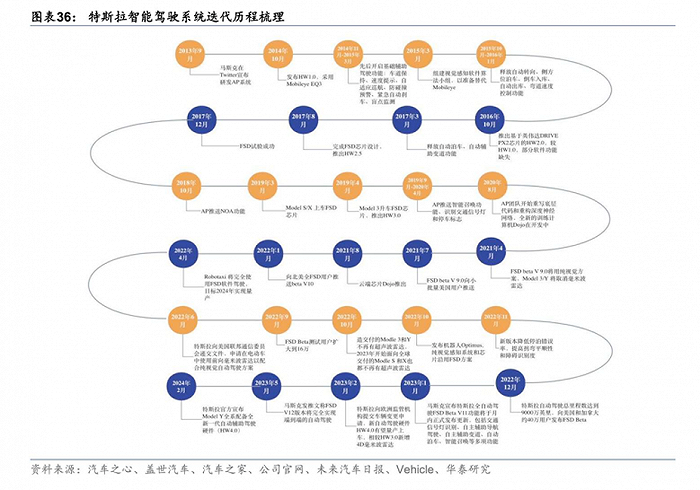

Annie with TSN Insight Edited by Fan Jingwei On the afternoon of May 6, Xiaopeng Motors fell more than 5%, widely believed to be due to Tesla’s FSD landing. Recently, Musk made a lightning visit to China, staying for less than 24 hours and achieving two major milestones: various regions in China have gradually lifted restrictions on Tesla; Baidu has provided Tesla with a mapping license to collect data on Chinese public roads, clearing the final regulatory obstacle for its FSD to enter the Chinese market. Musk’s move has brought strong momentum to Tesla, which is facing growth challenges: in the first quarter of 2024, Tesla’s revenue was $21.3 billion, a 9% decrease year-on-year. After Musk left China, the company’s stock surged more than 15%, increasing its market value by over $82.1 billion. Bank of America even believes that Musk’s visit to China may increase Tesla’s profitability in the next decade. It is reported that FSD is benchmarked against Level 5, with the ultimate goal of achieving autonomous recognition of road conditions, route planning, speed and direction control, and completing the journey from start to finish without human intervention. As early as 2023, Xiaopeng Chairman He Xiaopeng expressed his personal opinion: “Fully autonomous driving still lacks a complete logic, and I even think it may need to find another way.” But after Musk’s visit to China this year, he changed his tune: “I believe that whether it is Tesla’s FSD, Xiaopeng’s NGP, or competitors’ solutions, they are all representatives of new productivity and should be supported to allow for diversity.” Undoubtedly, the entry of FSD, this “catfish,” into China has already stirred up the current automotive industry. Can Tesla, which is under pressure in terms of sales and profits, turn the tide with FSD? By partnering with Baidu, which was the first to explore autonomous driving in China, what does Tesla intend to do? Huawei, widely recognized as the most powerful player in the smart driving industry, will its dominant position be shaken? PART-01 TSN RENEWAL, “SUPPLEMENTING SALES” OR “BOOSTING VOLUME” When it comes to Tesla, as the first car company in Silicon Valley and the first independent manufacturer of pure electric vehicles listed in the United States, its growth logic can be summed up simply: create a hit product, lead the market with a flagship product. In 2008, Tesla’s Roadster model mass production ushered in a new era of electric vehicles. In 2009, Tesla officially announced its first self-designed and developed luxury sedan, the Model S. From 2016 to 2022, Tesla achieved scale expansion and diversification: in 2016, the Model 3 was released, becoming a hit product promoted globally; in 2019, the SUV Model Y leveraged the high growth potential of the new energy vehicle market. The success of the flagship product strategy is also reflected in revenue: in 2021 and 2022, Tesla’s revenue and profits grew rapidly. In 2023, Tesla’s operating income reached $96.773 billion, an 18.80% year-on-year increase, with a net profit attributable to shareholders of $14.997 billion, a 19.44% year-on-year increase. However, as the smart driving circle enters the elimination round and more competitors of the same level emerge, Tesla is facing increasing pressure from peers: in the price range of only 200,000 to 300,000, Tesla’s Model 3 faces strong competition from Jike 007, Jike 001, Xingjiyuan ES, NIO ET5, Xiaopeng P7i, BYD Han, Xiaopeng P7, and Zhijie S7, among others, vying for market share, and most recently, Xiaomi SU7. Directly contributing to Tesla’s poor performance in 2024: 1. Decline in electric vehicle deliveries: In the first quarter of 2024, Tesla’s global cumulative deliveries were 387,000 vehicles, down 8.53% year-on-year and 20.2% quarter-on-quarter, marking the first year-on-year decline in quarterly electric vehicle deliveries in nearly four years. 