Recently, Luxshare Precision held a performance briefing, mentioning the investment in Chery. The investment in Chery is led by Luxshare Precision’s holding company, purely a personal investment behavior of shareholders, with no plan to inject into the listed company. Chery and Luxshare Precision have no direct relationship, just sharing the same shareholder. Luxshare Holding Co., Ltd. currently has no plan to sell the Chery shares it holds to Luxshare Precision. At least for now, Chery and Luxshare Precision are only in a “brotherly” relationship, cooperating but not involving in share transactions. Luxshare Precision is expanding into other areas, focusing mainly on automotive, communication, medical industries. With Luxshare Holding Co., Ltd. in the picture, the future cooperation between Chery and Luxshare Precision is expected to deepen.

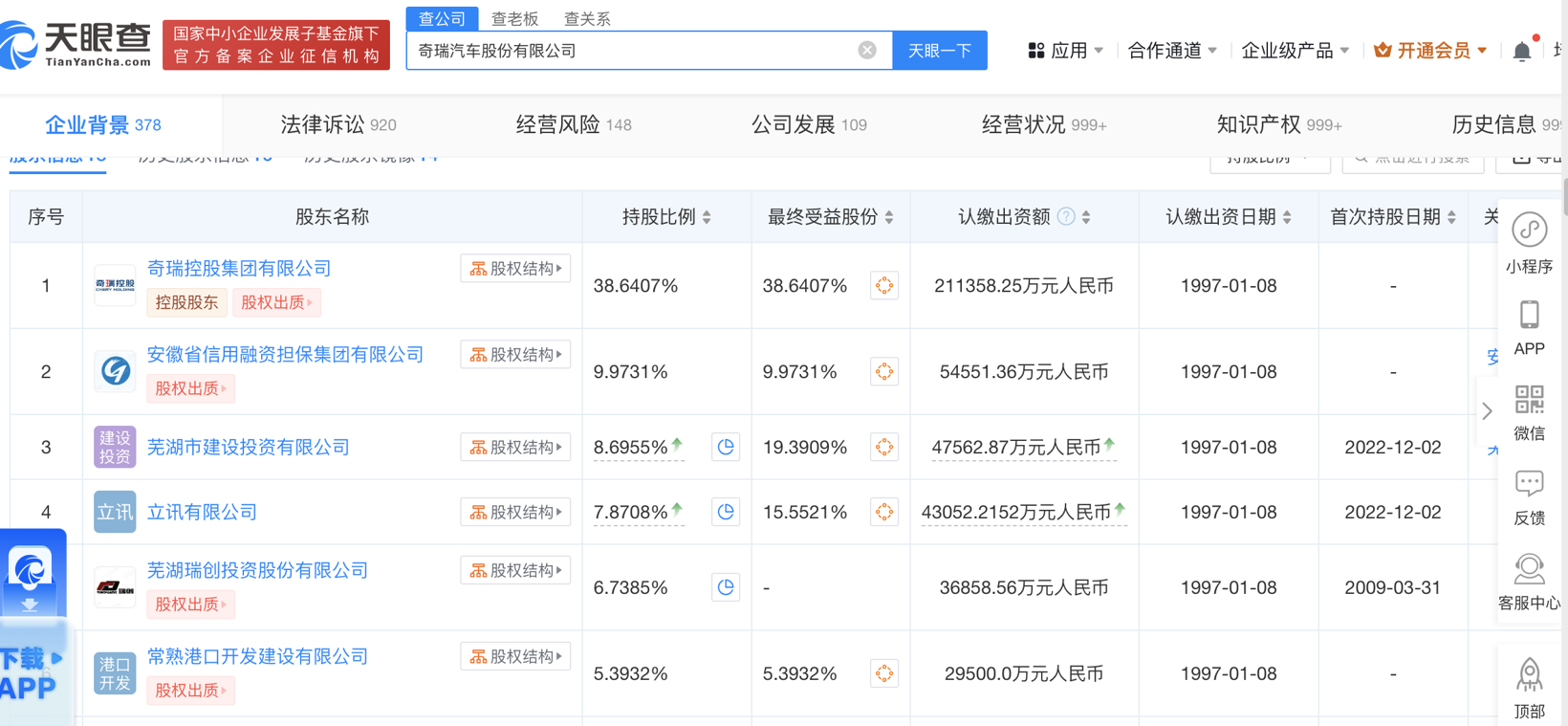

Both sides are now on the same boat. In early 2022, news about “Luxshare Precision investing in Chery” made a big splash. But in fact, this investment was led by Luxshare Precision’s controlling shareholder Luxshare Holdings Limited. Tianyancha App shows that Luxshare Holdings Limited is the controlling shareholder of Luxshare Precision, holding 38.05% of its shares. In February 2022, Luxshare Holdings Limited acquired 19.88% of Chery Holding, 7.87% of Chery Corporation, and 6.24% of Chery New Energy from Qingdao Wandaokou for 10.54 billion yuan. After the transaction, Luxshare Holdings Limited became the third largest shareholder of Chery Holding and the fourth largest shareholder of Chery Corporation.

At first glance, this deal seems unrelated to Luxshare Precision, but industry insiders believe it is paving the way for Luxshare Limited to expand its automotive business. At the same time, Luxshare Precision and Chery have signed a strategic cooperation agreement, planning to jointly establish a joint venture company in the new energy field to develop and utilize resources and advantages in R&D and vehicle manufacturing for brand customers, cultivating R&D and production teams, and developing cooperative business. The products created by this joint venture company will not only supply Chery but also target other carmakers, aligning with Luxshare Precision’s medium to long-term goal of becoming a leading Tier1 automotive parts manufacturer. Luxshare Precision, the leader in the fruit chain, aims to ride the wave of new energy vehicles, with Chery being the partner sought by its controlling shareholder. Chery’s mixed reform path and listing dream. From Luxshare Precision’s denial of Chery’s injection, it also means that Chery will not rely on external forces to achieve its dream of going public. Those familiar with Chery’s development history should know that it has