, computing platforms, and powerful algorithms. CEO Musk emphasized the importance of intelligent vehicle technology and reiterated Tesla’s commitment to dominating the market with electric vehicles and autonomous driving capabilities. Tesla recently lowered the price of FSD and offered a one-month free trial to US drivers with compatible vehicles. Musk believes the future is not only electric but also autonomous, requiring massive data and AI training sets. Tesla is investing in both to make this vision a reality.