2. Decline in revenue and profit: Total revenue for the first quarter of the 2024 fiscal year was $21.301 billion, down 9% year-on-year, the largest decrease since 2012. Additionally, the operating profit margin in the first quarter of 2024 also dropped significantly from 19.2% two years ago to 5.5%. To boost sales volume, Tesla first resorted to the simplest and most direct method – significant price cuts: On April 21, Tesla China reduced prices for all models by 14,000 yuan (1940$), with the price of the Model 3 dropping from 245,900-285,900 yuan (39570$) to 231,900-271,900 yuan (37630$), and the price of the Model Y dropping from 263,900-368,900 yuan (51060$) to 249,900-354,900 yuan (49120$). In the U.S. market, Tesla also reduced prices by $2,000 across all models. Rather than just lowering prices, Tesla is also actively increasing production by introducing FSD V12 in China to create additional value for its products: Technologically, FSD V12 is a major breakthrough in Tesla’s autonomous driving, laying the technical foundation for Tesla’s penetration of the Chinese market. FSD beta launched in 2020. Tesla released FSD V11 in 2023, expanding to highways. FSD V12 came in December 2023 with new self-driving route and HW4.0 chip. In January 2024, Tesla updated Model Y in China with this technology. This shift to neural network control is a game-changer.

In terms of compliance, the cooperation with Baidu has opened up the “last mile” for FSD V12 to be legally applied in China. In China, all intelligent driving systems need to obtain mapping qualifications to operate on public roads. After cooperating with licensed domestic companies and Baidu, Tesla has obtained a map service license and will be allowed to legally operate its FSD software on Chinese roads. The fleet can collect data about the surrounding environment, such as road layout, traffic signs, and nearby buildings, but it is currently unclear whether the collected data belongs to Tesla or Baidu. In terms of experience, Tesla surprisingly received an endorsement from its competitor: Xiaomi’s co-founder and vice chairman Lin Bin posted two videos on his personal Weibo account, experiencing Tesla FSD abroad. He wrote, “Just went to the Tesla 4S store to experience FSD V12 autonomous driving, from leaving the parking lot, getting on the highway, merging with traffic, exiting the highway, driving in the city, and finally returning to the parking lot, around ten minutes, covering nearly 10 kilometers. Although there were not many vehicles, it did not require high-definition maps or lidar, completely based on a pure visual model of autonomous driving technology, really impressive.” In terms of price, technology, and experience, Tesla is putting in full effort to “turn the tide.” By introducing FSD as a “catfish” into the Chinese intelligent driving circle, not only did the talkative Xiaopeng’s stock price be affected, but its partner Baidu’s stock price also rose by more than 6% at one point. It is worth noting that Baidu itself has also laid out intelligent driving. Its cooperation with Geely’s Jiyue car is currently on the front end of sales. This cooperation with “competitors,” Li Yanhong naturally has his own accounts: what Baidu needs to pay and what it will gain. Baidu’s “exclusive” customization, “support” or “covet” Foreign car companies must obtain a mapping license to collect data on public roads in China. Baidu has the qualifications. The cooperation between Tesla and Baidu in map-related business is undoubtedly an important breakthrough for FSD’s entry into China. The degree of attention Baidu pays to Tesla is also evident: According to the website of the Ministry of Natural Resources, in addition to the “Baidu Car Machine Map” used for car navigation services, Baidu Maps has recently obtained approval from the Ministry of Natural Resources for multiple “Advanced Driver Assistance Maps.” Among these maps, the GS4634 Advanced Driver Assistance Map submitted by Baidu Intelligent Map Technology Co., Ltd. for navigation is the lane-level map completed in cooperation with Tesla. The cooperation between Tesla and Baidu Maps this time is “exclusive” and deeply customized. This has also been confirmed by Baidu officials. Recently, Baidu Maps posted on Weibo: “Baidu Maps X Tesla: Start a new era of global navigation. Experience Tesla’s lane-level navigation first on May 1st.” The Weibo post also included a video, with the caption “Upgrade to Baidu Maps V20 on your phone and experience it now.”