always had a dream of listing the group as a whole or its automotive business, and has been striving for it for 20 years. However, due to long-term borrowing and financing, Chery’s debt ratio exceeds the industry’s 60% warning line, data shows. From 2015 to 2019, the asset-liability ratio of Chery Holdings and Chery Corporation hovered around 75%; the profit was also in a long-term deficit due to poor financial conditions, and the dream of Chery Holdings and Chery Corporation to go public has never been realized. After 2019, Chery once again embarked on the road of mixed ownership reform, introducing external assistance for self-rescue, and also aiming to delist Qingdao Wu Daokou New Energy Automobile Industry Fund to impact the market. With a total transaction value of 19.601 billion yuan, it respectively held 51% of Chery Holdings and 35.58% of Chery Corporation’s equity, becoming the largest shareholder of the two companies. Subsequently, Qingdao Wu Daokou’s relevant executives settled in the Chery system, among them, Zhou Jianmin was appointed as Vice Chairman of Chery Holdings and Vice Chairman of Chery Automobile. In 2020, Chery Chairman Yin Tongyue also stated, “After the capital increase and share expansion, Chery has put the work of accelerating the listing on an important agenda.” Zhou Jianmin also stated publicly that he would promote the listing process of Chery. However, due to funding issues later on, Qingdao Wu Daokou pledged Chery Holdings and Chery Automobile shares multiple times, eventually withdrawing from the Chery system, thus shattering Chery’s dream of going public once again. In 2022, Luxshare Precision Industry Co., Ltd. joined the Chery shareholder lineup by acquiring the equity of the Chery system from Qingdao Wu Daokou for hundreds of millions of yuan. However, according to the agreement between the two parties, after this transaction is completed, Luxshare Precision Industry Co., Ltd. will not control Chery Holdings, Chery Corporation, or Chery New Energy. However, Wang Chunlai, chairman of Luxshare Precision, is now a director of Chery Holdings.

Chery Holdings restarts subsidiary Chery Group’s IPO plan, aiming to submit IPO application by 2024 with a valuation of up to 150 billion yuan. Chery Automobile responds that it is actively preparing for the listing, other information is inaccurate. Chery Group’s sales and revenue have shown strong growth since 2021, with sales reaching 1.88 million units and revenue exceeding 300 billion yuan by 2023. Chery Group’s profits have exceeded 10 billion yuan, especially from exports. Chery Group’s executives reveal that the company’s profits have exceeded 10 billion yuan, especially from exports. If Chery Group can achieve three consecutive years of profits, a domestic IPO is imminent.