It is worth noting that, theoretically, Tesla has connected the last link in deploying FSD in China through cooperation with Baidu. However, it is currently unclear whether the data collected belongs entirely to Tesla or Baidu Maps. If Baidu Maps can also obtain data from the collaboration, on one hand, this will improve the accuracy of Baidu Maps itself; on the other hand, Tesla’s data may benefit Baidu’s autonomous driving business. After all, Baidu’s current intelligent driving business is not impressive compared to other players in the same league. Baidu’s exploration of intelligent driving began in 2013, but it was not until mid-2021 that it first clarified the three business models of Baidu Apollo’s intelligent driving business. Betting on large models, claiming to be the domestic leader in large model efforts, but not yet dominant or far ahead, and hoping that large models will empower intelligent driving. Its collaboration with the car brand JiYue has not made much of a splash. Therefore, the cooperation between Baidu Maps and Tesla is a win-win situation. Firstly, in terms of attention, Tesla and Musk themselves bring traffic, and Baidu Maps can take a step forward in the public eye, which is reflected in Baidu’s stock price. Secondly, in terms of map qualifications, Tesla’s choice of Baidu Maps represents its recognition of Baidu Maps’ business, with a giant “joining hands” with another giant. Thirdly, in terms of potential value, FSD uses Baidu as a stepping stone to enter the Chinese autonomous driving market, and in the future, the two may have deeper cooperation to benefit Baidu’s business. When the perspective is removed from Baidu and Tesla and extended to the entire intelligent driving circle, the entry of FSD into China will not only affect Xiaopeng, but also spark such sparks in the face of Huawei, the most powerful force in the Chinese intelligent driving circle. PART-03 “Competition” or “Disruption” In the intelligent driving technology path, the focus on whether to use lidar or pure visual solutions has always been a public concern. Currently, lidar is standard equipment for the vast majority of high-end models of new energy vehicle companies, whether it is the new forces in car manufacturing such as Xiaoli, Jike, and Zero Run, or Huawei’s Smart Selection Car and HI mode models, are all “fans” of lidar. However, after Tesla successfully tested the pure visual solution, due to its low cost advantage, the voices calling for “removing lidar” have been continuous. CICC Securities pointed out in a research report that the biggest advantage of the pure visual solution lies in the overall cost. The hardware cost of Tesla’s eight cameras is only about $200, while the cost of a set of lidar ranges from $3,000 to $10,000. In response, Huawei launched the Huawei Vision Intelligent Driving, such as the debut of the Smart Selection S7, equipped with 3 millimeter-wave radars, 10 visual perception high-definition cameras, and 12 ultrasonic radars, realizing a visual intelligent driving solution that does not rely on lidar. Yu Chengdong stated that in a comparative test conducted on the Shanghai elevated road with Tesla, the performance of Huawei Vision Intelligent Driving has already surpassed the “visual pioneer” Tesla. However, according to information released by Tesla, when FSD was tested in the United States earlier, its autonomous driving level was between L4-L5. Currently, the autonomous driving level of most mainstream domestic manufacturers in China is mostly at level L2, and Huawei, as a leader in domestic autonomous driving, has an autonomous driving level of only around L2.5. And, Tesla introduced “BEV+Transformer” in perception algorithm in 2020, significantly improving the perception accuracy of visual solutions, which has now become an industry standard. Xpeng, Li Auto, NIO and other vehicle manufacturers have followed suit to learn from this model. Huawei has made important breakthroughs in visual perception, perhaps able to stand “side by side” with Tesla. However, in terms of overall technology, Tesla’s BEV perception algorithm, the move towards end-to-end autonomous driving with large models, and the self-developed FSD chip and rapid iteration of domain control still maintain a short-term first-mover advantage and leading position. However, technology is only one aspect of competitiveness, with ecosystem and commercial implementation being more important. In this aspect, Huawei can indeed “lead from afar.” Currently, Tesla’s various capabilities are mainly used to empower its own products. In addition to vehicles, Tesla has also started to layout robot products. Huawei, on the other hand, is more like a “super water seller” in the automotive industry, empowering vehicle manufacturers from multiple perspectives, with cooperation partners including BAIC BJEV, GAC Aion, Changan Oshan, SAIC, Chery, BAIC and JAC. Currently, Huawei’s ADS 2.0 has achieved several industry firsts, with rapid iteration of computing power, models, and data, not relying on high-precision map design. Its advantages in technology and localization enable it to assist traditional vehicle manufacturers in the transformation process, and the benchmark set by the cooperation between Huawei and SAIC can also be replicated in other vehicle manufacturers. For Tesla’s FSD to enter the Chinese market and disrupt the market as an “enabler,” it will not be easy. On one hand, Tesla’s FSD technology will take time to gain the trust of Chinese users. On the other hand, as time goes by, the technology gap will gradually narrow, and Tesla will find it difficult to compete with Huawei’s dominant position in national brands and channels. Tesla’s FSD partnering with Baidu to enter China may capture some market share in the autonomous driving industry, but may have chosen the wrong strategy to truly disrupt the market.